Online On-Demand Home Services Market Size

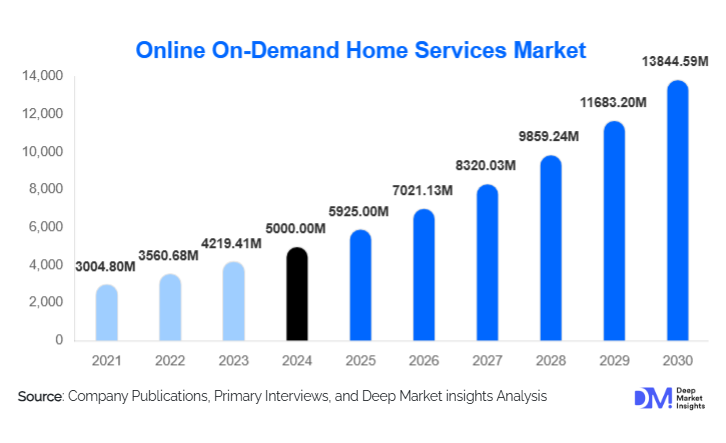

According to Deep Market Insights, the global online on-demand home services market size was valued at USD 5,000.00 million in 2024 and is projected to grow from USD 5,925.00 million in 2025 to reach USD 13,844.59 million by 2030, expanding at a CAGR of 18.5% during the forecast period (2025–2030). Growth in this market is primarily driven by the rising preference for digital service booking, rapid urbanization, and the growing demand for convenient, fast, and reliable home services across cleaning, repairs, beauty, caregiving, and lifestyle categories.

Key Market Insights

- Cleaning & housekeeping services dominate the global market, driven by recurring demand and high scalability of standardized service models.

- Marketplace/aggregator platforms lead the industry, offering wide service networks, transparent pricing, and trusted professional vetting.

- Residential consumers account for over 80% of total market demand, making the segment the backbone of revenue generation for service platforms.

- Asia-Pacific (APAC) is the fastest-growing region, fueled by rising smartphone penetration, digitization, and middle-class expansion in India and China.

- North America leads in market share with strong adoption of gig-economy platforms and a higher willingness to pay for convenience.

- Artificial intelligence, automation, and IoT integrations are transforming service matching, scheduling, quality assurance, and predictive maintenance.

What are the latest trends in the Online On-Demand Home Services Market?

Smart Home Integration and Predictive Maintenance Adoption

Platforms are increasingly integrating with IoT and smart home devices to create seamless, predictive home service ecosystems. Smart appliances, leak detectors, air-quality sensors, and automation hubs allow service platforms to offer predictive maintenance, such as dispatching plumbers when leak sensors trigger alerts or booking appliance technicians when performance metrics fall below optimal levels. This trend deepens customer retention and unlocks recurring revenue models. Partnerships between service platforms and smart home brands are strengthening, enabling automated scheduling, remote diagnostics, and real-time system monitoring. These innovations position home service platforms as integral components of the modern connected home.

AI-Driven Service Matching and Instant On-Demand Fulfillment

The rise of AI-powered routing, service matching, and demand forecasting has transformed how home services are delivered. Platforms now use predictive analytics to anticipate peak demand, optimize workforce allocation, and ensure faster response times. The shift toward 10–60 minute instant service is gaining traction in dense urban markets. Consumers increasingly expect real-time availability, transparent pricing, and tracked service professionals. These tech-driven enhancements appeal strongly to digital-native demographics and create competitive differentiation for platforms capable of ultra-fast fulfillment.

What are the key drivers in the Online On-Demand Home Services Market?

Growing Urbanization and Lifestyle Shifts

The rise of dual-income households, shrinking leisure time, and expanding urban populations are fueling demand for outsourced home services. Consumers are increasingly prioritizing convenience, leading to growing adoption of on-demand cleaning, repairs, beauty, and wellness services. Urban centers with dense populations, higher disposable incomes, and digital maturity contribute significantly to market expansion. This demographic shift is expected to accelerate demand for both recurring and specialized home services globally.

Technological Advancements and Platform Transparency

Improved mobile apps, AI-driven scheduling, real-time tracking, digital payments, and service professional verification have elevated customer trust and satisfaction. These innovations streamline operations, reduce delays, and improve the consistency and quality of service delivery. The adoption of such technologies helps platforms scale efficiently, attract new users, and differentiate their offerings with transparent pricing and reliable service fulfillment.

Expansion of the Gig Economy and Workforce Availability

The availability of flexible gig workers is a major growth engine for the market. Platforms can onboard local professionals quickly, expanding service coverage without heavy CapEx investments. This flexibility enables marketplace models to scale faster across cities and regions. The increasing acceptance of gig work as a mainstream income source, especially in developing markets, ensures strong supply pipelines for cleaning, maintenance, beauty, and caregiving services.

What are the restraints for the global market?

Workforce Fragmentation and Quality Inconsistency

A major challenge is maintaining uniform service quality across a large, distributed gig workforce. Inconsistent professionalism, variable skill levels, and incomplete vetting processes can negatively affect customer trust. This fragmentation increases customer acquisition costs and introduces operational risks, especially for platforms expanding rapidly into new regions.

Regulatory and Labor Compliance Challenges

On-demand platforms face increasing scrutiny regarding worker classification, insurance requirements, and safety regulations. Compliance requirements vary widely across regions, impacting operational efficiency and costs. Skilled trades such as plumbing and electrical work require licensing, which can complicate onboarding. Evolving gig economy legislation in Europe and North America could also create cost pressures for platforms.

What are the key opportunities in the Online On-Demand Home Services Industry?

Penetration into Tier-2 and Tier-3 Emerging Cities

Rapid digitization and rising middle-class incomes in emerging economies such as India, Indonesia, Vietnam, and Brazil present a massive untapped market. Consumers in these cities face limited availability of organized and trusted service providers. Platforms that adopt localized pricing, train local service professionals, and offer vernacular-language user experiences can capture this growing demand. The long-term value of these markets lies in recurring service needs, such as cleaning and repairs.

Subscription-Based Home Care and Elder Care Services

Elder care, physiotherapy-at-home, and routine home maintenance subscription plans represent high-growth opportunities. Aging populations in Europe, Japan, and North America are driving demand for reliable in-home support services. Subscription packages offer platforms recurring revenue, higher customer retention, and predictable demand patterns. Combining these services with telehealth or smart-home monitoring further enhances value propositions.

Integration of Eco-Friendly and Sustainable Service Packages

Consumers are increasingly seeking eco-conscious alternatives, such as green cleaning, energy-efficient repairs, and sustainable home improvement. Platforms that build sustainability certifications, offer eco-friendly products, or train professionals in green practices can differentiate their brands. Government incentives for energy-efficient upgrades also support this trend, especially in Europe and North America.

Product Type Insights

Cleaning & housekeeping services dominate the global market, capturing nearly 35–40% of the total 2024 revenue. These services lead due to high booking frequency, recurring demand, and standardized workflows that allow efficient scaling. Repair & maintenance services follow, supported by rising demand for electrical, plumbing, and appliance repair solutions. Beauty and wellness at home is a rapidly growing vertical, driven by urban professionals and convenience-oriented consumers. Pet care, home tutoring, and pest control continue to expand as specialized niches offering significant cross-selling potential for established platforms.

Application Insights

Residential applications represent over 80% of total platform usage due to the high demand for cleaning, repairs, beauty, and caregiving services among urban households. Commercial applications, including coworking spaces, serviced apartments, and real estate managers, are growing steadily as businesses outsource facility upkeep. Elder care and predictive maintenance powered by IoT devices are emerging as high-value applications, offering recurring demand and premium margins.

Distribution Channel Insights

Mobile apps dominate the distribution landscape, accounting for over 60% of all service bookings. Their appeal lies in intuitive UI, automated scheduling, real-time tracking, and secure payments. Web-based platforms remain important for desktop users and corporate bookings. Voice assistants and hotline-based services are gaining traction among older demographics. Subscription-based plans and loyalty programs are emerging as key channels for retaining high-frequency users and improving customer lifetime value.

Customer Type Insights

Residential customers form the core demand segment, driven by convenience and recurring household needs. Working professionals, young families, and elderly individuals generate the highest volume of bookings. Commercial customers, including property managers and rental operators, are increasingly outsourcing maintenance and cleaning to streamline operations. This segment offers growing B2B opportunities for platforms with reliable, trained service professionals.

Age Group Insights

Consumers aged 25–45 represent the largest share of users, attributing to their familiarity with digital platforms and preference for convenience services. The 18–25 demographic drives growth in budget-friendly and instant services, while older users (50+) are adopting platforms for wellness, caregiving, and routine home maintenance. These demographics collectively support broad-based market expansion across service categories.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global market with a 30–35% share in 2024. High disposable incomes, widespread adoption of gig-economy apps, and established service ecosystems support market expansion. The U.S. is the largest contributor, with strong demand for cleaning, repairs, and pet care services. Growth is further driven by technology adoption, advanced workforce vetting systems, and the rising popularity of instant on-demand bookings.

Europe

Europe accounts for roughly 20–25% of the global share. Strong demand for vetted and regulated service providers, eco-friendly home services, and subscription-based packages drives adoption. Key countries, including the U.K., Germany, France, and the Netherlands, show high digital literacy and willingness to outsource domestic tasks.

Asia-Pacific

APAC is the fastest-growing region, with demand driven by India, China, Indonesia, and Southeast Asia. Rising middle-class consumption, rapid urban migration, and smartphone penetration are transforming service booking behavior. India, in particular, has seen explosive growth due to large gig workforce availability, competitive pricing, and strong platform ecosystems.

Latin America

LATAM contributes around 8–10% of market revenue, led by Brazil, Mexico, and Colombia. Economic recovery, increased digital payments, and expanding urban populations are boosting adoption. Demand is strongest for cleaning, beauty, and appliance repair services. Local platforms are emerging, though market fragmentation remains high.

Middle East & Africa

MEA accounts for 5–8% of the global market. Gulf countries, particularly the UAE and Saudi Arabia, drive demand through high-income populations and strong reliance on domestic services. Africa presents long-term potential due to growing urban centers and increasing digital adoption, though infrastructure challenges persist.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Online On-Demand Home Services Market

- Urban Company

- Angi Inc.

- Thumbtack Inc.

- TaskRabbit

- Amazon Home Services

- Helpling GmbH

- Porch.com

- Handy Technologies Inc.

- AskforTask

- LawnStarter

- Lawn Love

- Zaarly

- ServiceWhale

- TaskEasy

- Openbay

Recent Developments

- In March 2025, Urban Company launched an AI-based technician routing engine, reducing service wait times by up to 40%.

- In January 2025, Angi Inc. expanded its subscription-based home maintenance plans across the U.S., targeting recurring service demand.

- In April 2025, Thumbtack integrated IoT-based predictive maintenance alerts through partnerships with major smart-home device manufacturers.