Outdoor Spotlight Market Size

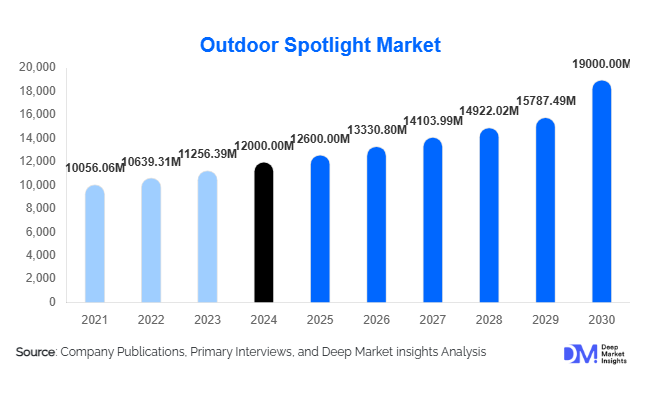

According to Deep Market Insights, the global outdoor spotlight market size was valued at USD 12,000 million in 2024 and is projected to grow from USD 12,600 million in 2025 to reach USD 19,000 million by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of energy-efficient LED lighting, rising demand for smart and solar-powered spotlights, urbanization-led infrastructure development, and the growing focus on architectural aesthetics, security, and public illumination.

Key Market Insights

- LED technology dominates the outdoor spotlight segment, offering higher energy efficiency, longer lifespan, and better optical control, which makes it the preferred choice for residential, commercial, and municipal applications.

- Solar and hybrid-powered outdoor spotlights are gaining traction, particularly in emerging regions with unreliable grid infrastructure, driven by falling battery and photovoltaic costs and government incentives for renewable energy.

- Commercial and municipal applications account for the largest market share, with street, façade, and public infrastructure lighting representing high-value installations across North America and Europe.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, government smart city initiatives, and increasing demand from residential and commercial sectors in China, India, and Southeast Asia.

- Smart and IoT-enabled spotlights, with motion sensors, remote control, and programmable lighting, are increasingly adopted for energy savings, safety, and user convenience, reshaping market dynamics.

- Durable, weather-resistant materials and high IP-rated products are creating new opportunities for outdoor lighting in harsh environmental conditions and coastal regions.

Latest Market Trends

Energy-Efficient LED and Solar Lighting Adoption

The shift toward energy-efficient LED spotlights is the most prominent trend in the market. LEDs provide reduced operational costs, longer service life, and superior color rendering, making them highly favored across municipal, commercial, and residential projects. Solar-powered spotlights, particularly in off-grid or rural regions, are witnessing rising adoption due to decreasing battery and solar panel costs. Smart integration with sensors and automated scheduling enhances energy savings, making LED and solar combinations a preferred solution for long-term infrastructure planning and sustainable urban development.

Smart and IoT-Enabled Outdoor Spotlights

Smart outdoor lighting systems are increasingly integrated with IoT technologies, allowing for remote control, automated dimming, and motion-sensor-based operation. These systems are particularly popular in urban municipal projects, commercial complexes, and residential landscapes, providing both safety and aesthetic benefits. Mobile applications now allow users to monitor, adjust, and schedule outdoor spotlight operations, supporting sustainability goals and improving energy efficiency. The growing trend of connected smart cities is accelerating the adoption of these technologically advanced outdoor lighting solutions globally.

Outdoor Spotlight Market Drivers

Urbanization and Infrastructure Development

Rapid urbanization in Asia-Pacific, Latin America, and the Middle East has led to increased construction of commercial complexes, residential communities, highways, and public infrastructure. Governments are investing in street, highway, and municipal lighting to enhance safety, visibility, and aesthetic appeal. Large-scale urban projects require durable and high-efficiency lighting, which is driving demand for LED and smart outdoor spotlights.

Government Incentives and Regulations

Regulations promoting energy efficiency, carbon reduction, and dark-sky compliance are compelling municipalities and commercial developers to upgrade to LED or solar-based outdoor lighting systems. Incentive programs and subsidies for renewable energy lighting projects, especially in emerging economies, further accelerate adoption. Smart city initiatives incorporating connected outdoor lighting systems provide additional impetus for market growth.

Rising Focus on Security and Aesthetics

Demand for outdoor spotlights is growing in residential, commercial, and public sectors to enhance security, illuminate pathways, and improve architectural aesthetics. Modern designs, adjustable beam options, and color-tunable lighting are increasingly preferred for landscaping, façade lighting, and outdoor entertainment venues, supporting both safety and visual appeal.

Market Restraints

High Initial Investment Costs

Premium LED, solar, and smart spotlights require higher upfront investments compared to traditional halogen or wired lighting. Installation costs, batteries, and specialized mounting can further increase the total project expense, which may slow adoption in cost-sensitive regions.

Technical and Environmental Challenges

Outdoor lighting systems must withstand extreme weather conditions, moisture, UV exposure, and vandalism. Solar-powered spotlights face challenges such as battery degradation and intermittent sunlight, while harsh environmental conditions require robust IP-rated fixtures. Maintenance and durability concerns act as potential restraints for widespread adoption, particularly in developing markets.

Outdoor Spotlight Market Opportunities

Smart City and IoT Integration

The increasing adoption of smart city projects provides significant opportunities for outdoor spotlight manufacturers. Integration with IoT-based control systems enables dynamic lighting schedules, motion-based activation, and real-time monitoring, allowing municipalities and commercial users to optimize energy consumption, improve safety, and provide aesthetically pleasing urban spaces. Companies investing in connected technologies can create value-added solutions and premium offerings.

Renewable and Solar-Powered Outdoor Lighting

Solar and hybrid outdoor spotlights offer sustainable solutions for areas with unreliable grid access, off-grid installations, and rural electrification projects. Falling solar panel and battery costs, combined with government incentives, present opportunities for both new entrants and existing players to capture market share in emerging regions, particularly in Africa, Asia-Pacific, and Latin America.

Architectural and Landscape Lighting

Growing demand for aesthetic enhancement of residential, commercial, and hospitality properties is driving the adoption of decorative and accent outdoor spotlights. Landscape architecture, façade illumination, and event lighting present high-margin opportunities for manufacturers, particularly those offering customizable, color-tunable, and adjustable-beam solutions. Partnerships with architects, contractors, and landscape designers are becoming strategic for market expansion.

Product Type Insights

LED outdoor spotlights dominate the market due to energy efficiency, durability, and smart control capabilities. Solar-powered spotlights are rapidly growing in emerging markets, driven by renewable energy adoption and off-grid applications. Halogen and HID spotlights are declining in popularity due to lower efficiency and higher operational costs. Premium smart spotlights with IoT integration are capturing a significant share in commercial, municipal, and residential segments seeking energy savings, automation, and advanced functionality.

Application Insights

Commercial and municipal applications are the largest drivers of the outdoor spotlight market, including street lighting, public parks, highways, façade illumination, and government buildings. Residential landscaping, security lighting, and hospitality outdoor lighting are also growing rapidly, particularly with smart and decorative LED solutions. Event and architectural lighting are emerging applications, with demand for adjustable-beam, color-tunable, and remote-controlled spotlights increasing globally.

Distribution Channel Insights

Online platforms, including e-commerce and direct-to-consumer websites, are increasingly used for residential and small commercial spotlight purchases. Wholesale and contractor-focused channels dominate commercial and municipal procurement, while direct partnerships with architects, developers, and urban planners provide additional market access. Emerging subscription-based and service models are enabling bundled lighting solutions with installation and maintenance services, particularly in smart city projects.

End-Use Insights

Municipal and government infrastructure dominates demand due to high-volume street, highway, and public space installations. Commercial and hospitality sectors follow closely, focusing on façade and landscape lighting for aesthetic and security purposes. Residential and small-scale industrial applications are growing, particularly in emerging economies where solar and IoT-enabled products provide new opportunities. Export-driven demand is strong from the Asia-Pacific region, where manufacturing hubs supply high-quality spotlights to North America, Europe, and the Middle East markets.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounted for approximately 32% of the global outdoor spotlight market in 2024. The U.S. leads demand due to urban infrastructure projects, commercial real estate development, and widespread adoption of smart lighting solutions. Canada is following with increasing municipal modernization projects and residential adoption of energy-efficient solutions. Smart city initiatives and aesthetic lighting investments drive steady growth in the region.

Europe

Europe contributed roughly 23% of the global market in 2024, led by Germany, the U.K., and France. Stringent energy efficiency regulations, façade lighting requirements, and public infrastructure modernization fuel demand. Eastern European countries are emerging markets for LED and solar outdoor spotlights, with higher growth rates due to ongoing urbanization and modernization projects.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, and Southeast Asia. Urban expansion, smart city projects, and rising residential and commercial construction create significant demand for LED, solar, and IoT-enabled spotlights. Government subsidies for renewable energy and off-grid lighting further accelerate adoption.

Latin America

Latin America represents 6–8% of the market, with Brazil and Mexico leading in municipal and commercial installations. Demand is rising due to urban development, tourism infrastructure, and renewable energy adoption, though economic and logistical challenges affect the growth pace.

Middle East & Africa

MEA accounts for approximately 5% of the global market. The Middle East, led by UAE and Saudi Arabia, shows strong demand for luxury commercial and hospitality outdoor lighting. Africa is experiencing rapid growth in solar and off-grid lighting due to electrification projects and rural infrastructure initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Outdoor Spotlight Market

- Signify (Philips Lighting)

- Acuity Brands, Inc.

- Hubbell Corporation

- OSRAM / ams-OSRAM

- Zumtobel Group

- Cree, Inc.

- Eaton Corporation

- General Electric (Lighting Business)

- Syska

- Dialight plc

- Legrand

- NVC Lighting

- Havells

- Foshan Lighting

- GE Current

Recent Developments

- In March 2025, Signify launched a new range of smart LED outdoor spotlights integrating IoT control for municipal street and park lighting projects in North America and Europe.

- In February 2025, Acuity Brands announced the expansion of solar-powered spotlight solutions in Southeast Asia, targeting off-grid residential and rural infrastructure projects.

- In January 2025, OSRAM introduced high-IP-rated, color-tunable LED outdoor spotlights for commercial façade and hospitality applications in the Middle East and Asia-Pacific.