Outdoor Swings Market Size

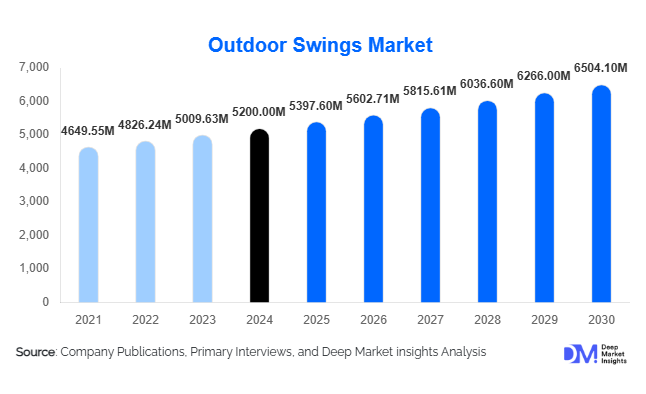

According to Deep Market Insights, the global outdoor swings market size was valued at USD 5,200 million in 2024 and is projected to grow from USD 5,397.6 million in 2025 to reach USD 6,504.1 million by 2030, expanding at a CAGR of 3.8% during the forecast period (2025–2030). The market growth is primarily driven by increasing residential and commercial demand, rising investments in public recreational spaces, and growing consumer preference for durable, aesthetic, and multifunctional outdoor leisure products.

Key Market Insights

- Residential adoption of outdoor swings is rising, driven by urban landscaping trends, increasing disposable incomes, and a focus on home leisure amenities.

- Hospitality and leisure segments are rapidly expanding, as hotels, resorts, and theme parks incorporate swings to enhance guest experiences and outdoor aesthetics.

- Metal and composite swings dominate globally, due to their durability, low maintenance, and suitability for public and commercial installations.

- Asia-Pacific is emerging as the fastest-growing region, led by rising middle-class populations in India, China, and Indonesia, and strong government investment in urban parks and recreational infrastructure.

- Technological integration and smart swings, including weather-resistant coatings, solar-powered lighting, and ergonomic designs, are reshaping consumer expectations and product differentiation.

- Offline retail remains dominant, while e-commerce channels are gaining traction for customizable and direct-to-consumer swing solutions.

What are the latest trends in the outdoor swings market?

Smart and Multifunctional Swing Designs

Manufacturers are increasingly integrating innovative features such as weather-resistant materials, ergonomic designs, solar-powered lighting, and safety sensors into swings. Multifunctional swings that can accommodate families, provide canopy protection, or double as hammocks are becoming popular among residential and hospitality consumers. This trend addresses consumer demand for comfort, longevity, and aesthetic appeal, while also allowing premium pricing models. Customization options for materials, colors, and design elements are further driving adoption in urban and high-income households.

Sustainable and Eco-Friendly Materials

The demand for eco-conscious swings is rising, with wood from certified forests, recycled metals, and polymer blends gaining popularity. Environmentally aware consumers are actively seeking products that reduce carbon footprint while offering durability and low maintenance. Companies are leveraging green certifications and sustainable packaging to strengthen brand reputation and attract the growing segment of environmentally conscious buyers.

What are the key drivers in the outdoor swings market?

Increasing Residential and Urban Landscaping Demand

Urban homeowners are investing in outdoor furniture to enhance gardens, terraces, and balconies, driving demand for single, double, and canopy swings. Rising disposable incomes and the desire for aesthetically pleasing and functional outdoor spaces contribute significantly to market growth. Urban landscaping projects, rooftop gardens, and condominium amenities have also emerged as key growth drivers.

Hospitality and Leisure Industry Expansion

Hotels, resorts, and recreational parks are incorporating outdoor swings to create inviting leisure spaces. Resorts and boutique hotels use swings as experiential elements in gardens and poolside areas, enhancing customer engagement. Government investments in public parks and community recreational areas further support demand for swings in outdoor infrastructure projects.

Material Innovation and Durability Trends

Consumers increasingly prefer swings made of durable metals, composite materials, and weather-resistant polymers. These materials offer longevity, low maintenance, and aesthetic versatility. Manufacturers are developing hybrid swings that combine metal frames with wooden or polymer seating, appealing to both residential and commercial segments while allowing premium pricing.

What are the restraints for the global market?

High Cost of Premium Swings

Wooden, designer, or smart-featured swings have higher upfront costs, which can limit adoption in budget-conscious segments. Price sensitivity in certain emerging markets restricts growth potential for premium swings despite rising disposable incomes.

Space Constraints in Urban Areas

Limited garden, terrace, or balcony space in urban apartments reduces the feasibility of installing larger freestanding or canopy swings. This spatial limitation affects sales of high-capacity swings and necessitates design innovation to cater to compact living areas.

What are the key opportunities in the outdoor swings market?

Expansion of Public Recreational Infrastructure

Governments and municipalities worldwide are investing in urban parks, community gardens, and public recreational spaces. This is creating large-scale procurement opportunities for swing manufacturers. Smart city initiatives and eco-friendly public spaces in APAC, North America, and Europe are further driving demand for durable, low-maintenance, and aesthetically appealing swings in outdoor infrastructure projects.

Smart and Technologically Advanced Swings

Integration of solar-powered lighting, motion sensors, ergonomic seating, and IoT-enabled monitoring is creating new market opportunities. Such smart swings appeal to premium residential customers and hospitality operators seeking differentiated products. Companies offering innovative, tech-enhanced swings can tap into a niche premium market segment while enhancing brand recognition.

Growing Middle-Class Consumer Base in Emerging Economies

Rising disposable incomes in India, China, Brazil, and Indonesia are fueling demand for residential swings with aesthetic appeal and multifunctional designs. Entry into these high-growth markets offers significant revenue potential, particularly in urban landscaping projects, gated communities, and high-end residential complexes.

Product Type Insights

Double/family swings dominate the market with a 42% share in 2024, primarily due to their widespread adoption in public parks, resorts, and large residential gardens. Single swings are preferred for apartments and small homes, while canopy and hammock swings are gaining traction among premium residential buyers. The trend towards multifunctional and weather-resistant designs is expected to further consolidate market share for family and canopy swings over the forecast period.

Material Insights

Metal swings lead the material segment with a 38% share in 2024, favored for durability, low maintenance, and suitability for public and commercial spaces. Wooden swings follow closely for premium residential segments due to aesthetic appeal. Composite swings are growing steadily due to hybrid designs that combine strength and eco-friendliness, meeting emerging consumer preferences.

Installation Insights

Freestanding swings accounted for 55% of market share in 2024, reflecting consumer preference for flexible placement and ease of installation. Hanging/fixed swings are primarily adopted in premium residential and hospitality spaces, where aesthetics and design integration with the environment are critical.

End-Use Insights

The residential segment leads with a 47% market share, driven by urban landscaping and private garden investments. Hospitality & leisure is the fastest-growing segment with a CAGR of 7.1%, as resorts, hotels, and recreational parks integrate swings into outdoor spaces to enhance guest experiences. Public parks and community spaces contribute to steady demand due to government infrastructure spending. Exports are increasing, particularly from APAC manufacturers to North America and Europe, where premium swings are in high demand.

| By Product Type | By Material | By Installation Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 28% of the global market in 2024, with the U.S. and Canada leading demand for residential and hospitality swings. High disposable income, urban garden culture, and strong investments in recreational spaces support growth. A moderate CAGR of 5.8% is expected through 2030.

Europe

Europe accounted for 25% of the market in 2024, led by Germany, the UK, and France. Strong urban landscaping culture, government-funded recreational projects, and demand for sustainable materials drive growth. Expected CAGR is 6.0% from 2025–2030.

Asia-Pacific

APAC is the fastest-growing region with a CAGR of 7.4%, driven by India, China, Indonesia, and Japan. Rising middle-class population, urban park investments, and increasing residential landscaping are key factors contributing to strong adoption.

Middle East & Africa

The region is witnessing steady growth with a CAGR of 5.5%, led by the UAE, Saudi Arabia, and South Africa. High-income households and luxury hospitality expansion are key drivers.

Latin America

Brazil, Mexico, and Argentina are increasing adoption, particularly in residential and leisure segments. CAGR is expected at 6.2%, supported by rising middle-class urban populations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Outdoor Swings Market

- Trex Outdoor Furniture

- Lifetime Products

- Leisure Grow

- Kettler

- Suncast

- Target Marketing Systems

- Fleurco

- Goplus

- Songmics

- Patio Creations

- Taymor

- Hanover

- Sojag

- Outsunny

- Best Choice Products

Recent Developments

- In May 2025, Trex Outdoor Furniture launched a new series of weather-resistant family swings for urban residential gardens, integrating solar-powered LED lighting.

- In April 2025, Leisure Grow expanded its commercial swing offerings to resorts and public parks in the Asia-Pacific region, focusing on durable metal and composite designs.

- In February 2025, Kettler introduced multifunctional canopy swings combining seating, shading, and ergonomic support for premium residential and hospitality segments.