Perfume Dupes Market Size

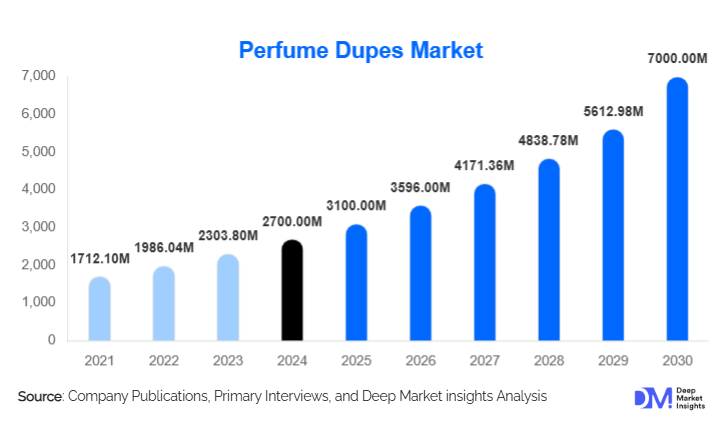

According to Deep Market Insights, the global perfume dupes market size was valued at USD 2,700 million in 2024 and is projected to grow from USD 3,100 million in 2025 to reach USD 7,000 million by 2030, expanding at a CAGR of 16% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer demand for affordable luxury fragrances, the increasing influence of social media on purchasing behavior, and the rapid adoption of online retail channels for fragrance discovery and purchase.

Key Market Insights

- Perfume dupes are gaining popularity among cost-conscious consumers, offering similar scent profiles to luxury perfumes at a fraction of the price.

- Online retail and direct-to-consumer platforms dominate, enabling small and mid-size brands to reach global audiences efficiently.

- Designer-inspired dupes lead the market, with consumers preferring affordable alternatives to high-end luxury brands like Chanel, Dior, and YSL.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising middle-class income, e-commerce adoption, and influencer-led trends in China, India, and Southeast Asia.

- Sustainability and ethical production practices are shaping brand differentiation, with cruelty-free and vegan formulations attracting younger consumers.

- Technological adoption, including analytical chemistry for scent replication, AI-driven product recommendations, and influencer marketing platforms, is accelerating market penetration.

What are the latest trends in the perfume dupes market?

Influencer-Led and Social Media Driven Growth

Perfume dupes have benefitted immensely from influencer-led marketing on platforms like TikTok, Instagram, and YouTube. Users frequently post comparison videos showing original perfumes versus affordable alternatives, driving virality and consumer trust. Brands leveraging social media to showcase scent comparisons, longevity tests, and value-for-money propositions have seen rapid growth. Short video content, user-generated reviews, and influencer campaigns have become the primary discovery and conversion tools for new customers, particularly among Gen Z and Millennials.

Sustainability and Ethical Formulations

Brands in the perfume dupe market are increasingly focusing on cruelty-free, vegan, and ethically sourced ingredients. Sustainable packaging, refillable bottles, and low-waste operations are gaining traction, catering to environmentally conscious consumers. This trend not only enhances brand equity but also aligns with regulatory expectations in regions with strict cosmetic safety and environmental standards. Companies highlighting sustainable practices differentiate themselves from low-quality competitors and strengthen customer loyalty.

What are the key drivers in the perfume dupes market?

Rising Cost of Luxury Perfumes

The increasing price of luxury perfumes due to premium raw materials, branding, and import duties has created strong demand for affordable alternatives. Perfume dupes provide similar olfactory experiences at a significantly lower cost, appealing to consumers seeking aspirational fragrances without the high investment. Inflationary pressures and rising disposable incomes in emerging markets have further fueled this trend.

Digital and Direct-to-Consumer Penetration

Online retail platforms and direct-to-consumer models reduce distribution costs and enable wider reach. Brands can launch globally with minimal overhead, offer sample kits, and leverage data analytics to target specific demographics. E-commerce adoption, combined with social media marketing, has democratized access to dupe perfumes and accelerated market growth, particularly among younger, tech-savvy consumers.

Growing Preference for Affordable Luxury and Variety

Consumers are increasingly interested in experimenting with multiple fragrances rather than committing to a single high-end perfume. Perfume dupes allow consumers to build a diverse fragrance collection at a fraction of the cost. The desire for affordable luxury and frequent scent rotation drives consistent demand for mid-tier and premium-quality dupes.

What are the restraints for the global market?

Regulatory and Quality Concerns

Perfume dupes face challenges related to safety standards, ingredient disclosure, and adherence to cosmetic regulations. Variations in regulatory compliance across regions may limit market access and require additional investment in quality control. Substandard formulations can result in skin irritation, harming brand reputation and consumer trust.

Perceived Inferiority and Longevity Issues

Although dupes replicate fragrance profiles, they may lack the longevity, projection, or complexity of original luxury perfumes. Consumers loyal to original brands or seeking high-status products may avoid dupes. Overcoming perceptions of inferiority and ensuring consistent quality remain critical challenges for market participants.

What are the key opportunities in the perfume dupes industry?

Expansion in Emerging Middle-Class Markets

Rising disposable incomes in countries such as India, China, and Southeast Asian nations provide significant growth opportunities. Consumers in these regions seek affordable luxury products, including designer-inspired dupes, allowing new entrants and established brands to scale quickly. Strategic marketing, localization, and online penetration can further accelerate adoption.

Subscription and Discovery-Based Models

Subscription boxes and discovery sets present opportunities to offer multiple scents at lower risk to consumers. Brands can encourage trial, upsell full-size bottles, and gather consumer preference data. This model appeals to younger demographics seeking variety and convenience and helps increase repeat purchase rates.

Technological Integration and Analytical Scent Replication

Advanced analytical techniques, such as gas chromatography-mass spectrometry (GC-MS), enable accurate scent profiling and replication. AI-based recommendation engines and online virtual scent experiences can enhance consumer engagement, drive online sales, and improve product development cycles. Technology adoption allows brands to maintain consistent quality and accelerate market entry.

Product Type Insights

Eau de Parfum (EDP) dupes dominate the market, accounting for approximately 35-40% of the 2024 market. EDP formulations provide a balance between scent longevity and affordability, appealing to consumers who seek performance close to luxury perfumes without paying premium prices. Other formats, such as body mists, oils, and Eau de Toilette (EDT), cater to niche preferences and casual daily use.

Application Insights

Women’s fragrances account for the majority of demand (55-60% of the market), with men’s and unisex dupes growing steadily. Designer-inspired fragrances lead the market (50-60%), followed by niche and celebrity-inspired dupes. Consumers are increasingly experimenting with multiple scents, seasonal collections, and mix-and-match layering, broadening the application spectrum of dupes beyond conventional personal fragrance usage.

Distribution Channel Insights

Online retail dominates (60-65% of market share), driven by e-commerce platforms, social media, and influencer marketing. Offline channels, including specialty stores, boutiques, and mass-market retailers, serve as complementary channels, particularly in regions with lower e-commerce penetration. Direct-to-consumer strategies allow brands to maintain price control, gather customer insights, and promote subscription models for recurring revenue.

End-User Insights

Gen Z and Millennials are the fastest-growing consumer segments, favoring affordable, variety-oriented, and ethically produced dupes. Older demographics (31-50 years) drive mid-tier and premium-quality dupe purchases, valuing longevity and performance. Unisex and gender-neutral dupes are emerging as niche segments, expanding market reach. Subscription services and discovery sets encourage trial and brand loyalty among younger consumers.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 25-30% of the global market, with the U.S. leading demand. High disposable incomes, strong e-commerce penetration, and social media influence drive the adoption of perfume dupes. Online retail and direct-to-consumer channels are particularly prominent, allowing small brands to scale efficiently.

Europe

Europe accounts for 20-25% of the market, with the U.K., Germany, and France as major contributors. Demand is driven by ethical consumerism, sustainability preferences, and the desire for affordable luxury. Online sales and influencer-led campaigns are key growth drivers, particularly among younger consumers.

Asia-Pacific

Asia-Pacific (30-35% of market) is the fastest-growing region, led by China, India, Japan, and Southeast Asia. Rising middle-class income, e-commerce adoption, and social media influence accelerate growth. Emerging urban markets and online-only dupe brands are driving significant incremental demand.

Latin America

Latin America (5-7%) is emerging, with Brazil, Mexico, and Argentina leading. Outbound travel-inspired trends, affordability, and online access are driving adoption, though growth is constrained by currency fluctuations and regulatory variability.

Middle East & Africa

MEA (5-8%) shows growing demand, with the UAE, Saudi Arabia, and South Africa as key markets. Strong perfume culture, high luxury fragrance pricing, and increasing online sales facilitate adoption. Regional brands offering inspired scents are expanding their reach locally and internationally.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Perfume Dupes Market

- Dossier

- Esencial MX

- ZENZ Perfumes

- One Dupe

- Fragrenza

- MOD Fragrances

- Chez Pierre

- Armaf

- Lattafa

- Maison 21G

- Al Haramain Perfumes

- Swiss Arabian

- Rasasi

- Ajmal Perfumes

- Perfume Parlour

Recent Developments

- In March 2025, Dossier launched a new range of luxury-inspired dupes with improved longevity and refillable packaging, targeting environmentally conscious consumers.

- In January 2025, Esencial MX expanded its e-commerce platform across Southeast Asia, leveraging influencer marketing to increase brand visibility and sales.

- In December 2024, ZENZ Perfumes introduced unisex fragrance lines inspired by designer originals, capturing younger demographics and social media-driven trends.