Pet Monitoring Camera Market Size

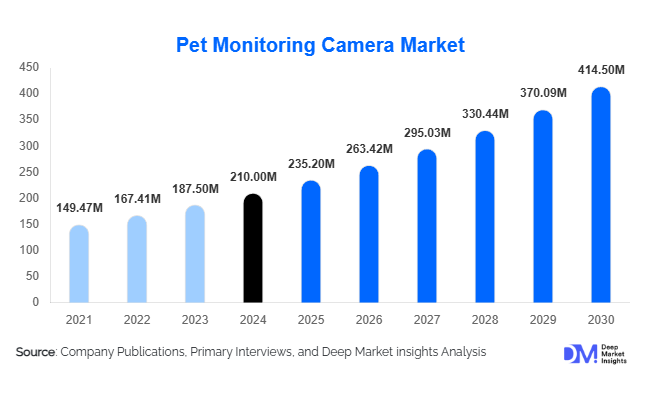

According to Deep Market Insights, the global pet monitoring camera market size was valued at USD 210.00 million in 2024 and is projected to grow from USD 235.20 million in 2025 to reach USD 414.50 million by 2030, expanding at a CAGR of 12.0% during the forecast period (2025–2030). Market growth is primarily driven by increasing pet humanization, the expansion of smart home ecosystems, and a growing preference for interactive, AI-enabled devices that allow pet owners to stay connected with their pets remotely.

Key Market Insights

- Rapid adoption of smart home technologies is accelerating the integration of pet monitoring cameras with platforms such as Alexa, Google Home, and Apple HomeKit.

- Two-way interactive cameras dominate the market, accounting for over 60% of global revenue in 2024, driven by demand for real-time communication with pets.

- North America leads the global market with nearly 50% share, supported by high pet ownership and disposable incomes.

- Asia-Pacific is the fastest-growing region, projected to grow at over 15% CAGR through 2030, driven by rising pet ownership in China and India.

- Online retail channels represent nearly 70% of global sales, reflecting the increasing role of e-commerce and D2C models in the pet tech industry.

- AI and behavioral analytics integration are creating new monetization opportunities through subscription-based models.

What are the latest trends in the pet monitoring camera market?

AI-Enabled Monitoring and Behavioral Analytics

Artificial Intelligence (AI) is transforming the pet monitoring camera market by enabling advanced features such as bark detection, activity recognition, and emotional state analysis. These cameras not only monitor but also interpret pet behavior, sending alerts when anomalies are detected. AI-driven insights allow owners to track health indicators and behavior patterns, fostering preventive care. The growing adoption of machine learning models integrated into cameras enhances accuracy and personalization, while cloud-based analytics enable continuous updates and feature enhancements through firmware upgrades.

Integration with Smart Home Ecosystems

Integration with broader smart home systems is becoming a defining trend. Pet monitoring cameras now function as part of interconnected ecosystems where users can control lighting, HVAC systems, and security devices alongside pet cameras via unified mobile apps. Companies are leveraging IoT protocols such as Zigbee and Wi-Fi 6 to deliver seamless connectivity and real-time notifications. This trend supports the shift toward fully automated pet-care environments where feeding, monitoring, and interaction occur through synchronized smart devices.

What are the key drivers in the pet monitoring camera market?

Rising Pet Ownership and Humanization

Global pet ownership has surged, with millennials and Gen Z consumers increasingly viewing pets as family members. This emotional connection drives demand for products that ensure pets’ well-being. The rise in dual-income households and remote work further boosts the need for remote monitoring solutions, fostering the adoption of smart cameras that allow owners to stay connected anytime, anywhere.

Growth of Smart Homes and IoT Penetration

The proliferation of smart home technologies, high-speed internet, and IoT-enabled devices supports the adoption of pet monitoring cameras. Integration with home security and automation systems enhances functionality and convenience, while increasing the affordability of Wi-Fi cameras broadens accessibility across markets.

Shift Toward Subscription-Based Revenue Models

Manufacturers are capitalizing on recurring revenue streams through subscription models that include cloud video storage, AI analytics, and premium features. This shift not only increases average revenue per user but also ensures consistent engagement and long-term customer retention.

What are the restraints for the global market?

High Device and Maintenance Costs

Premium cameras equipped with AI analytics, treat dispensers, and interactive features are priced above USD 300, limiting affordability for many pet owners. Additionally, ongoing subscription fees for cloud storage and software updates add to total ownership costs, especially in emerging economies.

Privacy and Data Security Concerns

Since these devices transmit live video and audio feeds from users’ homes, privacy breaches and data misuse are major concerns. Compliance with data protection regulations such as GDPR and CCPA adds cost and complexity for manufacturers. Addressing cybersecurity and encryption standards remains essential for market credibility and sustained adoption.

What are the key opportunities in the pet monitoring camera industry?

Integration with Advanced Smart Home Platforms

Seamless integration with home automation ecosystems presents a major opportunity. Cameras compatible with major voice assistants and home hubs enhance user convenience and open cross-selling possibilities within smart home ecosystems. Future innovations may enable unified dashboards managing pets, home security, and health analytics in a single interface.

Emerging Market Expansion

Rising disposable incomes and growing urban pet ownership in Asia-Pacific, Latin America, and the Middle East are creating new opportunities. Localized manufacturing, pricing strategies, and partnerships with regional distributors can help brands capture these high-growth markets. E-commerce infrastructure development further facilitates direct access to these consumer bases.

AI-Powered Services and Subscription Ecosystems

Developing AI-driven health insights, automated feeding alerts, and behavioral tracking offers companies new avenues for differentiation. Subscription-based ecosystems bundling devices with ongoing digital services can enhance long-term profitability, similar to models seen in the home security and fitness technology industries.

Product Type Insights

Two-way video and audio cameras dominate the global pet monitoring camera market with approximately 60% share in 2024. This dominance stems from consumers’ growing desire for real-time interaction and emotional engagement with pets when they are away from home. Features such as live video streaming, motion alerts, and voice communication have become standard in most mid- to high-end devices. The interactive treat-dispensing camera segment is the fastest-growing category, driven by owners seeking to remotely reward or comfort their pets, particularly during work hours or travel. This trend aligns with the global rise in pet anxiety management and human–animal bonding. Meanwhile, fixed indoor cameras remain popular for affordability and simplicity, serving entry-level users. In contrast, wearable pet cameras and outdoor rugged models are emerging niches, appealing to owners of adventurous or outdoor pets who need location-based insights and weatherproof durability.

Connectivity Insights

Wi-Fi–enabled and cloud-connected cameras held nearly 65% of the global market share in 2024, a result of their convenience, multi-device streaming, and integration with popular smart home ecosystems such as Alexa, Google Home, and Apple HomeKit. Consumers value the ability to access video feeds remotely and store recordings securely via cloud subscriptions. However, growing privacy concerns, particularly in Europe, are driving demand for local storage or hybrid cloud solutions, which allow users to retain data without third-party access. The segment of AI-assisted smart cameras is rapidly expanding, offering behavioral analytics, real-time pet motion recognition, and false-alert reduction. These features have begun redefining premium categories, with smart-home integrated cameras emerging as the preferred choice for tech-savvy consumers seeking unified automation experiences.

Price Range Insights

Premium pet monitoring cameras (priced above USD 300) captured over 55% of global revenue in 2024, reflecting strong demand for high-resolution imaging, AI-based insights, and subscription-enabled services. These products often include features such as pan–tilt–zoom tracking, night vision, and smart alerts integrated into mobile apps. The mid-range tier (USD 100–300) is expanding rapidly, balancing affordability with advanced features such as two-way audio and motion sensors. Entry-level devices (below USD 100) remain relevant in price-sensitive markets such as Latin America and parts of Asia-Pacific, where consumers prioritize basic monitoring functionality over premium add-ons. The ongoing price–performance improvement trend across all tiers continues to attract new customers, particularly in urban households with first-time pet owners.

Distribution Channel Insights

Online retail channels dominate global sales, accounting for about 70% of market share in 2024. E-commerce giants and direct-to-consumer (D2C) brand websites enable consumers to easily compare features, read peer reviews, and access discounts. Rapid logistics and influencer-driven marketing have strengthened the digital buying journey, especially in North America and the Asia-Pacific. Conversely, offline channels such as pet specialty stores and consumer electronics retailers retain importance for premium buyers who prefer physical demos before purchase. In the B2B space, direct enterprise contracts with veterinary clinics and pet boarding chains are rising, driven by requirements for integration, reliability, and after-sales service. The convergence of digital marketing and omni-channel retail is expected to further enhance reach across both developed and emerging markets.

End-Use Insights

Household pet owners account for roughly 80% of total market demand, making the consumer segment the undisputed leader in 2024. Growth is primarily driven by the increasing humanization of pets, urban lifestyles, and the rise of remote work, which heightens the need for continuous monitoring and reassurance. Within commercial applications, veterinary clinics and pet boarding or daycare facilities are rapidly adopting monitoring cameras for behavioral observation, staff supervision, and safety documentation. The veterinary segment, in particular, is leveraging AI-powered cameras for post-operative recovery tracking and remote diagnostics. Moreover, export-driven demand from Asian manufacturers, especially China and South Korea, is expanding the availability of affordable and feature-rich devices in Europe and North America, further boosting global penetration.

| By Product Type | By Functionality | By Connectivity | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global pet monitoring camera market, accounting for approximately 45–50% of global revenue in 2024. The U.S. remains the dominant contributor, followed by Canada. Regional growth is supported by high disposable income, widespread smart-home adoption, and a deeply ingrained pet humanization culture. Over 66% of U.S. households own pets, and the increasing integration of pet care with connected home ecosystems continues to propel market demand. Additionally, robust e-commerce infrastructure and well-established distribution networks ensure quick adoption of new technologies. Mature e-commerce ecosystems, premium spending power, and cross-device smart-home integration make North America the most lucrative market globally.

Europe

Europe represents around 20–25% of the global market share, led by the U.K., Germany, and France. The region’s growth is defined by high-quality and privacy-oriented consumer preferences. The General Data Protection Regulation (GDPR) has strongly influenced manufacturers to provide on-device data processing and edge storage options. Demand for premium and feature-rich models is high, and buyers prefer established brands with certified security compliance. Increasing pet ownership among young professionals and seniors is also driving recurring demand. Stringent data privacy norms and consumer preference for locally secured, high-quality devices fuel Europe’s steady growth trajectory.

Asia-Pacific

Asia-Pacific (APAC) is the fastest-growing regional market, contributing 15–20% of global revenue in 2024 and expected to post the highest CAGR through 2030. Rapid urbanization, rising disposable incomes, and growing pet adoption across China, India, Japan, and South Korea are major growth enablers. The proliferation of smartphones, combined with expanding e-commerce and local brand manufacturing, is lowering adoption barriers. Chinese and Indian consumers increasingly favor mid-range cameras, while Japan and South Korea lead in high-tech AI-enabled devices. Rapid urbanization, smartphone penetration, and the emergence of a tech-literate middle class are propelling APAC’s exceptional growth momentum.

Latin America

Latin America currently holds around 5–8% of the global share, with Brazil and Mexico as the leading markets. The region’s adoption is being accelerated by e-commerce expansion, online retail penetration, and a growing pet-loving culture among younger demographics. Consumers in this region are highly price-sensitive, favoring mid-tier and affordable products offering good value and basic functionality. Government-led digitalization initiatives and logistics infrastructure improvements are further enhancing accessibility for imported smart devices. Expanding online retail ecosystems and increasing pet adoption rates underpin steady regional growth.

Middle East & Africa

Middle East & Africa (MEA) accounts for 3–5% of the global market share. Early adoption is concentrated in GCC nations such as the UAE, Saudi Arabia, and Qatar, where high discretionary income and a growing focus on luxury pet care and smart-home integration drive premium purchases. Meanwhile, South Africa leads the African submarket, supported by urbanization and the increasing influence of social media in promoting pet technology. Although much of the region remains at a nascent stage, interest in ruggedized outdoor models and mobile-linked solutions is expanding. Rising premium pet care expenditure in GCC countries and increasing urbanization across Africa create early but promising growth opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Monitoring Camera Market

- Furbo Dog Camera

- Petcube

- Wyze Labs

- Hikvision Digital Technology Co., Ltd.

- Lenovo Group Ltd.

- Amazon.com Inc.

- EZVIZ Inc.

- Wagz Inc.

- PetChatz LLC

- Zmodo Technology Corp.

- PETKIT Ltd.

- Vimtag Technology Co. Ltd.

- Motorola Mobility LLC

- SpotCam Co. Ltd.

- Clever Dog Company

Recent Developments

- In May 2025, Furbo launched its AI-powered “Furbo 360° Dog Camera,” featuring real-time behavior alerts and motion tracking to enhance interactive monitoring.

- In April 2025, Petcube announced a cloud subscription service expansion offering health insights based on AI-driven video analytics.

- In February 2025, Wyze introduced its smart pet cam with treat-dispensing capability and Alexa integration, targeting affordable premium functionality for U.S. households.