Paper Shredder Market Size

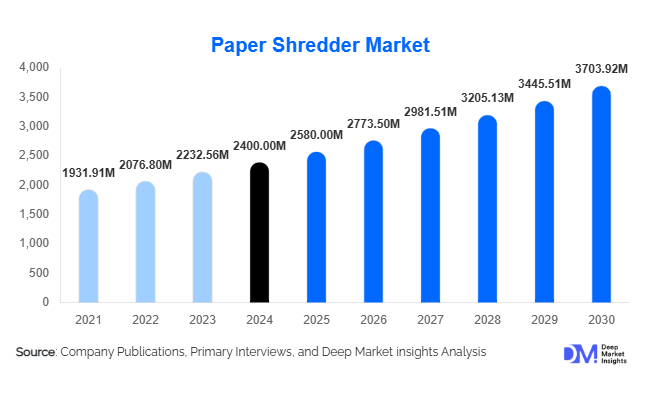

According to Deep Market Insights, the global paper shredder market size was valued at USD 2,400 million in 2024 and is projected to grow from USD 2,580.00 million in 2025 to reach USD 3,703.92 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The paper shredder market growth is driven by rising data-security awareness, stricter document-disposal regulations, and expanding adoption of office-automation equipment across commercial, institutional, and home-office environments worldwide.

Key Market Insights

- Growing emphasis on data protection and privacy compliance is fueling demand for secure document destruction solutions across industries and government institutions.

- Cross-cut and micro-cut shredders dominate global sales, offering enhanced security for confidential documents compared with basic strip-cut models.

- Commercial and institutional segments account for over 65 % of the market, driven by rising corporate compliance requirements and document-security mandates.

- North America leads the global market, representing roughly 36 % of 2024 revenue, while Asia Pacific is the fastest-growing region with double-digit expansion potential through 2030.

- Technological innovation — including auto-feed, energy-efficient, and IoT-enabled shredders — is transforming product portfolios and enabling new service models.

- Hybrid work and home-office adoption are accelerating demand for compact, affordable, and user-friendly shredders for personal and remote-use environments.

Latest Market Trends

Rising Demand for Smart and Automated Shredding Solutions

Manufacturers are introducing intelligent shredders equipped with auto-feed, anti-jam sensors, energy-saving modes, and connectivity features that simplify bulk shredding tasks. Corporate users are adopting network-enabled shredders capable of usage tracking, preventive-maintenance alerts, and security-audit reporting. This technological shift aligns with broader office-automation trends and supports compliance with internal data-protection policies. The integration of IoT connectivity also allows enterprises to monitor machine health, usage frequency, and maintenance cycles remotely, reducing downtime and operational costs.

Increasing Penetration of Paper Shredders in Home-Office Setups

The surge in hybrid work models has boosted the need for compact shredders suitable for personal use. Home-office workers increasingly handle sensitive information, making document destruction a priority. Manufacturers are responding with smaller, quieter, and energy-efficient models targeting residential and small-business segments. E-commerce platforms have emerged as key distribution channels, allowing consumers to easily compare prices and specifications online, further fueling this trend.

Regulatory and Environmental Focus on Secure Disposal

Governments and organizations worldwide are tightening compliance around data protection, particularly under regulations such as GDPR and HIPAA. Secure physical destruction of printed documents is now a legal requirement in many sectors. Simultaneously, sustainability initiatives are influencing product development; many manufacturers are designing shredders with recyclable materials, energy-efficient motors, and mechanisms for recycling shredded waste paper, aligning with circular-economy objectives.

Paper Shredder Market Drivers

Stringent Data-Protection Regulations

Global privacy laws and compliance standards are compelling businesses and institutions to adopt certified shredding equipment. Industries such as banking, healthcare, and government demand verified destruction of confidential records, pushing large-scale procurement of shredders. These mandates have transformed shredding from an optional office accessory into a compliance necessity.

Expansion of Commercial and Institutional Applications

The commercial segment, including corporate offices, educational institutions, and government departments, accounts for the largest share of global revenue. Increased document generation, outsourcing, and centralized record-management systems have multiplied shredding requirements. Organizations are standardizing secure-disposal practices across facilities, driving recurring replacement demand for shredders.

Technological Advancements and Feature Upgrades

Product innovation has accelerated with improvements such as micro-cut mechanisms for higher security, automatic feeders, jam-proof operation, and power-saving designs. Premium models offer quiet operation, digital control panels, and AI-based overload protection. These advancements enhance productivity and differentiate products in a competitive market.

Market Restraints

Shift Toward Paperless Offices

As organizations digitize operations and adopt cloud-based document-management systems, physical paper volumes are gradually declining. The transition to paperless workflows limits the total addressable market for shredders, particularly in advanced economies with strong digital-adoption rates.

Price Sensitivity and Product Commoditization

Low-end shredders have become commoditized, with intense price competition eroding manufacturer margins. Many consumers view basic shredders as interchangeable, forcing brands to compete primarily on cost rather than differentiation. This dynamic challenges smaller players to invest in innovation or service-based offerings to maintain profitability.

Paper Shredder Market Opportunities

Expansion in Emerging Markets and SME Segments

Rapid business formation, formalization of data-protection laws, and growing office infrastructure in Asia-Pacific and Latin America are opening new avenues for growth. Small and medium enterprises (SMEs) and home-office users represent a largely untapped customer base. Affordable, space-saving models tailored for these segments can generate significant incremental revenue for manufacturers.

Integration of Smart and IoT-Enabled Features

Advanced shredders featuring automation, connectivity, and diagnostics are creating high-value niches. IoT-linked devices that support centralized monitoring, predictive maintenance, and secure-destruction tracking appeal to enterprise customers seeking compliance transparency. Offering subscription-based maintenance or leasing services around these smart products further expands revenue potential.

Public-Sector Procurement and Compliance-Driven Demand

Governments worldwide are mandating secure document destruction within ministries, defense units, and healthcare agencies. Vendors certified to meet DIN security standards and eco-friendly waste-handling criteria can access lucrative tenders and bulk contracts. Public-sector digital-transformation initiatives also generate upgrade cycles for office equipment, including shredders with advanced safety and energy features.

Product Type Insights

Cross-cut shredders dominate the global market, accounting for roughly 50 % of 2024 revenue. These models strike an optimal balance between cost, speed, and security, making them the preferred choice for commercial offices and SMEs. Micro-cut shredders, offering higher confidentiality levels, are the fastest-growing sub-segment as industries handling sensitive data (finance, legal, healthcare) tighten compliance requirements. Strip-cut shredders remain relevant for low-security home or bulk-waste applications but are steadily losing share to cross-cut models.

Application Insights

Commercial applications lead the paper shredder market with around 65 % share in 2024. Corporate offices, financial institutions, and public agencies account for the majority of equipment purchases, primarily for regular data-disposal and compliance adherence. Government and institutional users follow, with demand driven by classified document destruction mandates. Residential and home-office usage is expanding rapidly, boosted by the hybrid-work trend and e-commerce availability of affordable models.

Distribution Channel Insights

Offline sales channels, including specialty office-equipment retailers and authorized distributors, held approximately 57 % of global sales in 2024. Buyers prefer offline purchasing for high-capacity machines due to service support and warranty assurance. However, online channels are growing swiftly, supported by the convenience of product comparison, reviews, and doorstep delivery. E-commerce platforms such as Amazon and direct-to-consumer manufacturer websites are emerging as preferred outlets for personal and small-business models.

End-Use Insights

Commercial and institutional sectors dominate end-use demand, but residential/home-office usage is the fastest-growing category with annual growth exceeding 8 %. Remote professionals, freelancers, and small-business owners increasingly require compact shredders for secure document disposal. Additionally, document-destruction service providers and recycling companies represent new downstream users purchasing industrial-scale shredders. Expansion in end-use industries such as BFSI, healthcare, and legal services — all heavily regulated for data protection continues to underpin sustained market growth.

| By Product Type | By Bin Capacity | By Shredding Capacity | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for approximately 36 % of global revenue in 2024. The United States leads with strong corporate compliance cultures, extensive government procurement programs, and high replacement cycles. Canada shows similar trends, with a growing SME base and increasing awareness of data-disposal best practices.

Europe

Europe represents around 25 % of the 2024 market, underpinned by the region’s stringent data-protection regulations such as the GDPR. Germany, the U.K., and France are major demand centers, while Eastern Europe is witnessing rising adoption among public-sector institutions. The region emphasizes certified high-security shredders that meet DIN 66399 P-level standards.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expected to expand at an 8–10 % CAGR through 2030. China and India are driving demand through rapid industrialization, increased office infrastructure, and rising SME formation. Japan and Australia represent mature markets emphasizing quality and reliability, while Southeast Asia is emerging as a high-volume, price-sensitive segment.

Latin America

Latin America accounts for about 8–10 % of global demand, with Brazil and Mexico leading growth. The expansion of corporate offices and greater awareness of corporate data-security regulations are driving adoption, though market maturity remains moderate compared with developed regions.

Middle East & Africa

The region holds roughly a 5–6 % share of the 2024 market. GCC countries such as the UAE and Saudi Arabia are modernizing public and private infrastructures, investing in document-security equipment for financial, healthcare, and governmental entities. Africa’s market is smaller but steadily expanding as institutional digitization and public-sector reforms accelerate.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Paper Shredder Market

- Fellowes Brands

- ACCO Brands Corporation

- HSM GmbH + Co. KG

- Intimus International Group

- Krug & Priester GmbH & Co. KG

- Aurora Corp. of America

- Bonsaii (Bonsen Electronics Ltd.)

- Dahle North America Inc.

- Meiko Shokai Co., Ltd.

- Elcoman Srl (Kobra)

- Royal Consumer Information Products Inc.

- Ideal (Brand of Krug & Priester)

- WEIMA Maschinenbau GmbH

- Shred-Tech Corporation

- Destroyit (German Engineering Brand)

Recent Developments

- May 2025 – Fellowes Brands launched a new line of AI-based auto-feed shredders featuring energy-efficient standby and real-time jam detection, targeting enterprise users.

- April 2025 – HSM GmbH announced the expansion of its manufacturing facility in Germany to increase the output of industrial-scale shredding systems for government and logistics applications.

- February 2025 – ACCO Brands introduced a smart shredder series under the Swingline brand, integrating cloud-linked performance monitoring and maintenance notifications.