Pet Carpet Market Size

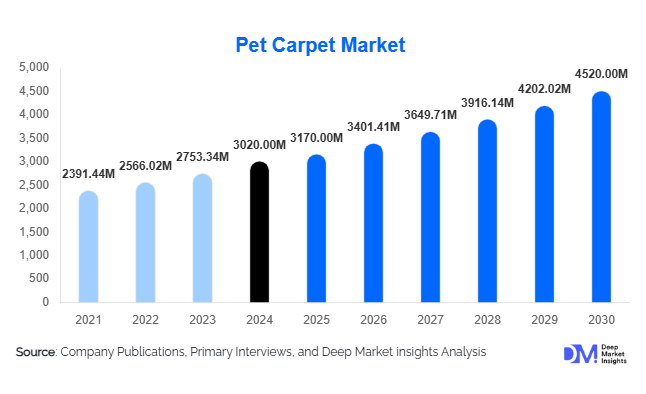

According to Deep Market Insights, the global pet carpet market size was valued at USD 3,020 million in 2024 and is projected to grow from USD 3,170 million in 2025 to reach USD 4,520 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The pet carpet market growth is primarily driven by the rising number of pet owners worldwide, increasing consumer preference for pet-friendly home furnishings, and growing awareness regarding hygiene and comfort for companion animals.

Key Market Insights

- Growing pet adoption rates globally are significantly influencing demand for specialized home décor products, including pet carpets designed for durability and easy cleaning.

- Technological advancements in stain-resistant and odor-control materials are boosting the premiumization of pet carpet products.

- North America dominates the global market due to high pet ownership rates and consumer spending on pet accessories and home products.

- Asia-Pacific is the fastest-growing region, led by rising disposable incomes, urbanization, and the humanization of pets in countries like China, Japan, and India.

- Online sales channels are expanding rapidly, providing pet owners with a diverse range of customizable and eco-friendly pet carpet options.

- Eco-conscious innovations such as recyclable fibers and sustainable production processes are shaping the next phase of market growth.

Latest Market Trends

Eco-Friendly and Sustainable Pet Carpets

Manufacturers are increasingly focusing on sustainability by introducing eco-friendly materials such as recycled nylon, PET fibers, and natural wool blends. These materials reduce environmental impact while maintaining durability and comfort. Brands are also adopting closed-loop recycling systems and biodegradable coatings to align with global sustainability goals. This trend appeals strongly to environmentally conscious consumers who seek pet products that are both functional and planet-friendly.

Smart and Functional Carpet Designs

Emerging technologies are being integrated into pet carpets to improve usability and maintenance. Innovations include odor-neutralizing microcapsules, anti-bacterial coatings, and water-repellent fibers. Some premium brands have introduced smart carpets embedded with sensors to monitor pet activity or cleanliness levels. These features cater to the growing demand for low-maintenance, hygienic, and multipurpose home products in modern households.

Pet Carpet Market Drivers

Increasing Pet Ownership and Humanization of Pets

The global surge in pet adoption, coupled with the trend of treating pets as family members, is a major growth driver. As pet parents increasingly invest in comfort-oriented and aesthetically pleasing home décor, pet carpets are becoming a key accessory. Pet owners seek products that combine functionality, hygiene, and design harmony with their interiors, pushing manufacturers to create premium, pet-friendly carpeting solutions.

Growing Focus on Hygiene and Indoor Air Quality

Pet carpets with odor-resistant and allergen-control properties are gaining traction, driven by heightened consumer awareness of hygiene and health. Manufacturers are incorporating antimicrobial treatments and easy-clean fibers to address these needs. The post-pandemic emphasis on indoor cleanliness has further accelerated the adoption of washable and stain-resistant carpets, supporting market growth.

Market Restraints

High Product Costs and Maintenance Challenges

Premium pet carpets often feature advanced materials and coatings, resulting in higher costs that may deter price-sensitive consumers. Maintenance complexities, such as the need for specialized cleaning products or professional services, also act as a barrier to widespread adoption, particularly in emerging markets.

Availability of Low-Cost Alternatives

Competition from low-cost rugs and mats made from synthetic materials poses a challenge for premium pet carpet manufacturers. Many consumers opt for cheaper, disposable alternatives, limiting the adoption of high-end pet carpet solutions.

Pet Carpet Market Opportunities

Customization and Aesthetic Integration

Rising demand for customizable carpets that match interior design trends presents significant opportunities. Manufacturers are offering options in size, texture, and color to cater to different home aesthetics. Integration with smart home ecosystems and design-focused collaborations with interior brands are emerging trends that can capture new customer segments.

Expansion in Emerging Economies

Emerging markets such as India, Brazil, and Southeast Asia offer strong potential due to growing pet populations and rising disposable incomes. Increasing awareness of pet hygiene and lifestyle products provides an untapped opportunity for global brands to expand their presence through localized product lines and e-commerce channels.

Product Type Insights

Stain-resistant pet carpets dominate the market, followed by odor-control and washable variants. The stain-resistant category benefits from technological innovations in fiber treatment and coating. Washable carpets are gaining popularity in urban households due to their ease of maintenance. Premium segments also feature antimicrobial and scratch-resistant products, catering to high-end consumers.

Distribution Channel Insights

Online retail platforms account for the largest market share, driven by convenience, variety, and promotional discounts. E-commerce channels such as Amazon, Chewy, and brand-owned websites enable customers to explore and compare product features easily. Offline retail, including pet specialty stores and home furnishing outlets, continues to play a crucial role in premium product display and personalized recommendations.

| Milliken & Company | Interface, Inc. | Armstrong Flooring, Inc. | PetFusion | Ruggable, Inc. | Beaulieu International Group | Tarkett S.A. | J+J Flooring Group | |

|---|---|---|---|---|---|---|---|---|

|

|

|

|

|

|

|

|

|

|

Regional Insights

North America

North America leads the global pet carpet market, with the U.S. accounting for a significant share due to high pet ownership rates and advanced home furnishing trends. The region’s market is characterized by strong consumer awareness, high spending capacity, and widespread availability of premium pet products.

Europe

Europe follows closely, with strong demand for sustainable and eco-certified carpets. The U.K., Germany, and France are major markets emphasizing quality, aesthetics, and environmental responsibility. Stringent regulations regarding material sustainability and recyclability are further shaping product innovation.

Asia-Pacific

Asia-Pacific is the fastest-growing region, supported by rapid urbanization and growing middle-class populations. China, Japan, and India are leading markets where pet humanization and digital retail channels are boosting product adoption. Domestic manufacturers are increasingly investing in premium pet care product lines to capture this trend.

Latin America

Latin America, led by Brazil and Mexico, is experiencing steady growth, driven by increasing pet adoption and improving household incomes. Local brands are introducing affordable and washable carpet solutions to attract budget-conscious consumers.

Middle East & Africa

The Middle East and Africa region is witnessing gradual market expansion, with premium products gaining traction in high-income economies like the UAE and Saudi Arabia. Africa’s growing urbanization and evolving pet culture are expected to create niche opportunities over the next decade.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Carpet Market

- Mohawk Industries, Inc.

- Shaw Industries Group, Inc.

- Milliken & Company

- Interface, Inc.

- Armstrong Flooring, Inc.

- PetFusion

- Ruggable, Inc.

Recent Developments

- In August 2025, Mohawk Industries launched a new line of eco-friendly pet carpets made from 100% recycled PET fibers to enhance sustainability and performance.

- In May 2025, Ruggable introduced a washable pet carpet collection featuring odor-resistant technology and customizable designs tailored for pet households.

- In March 2025, Milliken & Company expanded its product range with antimicrobial-treated carpet solutions targeting both residential and pet-specific applications.