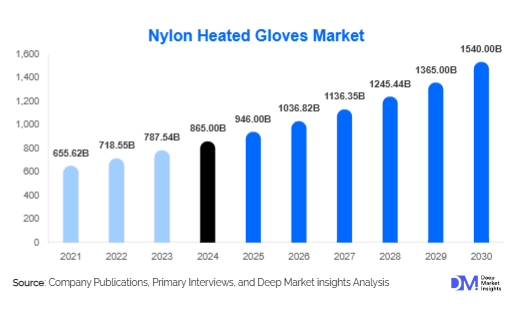

Nylon Heated Gloves Market Size

According to Deep Market Insights, the global nylon heated gloves market size was valued at USD 865 million in 2024 and is projected to grow to USD 946 million in 2025 and reach USD 1,540 million by 2030, expanding at a CAGR of 9.6% during the forecast period (2025-2030). The market growth is primarily driven by rising outdoor sports participation, stringent occupational safety regulations in cold climates, and increasing adoption of heated wearables in healthcare and military applications.

Key Market Insights

- Battery-powered heated gloves dominate the market, accounting for over 60% share in 2024 due to portability and ease of use.

- Outdoor sports & recreation remain the leading application, representing nearly 40% of the global market, fueled by ski tourism and winter adventure activities.

- North America leads the global market with a 35% share in 2024, driven by high winter sports participation and strict workplace safety norms.

- Asia-Pacific is the fastest-growing region, expanding at 11% CAGR, supported by winter tourism in China, Japan, and South Korea.

- Mid-range gloves ($50-$150) capture 60% share, balancing affordability with advanced features such as adjustable heating levels.

- Technological innovations, including smart sensors, Bluetooth connectivity, and longer battery life, are reshaping consumer preferences and product positioning.

What are the latest trends in the nylon heated gloves market?

Healthcare Applications on the Rise

The medical and healthcare segment is witnessing rapid growth as nylon heated gloves are increasingly recommended for conditions such as arthritis, Raynaud’s disease, and poor circulation. With more than 430 million arthritis patients globally expected by 2030, gloves designed with therapeutic heating technology are carving out a niche within medical wearables. This trend is encouraging manufacturers to seek regulatory certifications and expand product lines for healthcare-focused users.

Smart and Connected Heated Gloves

Integration of smart technology is transforming the product landscape. Gloves with Bluetooth-enabled temperature controls, app-based monitoring, and IoT connectivity are appealing to tech-savvy consumers. These innovations also have applications in industrial and defense sectors, where precise heat regulation and performance monitoring are critical. Smart heated gloves are positioned as premium products, offering opportunities for higher profit margins.

What are the key drivers in the nylon heated gloves market?

Outdoor Sports Participation

The popularity of skiing, snowboarding, and winter trekking is fueling strong demand for nylon heated gloves. Europe and North America recorded a 20% year-on-year increase in winter sports participation, making gloves essential for performance, comfort, and injury prevention in sub-zero conditions.

Workplace Safety Regulations

Industries such as construction, logistics, and mining in cold climates are required to provide heated PPE to workers. Regulations from OSHA in the U.S. and EU workplace directives are driving large-scale procurement of nylon heated gloves as part of industrial safety equipment.

Advancements in Battery & Heating Technology

The introduction of lightweight lithium-ion batteries offering 6-8 hours of heating, coupled with flexible heating panels, has boosted user adoption. Improved product reliability and portability have expanded usage from professional to mainstream consumer markets.

What are the restraints for the global market?

High Product Costs

Premium nylon heated gloves equipped with advanced sensors and long-lasting batteries often exceed $150, creating affordability barriers in price-sensitive markets. This limits penetration among low- and middle-income consumers, especially in developing regions.

Battery Safety Concerns

Challenges such as overheating risks, reduced lifespan, and inconsistent charging performance can deter buyers. Safety certification requirements add to manufacturing costs, further slowing down mass adoption in some markets.

What are the key opportunities in the nylon heated gloves industry?

Medical & Healthcare Market Expansion

Healthcare-focused heated gloves are an emerging opportunity, particularly for patients requiring improved blood circulation or pain relief. With the rising prevalence of arthritis and musculoskeletal conditions, this application is expected to double in market value by 2030, offering growth avenues for manufacturers that can meet regulatory and therapeutic standards.

Technology-Integrated Wearables

IoT-enabled gloves with temperature monitoring, mobile app controls, and smart sensors are set to redefine the category. These innovations not only improve convenience but also enable data-driven usage, catering to both individual consumers and industries requiring performance tracking.

Emerging Markets in APAC

China, Japan, and South Korea are driving rapid adoption thanks to growing winter sports culture, favorable government initiatives, and expanding e-commerce platforms. With APAC projected to be the fastest-growing region, brands entering these markets early stand to secure long-term competitive advantage.

Product Type Insights

Battery-powered heated gloves dominate the product landscape with a 62% share in 2024. These gloves are favored for portability and efficiency across sports, personal use, and workplace safety. USB-rechargeable and hybrid-powered gloves are gaining momentum but remain secondary segments. Future demand will favor multi-level and smart sensor-controlled gloves as consumers shift toward higher customization and control.

Application Insights

Outdoor sports & recreation lead applications with 40% market share in 2024, supported by ski resorts and winter adventure tourism in Europe, North America, and Japan. Industrial and occupational safety is the fastest-growing application, expanding at over 10% CAGR, as stricter worker protection standards drive demand. Healthcare and military applications, though smaller today, are expected to witness the highest long-term adoption rates due to therapeutic and defense-specific requirements.

Distribution Channel Insights

Online channels account for 52% of sales in 2024, fueled by the rapid expansion of e-commerce platforms and direct-to-consumer strategies. Offline retail, including specialty sports stores and large retailers, remains vital for premium purchases where customers prefer product testing before buying. Digital platforms, influencer-led marketing, and brand-owned websites are expected to further accelerate online dominance.

End-User Insights

Men accounted for 55% of the market in 2024, reflecting higher participation in outdoor sports and industrial occupations. Women’s demand is growing steadily, particularly in healthcare and recreational use. Unisex designs are also expanding as brands target universal comfort and broader inclusivity. Couples and family consumers are emerging as new segments in winter recreation markets, particularly in Europe and North America.

| By Product Type | By Temperature Control | By Application | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America led the global market with a 35% share in 2024. The U.S. remains the largest consumer, driven by widespread winter sports participation and strict worker safety compliance. Canada follows with significant demand in commuter wear and defense procurement.

Europe

Europe accounted for 32% of the global share in 2024, with Germany, France, Switzerland, and Nordic countries as key contributors. Strong winter tourism and ski resort infrastructure support steady demand, while workplace PPE adoption is rising in industrial hubs.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a 11% CAGR. China leads with increasing winter sports enthusiasm post-Beijing Olympics, while Japan and South Korea see consistent growth across sports and healthcare. India and Southeast Asia, though smaller, present opportunities via e-commerce-driven exports.

Latin America

Latin America remains a niche market, with Chile and Argentina showing demand for winter sports gear. Brazil contributes through exports and growing interest in recreational travel to colder regions abroad.

Middle East & Africa

Demand in MEA is limited, though high-altitude regions in Turkey, Iran, and South Africa see adoption for military and outdoor use. The Middle East shows minor growth, with affluent consumers purchasing heated gloves for travel abroad.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nylon Heated Gloves Market

- Savior Heat

- Gerbing Heated Clothing

- Therm-ic

- Volt Resistance

- ActionHeat

- Outdoor Research

- Snow Deer

- Seirus Innovation

- Hestra

- Ravean

- Milwaukee Tool

- Zanier Gloves

- Black Diamond Equipment

- Savior Glove Co., Ltd.

- Mobile Warming

Recent Developments

- In June 2025, Therm-ic launched a new smart sensor-controlled heated glove series with app-based battery management.

- In May 2025, Gerbing announced the expansion of its North American distribution network, enhancing availability through large retail partners.

- In April 2025, Savior Heat introduced a medical-grade heated glove line targeting arthritis therapy patients.