Paint Rollers Market Size

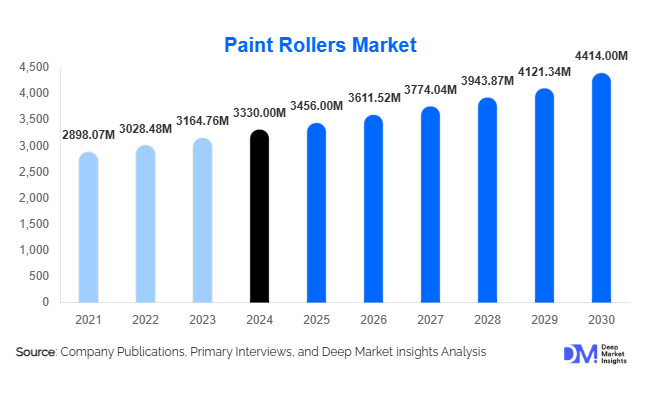

According to Deep Market Insights, the global paint rollers market size was valued at USD 3,330 million in 2024 and is projected to grow from USD 3,456 million in 2025 to reach USD 4,414 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). Growth in the market is driven by rising construction and renovation activity, increasing adoption of DIY home improvement, and product innovations in roller materials and ergonomic designs.

Key Market Insights

- Asia-Pacific dominates the global paint rollers market, contributing nearly 45% of total demand in 2024, led by China and India’s expanding housing sectors.

- Residential repainting and renovation account for more than half of market revenue, driven by DIY and home improvement trends.

- Woven and synthetic rollers lead product demand due to superior durability, paint retention, and lint-free finish quality.

- Medium-pile rollers remain the preferred choice globally, serving both professionals and homeowners for standard wall applications.

- Online retail and hardware megastores are transforming paint-tool distribution, enabling faster product turnover and brand visibility.

- Sustainability and eco-friendly materials are gaining traction, with growing interest in recyclable roller covers and biodegradable packaging.

Latest Market Trends

Eco-friendly and Sustainable Rollers

Manufacturers are increasingly developing rollers using recyclable frames, bio-based fabrics, and solvent-resistant materials to meet environmental regulations and green-building standards. Demand for low-VOC-compatible rollers is growing alongside the global shift to water-based paints. Companies are integrating sustainability into product design and packaging, including reusable roller frames and washable microfiber covers. These innovations not only appeal to eco-conscious consumers but also help brands differentiate in a commoditized market.

DIY and E-commerce Growth

DIY culture has gained momentum across North America, Europe, and Asia, with homeowners preferring convenient painting tools that ensure professional finishes. E-commerce platforms now host a wide range of roller kits, offering tutorials, bundled accessories, and next-day delivery. This digital expansion allows brands to reach both professionals and casual users directly, improving margins and customer engagement. Subscription models for home improvement supplies and influencer-driven marketing are also expanding online visibility for roller manufacturers.

Paint Rollers Market Drivers

Rising Global Construction and Renovation Activity

Continuous urbanization, infrastructure expansion, and increasing renovation of aging housing stock are stimulating demand for painting equipment. Residential and commercial renovation projects across Asia and North America are the strongest contributors. Paint rollers, being cost-effective and efficient, are preferred for large-surface coating, making them indispensable in both new construction and repainting cycles.

Shift Toward Professional Finishing and DIY Painting

Modern consumers are increasingly drawn to do-it-yourself interior decoration, driving demand for high-quality rollers that deliver professional results. Simultaneously, painting contractors and facility managers prefer rollers for their superior coverage and speed compared to brushes. This dual-segment growth ensures steady consumption across both professional and household markets.

Product Innovation and Ergonomic Design

Technological advancements in roller design, such as adjustable handles, anti-spatter coatings, and high-absorbency microfiber fabrics, have improved performance and ease of use. Innovations in roller cores and bearing systems enhance durability and reduce fatigue during large projects. These developments support market expansion by appealing to both new users and professionals upgrading to premium tools.

Market Restraints

Raw-Material Price Volatility

Fluctuations in the prices of synthetic fibers, plastic resins, and metals used in roller frames can erode manufacturers' margins and increase product costs. Oil-derived materials are particularly sensitive to global commodity cycles, limiting pricing flexibility for suppliers in cost-competitive markets.

High Competitive Pressure and Product Commoditization

The market’s fragmented structure and low entry barriers have led to intense price competition, especially in developing regions. Many brands compete on cost rather than innovation, leading to margin pressure. Without differentiation through quality or sustainability, manufacturers face commoditization risks that can slow profitability growth.

Paint Rollers Market Opportunities

Emerging-Market Renovation Boom

Rapid urbanization in the Asia-Pacific and Latin America has triggered a surge in housing refurbishments and small-scale construction. Consumers are investing in modern painting tools for improved finishes and faster application. Global brands can expand by localizing manufacturing and offering affordable, high-performance rollers suited to regional climates and paint types.

Technological and Material Innovation

Innovations in microfiber, nano-coating fabrics, and ergonomic handle systems are revolutionizing roller performance. Companies adopting recycled plastics and modular frames are capturing eco-conscious markets. Smart rollers with paint reservoirs and quick-release covers represent new frontiers for time-saving and convenience-driven applications.

Rising DIY Adoption and Digital Retail Expansion

The proliferation of online retail channels, combined with social media tutorials and influencer marketing, has greatly expanded the DIY customer base. Paint roller kits bundled with accessories are among the fastest-growing categories on e-commerce platforms. For new entrants, digital marketing and direct-to-consumer sales present high-margin opportunities with global reach.

Product Type Insights

Woven paint rollers dominate the product landscape, holding approximately 39% of the market in 2024 (USD 1.33 billion). Their leadership is driven by professional demand for smooth, lint-free finishes, superior paint absorption, and high coverage efficiency. Synthetic fabric rollers lead the material segment with a 41% share due to their durability, versatility across water- and oil-based paints, and broad adoption in both professional and DIY markets. Medium-pile rollers, representing about 37% of demand, are the most widely used globally because of their adaptability to common interior surfaces, making them a preferred choice for residential repainting and commercial projects.

Other product types are also seeing specific demand drivers: roller frames and handles benefit from ergonomic and anti-fatigue designs targeting professional painters, while extension poles and painting accessories grow due to large-area applications, safety, and bundled kit sales. Foam rollers are favored in price-sensitive segments and for specialty smooth finishes, whereas microfiber and blended rollers are increasingly adopted by high-end DIY users and professionals seeking low-shed, reusable options.

Application Insights

Residential applications account for roughly 50% of global demand (USD 1.7 billion in 2024), fueled by frequent repainting cycles, home renovation trends, and the rise of DIY culture. The growth of online tutorials and e-commerce platforms further supports this segment. Commercial applications, including offices, retail spaces, and hospitality projects, continue to expand alongside urban development, with medium- and long-pile rollers being preferred for efficiency and coverage. Industrial and specialty surface applications are driven by demand for textured coatings, industrial finishes, and large-scale infrastructure projects. Furniture and cabinetry finishing rollers are an emerging micro-segment, catering to interior design and appliance manufacturing, highlighting opportunities in niche precision painting markets.

| By Product Type | By Pile Size | By End-Use Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global paint rollers market with about 45% share (USD 1.53 billion in 2024). Growth is primarily driven by rapid urbanization, large-scale residential and commercial construction pipelines in China and India, and increasing DIY adoption among urban middle classes. Rising renovation activity, government-backed housing initiatives, and Make-in-India manufacturing policies also bolster market expansion. Southeast Asia is witnessing rising adoption due to affordable housing programs and urban infrastructure growth. The segment driver for medium-pile woven rollers further supports market dominance in this region due to their versatility in new-build and renovation projects.

North America

North America accounts for approximately 30% market share (USD 1.02 billion in 2024). Drivers include a strong renovation and remodeling market, high DIY participation, and consumer preference for premium, low-VOC, and eco-friendly products. Professional painters also adopt higher-quality microfiber rollers for superior coverage and durability. Short- and medium-pile rollers dominate demand for interior and smooth-surface finishes, supporting both residential repainting cycles and commercial projects. Market stability is reinforced by established retail chains and e-commerce penetration, sustaining a 4–6% CAGR.

Europe

Europe contributes roughly 15% of the global market (USD 510 million in 2024). The market is driven by refurbishment of older housing stock, strict environmental and VOC regulations, and a demand for high-quality finishes, particularly in historic building restoration. Eco-friendly and reusable rollers, such as synthetic and microfiber variants, are increasingly preferred due to regulatory compliance. Medium- and short-pile rollers dominate interior applications, while long-nap rollers support exterior and textured surfaces. Western Europe, led by the U.K., Germany, and France, continues to see consistent growth in residential renovation and professional contracting segments.

Latin America

Latin America holds about 8–10% of the market, with Brazil and Mexico as the leading countries. Market growth is driven by infrastructure and housing development, increasing retail penetration for DIY products, and price-sensitive segments favoring economy and mid-market rollers. Medium-pile synthetic rollers are commonly adopted across residential and commercial projects. Import of cost-efficient rollers from Asia supports market accessibility, while urban renovation trends stimulate adoption of higher-quality synthetic and microfiber rollers.

Middle East & Africa

MEA represents roughly 7% of global revenue. Growth is primarily supported by large-scale commercial and infrastructure projects, including office towers, hospitality developments, and industrial facilities. Concentrated professional demand and bulk procurement cycles tied to the oil sector and government CapEx further drive market expansion. Long-nap rollers and durable synthetic/microfiber variants are preferred for large-area projects, while high-quality tools for professionals support premium segment demand. Regional infrastructure investments, especially in GCC countries, position MEA for moderate but steady growth in 2025–2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top 15 Key Players

- The Wooster Brush Company

- Purdy Company

- Gordon Brush Mfg. Co., Inc.

- Anderson Products

- Hyde Tools, Inc.

- Beorol d.o.o.

- Linzer Products Corporation

- Marshall Brushes & Rollers Ltd.

- Premier Paint Roller Company LLC

- Dynamic Paint Products Inc.

- Magnolia Brush Manufacturers Ltd.

- Warner Manufacturing Company

- Quali-Tech Manufacturing

- N.S. Tools Co., Ltd.

- Shur-Line LLC

Recent Developments

- In March 2025, Wooster Brush introduced a new line of biodegradable roller covers aimed at reducing plastic waste in professional painting.

- In February 2025, Purdy Company expanded its production capacity in the U.S. to meet growing domestic DIY demand.

- In January 2025, Linzer Products Corp. announced automation upgrades at its Mexico facility to improve manufacturing efficiency and export readiness.