Organic Baby Clothing Market Size

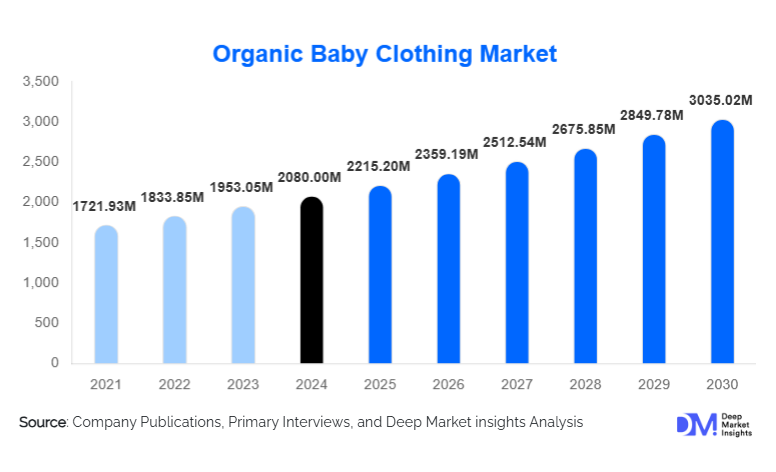

According to Deep Market Insights, the global organic baby clothing market size was valued at USD 2,080.00 million in 2024 and is projected to grow from USD 2,215.20 million in 2025 to reach USD 3,035.02 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). Market growth is primarily driven by rising parental awareness regarding chemical-free textiles, the growing influence of sustainable consumerism, and increased penetration of e-commerce and subscription-based baby apparel models.

Key Market Insights

- Organic cotton dominates the material mix, accounting for more than half of global demand due to its safety, softness, and widespread certification availability.

- Bodysuits and onesies remain the most purchased product category, driven by their usage frequency, affordability, and appeal among newborn-focused buyers.

- Online platforms lead distribution, supported by rising D2C brands, subscription boxes, and global marketplace penetration.

- Asia-Pacific is the fastest-growing region, supported by rising birth rates, growing disposable incomes, and expanding organic cotton production.

- North America remains the largest market with high awareness of textile safety and strong adoption of certified apparel.

- GOTS certification continues to strengthen its global dominance as parents increasingly demand validated sustainability and traceability standards.

What are the latest trends in the organic baby clothing market?

Traceability and Certification-Led Branding

Brands are increasingly integrating supply chain transparency initiatives such as QR-based garment tracking, farm-to-fabric traceability, and third-party certifications. Parents seek proof of clean production processes, ethical sourcing, and chemical-free finishes. As a result, GOTS, OEKO-TEX, and fair-trade labels have become essential for trust-building. Companies are publishing sustainability reports, offering biodegradable packaging, and using natural dyes to attract eco-conscious buyers. This shift is transforming organic baby clothing from a niche premium segment into a mainstream health-driven category.

Subscription and Direct-to-Consumer (D2C) Growth

The rise of subscription boxes, D2C online platforms, and curated baby wardrobe services is reshaping how parents purchase organic apparel. Monthly or quarterly “growth-stage boxes” introduce convenience and cost predictability for new parents, who require frequent clothing replacements. D2C models reduce distribution overhead, maintain premium margins, and allow brands to educate consumers about fabric quality and certifications. Enhanced digital marketing, social commerce, and influencer-led authenticity storytelling further accelerate adoption among millennial and Gen Z parents.

What are the key drivers in the organic baby clothing market?

Increasing Health Awareness Among Parents

Parents are becoming more aware of the risks associated with synthetic fabrics, chemical dyes, and pesticide residues found in conventional baby clothing. Rising concerns about allergies, eczema, and skin sensitivities are driving demand for natural, non-toxic, hypoallergenic fabrics. Organic cotton and bamboo-based clothing are seeing heightened adoption due to their softness and safety, while established certifications provide reassurance of chemical-free production.

Growing Preference for Sustainable and Ethical Products

Consumers, especially younger parents, are aligning their purchasing behaviors with sustainability values. Eco-conscious families seek products made with reduced water consumption, biodegradable materials, ethical labor practices, and transparent supply chains. Governments and brands are promoting sustainable textiles through awareness campaigns and environmental regulations. As sustainable lifestyle adoption increases, organic baby clothing is becoming a staple in eco-friendly parenting.

What are the restraints for the global market?

High Cost of Organic Raw Materials

Organic cotton and other eco-certified materials cost significantly more to grow, harvest, and process than conventional fabrics. Lower crop yields, certification fees, and stricter production guidelines further increase cost pressure. These expenses translate into premium pricing for consumers, limiting adoption in price-sensitive markets. Brands must strike a balance between high production costs and competitive pricing to reach a wider demographic.

Supply Chain Complexities and Certification Barriers

Maintaining internationally recognized certifications such as GOTS requires consistent auditing, documentation, and sustainable processing standards, which can be challenging for small and mid-sized manufacturers. Complex global supply chains, limited certified dyeing facilities, and regulatory discrepancies across countries can slow production cycles and increase operational risks. These constraints contribute to limited scalability for emerging brands.

What are the key opportunities in the organic baby clothing industry?

Expansion of Circular and Rental Models

Circular fashion models, including rental services, buy-back programs, and certified resale platforms, are emerging as lucrative opportunities. Babies rapidly outgrow clothes, making rentals and curated pre-loved organic collections highly appealing for cost-conscious and sustainability-focused parents. This model extends the product lifecycle, reduces waste, and enhances brand loyalty while unlocking recurring revenue streams for manufacturers.

Emerging Market Penetration and Localization

Asia-Pacific, Latin America, and parts of the Middle East and Africa represent untapped growth opportunities. Rising middle-class incomes, increasing birth rates, and growing organic cotton production, especially in India and China, make these markets attractive for expansion. Brands can localize manufacturing to reduce costs, improve margins, and serve both domestic and export audiences more effectively. Awareness campaigns and partnerships with maternity clinics offer further penetration pathways.

Product Type Insights

Bodysuits and onesies hold the largest market share due to their essential role in newborn daily wear, combined with high replacement frequency and affordability. Sleepwear, including swaddles and sleeping sacks, is another fast-growing category driven by parental focus on comfort and safety. Tops and bottoms serve as staple items for older infants and toddlers, while accessories, such as hats, socks, and mittens, benefit from multipack sales. Premium outerwear made from organic wool and bamboo blends caters to affluent buyers seeking winter comfort and eco-friendly materials.

Application Insights

Daily wear dominates the application segment, with parents prioritizing comfort, hypoallergenic fabrics, and breathable materials for newborns and infants. Gift sets and layette bundles are experiencing rapid growth, driven by increasing demand for premium baby shower and newborn gifts. Subscription-based apparel bundles serve parents seeking convenience and curated seasonal wardrobes. Eco-volunteering and sustainability-oriented consumer groups are also purchasing organic apparel as part of lifestyle alignment with low-impact, toxin-free products.

Distribution Channel Insights

Online channels, particularly D2C websites, marketplaces, and subscription services, dominate the distribution landscape. These platforms offer extensive product variety, eco-certification visibility, and convenient home delivery for busy parents. Offline specialty stores remain strong for premium organic brands, offering tactile shopping experiences and expert guidance. Large-format retailers are increasingly stocking certified organic lines to appeal to mainstream consumers. Social media, influencer marketing, and community parenting groups play a growing role in driving purchase decisions.

Age Group Insights

The newborn (0–3 months) segment accounts for the largest share due to the high sensitivity of infant skin, frequent clothing changes, and strong parental inclination toward safe, toxin-free fabrics. The infant (3–12 months) group drives continued repeat purchases as babies proliferate. The toddler segment (12–24 months) contributes steadily, largely through outerwear and seasonal products. Older baby segments (24+ months) remain smaller but exhibit growing demand for sustainable fashion aligned with family lifestyle values.

| By Product Type | By Material Type | By Age Group | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global organic baby clothing market, driven by high consumer awareness of textile safety, well-established direct-to-consumer (D2C) brands, and strong demand for certified organic apparel. U.S. parents show a strong preference for GOTS-labeled products, and online shopping dominates purchasing behavior. Premium organic brands and subscription services are widely adopted among eco-conscious families.

Europe

Europe represents the second-largest market, driven by stringent regulatory standards, strong sustainability culture, and widespread acceptance of ethical fashion. Countries like Germany, the U.K., France, and the Nordics lead in adoption. European consumers prioritize eco-certification, low-impact dyes, and fair-trade manufacturing. Boutique organic brands thrive across the region, supported by mature retail networks.

Asia-Pacific

Asia-Pacific is the fastest-growing market, with rising demand from China, India, South Korea, Japan, and Australia. Expanding middle-class wealth, rapid urbanization, and increasing production of organic cotton are fueling adoption. Chinese parents show a strong interest in premium imported organic brands, while Indian consumers benefit from local certified cotton production and affordability. E-commerce expansion is accelerating regional growth.

Latin America

Latin America is emerging as a growing market, driven by rising health awareness and growing interest in sustainable parenting. Brazil, Mexico, and Argentina are key contributors. While the market is still developing, rising organic cotton production and increased access to global e-commerce platforms are boosting adoption. Premium organic gift sets and newborn apparel are particularly popular.

Middle East & Africa

MEA remains a smaller but expanding market. The UAE and Saudi Arabia show strong demand for premium organic baby brands due to high disposable incomes. Africa is seeing gradual growth, particularly in South Africa, where eco-awareness and specialty retail networks are growing. Local manufacturing initiatives and export-driven production are helping the region participate more actively in the global supply chain.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Organic Baby Clothing Market

- Burt’s Bees Baby

- Hanna Andersson

- Finn + Emma

- L’ovedbaby

- Under The Nile

- Kate Quinn

- PACT Apparel

Recent Developments

- In March 2025, Burt’s Bees Baby launched a new QR-enabled traceability system, allowing parents to track cotton origin and production processes for enhanced transparency.

- In January 2025, Hanna Andersson expanded its GOTS-certified product line with bamboo-organic cotton blends designed for sensitive newborn skin.

- In October 2024, Finn + Emma introduced biodegradable packaging and a circular resale platform for gently used organic baby clothing, promoting waste reduction.