PCVR Device Market Size

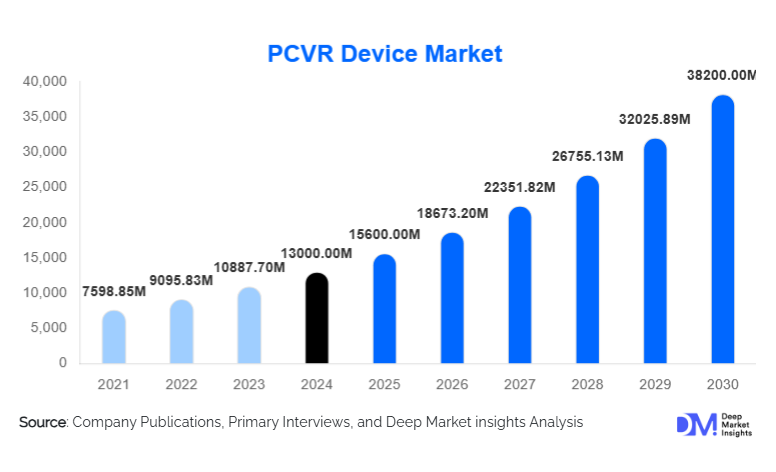

According to Deep Market Insights, the global Pcvr Device Market size was valued at USD 13,000 million in 2024 and is projected to grow from USD 15,600 million in 2025 to reach USD 38,200 million by 2030, expanding at a CAGR of 19.7% during the forecast period (2025–2030). Market growth is primarily driven by escalating demand for high-fidelity gaming experiences, surging enterprise adoption for simulation and training, improvements in device performance (tracking, optics), and falling price barriers for mid-range PC hardware.

Key Market Insights

- PC-tethered headsets dominate revenues, owing to their high performance and fidelity, especially in gaming and enterprise verticals, commanding 40% of 2024 market revenue.

- Inside-out tracking is becoming the standard among mid-range and entry-level devices, simplifying setup and lowering accessory costs captured 55% of device revenues in 2024.

- Gaming & Esports remain the largest end-use segment, generating 45% of Pcvr device revenues in 2024, though enterprise applications are growing faster.

- Online retail (OEM direct + e-commerce platforms) is the leading distribution channel, accounting for 60% of device revenue in 2024.

- Asia-Pacific is a critical growth region, contributing 32% of 2024 revenues (led by China and emerging value in India), with the fastest unit-growth projected through 2030.

- Technological integration, such as foveated rendering, eye-tracking, AI-assisted rendering, and better display panels, is accelerating adoption by reducing hardware requirement barriers.

What are the latest trends in the Pcvr Device Market?

Hybrid Device Cloud Ecosystems & AI-Enabled Rendering

Manufacturers are increasingly integrating cloud or edge-based services with local PC rendering to deliver low latency while offloading heavy content pipelines. AI-assisted features (e.g., predictive motion tracking, foveated rendering based on eye-tracking) are reducing dependency on top-tier GPUs. This enables mid-range PC setups to deliver an acceptable user experience, expanding the accessible market. These trends are particularly pronounced in regions where high-performance PCs are expensive or less common.

Enterprise Verticalization & Bundled Solutions

More companies are offering bundles targeting specific industry verticals (automotive, aerospace, healthcare), which include certified hardware, software, training, and service contracts. Enterprise customers value stable lifecycles, support, and certifications (e.g., for safety or medical use), which allows vendors to command premium ASPs. This vertical approach reduces risk and increases recurring revenue streams.

What are the key drivers in the Pcvr Device Market?

Growing Demand for Immersive & High-Fidelity Gaming Experiences

As PC gaming continues to push graphics and physics realism, users increasingly demand virtual reality hardware that matches that fidelity. High refresh rates, better optics, external tracking, and low latency are non-negotiables. AAA VR titles and community mods further create demand. The cohort of PC owners who upgrade components periodically supports cyclical hardware refresh demand.

Enterprise & Industrial Adoption for Training, Simulation, Design

Industries requiring precision, such as aerospace, automotive, defense, and medical, are investing heavily in PCVR devices for simulation, prototyping, and training. These industries value reliability, accuracy, and service support, which tend to favor tethered high-performance hardware. Such investments are often long-term, providing revenue stability beyond consumer cycles.

What are the restraints for the global Pcvr Device Market?

High Total Cost of Ownership & Hardware Requirements

The cost of a capable PC plus headset, sensors, controllers, and accessories remains high. Many consumers and enterprises are constrained by the need for powerful GPUs, fast CPUs, sufficient RAM, and adequate cooling. This high entry cost slows broader adoption, especially in price-sensitive regions.

Fragmented Content Ecosystems & Interoperability Barriers

Different platforms, APIs, and tracking standards force developers and users to navigate compatibility issues. Lack of consistency in content platforms, limited cross-device support, and required developer investment for multiple systems increase friction and cost. Until standardization (e.g., OpenXR) matures broadly, fragmentation remains a major restraint.

What are the key opportunities in the Pcvr Device Market?

Local Manufacturing & Policy Incentives in Emerging Regions

Governments in Asia-Pacific, Latin America, and parts of Eastern Europe are introducing incentives for local electronics manufacturing, including tax relief, tariff adjustments, and grants. Such policies help reduce component import costs, lower device prices, and enable faster delivery. Local OEMs who align with these incentives can gain a cost advantage and faster access into growing markets such as India, Southeast Asia, and Latin America.

Expanding Into Wellness, Remote Collaboration & Healthcare Verticals

Beyond gaming and industrial simulations, sectors like therapy, remote surgical training, mental health, immersive wellness, and collaborative design are showing rising demand. These verticals often tolerate a higher margin for quality, safety, and certification, and demand specialized features (e.g., hygiene, sterilizable parts). Device makers who build toward these needs can command premium pricing and differentiated value.

Product Type Insights

Premium PC-tethered headsets dominate market revenue, especially from high-end systems sold into gamers and enterprise simulation programs. Hybrid and inside-out systems are gaining ground in mid-range segments, offering a lower price and easier setup. Accessories like tracking stations and high-precision sensors represent a growing share of revenue, particularly in enterprise bundles. The value proposition is shifting: consumers increasingly expect good visuals with fewer external components; enterprises expect precision and support.

Technology Insights

Inside-out tracking now leads owing to lower setup complexity and better affordability, capturing 55% of revenue in 2024. Outside-in tracking remains important for high-precision use cases (training, simulators). Eye-tracking and hand-tracking are emerging as standard in premium devices. AI-driven features like foveated rendering are moving from “nice-to-have” to core differentiators.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest market (36% share of global revenues in 2024), led by the United States. Strong PC gaming hardware base, high disposable incomes, mature enterprise VR use, and strong tech ecosystems contribute to high demand. Enterprise training contracts and defense/aerospace simulation procurement are major drivers. Device makers see the US as a priority market for high-end launches and content developer support.

Asia-Pacific

Asia-Pacific is growing fast (32% share in 2024), with China leading in both consumption and OEM manufacturing. India is emerging rapidly, especially in educational and enterprise procurement, as device prices moderate. Japan, South Korea, and Australia contribute as premium markets. Growth is boosted by rising PC ownership, expanding gaming culture, and favorable policy incentives for tech adoption and local manufacturing.

Europe

Europe holds a significant portion (18% in 2024), with Germany, the UK, and France being the largest national markets. Industrial simulation (automotive, design) plays a key role. Demand is steady and rising in enterprise verticals and among consumer enthusiasts. Regulatory standards and industrial quality expectations influence device spec and pricing.

Middle East & Africa

This region (8% share) is driven largely by public sector projects, defense/local simulation, tourism & immersive entertainment sectors in wealthy GCC countries. Uptake tends to be project-based; price sensitivity and import duties are constraints. Growth is expected in South Africa, the UAE, and Saudi Arabia, among others.

Latin America

Latin America (6% share) is still nascent; demand comes mostly from gaming enthusiasts, universities, and early enterprise trials. Brazil and Mexico are the largest national demand centers. Growth depends on broader PC penetration, currency stability, and reducing import/market friction.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the PCVR Device Market

- Meta Platforms

- Valve Corporation

- HTC Corporation

- HP Inc.

- Sony Interactive Entertainment

- Lenovo Group Limited

- Pico Interactive

- Samsung Electronics

- Varjo Technologies

- Microsoft Corporation

- Acer Inc.

- ASUS

- Razer Inc.

- Magic Leap

- Epson

Recent Developments

- In 2024–2025, several device makers launched new high-fidelity tethered headsets offering better optics and inside-out tracking to reduce setup friction while maintaining enterprise-grade performance.

- In early 2025, major players pushed enterprise bundles combining training/simulation software, accessories, and support contracts, signalling a shift toward verticalized PCVR solutions.

- In mid-2025, AI integrations (foveated rendering, predictive motion tracking) began appearing as standard features in premium and mid-range PCVR devices, helping reduce hardware requirements for consumers and expanding addressable markets.