Online Bingo Games Market Size

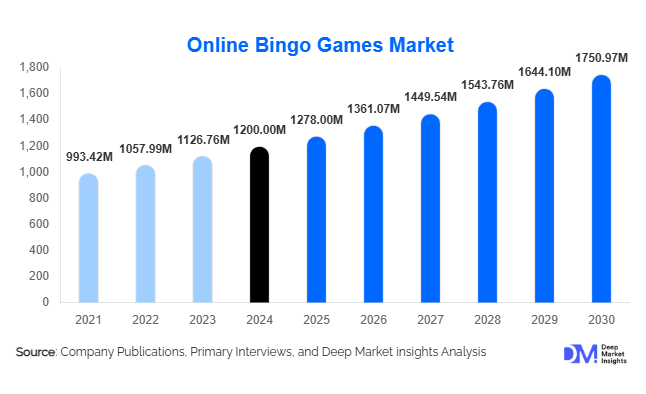

According to Deep Market Insights, the global online bingo games market size was valued at USD 1,200 million in 2024 and is projected to grow from USD 1,278.0 million in 2025 to reach USD 1,750.97 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The growth of the online bingo games market is primarily driven by the surge in mobile gaming, broader digital payment adoption, and the increasing popularity of interactive, community-driven gaming experiences worldwide.

Key Market Insights

- Europe remains the dominant regional market, accounting for nearly 46% of the global online bingo revenue in 2024, supported by mature regulation and high internet penetration.

- Mobile bingo apps represent the largest access channel, contributing about 60–65% of total market value due to ease of play and constant connectivity.

- 90-Ball Bingo leads game format preferences, holding an estimated 44% market share thanks to its familiarity and established player base in Western markets.

- The 40+ age group continues to generate the highest revenue, reflecting long-term bingo enthusiasts with strong brand loyalty and higher disposable income.

- Asia-Pacific is the fastest-growing region, driven by smartphone adoption, rising leisure expenditure, and expanding access to regulated online gaming.

- Technological convergence, live streaming, AR/VR, and social integration are reshaping user experience and creating new monetization models.

What are the latest trends in the Online Bingo Games Market?

Mobile-First Gaming Experiences

The market has rapidly transitioned from desktop-based to mobile-first platforms, with operators investing in app-based interfaces that support cross-device play. Mobile apps allow players to join rooms, chat, and participate in tournaments seamlessly, transforming bingo into an accessible, on-the-go pastime. Developers are focusing on lightweight, interactive interfaces and in-app communities, appealing strongly to both casual and dedicated players. This mobile migration has become the single largest driver of engagement and lifetime value per player.

Social and Live-Hosted Bingo Formats

Social interaction is becoming central to online bingo’s appeal. Platforms now feature live-hosted games, chat rooms, and community leaderboards that replicate the camaraderie of traditional bingo halls. Live streaming and influencer-hosted bingo events are gaining traction, blending entertainment and competition. These innovations increase engagement and retention while broadening the game’s demographic appeal, especially among younger, socially active users.

What are the key drivers in the Online Bingo Games Market?

Expansion of the Internet and Smartphone Penetration

Global digitalization continues to expand online bingo’s reach. Affordable smartphones, faster mobile internet, and higher broadband coverage have made online gaming ubiquitous. Emerging economies in Asia-Pacific and Latin America are witnessing exponential growth as first-time players adopt bingo apps via mobile devices, unlocking massive untapped demand.

Diverse Monetization and Game Innovation

Online bingo operators are diversifying revenue streams through freemium models, in-app purchases, premium rooms, and cross-promotions with other online casino offerings. Enhanced game formats, including 75-Ball, 80-Ball, and themed pattern bingo, create novelty, while brand collaborations and jackpot events drive virality. This combination of creativity and flexibility in monetization underpins long-term profitability.

Regulatory Evolution and Secure Payment Systems

Improved regulatory clarity in Europe and North America, coupled with innovations in secure digital payments, has increased player trust and participation. Seamless integration of e-wallets, cryptocurrencies, and local payment methods has made real-money play safer and faster. Countries with evolving iGaming legislation, such as India and Brazil, are further fueling future expansion potential.

What are the restraints for the global market?

Complex and Fragmented Regulation

Online bingo falls under varying gambling laws across jurisdictions, creating a patchwork of compliance requirements. Operators face challenges in acquiring multiple licenses, adhering to responsible gaming standards, and implementing strict identity verification systems. These complexities raise operational costs and slow new market entries.

Intense Competition and Rising Acquisition Costs

With increasing numbers of entrants, customer acquisition has become expensive. Established operators are heavily investing in promotions and loyalty schemes, putting pressure on margins. Players’ low switching costs intensify churn, forcing platforms to innovate continually and differentiate through superior engagement features or exclusive content.

What are the key opportunities in the Online Bingo Games Industry?

Untapped Emerging Markets

Asia-Pacific, Latin America, and parts of Africa represent the next frontier for online bingo. Rapid smartphone adoption, combined with localized content and vernacular language support, can unlock large new user bases. Early entrants can benefit from first-mover advantage by tailoring cultural formats, offering micro-transactions, and leveraging regional payment systems.

Advanced Technology Integration

Augmented Reality (AR), Virtual Reality (VR), and AI-driven personalization are redefining online bingo’s experience. Live-hosted AR rooms, AI-curated tournaments, and personalized player analytics can dramatically improve engagement. Integration with streaming and social media will drive viral growth, expanding bingo beyond traditional audiences.

Regulatory and Payment Liberalization

Governments worldwide are moving toward clearer iGaming frameworks, encouraging legal online bingo participation. Simultaneously, the adoption of digital payment infrastructures, e-wallets, instant bank transfers, and crypto is reducing friction for deposits and withdrawals. These shifts create new opportunities for legitimate operators to scale responsibly.

Product Type Insights

90-Ball Bingo continues to dominate the global online bingo games market, accounting for approximately 44% of total revenue in 2024. Its leadership is driven by long-standing popularity in regulated markets such as the U.K., Spain, and parts of Northern Europe, where the format has been culturally ingrained for decades. The structured grid, larger player base, and community-driven gameplay make it ideal for online tournaments and progressive jackpots. This format’s strong engagement levels have led major operators to enhance it with features such as themed rooms, live hosts, and cross-promotional events linked to television game shows.

75-Ball and 80-Ball Bingo formats are gaining rapid traction in North America and Asia-Pacific, appealing to players who prefer shorter rounds and higher play frequency. These versions are particularly popular on mobile platforms, where quick gameplay sessions align with on-the-go digital habits. Niche segments such as pattern-based and 30-Ball Bingo cater to social media and influencer-driven audiences seeking casual, fast-paced, and gamified bingo sessions integrated with chatrooms, live reactions, and digital gifting. The emergence of branded bingo collaborations with entertainment franchises is also driving renewed engagement across younger demographics.

Platform Insights

Mobile applications represent the largest and fastest-growing platform segment, contributing around 60–65% of total market revenue in 2024. The surge is fueled by high smartphone penetration, seamless payment integrations, and the convenience of playing anytime and anywhere. Mobile bingo apps increasingly feature push notifications, loyalty rewards, live multiplayer rooms, and social sharing options, all designed to extend player engagement and retention. Operators are leveraging gamification mechanics such as streak bonuses and daily challenges to sustain repeat play.

Meanwhile, web-based desktop platforms remain crucial in mature markets like Europe, catering to traditional players who prefer a stable, larger-screen experience. Tablet-based play is expanding among the 50+ age group, as the interface size and simplicity appeal to older audiences who value clarity and comfort. The transition toward cross-platform compatibility, allowing users to switch between mobile, web, and smart TV play, is further enhancing accessibility and retention across all demographics.

Business Model Insights

The Pay-to-Play model remains dominant, accounting for the largest share of global online bingo revenue in 2024. This model provides operators with predictable cash flows, strong Average Revenue Per User (ARPU), and enhanced player loyalty through real-money jackpots and tournaments. Regulatory clarity in Europe and expanding legalization in the U.S. further strengthen this segment’s profitability.

However, the freemium model, where players access free games with optional paid upgrades, is expanding rapidly, particularly across Asia-Pacific and Latin America. It attracts casual users through zero-entry barriers and monetizes engagement via in-app purchases, microtransactions, and virtual goods. The hybrid monetization model, blending ads, premium passes, and competitive event entries, is emerging as a sustainable approach for operators looking to balance scale and profitability in highly competitive digital ecosystems.

Demographic Insights

The 40+ age group continues to generate the highest revenue share, contributing nearly 45% of global online bingo spending in 2024. This demographic values reliability, established brands, and traditional gaming experiences with social interaction. Platforms targeting this audience emphasize simplicity, trust-based payment systems, and high payout transparency.

Conversely, the 18–25 age segment is expanding fastest, driven by gamified interfaces, real-time chatrooms, influencer-led events, and interactive live hosts. Younger audiences are drawn to bingo’s transformation from a static game into a dynamic, social entertainment format. The inclusion of mini-games, rewards-based progression, and crossover events (e.g., linking bingo to music or streaming platforms) is helping operators diversify engagement across generations. This generational blend is reshaping product development strategies and boosting long-term user retention.

| By Game Type | By Platform Type | By End User | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe maintains its position as the global leader in the online bingo market, holding approximately 46–48% share in 2024. The U.K., Spain, and Italy anchor this dominance, supported by established regulations, responsible gambling frameworks, and a deep-rooted cultural association with bingo. The region’s mature digital infrastructure, high internet penetration, and early adoption of mobile gambling platforms foster continuous growth.

Regional growth drivers include the integration of live-host bingo formats, enhanced cross-brand promotions with TV shows, and AI-based personalization, improving player engagement. The European market also benefits from a wave of regulatory modernization aimed at improving transparency and responsible gaming, enabling stable and sustainable expansion through 2030.

North America

North America accounts for approximately 30–32% of the global market share, led by the United States and Canada. The region’s momentum is fueled by the progressive legalization of online gambling and strong consumer adoption of digital entertainment. Partnerships between bingo operators and large casino or media brands are expanding reach, while custom-branded bingo events tied to pop culture (e.g., TV series, sports, and live streamers) are driving millennial participation.

Growth drivers include the expansion of real-money gaming licenses in U.S. states, rapid uptake of mobile payment systems, and integration of bingo into multi-platform entertainment ecosystems. The increasing use of advanced analytics for player retention and targeted marketing is further bolstering revenue performance in this region.

Asia-Pacific

Asia-Pacific (APAC) is the fastest-growing region globally, projected to grow at a CAGR of 8–9% through 2030. Key markets include India, Japan, Australia, and emerging Southeast Asian economies. The region’s surge is driven by mobile-first gaming habits, expanding digital payment infrastructure, and the cultural appeal of interactive social entertainment. Localized bingo platforms are adapting to regional languages, festivals, and micro-transaction models, significantly improving user engagement.

Regional growth drivers include the proliferation of affordable smartphones, rising disposable incomes, and favorable shifts in online gaming regulations. Integration with social media, live-streaming features, and e-wallets like Paytm and Alipay is reshaping bingo’s accessibility and monetization landscape.

Latin America

Latin America (LATAM) currently contributes 5–8% of global revenue, led by Brazil, Mexico, and Colombia. The region’s rapid digitalization, coupled with evolving regulatory environments, is attracting major global operators. The cultural enthusiasm for community-based entertainment and digital gaming aligns well with online bingo’s social framework.

Growth drivers include expanding middle-class populations, the rise of local payment gateways, and ongoing regulatory reforms encouraging responsible iGaming. Localized marketing, influencer engagement, and bilingual platform support are further enhancing adoption across the region.

Middle East & Africa

Middle East & Africa (MEA) currently holds 3–5% market share, constrained by restrictive gambling regulations across several countries. However, selective opportunities exist within social or free-to-play bingo platforms, especially in digitally advanced Gulf Cooperation Council (GCC) nations such as the UAE, Saudi Arabia, and Qatar. The region’s growing internet penetration, tourism-driven entertainment sector, and youth-driven demand for casual mobile gaming are beginning to open niche prospects for operators.

Regional growth drivers include increased smartphone adoption, government-led digital economy initiatives, and the rising popularity of social gaming formats that comply with regional restrictions. In Africa, expanding fintech ecosystems and improved connectivity are gradually enabling the entry of freemium and mobile-friendly bingo applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Online Bingo Games Market

- 888 Holdings PLC

- Flutter Entertainment PLC

- Entain (GVC Holdings)

- Kindred Group PLC

- Betsson AB

- Gamesys Group

- The Rank Group PLC

- NetEnt AB

- Playtech PLC

- Microgaming Software Systems Ltd.

- LeoVegas AB

- Bet365 Group Ltd.

- Tombola Ltd.

- BabyBingo Ltd.

- Red Tiger Gaming Ltd.

Recent Developments

- March 2025: 888 Holdings launched a new AI-driven player personalization system across its bingo platforms to enhance retention and responsible gaming compliance.

- February 2025: Flutter Entertainment introduced live-hosted bingo tournaments integrated with sports betting apps, marking a cross-vertical expansion strategy.

- January 2025: Playtech announced a partnership with several European operators to develop VR-enabled bingo rooms, enhancing immersion and community engagement.