Pallet Nailing Machines Market Size

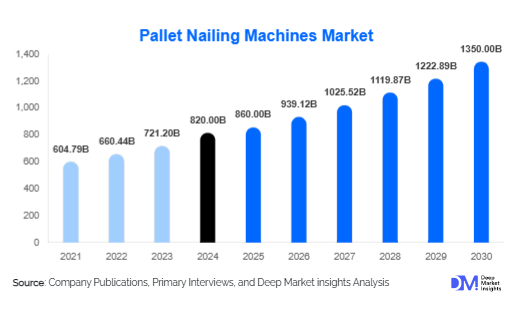

According to Deep Market Insights, the global pallet nailing machines market size was valued at USD 820 million in 2024 and is projected to grow from USD 860 million in 2025 to reach USD 1,350 million by 2030, expanding at a CAGR of 9.2% during the forecast period (2025–2030). Growth in the pallet nailing machines market is driven by increasing demand for automated pallet production in logistics and e-commerce, rising industrialization in emerging economies, and the integration of advanced robotic and high-speed nailing technologies that improve production efficiency and safety in pallet manufacturing plants.

Key Market Insights

- Automation is a critical growth driver, as manufacturers increasingly adopt robotic nailing machines to reduce labor costs, enhance operational safety, and improve throughput in pallet production facilities.

- Demand for sustainable and standardized wooden pallets is growing, driven by regulations in Europe and North America for recyclable packaging materials, contributing to higher adoption of modern pallet nailing machines.

- North America leads the market, with the U.S. and Canada contributing significantly due to advanced logistics infrastructure, high adoption of automation, and large-scale warehouse operations requiring standardized pallets.

- APAC is the fastest-growing region, fueled by manufacturing expansion, e-commerce growth in China and India, and industrial modernization initiatives.

- Technological adoption, including PLC-controlled systems, high-speed robotic nailing machines, and IoT-enabled monitoring, is reshaping production efficiency and predictive maintenance in pallet manufacturing.

What are the latest trends in the pallet nailing machines market?

Automation and Robotics Integration

Pallet manufacturing is increasingly shifting toward automation, with high-speed robotic nailing machines reducing manual labor requirements and minimizing human error. Modern machines feature programmable logic controllers (PLCs) and robotic arms that ensure precise nailing, consistent pallet quality, and higher throughput. Adoption is especially strong in developed regions, where labor costs are high and efficiency benchmarks are stringent. Smart sensors and automated defect detection systems further enhance reliability, allowing manufacturers to maintain quality standards while scaling operations efficiently.

Focus on Eco-Friendly Pallet Production

Environmental regulations and corporate sustainability initiatives are driving the adoption of machines optimized for recycled wood and standardized pallet sizes. Manufacturers are increasingly producing pallets with minimal waste, using advanced cutting, nailing, and assembly techniques. Eco-certification standards in Europe and North America, along with consumer demand for sustainable packaging, are encouraging pallet producers to invest in machines capable of supporting green manufacturing practices. This trend is likely to expand in APAC as industrial and logistics companies embrace eco-compliance for global supply chains.

What are the key drivers in the pallet nailing machines market?

Rapid Growth in E-Commerce and Logistics

The surge in e-commerce globally has amplified demand for pallets as a primary medium for transporting goods efficiently. Automated pallet nailing machines help meet the volume and speed requirements of logistics hubs and warehouses. With the rise of third-party logistics providers, manufacturers are under pressure to deliver pallets quickly, consistently, and at lower operational costs. Standardization in pallet size and strength has become crucial, driving the adoption of modern nailing technologies that can produce pallets meeting international specifications.

Industrialization and Manufacturing Expansion

Emerging economies in the Asia-Pacific, including China, India, and Southeast Asian countries, are witnessing significant industrial growth. Large-scale factories and production units require automated pallet solutions to optimize material handling and streamline supply chain operations. Pallet nailing machines provide cost efficiency, high speed, and consistent quality, making them a preferred investment for modern manufacturing facilities. The growing focus on export-oriented production further fuels demand for durable and standardized pallets, enhancing machine adoption rates.

Technological Advancements and Smart Machines

Integration of robotics, IoT, and PLCs has transformed pallet nailing operations, enabling predictive maintenance, remote monitoring, and energy-efficient performance. High-speed automated systems reduce downtime and labor dependency while increasing throughput. Manufacturers investing in smart machines gain a competitive edge by ensuring superior pallet quality, lower waste, and compliance with global logistics standards. Continuous improvements in machine design, including modular setups and flexible nailing configurations, are further driving market growth.

What are the restraints for the global market?

High Initial Investment Costs

The upfront cost of automated pallet nailing machines, including robotics and advanced control systems, can be prohibitive for small and medium-sized pallet manufacturers. Limited access to capital in developing regions restricts adoption, and small-scale operators continue to rely on manual or semi-automated solutions, slowing overall market penetration. Financing solutions and leasing options are gradually mitigating this challenge.

Raw Material Price Volatility

Fluctuations in timber and wood prices directly impact pallet production costs. Sudden price increases can affect machine utilization rates, return on investment, and overall profitability for manufacturers. While recycled wood offers some cost mitigation, variability in supply quality and sourcing challenges remain key concerns that can hinder market growth.

What are the key opportunities in the pallet nailing machines industry?

Expansion in Emerging Economies

Rising industrialization and warehouse infrastructure development in India, China, Brazil, and Southeast Asia provide significant growth opportunities. Governments are encouraging “Make in India” and similar initiatives, incentivizing investment in automated pallet production to meet growing domestic and export demand. Companies entering these markets can benefit from low labor costs combined with high demand for standardized pallets in logistics and manufacturing sectors.

Integration of IoT and Industry 4.0 Technologies

The adoption of smart, connected pallet nailing machines presents opportunities for predictive maintenance, operational analytics, and remote monitoring. IoT-enabled systems allow manufacturers to optimize machine uptime, reduce defects, and increase energy efficiency. Early adopters gain competitive advantages by offering higher-quality pallets faster, reducing operational costs, and integrating production with broader Industry 4.0-enabled smart factories.

Export-Driven Demand for Standardized Pallets

Global trade requires standardized pallets for shipping and storage, creating a steady export-driven market. Companies producing pallets that meet international quality standards can expand cross-border shipments, particularly to Europe and North America, where compliance and durability standards are stringent. Automated nailing machines capable of producing uniform pallets cater directly to this demand, enabling manufacturers to tap high-margin export markets efficiently.

Product Type Insights

Automatic pallet nailing machines dominate the market, accounting for approximately 55% of the 2024 market, due to their speed, precision, and labor savings. Semi-automatic machines, while slower, are widely used in small-scale operations where capital investment is constrained, contributing roughly 30% of the market. Manual nailing machines retain a niche presence (15%) for artisanal or highly customized pallet production, particularly in regions with low labor costs.

Application Insights

Industrial pallet production for logistics and warehousing remains the largest application, contributing around 65% of market demand. Construction and manufacturing end-use industries are growing steadily, accounting for 20% of total demand. Niche applications include custom pallets for export packaging, refrigerated logistics, and chemical industry shipments, representing 15% of the market. E-commerce and cold chain sectors are emerging as high-growth applications due to increasing packaging volume and standardized handling requirements.

Distribution Channel Insights

Direct sales from manufacturers dominate, particularly for large-scale industrial buyers requiring installation and maintenance support. Industrial equipment distributors contribute to smaller regional sales, while online platforms and B2B marketplaces are emerging channels, especially in APAC. After-sales service, maintenance contracts, and training are key differentiators in distribution strategy, enhancing customer retention.

End-Use Industry Insights

Logistics and warehousing remain the primary end users, driven by rapid e-commerce expansion. Manufacturing industries, including FMCG, automotive, and electronics, are increasingly adopting automated pallet solutions to improve supply chain efficiency. Export-oriented sectors, particularly in Europe and North America, drive demand for standardized pallets. Emerging applications include cold chain logistics and chemical transport, which require durable, precisely constructed pallets. End-use segments in APAC are expected to grow at a CAGR of 10.5% between 2025 and 2030, outpacing global growth due to industrial modernization and export-oriented manufacturing.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share (28% in 2024), led by the U.S. and Canada, driven by automation adoption, large-scale warehouse operations, and strict pallet standards. Demand is especially strong in e-commerce and logistics hubs such as California, Texas, and Ontario.

Europe

Europe accounts for 25% of the market, with Germany, France, and the U.K. leading due to stringent packaging regulations and high automation levels in manufacturing and logistics. The region emphasizes eco-friendly pallet production and standardization, supporting the growth of advanced nailing machines.

Asia-Pacific

APAC is the fastest-growing region, projected to expand at a CAGR of 11.2% due to rising industrialization in China, India, and Southeast Asia. Expansion of warehouses, e-commerce logistics, and export-oriented production are key growth drivers. China alone represents 15% of the 2024 market.

Latin America

Latin America accounts for 10% of the market, led by Brazil and Mexico. Growth is supported by industrial modernization and increased export activity. Regional challenges include limited automation adoption and higher reliance on semi-automatic machines.

Middle East & Africa

The Middle East & Africa contribute 7% of the market, with South Africa, the UAE, and Saudi Arabia leading. Demand is primarily driven by the construction, industrialization, and logistics sectors, with the gradual adoption of automated machinery for standardized pallet production.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pallet Nailing Machines Market

- Storopack

- Fastpack Systems

- Wood-Mizer

- Schneider Maschinenbau GmbH

- Kallesoe Machinery

- RimPac Systems

- Weinig Group

- Böhler-Werke

- Sigmatic Machinery

- Holzher GmbH

- Robopac

- Hawa Machines

- Famar Tec

- Palamatic Machinery

- Scm Group

Recent Developments

- In March 2025, Fastpack Systems launched a high-speed robotic pallet nailing machine capable of producing 1,200 pallets/day, reducing labor costs by 30% for large-scale manufacturers.

- In January 2025, Kallesoe Machinery introduced IoT-enabled monitoring for predictive maintenance in Europe, enhancing machine uptime and operational efficiency.

- In February 2025, Wood-Mizer expanded its pallet nailing machine production lines in APAC to meet rising demand from e-commerce and export-oriented manufacturing.