Personal Care Product Contract Manufacturing Market Size

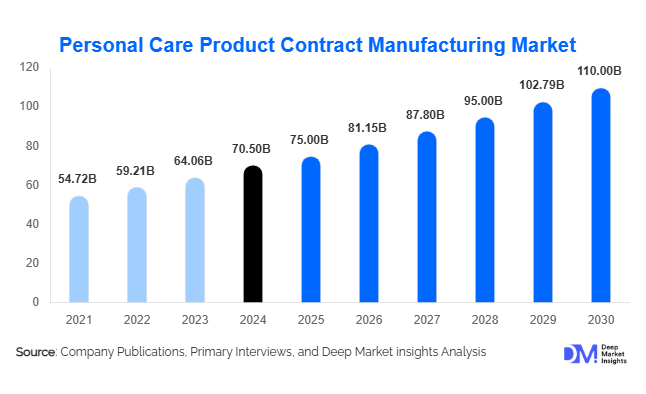

The global personal care product contract manufacturing market size was valued at USD 70.5 billion in 2024 and is projected to grow from USD 75 billion in 2025 to reach USD 110 billion by 2030, expanding at a CAGR of 8.2% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer demand for premium skincare and haircare products, increasing adoption of private-label solutions, and expansion of contract manufacturing partnerships to meet global e-commerce demand efficiently.

Key Market Insights

- Skincare remains the largest product category, accounting for over 35% of the global market in 2024, with anti-aging and natural formulations driving higher revenues.

- Retail and e-commerce channels dominate end-use demand, representing 52% of total consumption due to the surge of private-label brands and D2C platforms.

- Asia-Pacific is the fastest-growing region, led by China and India, capturing 38% of the market share in 2024 due to rising disposable incomes and urbanization.

- Technological adoption in contract manufacturing, including automation, AI-driven formulation design, and digital quality control, is enhancing efficiency and product innovation.

- Premium, natural, and sustainable products are gaining traction globally, influencing packaging, formulation, and production processes among leading manufacturers.

- Regulatory compliance and quality assurance are becoming critical competitive differentiators, especially for exports to North America and Europe.

Latest Market Trends

Shift Toward Natural and Sustainable Products

Contract manufacturers are increasingly focusing on organic, natural, and cruelty-free personal care formulations. Consumers are demanding clean-label products free of harmful chemicals, prompting manufacturers to innovate and offer specialized formulations. Sustainable packaging, recyclable containers, and biodegradable sachets are becoming industry standards, particularly in skincare and haircare products. This shift supports brand positioning for eco-conscious consumers and enhances export opportunities in regions with strict environmental regulations.

Rise of Private Label and E-commerce Demand

The growth of online retail and direct-to-consumer platforms has accelerated the demand for private-label personal care products. Contract manufacturers are providing end-to-end solutions, including formulation, production, packaging, and logistics. Small and medium-sized brands can now scale globally without heavy capital investment. E-commerce-driven demand is particularly strong for niche categories such as organic skincare, men’s grooming, and anti-aging products, creating opportunities for innovative and flexible manufacturing partnerships.

Personal Care Contract Manufacturing Market Drivers

Rising Consumer Preference for Premium Products

Increasing awareness about personal grooming, anti-aging, and wellness products is driving demand for premium formulations. Consumers prefer high-quality, sustainable, and effective personal care solutions, prompting brands to outsource production to specialized contract manufacturers capable of meeting these quality standards efficiently.

Cost-Efficiency for Brands

Outsourcing manufacturing reduces CAPEX and operational costs for personal care brands. Companies can focus on marketing, branding, and R&D while leveraging contract manufacturers for large-scale, high-quality production. This financial advantage continues to fuel market growth, especially among new entrants and small-scale brands.

Global Retail and E-commerce Expansion

The proliferation of online marketplaces and international retail chains has increased the need for scalable, flexible manufacturing solutions. Contract manufacturers offering quick turnaround, private-label options, and export-ready products are seeing strong demand globally, particularly in skincare and haircare segments.

Market Restraints

Regulatory Compliance Complexity

Strict regulations on personal care products across multiple regions can slow product development and increase operational costs. Manufacturers must navigate FDA regulations, ISO 22716 GMP standards, and EU cosmetics directives to ensure compliance, which can be challenging for small-scale operators.

Volatility of Raw Material Prices

Dependence on natural and specialty ingredients makes manufacturers vulnerable to price fluctuations, impacting profit margins and product pricing. Securing a stable supply chain and managing cost variations are critical challenges in sustaining growth.

Market Opportunities

Expansion in Emerging Markets

Rising disposable income and urbanization in regions like India, Southeast Asia, and Latin America are fueling demand for personal care products. Contract manufacturers can tap into these markets through localized production and region-specific formulations, reducing logistics costs and meeting culturally tailored preferences.

Advanced Technology Integration

Adoption of automation, AI, and digital quality control is creating opportunities for faster product development, consistent quality, and cost-effective operations. Manufacturers can develop innovative products, including personalized skincare and haircare solutions, while improving operational efficiency and scalability.

Private Label and Niche Product Growth

The surge of private-label products among retailers and e-commerce platforms is creating significant opportunities. Contract manufacturers providing full-service solutions—including formulation, packaging, and export compliance—can capture higher margins while supporting brands in rapid market entry and product diversification.

Product Type Insights

Skincare products dominate, driven by high demand for anti-aging creams, serums, and moisturizers, accounting for 35% of the market in 2024. Haircare follows closely, with shampoos, conditioners, and hair treatment solutions representing another significant revenue share. The trend toward natural and organic ingredients is particularly strong in these categories, shaping formulation strategies and influencing global market dynamics.

Formulation Insights

Creams and lotions lead the formulation segment, contributing 40% of the market due to consumer preference for easy-to-apply, effective, and premium-feeling products. Gels, sprays, and powders have specialized applications, while liquids dominate haircare production. Emerging demand for hybrid formulations like moisturizing gels and multifunctional creams is expected to drive segment innovation.

Packaging Insights

Bottles and jars are the most widely used packaging formats, holding 45% of the market, primarily for skincare and haircare products. Pumps and tubes are gaining popularity for hygienic dispensing, while sachets and pouches cater to travel-size and subscription-based models. Sustainable and recyclable packaging is becoming a key differentiator among manufacturers.

End-Use Insights

Retail and e-commerce channels dominate end-use demand with 52% of market share, driven by private-label brands and D2C platforms. Professional salons, spa chains, and dermatology clinics are increasingly outsourcing premium formulations, creating high-margin opportunities. Export-driven demand is rising, particularly from North America and Europe, for high-quality, compliant products manufactured in Asia and Europe.

| By Product Type | By Formulation | By Packaging Type | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

The U.S. leads the North American market, valued at USD 19,700 million in 2024, with high consumer awareness and a strong preference for premium, organic, and sustainable personal care products. Canada shows moderate growth, primarily driven by eco-conscious consumers and private-label demand.

Europe

Germany and France are key contributors, with the region capturing 25% of the 2024 market. High-quality standards, regulatory compliance, and growing preference for natural products drive demand. Younger demographics are fueling growth through e-commerce adoption and sustainable product choices.

Asia-Pacific

APAC is the fastest-growing region, led by China and India, accounting for 38% of the global market in 2024. Rapid urbanization, increasing disposable income, and rising awareness of personal grooming are the key growth drivers. E-commerce platforms further accelerate market penetration, particularly in skincare and haircare categories.

Latin America

Brazil and Mexico are emerging markets, with a CAGR of 7.5%, driven by rising urban populations and interest in private-label personal care products. Affluent consumers increasingly purchase imported and premium products, creating export opportunities.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is expanding rapidly due to high disposable income and luxury product demand. South Africa is a major African market, benefiting from tourism and rising personal care consumption. Imports of premium products remain significant, with increasing local contract manufacturing capabilities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Personal Care Contract Manufacturing Market

- Givaudan

- Symrise

- Fareva

- HCT Group

- Cosmax

- Kolmar Korea

- Intercos

- Mane

- Schwan-STABILO

- Ohly Group

- Kao Corporation

- Sakura Cosmetic

- Hugel

- Wacker Chemie AG

- Vantage Specialty Chemicals

Recent Developments

- In March 2025, Cosmax expanded its R&D facilities in South Korea to develop personalized skincare formulations and eco-friendly packaging solutions.

- In January 2025, Givaudan acquired a European contract manufacturer to strengthen its natural and organic personal care portfolio.

- In June 2024, Fareva announced a USD 100 million investment in automated production lines for premium haircare and skincare products in the Asia-Pacific.