Pet Accessories Market Size

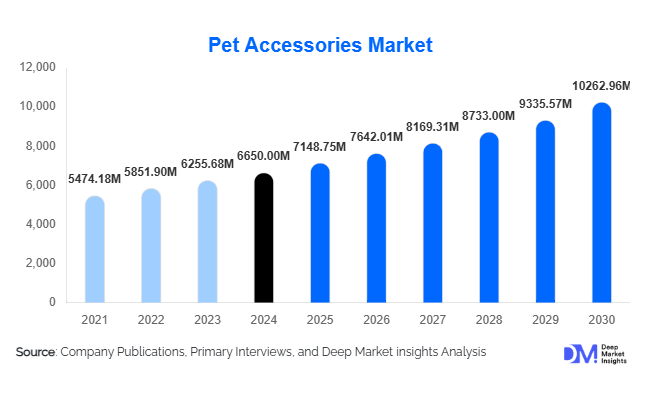

According to Deep Market Insights, the global pet accessories market size was valued at USD 6650 million in 2024 and is projected to grow from USD 7148.75 million in 2025 to reach USD 10,262.96 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The pet accessories market growth is primarily driven by rising pet adoption rates, the humanization of pets, and the increasing demand for premium and smart pet products globally.

Key Market Insights

- Smart pet accessories such as GPS collars and automated feeders are gaining traction, catering to tech-savvy pet owners seeking convenience and health monitoring features.

- Premium and mid-range pet accessories dominate the market, reflecting consumer preference for quality, durability, and design aesthetics.

- North America holds the largest market share, led by high pet ownership and disposable incomes driving demand for innovative and luxury products.

- Europe remains a significant growth region, fueled by sustainability trends, premium product adoption, and the humanization of pets.

- Asia-Pacific is emerging as a key growth market, driven by increasing urbanization, disposable incomes, and rising pet adoption in China and India.

- E-commerce platforms, including D2C websites and online marketplaces, are reshaping consumer access and engagement with pet accessories.

What are the latest trends in the pet accessories market?

Smart & Connected Pet Products

Pet accessory manufacturers are increasingly integrating technology into their products. GPS-enabled collars, automatic feeders, and health-monitoring devices are becoming mainstream, enhancing pet safety and owner convenience. Mobile apps linked to smart accessories provide real-time tracking, health analytics, and interactive features that appeal to tech-savvy consumers. IoT-enabled devices are also enabling subscription services for consumables such as smart feeders and treat dispensers.

Premiumization and Customization

Consumers are seeking high-quality, customizable accessories such as designer collars, clothing, and bedding. Premium products offer durability, aesthetic appeal, and advanced features, creating differentiation in a competitive market. Customization trends allow owners to personalize products according to pet size, breed, and preferences, expanding pet accessories market engagement.

What are the key drivers in the pet accessories market?

Rising Pet Adoption & Humanization

The growing number of pet owners globally, combined with the trend of treating pets as family members, drives demand for diverse accessories. Pet owners increasingly invest in products that enhance comfort, safety, and style, from collars and toys to apparel and grooming supplies. Urbanization and nuclear family structures also boost reliance on accessories to ensure pet well-being.

Expansion of E-commerce Channels

The rapid growth of online retail enables wider reach and convenience, supporting sales of pet accessories across regions. Digital marketing, subscription models, and direct-to-consumer strategies are expanding access to premium and niche products, driving revenue growth.

What are the restraints for the global market?

High Costs of Premium Products

Premium and technologically advanced pet accessories come at high price points, limiting affordability for middle-income consumers. Price sensitivity may restrict mass adoption, particularly in emerging markets.

Regulatory & Compliance Challenges

Manufacturers must navigate diverse safety, quality, and environmental regulations across regions. Non-compliance can result in product recalls, fines, or restricted market access, acting as a barrier to entry for smaller players.

What are the key opportunities in the pet accessories industry?

Emerging Markets

Asia-Pacific and Latin America present significant growth potential due to increasing urbanization, rising disposable incomes, and growing pet ownership. Companies can expand distribution networks and tailor products to local preferences to capitalize on these opportunities.

Subscription & Innovative Product Models

Subscription services offering curated accessory kits or smart device bundles are gaining popularity. Innovation in eco-friendly, durable, and tech-enabled products provides differentiation and recurring revenue opportunities for pet accessories market players.

Product Type Insights

Collars, leashes, and harnesses remain the leading product type, reflecting safety and control priorities. Apparel and fashion accessories are gaining popularity among urban pet owners, particularly in North America and Europe. Toys and bedding continue to drive volume sales in mid-range and budget segments. Smart accessories, including GPS collars and automated feeders, are emerging as a high-growth category across regions.

Application Insights

Personal use by pet owners represents the largest application segment, followed by commercial use in grooming salons, veterinary clinics, and boarding facilities. Emerging applications include subscription-based services, IoT-integrated accessories, and wellness-focused products that monitor pet health and activity, offering convenience and peace of mind for owners.

Distribution Channel Insights

Online channels dominate sales, with marketplaces and D2C websites enabling product comparison, real-time reviews, and convenient delivery. Specialty stores and offline retailers remain relevant for premium and experiential purchases. Subscription-based services and mobile app integrations are emerging as new engagement channels, enhancing consumer loyalty and recurring revenue opportunities.

Pet Owner Type Insights

Individual pet owners drive the largest market demand, particularly in urban regions. Family households are increasingly investing in accessories for multiple pets, while commercial buyers such as grooming salons and clinics support bulk purchases. Young, tech-savvy consumers are adopting smart accessories faster, whereas older, affluent pet owners prefer premium and durable products.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest pet accessories market share, led by high disposable incomes and elevated pet ownership. Demand is highest for smart and premium accessories, with online retail penetration supporting convenience and wide product selection.

Europe

Europe is growing steadily, driven by sustainability trends, premiumization, and the humanization of pets. Consumers are increasingly opting for eco-friendly and high-quality accessories, with Germany, the U.K., and France as key markets.

Asia-Pacific

Asia-Pacific is emerging as a high-growth region due to urbanization, rising income levels, and increasing pet adoption in China, India, and Japan. Mid-range and affordable smart products are particularly popular among emerging middle-class consumers.

Latin America

Pet accessories adoption is gradually increasing, led by Brazil, Mexico, and Argentina. Outbound awareness campaigns, online platforms, and growing pet humanization are supporting pet accessories industry growth.

Middle East & Africa

The Middle East shows growth potential with high-income consumers in the UAE, Saudi Arabia, and Qatar. Africa represents a nascent market with rising awareness and gradual urban adoption driving niche demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The pet accessories market is moderately fragmented, with the top 5 players accounting for approximately 55% of the global market. Premium brands dominate urban and high-income regions, while mid-range and local brands hold relevance in emerging markets.

Top Companies in the Pet Accessories Market

- Petco Animal Supplies, Inc.

- PetSmart Inc.

- Mars Petcare

- Nestlé Purina Petcare

- Spectrum Brands Holdings, Inc.

- Central Garden & Pet Company

- Rolf C. Hagen Inc.

- Trixie Heimtierbedarf GmbH & Co. KG

- Beaphar

- Ferplast S.p.A.

- PetSafe

- Coastal Pet Products, Inc.

- KONG Company

- Ethical Products Inc.

- JW Pet Company

Recent Developments

- In 2025, Petco launched a line of smart feeders with AI-based meal tracking, enhancing pet health monitoring and owner convenience.

- In 2024, Nestlé Purina Petcare expanded its premium accessories range in Europe, focusing on eco-friendly collars and apparel.

- In 2025, Mars Petcare partnered with e-commerce platforms in the Asia-Pacific to introduce subscription-based accessory kits, improving reach and recurring revenue streams.