OBD2 Scanner Market Size

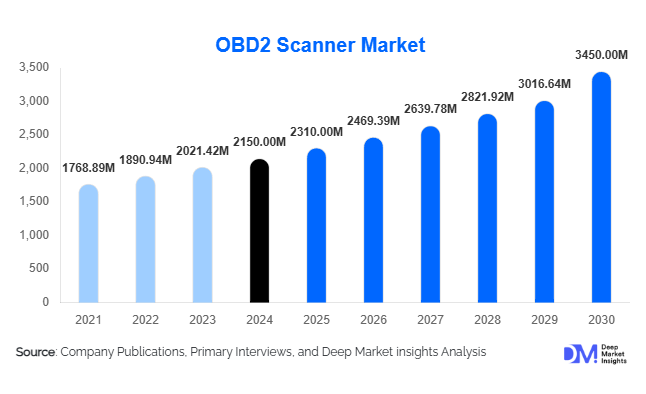

According to Deep Market Insights, the global OBD2 scanner market size was valued at USD 560 million in 2023 and is projected to grow from USD 599.20 million in 2024 to reach USD 840.41 million by 2030, expanding at a CAGR of 6.9% during the forecast period (2024–2030). Market growth is primarily driven by rising vehicle electrification, increasing demand for vehicle diagnostics, and regulatory requirements for emission control and safety compliance.

Key Market Insights

- Adoption of advanced automotive diagnostics is accelerating, with OBD2 scanners increasingly integrated into professional repair shops and consumer-level devices.

- Wireless and Bluetooth-enabled OBD2 scanners are gaining traction, driven by smartphone integration and ease of use for consumers.

- Asia-Pacific dominates the OBD2 scanner market, fueled by growing vehicle sales, stricter emission norms, and rising automotive aftermarket demand.

- North America remains a mature market, with strong penetration of OBD2 devices due to established emission control policies.

- Connected car technologies and IoT integration are reshaping OBD2 scanners into smart diagnostic platforms that enable real-time monitoring and predictive maintenance.

- DIY car diagnostics are gaining popularity among individual vehicle owners, supporting growth in portable, user-friendly OBD2 scanners.

What are the latest trends in the OBD2 scanner market?

Shift Toward Smartphone-Connected Devices

Consumer preference is shifting toward Bluetooth and Wi-Fi-enabled OBD2 scanners that connect seamlessly with mobile apps. These solutions allow users to monitor real-time vehicle performance, clear error codes, and even access predictive analytics through user-friendly dashboards. App-based integration also enables subscription models for premium services, further expanding revenue streams for scanner manufacturers.

Integration with Telematics and Fleet Management

OBD2 scanners are increasingly integrated with telematics systems, particularly in fleet management. These devices provide real-time data on fuel consumption, driver behavior, and predictive maintenance needs, enhancing operational efficiency. Fleet operators are adopting connected OBD2 scanners to reduce downtime, improve compliance, and optimize vehicle utilization.

What are the key drivers in the OBD2 scanner market?

Stringent Emission and Safety Regulations

Governments worldwide are enforcing stricter vehicle emission and safety norms, driving the adoption of OBD2 scanners in both OEM and aftermarket applications. Compliance with OBD requirements has become mandatory in regions such as North America, Europe, and Asia-Pacific, boosting the demand for advanced diagnostics solutions.

Growing Demand for Used Vehicle Diagnostics

The expansion of the used car market is fueling demand for OBD2 scanners, as buyers and dealerships increasingly rely on diagnostic tools to assess vehicle health before resale. This trend is especially strong in emerging markets, where affordability drives demand for second-hand vehicles.

What are the restraints for the global market?

Compatibility and Standardization Issues

Despite OBD2 being a global standard, variations across regions (such as EOBD in Europe and JOBD in Japan) create compatibility issues for scanner manufacturers. Limited interoperability with older or non-standard vehicles continues to be a challenge in adoption.

Data Privacy and Cybersecurity Concerns

As OBD2 scanners integrate with smartphones and cloud platforms, concerns over data security and unauthorized access are growing. Protecting sensitive vehicle and user data remains a restraint that manufacturers must address through robust cybersecurity measures.

What are the key opportunities in the OBD2 scanner industry?

AI-Enabled Predictive Diagnostics

The integration of artificial intelligence and machine learning in OBD2 scanners presents significant opportunities. Predictive diagnostics powered by AI can help identify potential issues before failure, reducing maintenance costs and enhancing customer value.

Rising Adoption of EV Diagnostics

With the rapid growth of electric vehicles (EVs), demand for specialized OBD2 scanners that can diagnose battery performance, charging efficiency, and EV-specific systems is increasing. Companies offering EV-compatible diagnostic tools are well-positioned to capture this emerging market.

Product Type Insights

Handheld OBD2 scanners dominate the professional market, offering advanced features for repair shops and technicians. Wireless/Bluetooth scanners are rapidly growing among consumers due to affordability and smartphone integration. PC-based scanners cater to specialized applications, particularly in fleet diagnostics and research.

Application Insights

Automotive repair shops represent the largest application segment, driven by rising demand for efficient and accurate diagnostics. DIY consumers are the fastest-growing segment, fueled by rising interest in personal vehicle maintenance. Fleet operators are adopting OBD2 scanners for predictive maintenance and cost optimization.

Distribution Channel Insights

Online sales channels dominate, with platforms such as Amazon and OEM e-commerce sites offering easy access to consumers. Offline retail and automotive workshops remain critical for professional-grade devices and value-added services. Subscription-based diagnostic platforms are emerging as a new distribution channel.

| Type | Functionality | End User |

|---|---|---|

|

|

|

Regional Insights

North America

North America is a mature market due to well-established OBD regulations. High adoption among both professionals and DIY consumers continues to support steady growth. The region also leads in telematics and fleet management integration.

Europe

Europe remains a strong market, driven by stringent EU emission regulations and the popularity of eco-conscious automotive technologies. The region is also adopting OBD2 scanners for EV diagnostics as electric vehicle penetration grows.

Asia-Pacific

Asia-Pacific dominates the global market, supported by massive vehicle production, rising adoption of aftermarket solutions, and government-led emission regulations. China, Japan, and India are key contributors, with increasing consumer adoption of Bluetooth scanners.

Latin America

Latin America is experiencing gradual growth, driven by the expanding used car market and regulatory push for emission control in Brazil and Mexico. Affordability and DIY diagnostics are driving adoption in this region.

Middle East & Africa

The market in the Middle East & Africa is at a nascent stage, with growth driven by urbanization and increasing vehicle imports. Rising demand for aftermarket services and regulatory alignment with global standards are expected to support long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the OBD2 Scanner Market

- Autel

- Launch Tech

- Bosch Automotive Service Solutions

- Innova Electronics

- Foxwell

- BlueDriver

- Snap-on Incorporated

Recent Developments

- In June 2024, Autel launched a new AI-powered OBD2 scanner with predictive maintenance features tailored for EVs.

- In March 2024, Bosch introduced a cloud-connected OBD2 diagnostic platform for fleet operators, integrating telematics and remote monitoring.

- In January 2024, Launch Tech expanded its Bluetooth-enabled consumer OBD2 scanner portfolio with enhanced smartphone app features.