OLED Market Size

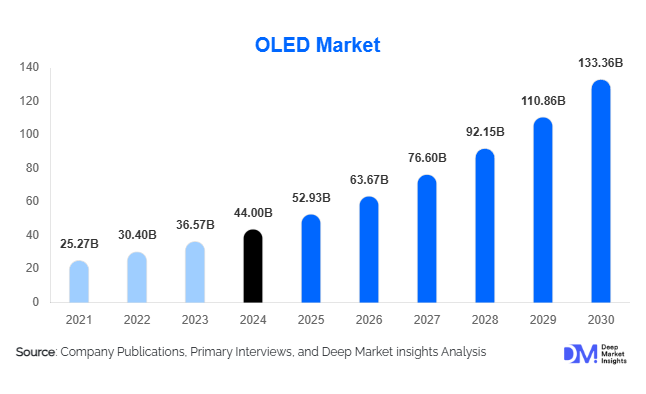

According to Deep Market Insights, the global OLED market size was valued at USD 44.0 billion in 2024 and is projected to grow from USD 52.932 billion in 2025 to reach USD 133.366 billion by 2030, expanding at a CAGR of 20.3% during the forecast period (2025–2030). The OLED market growth is primarily driven by rising consumer demand for premium displays in smartphones and TVs, increasing automotive integration of flexible OLEDs, and technological advancements in panel manufacturing and material science.

Key Market Insights

- OLED displays dominate the market, accounting for over 70% of global revenues in 2024, with smartphones and tablets leading demand.

- AMOLED technology holds more than 75% market share, thanks to higher resolution, flexibility, and compatibility with premium devices.

- Asia-Pacific leads the market with a 40% share, driven by massive production bases in China and South Korea and strong domestic demand.

- Flexible and foldable OLED panels are the fastest-growing sub-segment, supported by consumer appetite for design innovation in premium devices.

- Automotive OLED adoption is accelerating, with EVs and digital cockpit trends driving growth in curved dashboards and ambient lighting.

- OLED lighting and transparent displays are emerging niches, expanding into architecture, retail, and automotive exterior applications.

What are the latest trends in the OLED market?

Flexible and Foldable OLEDs Driving Innovation

Flexible OLEDs are revolutionizing device design, enabling foldable smartphones, rollable TVs, and curved monitors. As yields improve and costs decline, these displays are penetrating mainstream consumer electronics. OEMs are increasingly using flexible OLEDs as a differentiator in flagship devices, appealing to consumers seeking novelty and premium aesthetics. Ultra-thin glass substrates and improved polyimide layers are ensuring durability, making foldable and rollable formats commercially viable.

Automotive Integration of OLED Displays and Lighting

The automotive industry is rapidly adopting OLED technology for infotainment systems, instrument clusters, and ambient lighting. EV manufacturers in particular are leveraging OLED’s flexibility and energy efficiency to create futuristic digital cockpits. Curved dashboards, transparent HUDs, and signature lighting elements enhance brand differentiation and user experience. Growing government support for EV adoption and digitalization in vehicles further accelerates this trend.

What are the key drivers in the OLED market?

Rising Consumer Preference for Premium Visuals

Consumers increasingly demand high-contrast, energy-efficient, and immersive displays in smartphones, TVs, and wearables. OLED’s ability to deliver deep blacks, vibrant colors, and wide viewing angles positions it as the premium choice in display technology.

Technological Advancements Reducing Costs

Continuous improvements in emitter materials, encapsulation methods, and deposition techniques are lowering manufacturing costs. Inkjet printing and maskless patterning are improving production yields, making OLED panels more affordable and widening adoption beyond high-end products.

Expanding Applications Beyond Consumer Electronics

Wearables, AR/VR headsets, automotive interiors, and architectural lighting are creating new revenue streams for OLED technology. These applications require lightweight, thin, and flexible panels, areas where OLED outperforms traditional LCD and LED solutions.

What are the restraints for the global OLED market?

High Manufacturing Costs and Material Challenges

OLED panel fabrication involves expensive substrates, complex encapsulation, and costly emitter materials, especially for blue pixels with shorter lifespans. These challenges increase production costs and limit mass adoption in budget segments.

Competition from Alternative Display Technologies

Mini-LED, micro-LED, and advanced QLED technologies are becoming strong alternatives, offering high brightness and durability at competitive costs. OLED manufacturers face pricing pressure and must invest heavily in innovation to maintain leadership.

What are the key opportunities in the OLED industry?

Flexible and Transparent Display Applications

Opportunities lie in expanding foldable smartphones, rollable TVs, and transparent displays for retail signage and automotive applications. Consumer appetite for design innovation and immersive experiences makes this a high-growth area.

Automotive and EV Integration

Digital cockpits, curved dashboards, and OLED-based ambient lighting in EVs represent a strong growth opportunity. Automakers are increasingly partnering with OLED manufacturers to deliver futuristic interiors and energy-efficient lighting solutions.

Localization of Manufacturing in Emerging Markets

Government initiatives such as "Make in India" and China’s "Made in China 2025" are promoting local display production. Establishing OLED fabs in emerging economies reduces import reliance, lowers costs, and addresses rising domestic demand.

Product Type Insights

OLED displays accounted for over 70% of market revenues in 2024, led by smartphones and tablets. OLED lighting, though smaller, is expected to grow rapidly in automotive interiors and architectural applications due to design flexibility and energy efficiency.

Technology Insights

AMOLED dominates the technology landscape with more than 75% share in 2024. Its superior resolution, flexibility, and scalability make it the preferred choice for smartphones, TVs, and automotive applications. PMOLED is limited to simple indicators and small wearables, while micro-OLED is gaining traction in AR/VR headsets.

Application Insights

Smartphones and tablets lead with a 50-55% share of the market in 2024. TV adoption continues to rise, particularly in premium segments, while automotive OLED applications are the fastest-growing due to EV trends. Wearables and AR/VR represent promising future growth areas.

| Application | Panel Type | End-use Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global OLED market with 40% share in 2024. China and South Korea lead manufacturing, while Japan and Taiwan contribute with technology and materials innovation. India is emerging as a demand hub for mid-tier smartphones with OLED displays.

North America

North America accounts for 25-30% of global revenues, led by the U.S. Demand is strong in premium consumer electronics, AR/VR devices, and automotive OLED adoption. The region is also a hub for OLED material R&D and intellectual property development.

Europe

Europe holds a 15-20% market share in 2024, with Germany, the U.K., and France as key demand centers. Automotive integration of OLED displays and lighting is a major growth driver, supported by the strong presence of premium automakers.

Latin America

Latin America holds 3-6% of the global market share, with Brazil leading demand. Adoption is gradually increasing for OLED TVs and smartphones, but affordability remains a constraint for mass-market penetration.

Middle East & Africa

MEA contributes 2-5% of global revenues, with the UAE, Saudi Arabia, and South Africa leading demand. OLED signage and premium consumer electronics are gaining traction, while infrastructure investments in urban development drive niche demand for transparent displays and OLED lighting.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the OLED Market

- Samsung Display

- LG Display

- BOE Technology Group

- China Star Optoelectronics Technology (CSOT)

- Japan Display Inc.

- Visionox

- AU Optronics

- Sony Corporation

- Universal Display Corporation

- eMagin Corporation

- Sharp Corporation

- Konica Minolta

- EverDisplay Optronics

- Innolux Corporation

- TCL Technology

Recent Developments

- In August 2024, Samsung Display expanded its foldable OLED production line to meet rising demand for premium smartphones and tablets.

- In June 2024, LG Display introduced next-generation automotive OLED panels optimized for EV dashboards and curved infotainment systems.

- In April 2024, BOE Technology announced mass production of OLED panels using advanced inkjet printing technology, aimed at reducing costs and improving yields.