Organic Makeup Remover Market Size

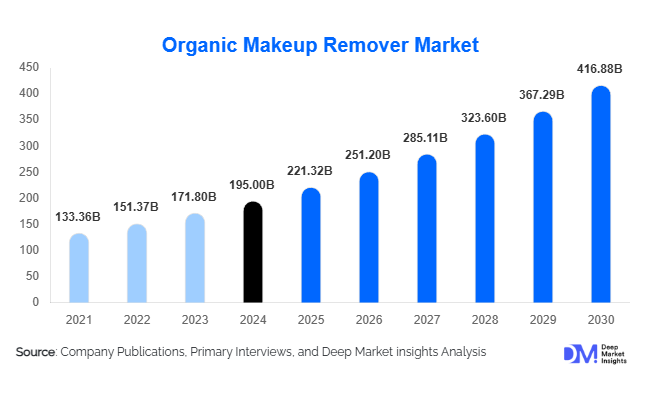

According to Deep Market Insights, the global organic makeup remover market size was valued at USD 195.00 billion in 2024 and is projected to grow from USD 221.32 billion in 2025 to reach USD 416.88 billion by 2030, expanding at a CAGR of 13.5% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer preference for clean and natural skincare products, increasing adoption of sustainable and vegan-certified beauty products, and the growth of e-commerce channels enabling greater access to niche organic brands.

Key Market Insights

- Consumer demand for clean and natural beauty products is rising globally, with an increasing shift away from chemical-based makeup removers due to skin sensitivity and health concerns.

- Online retail and e-commerce channels are expanding rapidly, allowing niche organic makeup remover brands to reach new demographics and emerging markets with minimal infrastructure costs.

- North America dominates the market, driven by high consumer awareness, premium beauty culture, and well-established retail infrastructure.

- Europe is the second-largest region, supported by strong regulatory frameworks and growing consumer preference for certified organic and vegan products.

- Asia-Pacific is emerging as the fastest-growing region, with demand fueled by increasing disposable income, urbanization, and rising awareness of clean beauty in China, India, Japan, and Australia.

- Sustainable and certified organic product offerings, including vegan, cruelty-free, and recyclable packaging, are becoming key differentiators for brand loyalty and premium pricing.

Latest Market Trends

Rising Demand for Clean and Sustainable Beauty

Consumers are increasingly favoring organic makeup removers with natural and plant-derived ingredients, avoiding parabens, sulfates, and synthetic chemicals. This trend is particularly strong among millennials and Gen Z consumers who value eco-friendly, vegan, and cruelty-free formulations. Brands are responding with transparent ingredient sourcing, certified organic labels, and sustainable packaging solutions such as refillable or compostable formats. Social media and influencer marketing amplify awareness of these clean beauty options, driving adoption globally.

Digital and E-Commerce-Driven Growth

The rapid expansion of online retail platforms has transformed distribution for organic makeup removers. Direct-to-consumer (D2C) sales, subscription models, and social media-driven marketing campaigns allow brands to connect directly with consumers while maintaining brand authenticity. Augmented reality (AR) tools and QR-based ingredient transparency are also being adopted to enhance consumer confidence. E-commerce has emerged as the fastest-growing channel globally, with a projected high double-digit CAGR due to convenience and access to niche products.

Organic Makeup Remover Market Drivers

Increasing Awareness of Skin Health and Clean Beauty

Growing consumer knowledge about the potential adverse effects of synthetic chemicals in makeup removers is driving the shift to organic alternatives. Sensitive skin and anti-aging segments are particularly attracted to organic products, perceiving them as gentler, safer, and better aligned with wellness lifestyles. This driver is especially strong in North America and Europe.

Sustainability and Ethical Beauty Trends

Global focus on sustainability and ethical consumption encourages the adoption of certified organic and eco-friendly makeup removers. Consumers are willing to pay premium prices for products with sustainable packaging, vegan formulations, and ethical sourcing, supporting market growth. This trend is also influencing large beauty companies to expand their clean beauty portfolios.

Growth of E-Commerce and Omnichannel Retail

Online channels, including marketplaces, D2C websites, and subscription-based services, are boosting accessibility and convenience for organic makeup removers. E-commerce enables rapid brand expansion across regions and strengthens direct engagement with eco-conscious consumers, fueling higher sales and broader adoption.

Market Restraints

Premium Pricing and Consumer Cost Sensitivity

Organic makeup removers are priced higher than conventional products due to costlier raw materials, certifications, and smaller batch manufacturing. This limits adoption among price-sensitive consumers, particularly in emerging markets, constraining market penetration.

Complexity of Certification and Ingredient Sourcing

Maintaining organic certifications, sourcing sustainable raw materials, and ensuring product stability without synthetic preservatives is challenging. These operational complexities may limit production scale, increase costs, and restrict product availability in some regions.

Organic Makeup Remover Market Opportunities

Expansion in Emerging Regions

Emerging markets in Asia-Pacific (China, India, Japan) and Latin America (Brazil, Mexico) present significant growth potential. Increasing disposable incomes, awareness of clean beauty, and e-commerce penetration create opportunities for both new entrants and established players to capture market share. Localized product formats and multi-language packaging can strengthen adoption.

Certification and Sustainable Packaging Differentiation

Brands can leverage certifications, such as ECOCERT and COSMOS, and emphasize vegan, cruelty-free, and recyclable packaging to attract eco-conscious consumers. Transparency about ingredients and traceability, combined with premium branding, creates differentiation and loyalty among target consumers.

Digital Marketing and Influencer-Led Growth

Influencer collaborations, social media campaigns, and D2C subscription models offer new avenues to connect with younger consumers. Technology integration, including QR code ingredient transparency and AR tools, can enhance engagement, strengthen brand credibility, and increase market penetration.

Product Type Insights

Liquid makeup removers dominate the market, offering convenience, broad consumer acceptance, and versatility across skin types. This segment held approximately 30% of the global market in 2024 and continues to lead due to familiarity and ease of use. Wipes, creams, oils, and gels are growing as niche alternatives, particularly in travel and professional use formats.

Application Insights

Home and individual use remains the largest application segment, driven by daily skincare routines. Professional use in salons and spas is the fastest-growing application segment, reflecting the adoption of organic products for premium services. Travel-sized formats, including wipes and mini bottles, are emerging rapidly for on-the-go use, reflecting consumer mobility and convenience preferences.

Distribution Channel Insights

Online retail dominates growth, supported by D2C and marketplace channels. Supermarkets and hypermarkets remain key for volume sales, while specialty beauty stores and pharmacies contribute to premium consumer engagement. Social media-driven marketing, subscription services, and interactive e-commerce experiences are reshaping consumer purchasing behavior.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 30% share in 2024, driven by high consumer awareness, premium spending on beauty, and mature retail infrastructure. The United States is the largest contributor, emphasizing both home use and professional adoption.

Europe

Europe holds about 25–30% of the global market, led by Germany, the UK, and France. Consumers in these countries prefer certified organic and vegan products. Growing e-commerce adoption and regulatory support for clean beauty further strengthen demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with strong adoption in China, India, Japan, and Australia. Rising middle-class incomes, urbanization, and increasing awareness of clean and natural skincare are primary growth drivers. E-commerce platforms play a critical role in market penetration.

Latin America

Brazil, Mexico, and Argentina are emerging markets with increasing demand for imported organic makeup removers. Affluent and urban populations are driving interest in premium and sustainable products.

Middle East & Africa

The GCC countries, particularly the UAE and Saudi Arabia, are witnessing rising adoption due to high-income consumers and luxury beauty preferences. South Africa also contributes to regional growth, primarily in urban and professional markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Organic Makeup Remover Market

- The Body Shop International Limited

- L’Oréal S.A.

- Estée Lauder Companies Inc.

- Unilever PLC

- Natura & Co.

- Shiseido Company, Limited

- Amorepacific Corporation

- Kao Corporation

- Revlon, Inc.

- Beiersdorf AG

- E.l.f. Beauty, Inc.

- Johnson & Johnson Consumer Inc.

- Inika Organic Australia Pty Ltd.

- Caudalie S.A.

- RMS Beauty LLC

Recent Developments

- In March 2025, The Body Shop expanded its organic makeup remover line with vegan-certified cleansing oils and wipes targeting sensitive skin.

- In February 2025, Estée Lauder launched a new e-commerce subscription model for organic makeup removers in North America and Europe.

- In January 2025, L’Oréal announced sustainable packaging initiatives for its organic makeup remover products, including refillable bottles and compostable wipes.