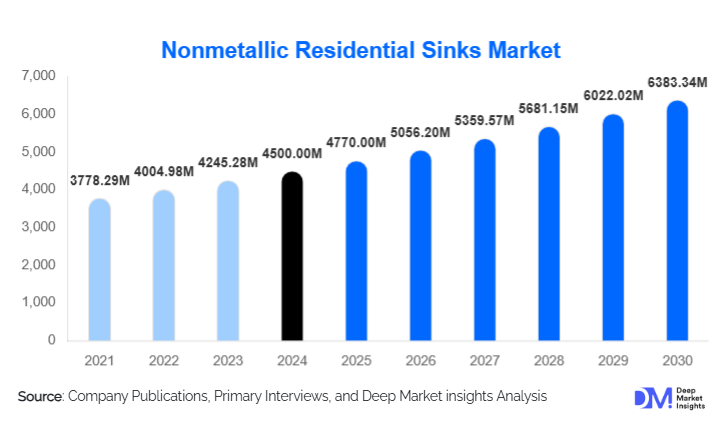

Nonmetallic Residential Sinks Market Size

According to Deep Market Insights, the global Nonmetallic Residential Sinks Market was valued at USD 4,500 million in 2024 and is projected to grow from USD 4,770.00 million in 2025 to reach USD 6,383.34 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). Growth in the market is being driven by rising residential construction, increased remodeling activities, and a growing consumer shift toward premium, aesthetic, and sustainable nonmetallic materials such as composite granite, ceramic, and acrylic. The market is also benefiting from e-commerce expansion, digital visualization tools, and growing design-conscious homeownership across both mature and emerging economies.

Key Market Insights

- Composite granite and quartz sinks lead the market, accounting for nearly 43% of global demand due to superior durability and premium design appeal.

- Kitchen applications dominate with over 60% market share, supported by strong renovation and remodeling activity in developed markets.

- Undermount installations are the fastest-growing mounting type, driven by demand for sleek aesthetics and seamless integration with countertops.

- North America holds approximately 35% of the global market share, while Asia-Pacific is the fastest-growing region, fueled by rapid urbanization and rising disposable incomes.

- Online retail channels are expanding rapidly, accounting for roughly one-quarter of total sales in 2024 and gaining traction through customization and direct-to-consumer delivery models.

- Eco-friendly materials and recycled composites are increasingly being adopted, aligning with global sustainability trends in residential interiors.

Market Trends in the Nonmetallic Residential Sinks Market

Growing Preference for Composite Materials

Homeowners are increasingly favoring composite granite and quartz sinks because of their scratch resistance, thermal stability, and premium finish options. These materials offer long-term durability with a natural stone appearance, complementing modern and minimalist kitchen designs. Advancements in resin technologies are enabling deeper color customization and reduced porosity, enhancing hygiene and stain resistance. Manufacturers are also innovating with recycled aggregates and bio-based resins, aligning with sustainable home construction and green certification standards.

Rise of Smart and Customizable Sink Designs

Customization is becoming a key differentiator. Consumers now prefer non-metallic sinks with integrated accessories such as drying racks, chopping boards, and sensor-enabled faucets. The integration of smart technologies, including temperature regulation, touchless functionality, and antimicrobial coatings, is redefining premium segments. 3D visualization and AR tools offered by online platforms enable homeowners to preview sinks within virtual kitchen layouts, driving digital sales and reducing showroom dependency.

Market Drivers

Surge in Kitchen and Bathroom Renovations

The global remodeling boom, especially in North America and Europe, is a major demand driver. Aging housing stock, coupled with rising disposable incomes, is prompting homeowners to upgrade fixtures for both aesthetic and functional improvements. Nonmetallic sinks — with their noise-dampening, heat-resistant, and easy-maintenance properties — are increasingly replacing stainless steel variants in renovation projects.

Design Versatility and Material Innovation

Nonmetallic materials allow for a broader range of designs, shapes, and finishes compared to metals. The ability to integrate seamlessly with countertops or match specific décor palettes has boosted their adoption. Ongoing innovations in engineered composites and high-performance ceramics are expanding product lifespans and reducing maintenance requirements, further fueling market penetration.

E-Commerce and Digital Channel Expansion

The rapid digitalization of the home improvement sector has made it easier for consumers to access global designs. Online platforms now account for around 25% of sales, offering enhanced visualization tools, easy customization, and faster delivery. Manufacturers are leveraging online partnerships and direct-to-consumer models to expand reach, reduce costs, and maintain stronger brand visibility.

Market Restraints

Competition from Metal Sinks

Stainless steel sinks continue to dominate due to their affordability, durability, and established trust among builders. Despite growing consumer interest in nonmetallic alternatives, widespread adoption in mass-market housing remains limited due to cost differentials and familiarity with metal fixtures.

High Raw Material and Manufacturing Costs

Composite and resin-based sink production requires specialized molds and high-quality raw materials, increasing unit costs. Volatility in resin and pigment prices adds margin pressure. Smaller manufacturers face challenges scaling production economically while maintaining quality consistency, limiting competition in lower price brackets.

Key Opportunities in the Nonmetallic Residential Sinks Market

Expanding Middle-Class Housing in Emerging Markets

Rapid urbanization in Asia-Pacific, Latin America, and Africa is spurring demand for residential sinks as housing construction accelerates. Affordable yet premium-looking composite sinks are gaining traction among middle-class consumers seeking value upgrades. Localized production and distribution partnerships present strong opportunities for new entrants.

Premiumization and Aesthetic Differentiation

In developed markets, homeowners are emphasizing design aesthetics and material quality. Manufacturers that offer customizable colors, matte finishes, and integrated counter solutions are capturing high-margin segments. Premium nonmetallic sinks are being marketed as lifestyle enhancements, rather than mere utility products, opening new branding opportunities.

Sustainability and Circular Design

The shift toward eco-friendly construction materials offers significant potential. Nonmetallic sinks incorporating recycled composites, low-VOC resins, or bio-based polymers are increasingly favored in green-certified homes. Manufacturers that invest in carbon-neutral processes and life-cycle transparency are likely to gain a competitive edge with environmentally conscious buyers.

Product Type Insights

Composite granite and quartz sinks dominate the market with around 43% share, offering superior durability, heat resistance, and aesthetic appeal. Ceramic and fireclay variants remain popular in Europe and Asia for bathrooms due to their glossy finishes and affordability. Acrylic and solid-surface sinks are gaining attention in modern kitchens, offering flexibility for integrated countertop-sink designs. Innovations in engineered composites with lighter weight and higher impact resistance are expected to further increase adoption in both new builds and remodeling projects.

Installation Type Insights

Undermount sinks lead global demand, representing roughly 30% of total installations. The design trend toward seamless kitchen countertops, particularly in quartz and solid surfaces, drives this segment’s growth. Top-mount (drop-in) sinks remain common in budget and renovation markets due to easier installation, while farmhouse (apron-front) styles are expanding within premium country-style kitchens. Integrated sink-counter units are emerging as a niche innovation, particularly in luxury residential projects.

Application Insights

Kitchen sinks dominate the application segment with about 60% of the total market value. The combination of functional importance and design visibility makes kitchens the primary focus of sink replacement. Bathroom and utility sinks form secondary segments, while outdoor kitchen installations represent an emerging trend, particularly in North American and European luxury housing. The growing preference for multifunctional sinks combining washing, rinsing, and preparation is enhancing kitchen-based product demand.

Distribution Channel Insights

Online retail and e-commerce channels are rapidly gaining market share, estimated at 25% in 2024. Digital marketplaces allow homeowners to compare finishes, configurations, and brands more conveniently. Offline retail through specialty showrooms and home improvement stores continues to dominate overall sales, particularly in regions where tactile evaluation is preferred. B2B sales through builders, architects, and contractors remain vital, especially for large-scale housing projects.

| By Material Type | By Installation Type | By Basin Configuration | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 35% of the global market in 2024, valued at around USD 1.57 billion. The U.S. leads the region with strong remodeling activity, premium kitchen upgrades, and widespread adoption of composite sinks. Canada contributes moderately, driven by sustainable housing initiatives and a growing urban housing stock.

Europe

Europe holds a 20–25% share, supported by mature housing markets and environmental awareness. Germany, the U.K., and France are major consumers, emphasizing ceramic and composite designs aligned with sustainable and minimalistic aesthetics. European consumers value quality certification and recyclability, encouraging the adoption of eco-friendly non-metallic sinks.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at a CAGR above 8% during 2025–2030. Rising disposable incomes, booming housing construction in China and India, and growing middle-class demand for stylish interiors drive growth. Manufacturers are expanding local production to serve regional preferences in color, size, and design.

Latin America

Latin America accounts for 5–10% of the global market share, led by Brazil and Mexico. Increased urban housing projects and growing consumer exposure to premium global brands are expanding the adoption of composite and ceramic sinks.

Middle East & Africa

The Middle East & Africa region holds a modest share (5–10%) but is witnessing steady demand growth in high-end residential projects. The UAE and Saudi Arabia are investing heavily in premium real estate and luxury housing, driving demand for stylish, heat-resistant nonmetallic sink solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nonmetallic Residential Sinks Market

- Kohler Co.

- Franke Group

- BLANCO GmbH

- LIXIL Group Corporation

- TOTO Ltd.

- Duravit AG

- Elkay Manufacturing Company

- ROCA Sanitario S.A.

- Astracast

- TEKA Industrial S.A.

- OULIN Co., Ltd.

- Alveus s.r.o.

- Primy Corporation

- Roca Group

- Teka Group

Recent Developments

- In June 2025, BLANCO launched its SILGRANIT Infinity range, featuring ultra-matte finishes made from recycled composite materials to support eco-friendly home design.

- In April 2025, Kohler announced a new digital customization tool allowing customers to design composite sinks online with real-time 3D visualization and integrated color matching.

- In March 2025, LIXIL Group expanded its non-metallic sink manufacturing facility in India under the “Make in India” initiative to meet growing regional demand and reduce import dependency.

- In January 2025, Franke Group introduced antimicrobial coating technology for its composite sinks, enhancing hygiene and safety in residential applications.