Organic Hair Color Market Size

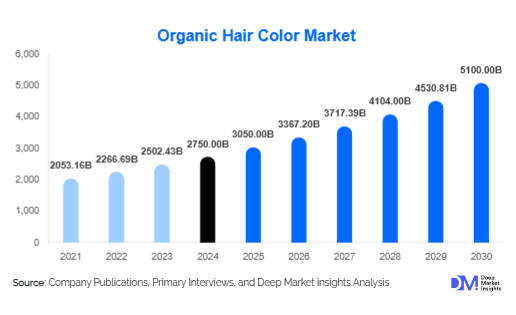

According to Deep Market Insights, the global organic hair color market size was valued at USD 2,750 million in 2024 and is projected to grow from USD 3,050 million in 2025 to reach USD 5,100 million by 2030, expanding at a CAGR of 10.4% during the forecast period (2025-2030). The organic hair color market growth is primarily driven by rising consumer awareness of clean-label beauty products, increasing demand for sustainable and ammonia-free hair care, and the growing influence of e-commerce channels in beauty and personal care distribution.

Key Market Insights

- Organic hair color is rapidly moving from niche to mainstream, driven by clean beauty trends and regulatory scrutiny of chemical-based dyes.

- Premium organic hair colors lead in revenue share, supported by salon demand and affluent consumer adoption in urban markets.

- Women account for the largest user base, while men’s grooming and unisex offerings are emerging as fast-growth categories.

- Asia-Pacific dominates production and consumption, fueled by India and China’s heritage of herbal dyes and rising middle-class spending.

- Europe remains the fastest-growing region, led by strict cosmetic regulations and high consumer preference for eco-friendly personal care.

- Technology-driven formulations, including long-lasting organic dyes and hybrid semi-permanent solutions, are reshaping consumer expectations.

What are the latest trends in the organic hair color market?

Shift Toward Plant-Based and Herbal Formulations

Manufacturers are investing heavily in research to create effective, long-lasting organic hair dyes using natural ingredients such as henna, indigo, beetroot, hibiscus, chamomile, and coffee extracts. This trend is driven by consumer rejection of ammonia, parabens, and synthetic chemicals in favor of natural, scalp-friendly solutions. Herbal and vegan-certified products are gaining traction, especially in Europe and North America, where clean-label certification is a major purchase driver. Brands are also experimenting with hybrid blends that combine natural pigments with minimal safe synthetics for better color retention, thereby addressing the key challenge of durability in natural dyes.

E-Commerce and D2C Channels Revolutionizing Sales

Online retail channels have become the dominant growth driver for organic hair color sales. Direct-to-consumer (D2C) brands leverage influencer marketing, subscription models, and AI-powered personalization tools to expand customer bases. Online tutorials, social media campaigns, and AR-based hair color try-on apps are boosting consumer confidence in experimenting with organic shades. This trend has allowed smaller indie brands to gain visibility alongside global giants, intensifying competition and creating a fragmented but dynamic market landscape.

What are the key drivers in the organic hair color market?

Growing Awareness of Hair and Scalp Health

Consumers are increasingly concerned about the long-term side effects of chemical dyes, such as hair thinning, dryness, and allergic reactions. Organic hair colors, enriched with nourishing botanicals and free from ammonia or peroxide, are seen as safer alternatives. The rising incidence of dermatological concerns has accelerated this shift, particularly among millennials and Gen Z, who are highly responsive to wellness-driven product narratives.

Rise of Clean Beauty and Sustainability

The clean beauty movement is driving the adoption of organic hair color globally. Consumers are demanding cruelty-free, vegan, and eco-certified products, pushing companies to re-engineer formulations and packaging. Government regulations in Europe and North America are also banning harmful synthetic ingredients, further strengthening the business case for organic alternatives. Recyclable packaging and carbon-neutral supply chains are becoming important differentiators for leading brands.

Expanding Salon and Professional Adoption

While at-home use dominates, salons and professional stylists are increasingly adopting organic hair color as part of premium service offerings. Professional ranges often come at higher price points, boosting margins for manufacturers. The trend is particularly strong in urban centers of North America, Europe, and APAC, where consumers are willing to pay more for safer, long-lasting organic hair coloring services.

What are the restraints for the global market?

Higher Price Points Limiting Mass Adoption

Organic hair colors are generally more expensive than their synthetic counterparts due to complex sourcing, certification, and production processes. This pricing gap creates barriers for widespread adoption in price-sensitive markets, especially across LATAM and MEA, where consumers remain heavily reliant on low-cost chemical dyes.

Challenges in Color Retention and Range

Despite significant innovation, organic hair colors still struggle with limited shade availability and shorter-lasting effects compared to chemical dyes. Consumers seeking vibrant, bold, or fashion-forward shades often revert to synthetic options, limiting market penetration in certain demographics. R&D investments are focused on bridging this gap, but performance perception remains a restraint.

What are the key opportunities in the organic hair color industry?

Men’s Grooming Expansion

The men’s grooming industry is a fast-growing avenue for organic hair colors, with increasing demand for beard and hair tinting solutions free of harsh chemicals. Companies tapping into male-focused product lines stand to capture a rapidly expanding segment, particularly in North America and APAC.

Government Incentives for Sustainable Cosmetics

Policies like “Made in India” herbal cosmetic initiatives and the EU’s Green Deal are encouraging local production of sustainable personal care products. Tax benefits, research grants, and certifications are fostering favorable environments for startups and multinational companies to invest in organic hair color manufacturing facilities and R&D hubs.

Emerging Markets Driving Volume Growth

APAC, LATAM, and parts of Africa are witnessing a surge in demand for organic beauty solutions as disposable incomes rise and traditional herbal practices gain renewed consumer trust. These regions provide significant untapped volume opportunities, particularly for mid-range organic products tailored to local preferences.

Product Type Insights

Permanent organic hair colors dominate the market, accounting for approximately 48% of global revenues in 2024. Their popularity stems from long-lasting effects, salon usage, and wide consumer acceptance compared to temporary or semi-permanent formats. Semi-permanent colors hold about 28%, appealing to younger demographics experimenting with shades, while temporary and root-touch-up formats collectively account for the remaining 24%.

Form Insights

Cream-based formulations lead the market with nearly 40% share in 2024, driven by ease of application and salon compatibility. Powder-based colors remain popular in APAC, particularly in India, due to the prevalence of henna. Gel and liquid formats are gaining traction in premium retail channels, supported by product innovation in hybrid textures.

Distribution Channel Insights

Offline retail, particularly specialty beauty stores and salons, accounts for 55% of the global market in 2024. However, online sales are the fastest-growing channel, expanding at a double-digit CAGR due to digital marketing campaigns, influencer endorsements, and subscription-based delivery models.

Gender Insights

Women dominate demand, contributing nearly 68% of revenues in 2024. However, men’s hair and beard color demand is the fastest-growing sub-segment with a CAGR above 12% during 2025-2030. Unisex product launches are also increasing in frequency as brands seek inclusivity-driven marketing approaches.

Price Range Insights

Premium organic hair colors lead the market, accounting for a 42% share in 2024, supported by urban consumers, salon professionals, and eco-conscious millennials. Mid-range products capture 38%, while economy options account for 20% and are gaining traction in emerging economies.

| By Product Type | By Form | By Distribution Channel | By Gender | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 27% of the global organic hair color market in 2024. The U.S. leads due to high adoption of clean beauty products, advanced salon networks, and rising demand for vegan-certified hair dyes. Canada contributes steadily, with growing interest in eco-conscious personal care brands.

Europe

Europe is the fastest-growing region, with a CAGR of 11.5% during 2025-2030. Strict EU cosmetic regulations banning harmful synthetic dyes have accelerated consumer adoption. Germany, France, and the U.K. dominate consumption, while Nordic countries show high per-capita spending on organic cosmetics.

Asia-Pacific

APAC is the largest region, holding 35% of global revenues in 2024. India dominates due to its deep-rooted heritage in herbal hair care, followed by China, which is witnessing massive adoption of eco-friendly beauty among urban millennials. Japan and South Korea are innovation hubs for hybrid organic-synthetic blends.

Latin America

LATAM is growing steadily, led by Brazil and Mexico. Rising awareness of natural products, coupled with local herbal traditions, is fueling demand. However, high pricing and limited distribution remain barriers in rural areas.

Middle East & Africa

MEA holds a smaller share but is experiencing increasing demand in GCC nations, driven by expatriate populations and luxury salon demand. South Africa and Nigeria are emerging markets where affordability-focused mid-range organic hair colors are expected to grow significantly.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Organic Hair Color Market

- L’Oréal S.A.

- Henkel AG & Co. KGaA

- Godrej Consumer Products Ltd.

- Revlon Inc.

- Honasa Consumer Pvt. Ltd. (Mamaearth)

- Kao Corporation

- Natura & Co.

- AVEDA Corporation

- Herbatint (Antica Erboristeria S.p.A.)

- Khadi Natural

- Radico Ltd.

- Surya Brasil

- Tints of Nature

- Bio Veda Action Research Co. (Biotique)

- Indus Valley Organic

Recent Developments

- In July 2025, L’Oréal announced the launch of a 100% plant-based permanent organic hair color line under its Garnier brand, focusing on Europe and North America.

- In May 2025, Godrej Consumer Products expanded its natural hair color portfolio in India and Southeast Asia, introducing affordable powder-based henna blends.

- In March 2025, Surya Brasil unveiled a new vegan-certified product line targeting the U.S. and European salon markets, with recyclable packaging and cruelty-free certification.