Peptide Supplements Market Size

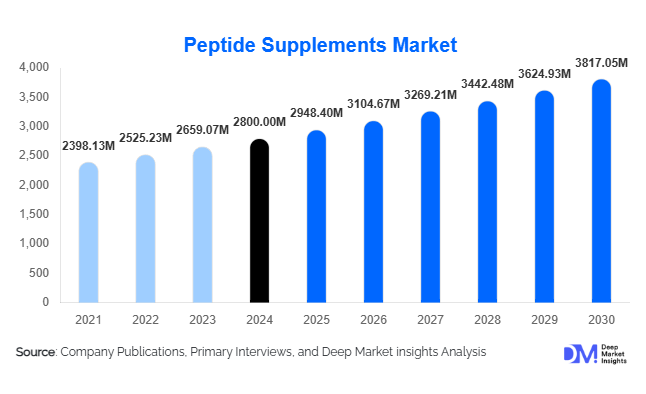

According to Deep Market Insights, the global Peptide Supplements market size was valued at USD 2,800 million in 2024 and is projected to grow from USD 2,948.4 million in 2025 to reach USD 3,817.05 million by 2030, expanding at a CAGR of 5.3% during the forecast period (2025–2030). The peptide supplements market growth is primarily driven by the rising demand for preventive health solutions, increasing consumer focus on anti-aging and beauty-from-within products, and the expanding sports and fitness industry worldwide.

Key Market Insights

- Collagen peptides dominate product demand, accounting for nearly 30% of the market in 2024 due to their strong application in skin, joint, and bone health.

- Animal-derived peptides lead sourcing with over 30% share, though plant-based and synthetic peptides are rapidly gaining traction due to sustainability and ethical trends.

- Sports & fitness applications are accelerating, as peptides for muscle recovery and endurance attract younger demographics and athletes globally.

- Online retail is the largest distribution channel, capturing nearly 40% of global sales in 2024 as e-commerce and direct-to-consumer models expand.

- North America leads in overall market share, while Asia-Pacific is the fastest-growing region, driven by China, India, and Japan.

- Technological innovations in bioavailability, such as encapsulation and synthetic peptide engineering, are reshaping product efficacy and consumer trust.

What are the latest trends in the peptide supplements market?

Beauty-from-Within Products on the Rise

Collagen peptides are increasingly marketed as ingestible beauty solutions, particularly in Asia and Europe. Consumers are shifting from topical products to oral supplements that support skin elasticity, hair strength, and nail health. This “beauty-from-within” trend is strongly influenced by the K-beauty and J-beauty industries and is now expanding globally. Premium positioning, clinical studies, and endorsements from dermatologists and wellness influencers are fueling this trend, making beauty the second-largest application segment after sports nutrition.

Plant-Based and Sustainable Peptides Gaining Momentum

With growing concerns about ethical sourcing and sustainability, plant-derived and marine peptides are gaining favor. Vegan formulations appeal to younger, environmentally conscious consumers, while marine collagen is marketed as a premium and sustainable alternative. Brands emphasizing traceability, eco-friendly production, and clean-label claims are capturing niche yet rapidly growing consumer bases. This is reshaping the market from its heavy reliance on bovine- and porcine-derived sources.

Functional Blends and Advanced Delivery Systems

Companies are launching peptide supplements blended with vitamins, probiotics, and antioxidants to enhance value and differentiation. Innovative delivery formats such as liquid shots, chewables, oral strips, and encapsulated slow-release systems are boosting consumer compliance and perceived efficacy. Advances in peptide engineering are improving bioavailability, allowing smaller doses with more significant effects, thus supporting premium pricing strategies.

What are the key drivers in the peptide supplements market?

Rising Health & Wellness Awareness

Consumers are increasingly proactive about managing long-term health through nutrition, driving demand for peptides that support immunity, cardiovascular health, weight management, and inflammation reduction. Post-pandemic health consciousness has further accelerated this driver, making supplements part of mainstream daily routines.

Aging Population & Anti-Aging Demand

Global aging demographics, particularly in North America, Europe, and Japan, are creating sustained demand for peptide supplements targeting joint mobility, bone health, and skin elasticity. Collagen peptides are especially popular among older consumers seeking anti-aging benefits, positioning this segment as both stable and high-margin.

Advancements in Peptide Technology

Peptide extraction, purification, and synthetic production have become more cost-effective and scalable. Innovations in molecular design and encapsulation techniques are enhancing stability and absorption. These advancements increase efficacy, broaden applications, and strengthen consumer trust through scientifically backed claims.

What are the restraints for the global market?

Regulatory Complexities and Safety Concerns

The peptide supplements market faces fragmented regulatory frameworks across regions. Variations in labeling, permissible health claims, and novel food approvals delay product launches and complicate international expansion. Quality concerns, including contamination and false claims, also risk eroding consumer trust.

High Production and Raw Material Costs

Peptide production, especially for synthetic and marine-derived sources, is cost-intensive, leading to premium pricing. While affluent consumers can absorb costs, price-sensitive markets remain underpenetrated. Raw material volatility and supply chain complexities further constrain affordability and large-scale adoption.

What are the key opportunities in the peptide supplements industry?

Expansion in Asia-Pacific and Emerging Markets

Asia-Pacific, led by China, India, Japan, and South Korea, is witnessing explosive demand due to rising disposable incomes, a growing middle class, and the cultural prioritization of skin health and wellness. Companies entering these markets with localized formulations and strong digital marketing stand to capture significant growth.

Innovation in Formats and Delivery

New delivery systems such as oral strips, functional beverages, and fortified foods open additional revenue streams. Convenience-driven formats are particularly appealing to younger consumers, while functional blends targeting specific conditions (e.g., sleep, immunity, cognitive function) enhance cross-selling opportunities.

Certification and Regulatory Compliance as Differentiators

Brands that invest in GMP compliance, third-party testing, and certifications such as NSF, halal, and organic are gaining trust and market share. As regulations tighten, early adopters of stringent safety and quality standards will face fewer barriers and gain a competitive edge in global expansion.

Product Type Insights

Collagen peptides dominate, holding approximately 30% share in 2024, due to their established role in beauty and joint health. Whey peptides and bioactive peptides follow, appealing to sports and fitness consumers. Muscle-building and immune-enhancing peptides are smaller but fast-growing, supported by increasing demand for specialized health solutions.

Application Insights

Sports and fitness lead global applications, representing nearly 25% of market share, as peptides are widely used for muscle recovery and endurance. Beauty and anti-aging follow closely, driven by collagen peptide supplements. Emerging applications include immune health, weight management, and cognitive enhancement, which are expected to drive future diversification and growth.

Distribution Channel Insights

Online retail dominates, with around 40% market share in 2024, as consumers increasingly rely on e-commerce and direct-to-consumer brands. Pharmacies and specialty nutrition stores remain strong offline channels, while supermarkets and hypermarkets cater to mainstream consumers. Subscription-based models and influencer-driven online sales are reshaping engagement strategies.

End-Use Insights

Sports & fitness enthusiasts and aging populations are the primary end-users, fueling stable and recurring demand. Beauty consumers, particularly women in Asia and Europe, represent the fastest-growing end-use segment. Clinical and therapeutic applications, while smaller, provide long-term opportunities through medical-grade peptide formulations. Export-driven demand from emerging economies further supports global market expansion.

| By Product | By Application | By Form | By Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share, accounting for 30–35% of the global market in 2024. The U.S. leads due to strong supplement culture, high disposable incomes, and an established e-commerce ecosystem. Demand is centered around sports nutrition, anti-aging, and immune support products.

Europe

Europe contributes 20–25% of global revenue, led by Germany, the U.K., France, and Italy. Strict regulatory frameworks support consumer confidence in premium-quality products. Plant-based and marine peptides are particularly popular in this region, driven by sustainability preferences.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a projected CAGR exceeding 12%. China, India, Japan, and South Korea drive growth through rising middle-class consumption and strong beauty-from-within demand. Japan and South Korea are mature markets, while China and India represent expansion hotspots for new entrants.

Latin America

Latin America accounts for 5–10% of market share, with Brazil and Mexico leading. Growing wellness awareness and increasing penetration of online retail are boosting demand, though affordability remains a constraint.

Middle East & Africa

This region represents approximately 5% of global demand. The UAE and Saudi Arabia are key markets, benefiting from high-income populations and strong interest in luxury wellness. South Africa is emerging as a consumer hub, particularly in sports nutrition. Regulatory challenges and import costs limit faster adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Peptide Supplements Market

- Thorne Research

- NOW Foods

- Life Extension

- Designs for Health

- Pure Encapsulations

- Nootropics Depot

- Douglas Laboratories

- Source Naturals

- Hammer Nutrition

- Kirkman Laboratories

- BioMed Nutrition

- American Peptide Company

- Vitamin Research Products

- Vitabase

- Peptides Sciences

Recent Developments

- In June 2025, Thorne Research announced the launch of a new line of plant-based peptide supplements targeting vegan consumers seeking sustainable alternatives.

- In April 2025, NOW Foods expanded its collagen peptide offerings with clinically studied marine collagen, marketed toward skin and joint health.

- In February 2025, Pure Encapsulations introduced encapsulated peptide blends combining immune and cognitive support functions, leveraging advanced delivery technologies.