Personal eVTOL Market Size

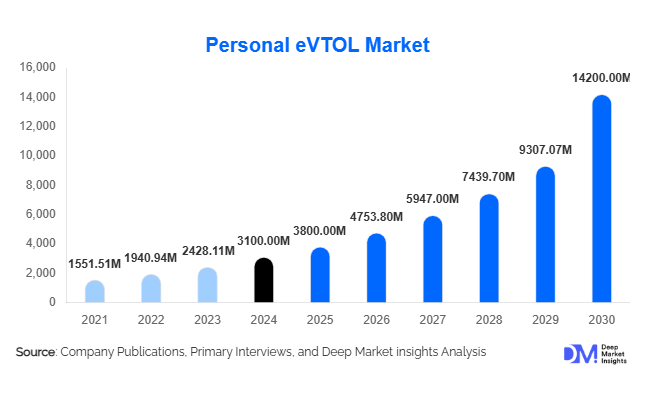

According to Deep Market Insights, the global personal eVTOL (electric vertical take-off and landing) market size was valued at USD 3,100 million in 2024 and is projected to grow from USD 3,800 million in 2025 to reach USD 14,200 million by 2030, expanding at a CAGR of 25.1% during the forecast period (2025–2030). Market growth is primarily driven by accelerating technological innovation in electric propulsion and autonomous flight systems, government initiatives supporting urban air mobility (UAM), and increasing demand for sustainable personal transport alternatives that reduce congestion and emissions.

Key Market Insights

- The rise of electric aviation and zero-emission mobility is positioning personal eVTOLs as a transformative mode of transport for short-range urban and regional travel.

- 2–5-seat eVTOL aircraft currently dominate development pipelines, offering the optimal balance between weight, performance, and certification feasibility for early-stage commercialization.

- Battery-electric propulsion systems lead the market, representing over 65% of 2024 prototypes and pilot production models, with hybrid and hydrogen variants emerging for extended-range applications.

- North America accounts for roughly 40% of global demand, supported by early FAA regulatory frameworks, strong venture capital investment, and leading OEM presence.

- Asia-Pacific is the fastest-growing region, driven by urbanization, smart city initiatives, and government investment in next-generation air mobility infrastructure.

- Autonomy, AI-based flight control, and vertiport infrastructure are key enablers reshaping the competitiveness and scalability of the personal eVTOL ecosystem.

Latest Market Trends

Shift Toward Personal Air Mobility Ecosystems

As electric aviation matures, manufacturers and cities are moving beyond vehicle design toward developing integrated personal air mobility ecosystems. This includes vertiport networks, charging and energy management systems, and low-altitude traffic control frameworks. Strategic partnerships between OEMs, infrastructure developers, and municipalities are accelerating the creation of certified flight corridors and “U-space” zones for eVTOLs. The convergence of smart city technologiesIoT-enabled navigation, autonomous fleet management, and AI-based air traffic control will drive seamless personal aviation experiences within urban areas.

Hybrid and Hydrogen-Electric eVTOL Development

While battery-electric designs dominate early prototypes, hybrid-electric and hydrogen-powered systems are gaining traction to extend range and payload capacity. Companies are exploring solid-state batteries and hydrogen fuel cells to overcome current energy density limitations. By 2030, hybrid systems could account for nearly 20% of total eVTOL deployments, particularly in intercity transport applications. Advances in lightweight materials, thermal management, and modular energy packs are further enabling scalable production and cost reduction.

Personal eVTOL Market Drivers

Technological Advancements in Battery and Autonomy

Continuous improvement in battery efficiency, energy density, and charging speed is a primary growth catalyst. Innovations such as high-nickel cathodes, solid-state electrolytes, and ultra-fast DC charging infrastructure are making eVTOLs commercially feasible. Parallelly, AI-based autonomous navigation and flight stabilization systems are reducing pilot dependency, enabling safer and more cost-effective personal operations.

Urban Congestion and Sustainability Push

With global cities facing rising congestion and emissions challenges, personal eVTOLs offer a practical alternative to ground transport. Their zero-emission electric propulsion aligns with global decarbonization targets and sustainability initiatives. Governments are integrating UAM into future transport planning, providing funding and incentives for local eVTOL adoption as part of broader net-zero mobility goals.

Governmental and Regulatory Support

Agencies such as the FAA (U.S.), EASA (Europe), and CAAC (China) are advancing certification standards for small electric aircraft. National programs like the EU Green Deal, Japan’s Urban Air Mobility Roadmap, and China’s Low-Altitude Economy strategy are actively promoting eVTOL R&D and pilot projects. Early regulatory clarity provides investors and OEMs confidence to scale production and commercial operations.

Market Restraints

High Manufacturing and Certification Costs

R&D, certification, and manufacturing costs remain substantial barriers to scalability. Safety validation, airworthiness certification, and redundancy testing require multi-year processes and heavy capital outlay. As of 2024, unit costs for personal eVTOLs remain highranging between USD 200,000 and USD 600,000limiting accessibility to high-income consumers and institutional buyers.

Infrastructure and Public Acceptance Challenges

The lack of standardized vertiport infrastructure, charging grids, and low-altitude airspace regulation limits near-term adoption. Additionally, public perception related to safety, noise, and privacy continues to be an obstacle. Public acceptance campaigns, pilot demonstration flights, and urban integration programs are key to overcoming these restraints.

Personal eVTOL Market Opportunities

Regulatory and Certification Leadership

Governments are formalizing certification frameworks for electric aircraft. Companies that achieve early certification under FAA or EASA standards will secure first-mover advantages. This leadership extends beyond compliance, opens export opportunities, and positions certified manufacturers as preferred suppliers for emerging UAM networks worldwide.

Technology Integration and Ecosystem Development

Integrating lightweight composites, modular battery packs, and autonomy software offers opportunities for differentiation. Cross-industry collaboration among aerospace, automotive, and software firms is fostering hybrid innovation. Building ecosystem solutionsvertiports, energy networks, and digital air traffic control creates new revenue streams for both startups and established players.

Regional Demand and New Business Models

Rapidly urbanizing regions such as China, India, and the Middle East are investing heavily in next-generation transport infrastructure. Fractional ownership, subscription leasing, and mobility-as-a-service models are expanding access beyond individual ownership, increasing utilization rates, and reducing per-user costs. These flexible ownership structures could catalyze mass-market adoption post-2030.

Product Type Insights

By seating capacity, 2–5 seat eVTOLs dominate the market, accounting for around 38% of the 2024 global share. This configuration provides an optimal balance between payload, safety, and range, making it ideal for personal and semi-private use. Single-seaters remain niche for recreational and pilot training purposes, while larger 6+ seat variants are still in prototype stages. Battery-electric propulsion currently holds a 67% market share, outperforming hybrid-electric models in operational readiness and certification progress.

Application Insights

Private ownership and personal commuting applications represent about 45% of 2024 demand, as early adopters and high-net-worth individuals lead purchases. Urban air taxi operators and tourism providers are fast-growing adjacent applications, expected to collectively exceed 35% of total market revenue by 2030. Emergency medical services (EMS) and recreational eVTOL experiences as aerial sightseeing and adventure sportsare emerging segments contributing to incremental growth.

| By Lift + Cruise Configuration Type | By Propulsion Type | By Range | By Seating Capacity | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global personal eVTOL market with a 39% share in 2024. The United States is home to major OEMs such as Joby Aviation, Archer Aviation, and Wisk Aero, supported by strong venture capital inflows and FAA-backed certification programs. Growing urban congestion in cities such as Los Angeles, New York, and Dallas is driving regional adoption, with pilot projects underway to integrate personal eVTOLs into future transport networks.

Europe

Europe holds approximately 28% of the global market share in 2024, led by Germany, France, and the United Kingdom. The European Union’s Green Mobility initiative and national funding for sustainable aviation have accelerated R&D investments. Volocopter and Lilium are spearheading commercial deployment efforts, with pilot corridors planned between major urban centers and tourism destinations by 2030.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR projected above 30% through 2030. China’s Low-Altitude Economy policy, Japan’s Osaka Expo 2025 initiatives, and South Korea’s UAM roadmap are driving early commercialization. Rapid urbanization, high population density, and strong government backing make APAC a strategic growth hub for personal and shared eVTOL use.

Latin America

Latin America accounts for roughly 6% of the 2024 market share. Brazil and Mexico are front-runners, leveraging strong aerospace capabilities and congested megacities as demand drivers. Infrastructure challenges persist, but rising middle-class income and tourism integration create long-term potential.

Middle East & Africa

The Middle East and Africa collectively represent around 7% of the market in 2024, led by the UAE and Saudi Arabia. Dubai’s Smart Mobility strategy and Saudi Arabia’s NEOM city initiative are attracting major pilot projects. Africa’s adoption is slower but growing in air ambulance and tourism applications in South Africa and Kenya.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Personal eVTOL Market

- Joby Aviation

- Archer Aviation

- EHang Holdings

- Volocopter GmbH

- Lilium N.V.

- Vertical Aerospace

- Wisk Aero (Boeing-JV)

- Eve Air Mobility

- Beta Technologies

- SkyDrive Inc.

- AutoFlight

- Opener Aero

- Airbus (CityAirbus NextGen)

- Urban Aeronautics

- Ascendance Flight Technologies

Recent Developments

- In July 2025, Joby Aviation completed its first FAA-conforming prototype series for type certification testing, marking a milestone in U.S. commercial eVTOL readiness.

- In May 2025, Volocopter announced its first production-ready VoloCity airframe at its Bruchsal facility, aiming for commercial operation ahead of the 2026 Paris Olympics.

- In March 2025, EHang received type certification for its EH216-S model from the Civil Aviation Administration of China (CAAC), the first fully autonomous passenger eVTOL certified globally.

- In January 2025, Archer Aviation partnered with United Airlines to develop eVTOL infrastructure in Chicago and New York City for short-haul mobility corridors.