Office Automation Market Size

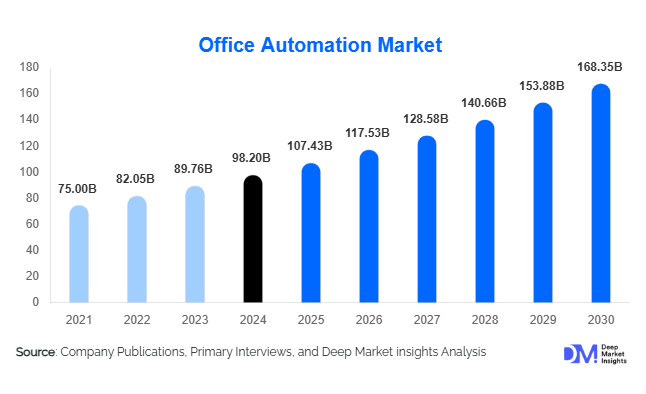

According to Deep Market Insights, the global office automation market size was valued at USD 98.20 billion in 2024 and is projected to grow from USD 107.43 billion in 2025 to reach USD 168.35 billion by 2030, expanding at a CAGR of 9.4% during the forecast period (2025–2030). The office automation market growth is driven by rapid enterprise digitalization, widespread adoption of cloud-based workplace solutions, increasing reliance on AI-enabled workflow automation, and the long-term shift toward hybrid and remote work environments across global industries.

Key Market Insights

- Software-led office automation dominates the market, driven by document management, workflow automation, and collaboration platforms.

- Cloud-based deployment accounts for over half of total adoption, reflecting enterprise demand for scalability, flexibility, and remote accessibility.

- Large enterprises remain the primary revenue contributors, supported by complex workflows and high-volume document processing needs.

- BFSI and government sectors collectively represent the largest end-use demand, driven by compliance-intensive operations.

- North America leads global demand, while Asia-Pacific is the fastest-growing regional market.

- AI, RPA, and SaaS pricing models are reshaping competitive dynamics and accelerating adoption among SMEs.

What are the latest trends in the office automation market?

AI-Powered Intelligent Automation

The office automation market is rapidly evolving from rule-based process automation toward AI-driven intelligent systems. Enterprises are increasingly deploying AI-powered document classification, natural language processing, intelligent chatbots, and predictive workflow optimization tools. These technologies enable automated decision-making, reduce manual intervention, and improve operational accuracy. Generative AI is also being embedded into office productivity suites to automate content creation, summarization, and enterprise knowledge management, significantly enhancing employee efficiency.

Cloud-First and SaaS Adoption

Cloud-based office automation platforms are becoming the preferred deployment model due to lower upfront costs, faster implementation, and ease of scalability. SaaS-based office suites, collaboration tools, and cloud document management systems are witnessing strong adoption among SMEs and mid-sized enterprises. Subscription-based pricing and continuous software updates are further accelerating cloud migration, while hybrid deployment models are helping large enterprises transition from legacy systems.

What are the key drivers in the office automation market?

Enterprise Digital Transformation Initiatives

Organizations across industries are prioritizing digital transformation to improve productivity, reduce operational costs, and enhance workforce collaboration. Office automation solutions streamline administrative workflows, eliminate paper-based processes, and enable real-time information sharing, making them a core component of digital workplace strategies.

Growth of Remote and Hybrid Work Models

The sustained adoption of remote and hybrid work has increased demand for cloud collaboration platforms, automated document workflows, and secure digital communication tools. Office automation enables seamless operations across geographically dispersed teams, supporting long-term changes in workforce structure.

Cost Optimization and Process Efficiency

Automation reduces dependency on manual labor, minimizes errors, and shortens processing cycles. Enterprises adopting workflow automation and RPA report measurable reductions in administrative costs and improved compliance, driving continued investment in office automation technologies.

What are the restraints for the global market?

Data Security and Compliance Concerns

Handling sensitive enterprise data through office automation platforms raises concerns related to cybersecurity, data privacy, and regulatory compliance. Industries such as BFSI and healthcare often face longer adoption cycles due to stringent regulatory requirements.

Integration Challenges with Legacy Systems

Many organizations still rely on legacy IT infrastructure, making integration with modern automation platforms complex and costly. Customization requirements and implementation delays can slow down adoption, particularly among large enterprises.

What are the key opportunities in the office automation industry?

Government-Led Digitalization Programs

Governments worldwide are accelerating paperless governance, e-government platforms, and digital public service delivery. Large-scale automation of administrative workflows, records management, and citizen engagement systems presents significant long-term opportunities for office automation vendors.

SME Automation in Emerging Economies

Rapid growth of SMEs in Asia-Pacific, Latin America, and the Middle East is creating strong demand for affordable, cloud-based office automation tools. Vendors offering modular, subscription-based solutions tailored to SMEs can capture high-growth opportunities and recurring revenues.

Product Type Insights

Office software solutions dominate the market, accounting for approximately 38% of the 2024 market size. Document management systems, workflow automation software, and collaboration platforms lead adoption due to their direct impact on productivity and compliance. Cloud-based office automation platforms follow closely, driven by SaaS adoption. Office hardware systems such as printers and multifunction devices continue to generate stable demand, particularly in regulated and document-heavy industries.

Deployment Mode Insights

Cloud-based deployment leads with nearly 57% market share in 2024, reflecting strong enterprise preference for scalable and remote-access solutions. On-premise deployments remain relevant in highly regulated industries, while hybrid models are gaining traction among large enterprises, balancing security and flexibility.

End-Use Industry Insights

BFSI represents the largest end-use segment with around 24% market share, driven by compliance, reporting, and document-intensive operations. Government and public sector adoption remains strong due to digital governance initiatives. Healthcare and IT & telecom are the fastest-growing segments, supported by digital records management and distributed workforce models.

Organization Size Insights

Large enterprises account for approximately 62% of total market revenue, driven by enterprise-wide automation initiatives. SMEs are the fastest-growing segment, benefiting from cloud-based solutions that reduce IT complexity and upfront investment.

| By Product Type | By Deployment Mode | By Organization Size | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global office automation market in 2024, led by the United States. Early technology adoption, high enterprise IT spending, and widespread cloud migration support regional dominance.

Europe

Europe accounts for nearly 22% market share, driven by regulatory compliance requirements and strong adoption of document management and workflow automation solutions across industries.

Asia-Pacific

Asia-Pacific represents around 29% of the market and is the fastest-growing region, expanding at a CAGR of over 12%. China and India lead demand due to enterprise expansion, SME digitization, and government digital initiatives.

Latin America

Latin America shows steady growth, supported by increasing cloud adoption among SMEs and public sector automation programs in Brazil and Mexico.

Middle East & Africa

The Middle East & Africa region is witnessing rising adoption driven by smart government initiatives, enterprise modernization, and growing IT investments in the UAE, Saudi Arabia, and South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Office Automation Market

- Microsoft

- IBM

- Canon

- Ricoh

- Xerox

- HP Inc.

- Konica Minolta

- SAP

- Oracle

- Adobe

- OpenText

- UiPath

- Fujitsu

- Toshiba Tec

- Panasonic

Recent Developments

- In 2024, leading vendors expanded AI-powered automation features within office productivity and document management platforms to support generative content creation and intelligent workflows.

- In 2024, multiple global enterprises accelerated migration from on-premise office systems to cloud-based SaaS automation platforms to support hybrid work models.

- In early 2025, increased M&A activity was observed among automation software providers focusing on RPA, AI analytics, and cloud collaboration capabilities.