Paragliding Equipment Market Size

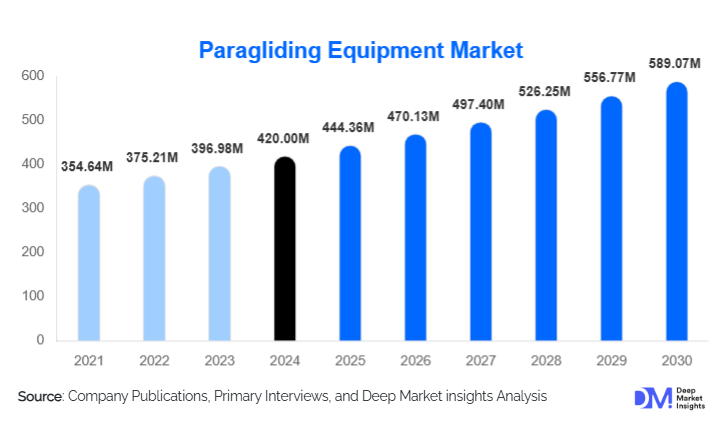

According to Deep Market Insights, the global paragliding equipment market size was valued at USD 420 million in 2024 and is projected to grow from USD 444.36 million in 2025 to reach USD 589.07 million by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). Growth in the market is driven by rising adventure tourism participation, increasing demand for certified safety equipment, and technological advancements in lightweight materials, instrumentation, and aerodynamic wing design.

Key Market Insights

- Adventure tourism expansion is accelerating global demand for paragliding gear, particularly in scenic and mountainous destinations.

- Paragliders (wings) remain the largest product segment, accounting for over 30–35% of total market revenue.

- Europe dominates the global market, supported by mature flight school infrastructure and strong recreational pilot communities.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes and growing interest in aerial adventure sports.

- Technology integration is reshaping pilot experience, with smart variometers, GPS systems, and connected flight instruments gaining popularity.

- Safety-focused design innovations such as improved reserve parachutes and integrated airbag harness systems are boosting replacement demand.

What are the latest trends in the paragliding equipment market?

Lightweight & High-Performance Wing Design

Manufacturers are increasingly focusing on ultralight wings, hybrid materials, and optimized cell structures that improve glide ratios and collapse resistance. “Hike-and-fly” wings are gaining momentum, appealing to mountaineers and adventure travelers seeking portable, compact solutions. Performance pilots are driving demand for competition-grade wings that combine high-speed efficiency with safety enhancements. These aerodynamic innovations significantly influence market upgrades and replacement cycles.

Electronics and Smart Flight Instruments

Advanced variometers, GPS trackers, and flight-logging instruments are transforming the paragliding experience. Bluetooth-enabled flight devices now integrate with smartphones, enabling real-time navigation, thermal detection, and post-flight analytics. These upgrades appeal to intermediate and advanced pilots seeking better performance insights. Flight apps with live tracking, community competitions, and safety alerts are accelerating digital adoption across the global pilot community.

What are the key drivers in the paragliding equipment market?

Growing Adventure Tourism Participation

Demand for paragliding equipment is strongly linked to the expansion of global adventure tourism. Mountain destinations in Europe, Asia, and Latin America are investing in paragliding infrastructure, including training schools, designated takeoff zones, and tandem tourism operations. As new participants enter the sport through tandem experiences, they increasingly progress into certified pilot training, driving demand for complete gear sets including wings, harnesses, helmets, and reserve parachutes.

Increasing Safety Awareness Among Pilots

Improved safety standards and greater awareness of equipment certifications (such as EN ratings) are encouraging pilots to invest in higher-quality gear. Demand for advanced reserve parachutes, protective helmets, and integrated-airbag harnesses is increasingly shaping purchasing patterns. As social media and pilot communities highlight accident prevention and responsible flying, safety-driven upgrades are rising even among recreational pilots, contributing to premium product adoption.

What are the restraints for the global market?

High Initial Equipment Costs

The cost of a full paragliding setup, including a wing, harness, helmet, reserve parachute, and instrument, remains a major barrier for beginners. Even entry-level wings and harnesses are relatively expensive due to safety compliance and material requirements. These high upfront costs restrict broader adoption, particularly in developing markets. Although used-gear markets exist, safety concerns often push pilots to favor new certified equipment, sustaining the price barrier.

Limited Infrastructure and Regulatory Inconsistencies

In many emerging paragliding markets, the sport lacks dedicated flying sites, certified schools, and standardized regulations. This limits access for new pilots and slows industry expansion. Regulatory inconsistencies, such as unclear certification requirements or restricted flying zones, further impede growth. Countries with strong tourism potential often require long-term infrastructure investments to support sustained paragliding activity.

What are the key opportunities in the paragliding equipment industry?

Growth of Tandem and Tourism-Based Paragliding

The rapid growth of adventure tourism is creating demand for tandem wings, dual harnesses, and specialized safety equipment tailored to commercial operators. Tourist-heavy markets like the Alps, Himalayas, Turkey, and Latin America are expanding tandem fleets, generating recurring opportunities for manufacturers and service providers. Equipment replacement cycles are shorter in commercial operations, offering long-term revenue potential in high-volume tourist regions.

Sustainable Materials and Eco-Friendly Design

Manufacturers are exploring recycled fabrics, modular repairable components, and low-impact material sourcing to meet rising sustainability expectations. Eco-conscious pilots increasingly prefer durable, repair-friendly gear that extends product life and reduces environmental impact. Regions with strong environmental regulations, particularly in Europe, are driving early adoption of sustainable equipment manufacturing practices.

Product Type Insights

Paragliders (wings) dominate the global market, representing the largest revenue share due to their essential role and higher price point. Beginner wings prioritize stability and safety, while intermediate and performance gliders drive premium demand. Harnesses, including lightweight, pod, and airbag-integrated models, form the second-largest category, supported by strong safety-driven replacement cycles. Reserve parachutes and protective equipment continue to gain traction as pilots emphasize risk mitigation. Electronic instruments (variometers, GPS units) are the fastest-growing product subset, driven by navigation innovation and digital adoption among pilots.

Application Insights

Recreational flying is the largest application segment, supported by millions of global adventure enthusiasts. Training and flight school applications generate consistent baseline demand for entry-level gear. Tandem tourism is expanding rapidly in popular adventure destinations, creating recurring demand for durable, certified equipment. Competitive and cross-country flying remains a niche but high-value segment, with pilots investing in advanced performance wings, lightweight harnesses, and top-tier instruments. Commercial applications such as aerial photography and filming continue to emerge as supplementary demand drivers.

Distribution Channel Insights

Specialty paragliding stores and flight schools lead global distribution, accounting for a major share of equipment sales due to hands-on evaluation and instructor recommendations. Online retail channels are expanding, especially for accessories and electronics, as pilots increasingly compare specifications and reviews digitally. Direct-to-consumer brand websites support personalized gear configuration and certification details. Rental-based distribution is growing in tourist regions, allowing beginners to access gear without high upfront costs.

Pilot Type Insights

Beginner and recreational pilots represent the largest customer segment, driven by entry-level training programs, tourism exposure, and the growth of flying clubs. Intermediate pilots contribute strongly to upgrade-driven demand as they transition into higher-performance wings. Advanced and competition pilots, although fewer in number, drive premium purchases, including high-performance gliders and advanced instruments. Tandem and commercial pilots require durable, certified equipment with frequent replacement cycles, contributing substantially to recurring revenue streams.

Age Group Insights

The 25–45 age group dominates the market, reflecting high participation in adventure sports and greater discretionary spending on outdoor activities. Younger pilots aged 18–24 contribute to growth in budget and lightweight wings, supported by digital learning resources and social media influence. Pilots aged 46–60 represent a strong share of premium gear purchases, prioritizing safety and comfort. The 60+ demographic, though smaller, increasingly participates in recreational flying and tandem experiences, creating steady demand for safety-focused equipment.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Europe

Europe is the largest regional market, accounting for approximately 30–35% of global paragliding equipment demand. Countries such as France, Switzerland, Austria, and Germany host mature paragliding ecosystems, with extensive flight schools, competitive leagues, and strong tourism activity. European manufacturers also lead global production and export, strengthening the region’s dominance. Safety regulations and infrastructure investment continue to support steady, sustainable growth.

North America

North America represents one of the most active paragliding communities outside Europe, with the U.S. and Canada driving stable demand. Popular flying sites across California, Utah, Oregon, and British Columbia support strong recreational activity. High adoption of performance wings, electronics, and safety gear characterizes the region. Adventure tourism and cross-country competitions are increasing equipment turnover and driving technological adoption.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, fueled by expanding adventure tourism in India, Nepal, Vietnam, Japan, and China. Growing middle-class incomes, improved access to training schools, and government-led tourism initiatives are accelerating participation. Scenic flying destinations such as Bir Billing, Pokhara, and Oludeniz-style coastal sites in Southeast Asia are attracting global pilots and stimulating equipment imports from Europe.

Latin America

Latin America is witnessing gradual growth, with Brazil, Argentina, and Colombia emerging as key recreational and tourism hubs. Expanding flying sites and regional competitions are increasing interest among younger pilots. As tourism infrastructure strengthens, the region is expected to adopt more certified equipment and training standards, driving steady market expansion.

Middle East & Africa

Adventure hubs in South Africa, Turkey, the UAE, and Morocco are boosting regional paragliding activity. Africa’s scenic mountains and coastline make it a rising destination for international pilots and tandem tourists. The Middle East, supported by high-income populations and tourism diversification agendas, is rapidly investing in adventure sports infrastructure. However, limited training schools and regulatory inconsistencies remain barriers in several countries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Paragliding Equipment Market

- Ozone Gliders

- Advance Thun AG

- Gin Gliders Inc.

- Nova Performance Paragliders GmbH

- Sup’Air SAS

- Skywalk GmbH & Co. KG

- Dudek Paragliders

Recent Developments

- In 2024, several manufacturers expanded ultra-light "hike-and-fly" product lines, reflecting rising demand from mountain and trekking pilots.

- In 2025, leading European brands introduced new EN-certified reserve parachutes with improved rapid-deployment systems and enhanced descent stability.

- In early 2025, multiple manufacturers launched upgraded Bluetooth-enabled variometers, integrating real-time weather data, flight analytics, and emergency alert systems.