Online Coaching Market Size

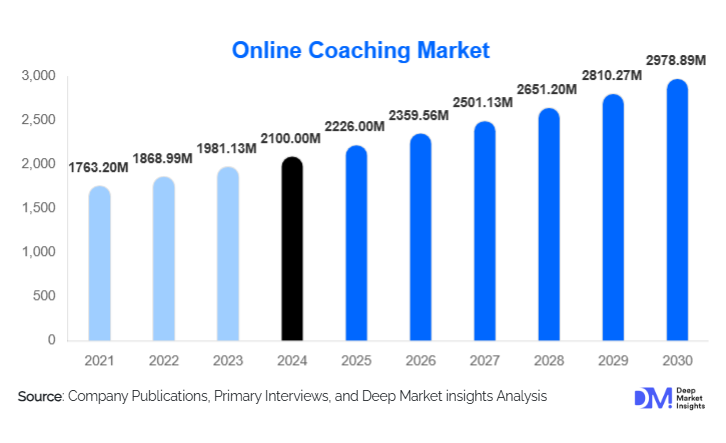

According to Deep Market Insights, the global online coaching market size was valued at USD 2,100 million in 2024 and is projected to grow from USD 2,226 million in 2025 to reach USD 2,978.89 million by 2030, expanding at a CAGR of 6% during the forecast period (2025–2030). The market growth is primarily driven by increasing enterprise adoption of digital coaching platforms, rising consumer demand for health, career, and life coaching, and advancements in AI-enabled personalized coaching solutions that enhance scale and measurable outcomes.

Key Market Insights

- Enterprise L&D is the largest revenue segment, with corporations investing heavily in leadership, sales, and employee upskilling programs delivered via online coaching platforms.

- One-to-one live coaching remains the most premium service type, accounting for 35% of the 2024 market, due to high per-user pricing and strong adoption among both corporate and affluent consumer segments.

- North America dominates the market, with the U.S. accounting for 35% of the global market in 2024, driven by high enterprise spend and consumer willingness to pay for personalized coaching.

- Asia-Pacific is the fastest-growing region, led by India and China, due to rising mobile penetration, expanding middle-class consumer base, and growing demand for test-prep, career, and wellness coaching.

- Digital health and wellness coaching is emerging as a high-growth vertical, supported by payor reimbursement, employer-sponsored programs, and evidence-based behavior-change initiatives.

- Technological integration, including AI-powered personalization, predictive analytics, and integrated platform solutions, is enabling scalable coaching delivery and enhanced client outcomes.

What are the latest trends in the online coaching market?

AI-Augmented and Hybrid Coaching Models

Platforms are increasingly integrating AI to enhance coach productivity, automate session summaries, personalize learning paths, and improve client engagement. Hybrid coaching models combining self-paced digital programs with scheduled live sessions are gaining traction, as they offer the scalability of on-demand content while maintaining the personalized touch of live interaction. These models appeal to both enterprise clients seeking measurable outcomes and consumers desiring flexible, affordable solutions.

Digital Health and Wellness Coaching Expansion

Health and wellness coaching has become a major growth driver, with programs targeting chronic disease prevention, mental well-being, and fitness. Employers and payors increasingly reimburse evidence-based programs, creating premium revenue streams. Integration with telehealth platforms and mobile apps has expanded accessibility, enabling consumers and patients to track progress, receive personalized recommendations, and engage with certified coaches remotely.

Outcome-Based Enterprise Solutions

Corporations are shifting from generic training to measurable coaching outcomes such as promotion rates, retention, sales performance, and leadership development. Platforms providing integrated dashboards, KPI tracking, and analytics are experiencing higher adoption, enabling clients to quantify ROI. Outcome-based enterprise contracts are increasingly multi-year, with premium pricing tied to demonstrated results.

What are the key drivers in the online coaching market?

Corporate Digital Transformation and L&D Modernization

Organizations are investing in digital coaching platforms to upskill employees, strengthen leadership pipelines, and enhance retention. The focus on measurable impact has accelerated enterprise adoption, particularly for executive coaching, DEI programs, and sales enablement. Enterprise clients prefer subscription-based, multi-year contracts that provide predictable revenue for platforms.

Consumer Demand for Personalized Coaching

Consumers are increasingly seeking coaching for life, career, and wellness, valuing personalized, outcome-oriented experiences. Subscription models and micro-programs make coaching accessible, encouraging long-term engagement. High-value segments, including professionals and health-conscious individuals, are willing to pay premium fees for quality services, driving revenue growth for specialized providers.

Technological Innovation and Platformization

Platforms are adopting AI, predictive analytics, and integrated software solutions to scale coaching, improve retention, and enhance personalization. Tools such as automated nudges, goal-tracking, and coach matching improve client outcomes and efficiency. Investment in secure, compliant, and scalable infrastructure is enabling global delivery and cross-border expansion.

What are the restraints for the global market?

Quality Inconsistency and Credentialing Challenges

The market is fragmented with varying coach qualifications and inconsistent service quality. Enterprises and consumers often require evidence of credentials, especially in health and executive coaching. Lack of standardization can reduce adoption and slow growth in certain segments.

Customer Acquisition Costs and Pricing Pressure

High competition, particularly among consumer-facing apps and marketplaces, has increased customer acquisition costs and applied downward pressure on pricing. Independent coaches and smaller platforms may struggle to maintain margins unless they provide demonstrable value or achieve scale through technology adoption.

What are the key opportunities in the online coaching industry?

Enterprise Outcome-Based Coaching Programs

Platforms can develop outcome-driven coaching programs for corporations, integrating KPI tracking and analytics. By demonstrating measurable ROI, providers can secure high-value, multi-year enterprise contracts. Focus areas include leadership development, sales enablement, and DEI initiatives, where premium pricing is accepted.

Health and Wellness Digital Coaching

Evidence-based digital health coaching programs offer opportunities for reimbursement from payors and employers. Partnerships with telehealth providers, integration with EHR systems, and clinically validated behavior-change interventions can create sticky revenue streams and improve scalability. Expansion into preventive care, mental wellness, and chronic disease management is particularly promising.

AI and Personalized Coaching Solutions

Platforms leveraging AI to automate coaching workflows, personalize content, and provide predictive insights can scale operations while reducing costs. AI-enhanced services improve retention, optimize scheduling, and enable personalized client experiences. Startups and incumbents that offer AI-augmented micro-coaching programs can tap into underserved consumer and enterprise segments globally.

Service Type Insights

One-to-one live coaching continues to dominate the online coaching market, representing approximately 35% of 2024 revenues. This segment commands premium pricing due to its high degree of personalization, direct interaction with certified coaches, and measurable outcomes, making it especially appealing for enterprise clients and high-value consumers. Enterprise demand for leadership and performance improvement coaching is the primary driver behind the dominance of this service type, as companies increasingly tie employee coaching to measurable KPIs and long-term development strategies. Group coaching and hybrid programs are gaining traction, particularly in corporate L&D, due to their cost efficiency and ability to deliver structured training at scale. Self-paced digital programs are expanding rapidly, driven by scalability, accessibility, and lower cost per user. Additionally, platform fees, assessment tools, and integrated analytics provide supplementary revenue streams for technology providers, making these models attractive for both B2B and B2C segments.

Application Insights

Corporate learning and development (L&D) remains the largest application in the market, fueled by demand for leadership development, sales performance improvement, and employee engagement programs. Enterprise adoption of measurable, outcome-focused coaching programs is the key driver for growth in this segment, with corporations seeking tangible ROI from coaching investments. Digital health and wellness applications are expanding rapidly, supported by employer-sponsored programs, payor reimbursement models, and the increasing adoption of telehealth platforms. Academic and test-prep coaching in APAC markets, particularly in India and China, shows strong growth, while career and life coaching continues to attract a global consumer base seeking personal and professional development. Niche applications, including sports coaching and creative skills development, are emerging as additional revenue streams, especially in markets with high digital literacy and mobile access.

Distribution Channel Insights

Enterprise sales and SaaS subscriptions dominate B2B distribution, providing predictable and recurring revenue streams. B2C consumer coaching is primarily delivered through mobile apps and direct-to-consumer websites, leveraging subscription-based models for scalability. Marketplaces and aggregator platforms help generate leads, but can compress margins due to competition. Strategic partnerships with health systems, insurers, and telecommunications providers in APAC and LATAM are enabling cross-border distribution, particularly for digital health and wellness coaching programs. The growing trend of integrated platforms that combine self-paced content with live coaching is enhancing engagement and retention across regions.

End-User Insights

B2B corporate clients account for approximately 40% of 2024 market revenue, driven by enterprise L&D budgets and a strong focus on leadership development and measurable employee performance. B2C consumers represent a sizable segment, especially in life, career, and health coaching. Institutional adoption (B2G) is smaller but steadily increasing through educational and government programs. The fastest-growing end-user segments are corporate L&D and digital health coaching, reflecting high willingness to pay, multi-year subscription adoption, and measurable ROI for enterprises and payors.

Age Group Insights

Professionals aged 31–50 represent the largest market share, combining disposable income with high demand for personal and career development. Younger demographics (18–30) are driving growth in budget-friendly digital coaching subscriptions and self-paced programs, particularly in career and academic preparation. Older adults (51–65) favor premium executive and wellness coaching, while the 65+ segment represents a niche for high-value, low-intensity coaching services, often focusing on wellness, mental well-being, and lifestyle management.

| By Service Type | By Application | By Distribution Channel | By End-User | By Age Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest market (42% of 2024 revenue, USD 1,419M), with the U.S. leading adoption due to substantial enterprise L&D budgets, high consumer purchasing power, and a mature ecosystem of certified coaches. Canada contributes through corporate training, health, and wellness coaching programs. Key drivers of regional growth include the integration of AI-driven coaching platforms, high adoption of outcome-based coaching in enterprises, and increasing corporate emphasis on employee retention, leadership development, and DEI initiatives. Premium service adoption, advanced technological infrastructure, and widespread acceptance of remote coaching continue to sustain market leadership in North America.

Europe

Europe accounts for 20% of 2024 revenues ( USD 675M), with the U.K., Germany, and France being major contributors. Growth is fueled by enterprise demand for measurable outcomes in leadership and performance coaching, digital health adoption, and robust regulatory frameworks that support accredited coaching programs. Drivers of regional expansion include government incentives for workforce development, increasing awareness of mental health and wellness coaching, and growing investment in AI-based personalized coaching solutions. Younger European professionals are adopting digital platforms for career coaching, while large enterprises are leveraging hybrid and group coaching to train employees at scale.

Asia-Pacific

APAC represents 28% of the market ( USD 945M) and is the fastest-growing region. India and China are primary growth drivers due to a strong focus on academic/test-prep coaching, career advancement, and wellness programs. Australia and Japan maintain mature corporate and consumer segments. Key growth drivers include rising smartphone penetration, expanding middle-class disposable income, increasing corporate investment in employee upskilling, and the popularity of mobile-first, self-paced, and hybrid coaching platforms. Governments in India and China are increasingly supporting online learning and digital skill development initiatives, further accelerating adoption.

Latin America

Latin America accounts for 6% of the market ( USD 203M), with Brazil and Mexico being the primary contributors. Growth is emerging in consumer-focused and outbound coaching programs, particularly in wellness, career development, and leadership. Regional drivers include increasing digital penetration, rising awareness of personal development solutions, and partnerships with telcos and health platforms to improve accessibility. Niche offerings and localized content are helping to capture a growing middle-class consumer base across the region.

Middle East & Africa

MEA represents 4% of the global market ( USD 135M). The Middle East, led by the UAE and Saudi Arabia, shows strong adoption of premium coaching services due to high disposable incomes and corporate investment in executive leadership and wellness programs. Africa, encompassing emerging markets such as South Africa and Nigeria, is experiencing growth in educational, corporate, and intra-regional coaching programs. Key growth drivers include increasing government support for digital education initiatives, rising entrepreneurship, expanding corporate L&D budgets, and growing awareness of wellness and life coaching, which collectively support market expansion in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Online Coaching Market

- BetterUp

- Noom

- CoachHub

- Omada Health

- Lyra Health

- Headspace / Calm

- Coursera (Enterprise Coaching Modules)

- Skillsoft

- Torch

- Lark

- Lyra Health

- Atlantis Health

- Naluri

- Learnlight

- Mindset Health

Recent Developments

- In March 2025, BetterUp expanded its enterprise platform in Europe, integrating AI-powered leadership analytics and predictive coaching for multinational clients.

- In February 2025, CoachHub raised $80 million in a growth round to enhance AI-driven coach matching and global enterprise scalability.

- In January 2025, Omada Health partnered with telehealth providers in the U.S. to expand digital health coaching programs for chronic disease prevention and employer wellness initiatives.