Pet Hard Goods Market Size

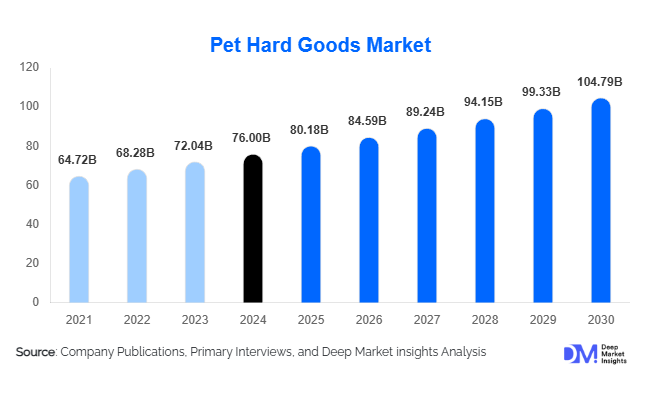

According to Deep Market Insights, the global pet hard goods market size was valued at USD 76.0 billion in 2024 and is projected to grow from USD 80.18 billion in 2025 to reach USD 104.79 billion by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The market growth is driven by rising pet humanization trends, the surge in premium and smart pet accessories, and the growing adoption of pets across emerging economies. As pet owners increasingly treat pets as family members, demand for high-quality, stylish, and technologically advanced products has accelerated worldwide.

Key Market Insights

- Pet humanization is redefining spending patterns, leading to higher expenditure on comfort, safety, and entertainment-oriented products for pets.

- Smart and connected pet accessories such as GPS-enabled collars, automatic feeders, and IoT-based toys are gaining strong traction globally.

- North America dominates the global market, accounting for nearly 45% of revenue in 2024, supported by mature pet ownership and premium product penetration.

- Asia-Pacific is the fastest-growing regional market, led by rapid pet adoption in China, India, and Southeast Asia.

- E-commerce and D2C platforms are reshaping distribution, driving accessibility and brand engagement through online customization and subscriptions.

- Sustainability is becoming a key differentiator, with growing consumer preference for eco-friendly, recyclable, and ethically sourced materials in pet products.

What are the latest trends in the Pet Hard Goods Market?

Premiumization and Design-Driven Pet Goods

Premiumization is a central trend transforming the pet hard goods landscape. Consumers increasingly seek premium, ergonomic, and design-led pet accessories, ranging from orthopedic beds to handcrafted collars and luxury crates that blend with home interiors. Lifestyle integration is reshaping purchasing behavior, with owners prioritizing comfort and aesthetics alongside utility. Brands are launching designer collections and customizable goods that mirror human lifestyle products. The rise of “pet wellness” has also driven demand for orthopedic furniture, calming toys, and travel products engineered for stress-free mobility.

Smart and Connected Accessories

Technological integration is revolutionizing pet ownership. GPS-enabled collars, app-linked feeders, interactive toys, and pet monitoring cameras are rapidly entering mainstream markets. These devices not only enhance pet safety and convenience but also provide real-time data for owners, promoting preventive pet care. Smart products allow tracking of feeding schedules, activity levels, and health indicators, aligning with the humanization and digital health trends. IoT-enabled devices are particularly popular in North America and Europe, with growing adoption in Asia-Pacific driven by millennial and Gen Z pet owners.

Sustainable and Eco-Friendly Product Development

Environmental awareness among consumers is pushing manufacturers toward sustainable innovation. Products made from recycled plastics, organic fabrics, bamboo, and plant-based fibers are increasingly preferred. Many global brands are adopting circular economy models, offering repairable, refillable, or recyclable goods. Eco-label certifications and transparent sourcing are becoming purchase influencers. This trend not only aligns with global sustainability goals but also enhances brand reputation and long-term customer loyalty.

What are the key drivers in the Pet Hard Goods Market?

Rising Pet Humanization and Emotional Spending

Pet ownership is increasingly associated with emotional well-being, companionship, and lifestyle enhancement. As pets become integral family members, owners willingly spend more on premium and comfort-oriented hard goods. Emotional connection translates to higher investment in quality, design, and functionality, directly driving demand across categories such as toys, beds, and accessories.

Urbanization and Multi-Pet Households

With more people living in urban environments, small living spaces have amplified the need for multifunctional, space-efficient, and stylish pet products. Modern designs like collapsible crates, convertible furniture, and travel-friendly beds are gaining popularity. The rise of multi-pet households in major cities across the U.S., Europe, and Asia is further increasing per-household spending on hard goods.

Expansion of E-commerce and Direct-to-Consumer Channels

Online platforms have dramatically increased product accessibility and price transparency. Brands are leveraging D2C websites and marketplaces to sell customized goods, offer subscription models, and collect user data for personalization. Global online pet product sales are growing at an estimated CAGR of 7% between 2025–2030, outpacing traditional retail growth. This digital evolution enables smaller brands to compete with established players by focusing on niche, high-margin offerings.

What are the restraints for the global market?

High Product Costs and Price Sensitivity

Premium pet hard goods often carry high production costs due to advanced materials, smart features, and aesthetic design. In price-sensitive markets, especially across Latin America and Southeast Asia, affordability remains a constraint. Consumers in developing regions still prioritize essential pet supplies over premium accessories, limiting volume growth for high-end segments.

Supply Chain Challenges and Raw Material Volatility

Pet hard goods manufacturing depends on raw materials such as plastics, metals, and fabrics. Price fluctuations, supply chain disruptions, and rising freight costs post-pandemic have squeezed manufacturer margins. Additionally, regulatory changes and environmental compliance requirements increase production costs for exporters, particularly in Asia.

What are the key opportunities in the Pet Hard Goods Market?

Expansion in Emerging Economies

Developing markets in Asia-Pacific, Latin America, and the Middle East represent significant untapped potential. Rising disposable income, changing lifestyles, and increasing pet adoption rates are accelerating demand. Localization of production and partnerships with regional e-commerce giants can help brands penetrate these fast-growing markets.

Growth of Smart and Tech-Enabled Pet Products

Integration of IoT and AI technologies into pet accessories offers opportunities for differentiation and premium pricing. Companies introducing connected toys, automated feeders, and health-tracking devices can capture the rising segment of tech-savvy pet owners. These products also open avenues for recurring revenue via app subscriptions and data analytics services.

Sustainability and Circular Economy Initiatives

As sustainability becomes a core consumer expectation, companies focusing on biodegradable, recyclable, or carbon-neutral pet goods stand to gain. Partnerships with eco-certification bodies and the adoption of sustainable packaging can enhance competitive positioning and regulatory compliance. The shift toward environmental responsibility is expected to generate long-term brand equity and consumer trust.

Product Type Insights

Pet toys dominated the global pet hard goods market in 2024, accounting for approximately 28.9% of total revenue (USD 21.5 billion). Toys are indispensable for pet enrichment, behavioral training, and exercise, fostering emotional and physical well-being among companion animals. Demand is particularly strong for interactive, treat-dispensing, and smart sensor-enabled toys that combine play with cognitive stimulation. The growing trend of humanizing pets has driven premiumization in toy design, with brands focusing on durability, safety, and eco-friendly materials such as natural rubber and recycled fibers.

Beyond toys, collars, harnesses, and leashes represent one of the fastest-growing product categories, driven by the global surge in outdoor and recreational pet activities. Innovations such as GPS-enabled tracking collars and ergonomic harness designs are expanding consumer interest. Grooming tools, including brushes, clippers, and de-shedding devices, are also experiencing robust growth due to increased hygiene awareness and at-home grooming preferences. The convergence of technology and design aesthetics continues to redefine the product landscape, ensuring sustained expansion across all major categories.

Distribution Channel Insights

Offline retail, including pet specialty stores, veterinary outlets, and mass merchandisers, continues to dominate global sales due to strong consumer preference for in-person product evaluation and instant availability. However, the online channel is rapidly expanding, forecasted to grow at a CAGR of around 7.0% during 2025–2030. E-commerce platforms such as Amazon, Chewy, Zooplus, and JD.com have revolutionized product accessibility, offering competitive pricing, global assortment, and personalized subscription models.

Online channels are increasingly driven by data-driven recommendation systems, auto-replenishment models, and D2C brand launches. Pet owners, especially millennials, prefer digital purchases due to convenience and access to reviews. Companies adopting omnichannel retail strategies, integrating online and offline sales, are experiencing the highest growth momentum. The rise of subscription boxes for monthly pet supplies and customized care kits is further enhancing customer retention and long-term engagement.

End-Use Insights

The residential segment remains the dominant end-use category, accounting for the majority of global demand in 2024. Households are the core consumers of pet hard goods, supported by rising pet adoption among millennial and Gen Z populations. Increasing disposable incomes, single-person households, and emotional well-being awareness have collectively reinforced the role of pets as family members, sustaining long-term spending on comfort and safety-related accessories.

The commercial segment, which includes grooming salons, pet daycares, and boarding facilities, is expanding at a faster-than-average pace. The segment’s growth is supported by rising urban pet populations and increasing professionalization of pet care services. B2B demand from such establishments has spurred bulk purchasing of grooming tools, containment systems, and feeding accessories. Additionally, export-driven production hubs in China and India continue to supply large volumes of pet hard goods globally, leveraging cost-efficient manufacturing and growing brand partnerships with Western retailers.

| By Product Type | By Pet Type | By Material Type | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America led the global pet hard goods market with approximately 45% market share in 2024 (USD 33–35 billion). The United States remains the epicenter of demand, driven by high pet ownership rates (over 66% of U.S. households) and well-established retail ecosystems. Growth is further supported by premiumization trends, sustainable material adoption, and the rise of digital pet commerce. Leading brands continue to invest in smart pet devices, ergonomic furniture, and health-focused toys tailored for mature markets. Key growth drivers in North America include expanding pet humanization trends, growing awareness of animal welfare, and robust e-commerce infrastructure. Canada is also witnessing accelerated growth due to increasing adoption of rescue pets, government-backed animal care awareness programs, and product innovation in eco-friendly categories. Collectively, these factors ensure North America’s continued dominance in global pet hard goods revenue.

Europe

Europe accounted for approximately 31% of total market revenue (USD 23–24 billion) in 2024. The region’s growth is driven by sustainability-focused consumer behavior, stringent product safety regulations, and innovation in biodegradable and recyclable materials. The U.K., Germany, and France lead market demand, supported by mature retail channels and a high preference for eco-labeled, cruelty-free, and ethically sourced products. Regional drivers include the surge in digital retail expansion, green packaging initiatives, and the increasing popularity of pet-friendly urban living spaces. Growth is steady at a projected CAGR of 5.4% through 2030, as manufacturers focus on replacing traditional plastics with plant-based polymers and recyclable fabrics. Europe’s integration of smart logistics and traceability technologies in e-commerce is further enhancing consumer trust and product transparency.

Asia-Pacific

The Asia-Pacific (APAC) region is the fastest-growing market globally, expected to expand at a CAGR of about 7.0% during 2025–2030. China’s pet hard goods market alone was valued at USD 5.0 billion in 2024 and is anticipated to reach USD 7.7 billion by 2030. Rising disposable incomes, urban lifestyle shifts, and an emerging middle-class preference for pet companionship are central to this expansion. Regional growth is primarily driven by rapid e-commerce adoption, local manufacturing capacity, and evolving consumer behavior toward pet wellness and safety. In India and Southeast Asia, pet adoption rates are accelerating due to cultural normalization of pet ownership and the rising influence of social media. Increasing domestic production in China, Thailand, and Vietnam supports cost-efficient exports, while partnerships with Western brands strengthen the regional value chain.

Latin America

Latin America holds a smaller but rapidly expanding share of the global pet hard goods market, led by Brazil, Mexico, and Argentina. Rising awareness of pet hygiene, increasing middle-class spending, and improving retail access are fostering a robust consumer base. Brazil alone represents over half of regional demand, supported by a strong pet ownership culture and local pet product manufacturing initiatives. Regional growth is driven by the rise of digital retail platforms, urbanization, and domestic brand innovation. Online platforms and partnerships between local producers and global retailers are reducing dependency on imports and enabling price competitiveness. Latin America’s favorable trade policies and lower production costs are also attracting foreign investments in the pet hard goods manufacturing ecosystem.

Middle East & Africa

The Middle East & Africa (MEA) region is emerging as a lucrative frontier market for premium pet accessories and containment solutions. The segment’s growth is primarily driven by rising pet adoption among affluent households in the UAE, Saudi Arabia, and South Africa. The region’s pet industry is evolving rapidly as consumers increasingly seek premium, imported, and sustainable products tailored for small living spaces. Key regional growth drivers include government initiatives promoting pet-friendly regulations, growing expat populations, and expanding specialty retail outlets. In South Africa, local manufacturing capacity is strengthening, supported by government-backed SME programs, while the GCC region demonstrates strong demand for travel carriers, grooming tools, and climate-adaptive pet furniture. With increasing disposable income and a young, urbanized population, MEA is positioned to register the highest long-term potential among emerging pet hard goods markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Hard Goods Market

- Spectrum Brands Holdings, Inc.

- Radio Systems Corporation (PetSafe)

- Coastal Pet Products, Inc.

- The KONG Company

- The Hartz Mountain Corporation

- Ruffwear, Inc.

- ZippyPaws, LLC

- MidWest Homes for Pets

- New Age Pet

- Petmate

- Trixie Heimtierbedarf GmbH & Co. KG

- Ferplast S.p.A.

- Outward Hound

- Rolf C. Hagen Inc.

- Doskocil Manufacturing Company, Inc.

Recent Developments

- In August 2025, PetSafe launched a new range of smart collars integrated with GPS tracking and activity analytics, expanding its IoT-enabled product line.

- In June 2025, Ruffwear announced the opening of a new manufacturing facility in Vietnam to strengthen supply chain resilience and support rising Asia-Pacific demand.

- In March 2025, KONG Company introduced an eco-friendly toy line made entirely from recycled rubber, reinforcing its commitment to sustainability.