Night Skin Care Products Market Size

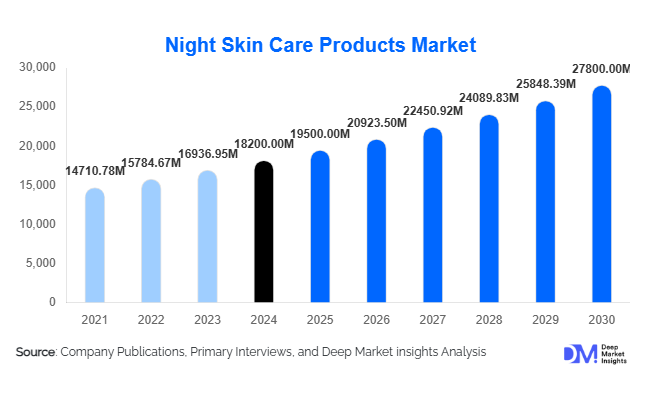

According to Deep Market Insights, the global night skin care products market size was valued at USD 18,200 million in 2024 and is projected to grow from USD 19,500 million in 2025 to reach USD 27,800 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The night skin care products market growth is primarily driven by increasing consumer awareness about skin health, rising demand for anti-aging and hydration solutions, and the rapid expansion of premium and e-commerce-focused product offerings worldwide.

Key Market Insights

- Consumer preference is shifting toward preventive and anti-aging night skin care products, with increasing adoption of serums, creams, and masks targeting hydration, regeneration, and pigmentation control.

- Premium and luxury night skin care products are experiencing high demand, especially in North America and Europe, due to rising disposable incomes and willingness to pay for scientifically advanced formulations.

- Online retail channels dominate distribution, leveraging e-commerce platforms, social media influence, and AI-based skin diagnostics to reach a global consumer base.

- Asia-Pacific is the fastest-growing regional market, driven by increasing beauty awareness, urbanization, and rising middle-class spending in countries such as China, India, and Japan.

- Technological innovation in product formulation, including hyaluronic acid, retinol, peptides, and natural extracts, is reshaping product offerings and consumer expectations.

- Focus on sustainable and organic formulations is increasing, with consumers demanding eco-friendly ingredients, cruelty-free testing, and recyclable packaging.

Latest Market Trends

Innovation in Anti-Aging and Regenerative Formulations

Night skin care products are evolving to include advanced anti-aging and regenerative formulations. Products enriched with retinol, peptides, and hyaluronic acid help reduce wrinkles, boost collagen synthesis, and improve skin elasticity overnight. Plant-based extracts and natural antioxidants are increasingly incorporated to address pigmentation, dark spots, and environmental damage. This trend is particularly popular among middle-aged consumers, while younger demographics are adopting preventive care products to maintain skin health. The growing integration of clinical research in product development also boosts consumer trust and willingness to pay premium prices.

Digital Integration and E-Commerce Expansion

Online platforms have become a crucial channel for night skin care products, allowing brands to provide personalized consultations, AI-driven recommendations, and virtual try-on tools. Social media campaigns and influencer marketing enhance visibility and brand engagement, particularly among millennials and Gen Z. Subscription models and membership-based programs are gaining traction, offering repeat customers curated product boxes and early access to new launches. E-commerce penetration is enabling global reach, allowing brands to target emerging markets with growing disposable income and digital connectivity.

Night Skin Care Products Market Drivers

Rising Consumer Awareness and Beauty Consciousness

Increasing knowledge about skin health and the benefits of nighttime repair routines is significantly driving demand. Consumers are focusing on anti-aging, hydration, and skin regeneration products, with many incorporating night creams, serums, and masks into daily routines. Awareness campaigns, social media education, and dermatologist endorsements are boosting adoption rates, particularly in urban areas and emerging markets.

Premiumization and Product Innovation

Technologically advanced formulations are fueling growth in the premium segment. High-performance serums, anti-aging creams, and regenerative masks are attracting consumers willing to pay a premium for scientifically backed benefits. Innovations such as slow-release moisturizers, skin repair peptides, and eco-certified ingredients are setting new benchmarks in product performance, expanding market share for premium and luxury products.

Expansion of Online and E-Commerce Channels

The surge in e-commerce adoption is a major growth driver, with online retail providing convenience, product variety, and access to expert advice. Virtual consultations, AI-driven skin assessments, and personalized recommendations are improving customer experience. Social media marketing, influencer collaborations, and live product demonstrations further enhance brand awareness and sales, particularly among younger demographics seeking innovative skincare solutions.

Market Restraints

High Cost of Premium Night Skin Care Products

Advanced night skin care formulations often come at premium prices, limiting adoption among price-sensitive consumers, especially in developing economies. High costs of active ingredients, sustainable packaging, and marketing also constrain widespread penetration. Additionally, seasonal price variations and currency fluctuations impact affordability, slowing market growth in certain regions.

Regulatory Compliance and Market Fragmentation

Stringent cosmetic regulations across different regions, including FDA compliance in the U.S. and EU Cosmetics Regulation, require rigorous testing and documentation. Compliance increases operational costs and delays product launches. Market fragmentation, with a mix of global brands, local players, and niche organic brands, adds complexity, making it challenging for new entrants to gain traction without significant investment.

Night Skin Care Products Market Opportunities

Growth of Organic and Sustainable Product Offerings

Consumer demand for organic, natural, and sustainable night skin care products is increasing rapidly. Brands incorporating eco-friendly packaging, cruelty-free certifications, and botanical ingredients can capture a loyal and high-value customer base. This opportunity allows companies to differentiate themselves in a competitive market while aligning with global sustainability trends and regulatory incentives promoting green products.

Emerging Markets and Urbanization in APAC and LATAM

Emerging economies such as China, India, Brazil, and Mexico present high-growth opportunities. Rising disposable income, urban lifestyles, and increasing awareness of beauty routines drive adoption. Expanding retail infrastructure, including e-commerce platforms, specialty stores, and premium salons, allows brands to tap into a growing urban consumer base. Strategic marketing and partnerships in these regions can accelerate penetration and revenue growth.

Technological Integration in Skincare Solutions

Integration of AI-driven diagnostics, personalized skincare solutions, and virtual consultations is transforming the market. Brands that adopt advanced technology can provide customized regimens, track efficacy, and improve customer satisfaction. The use of digital skin analysis, subscription boxes, and data-driven product recommendations is attracting tech-savvy consumers and expanding overall market potential.

Product Type Insights

Night creams dominate the market, holding 38% of the 2024 global share, driven by their hydration and anti-aging benefits. Night serums are gaining momentum due to concentrated formulations and fast-acting ingredients targeting specific skin concerns. Specialty treatments for acne, pigmentation, and sensitive skin are emerging as niche but high-growth products. Premium products within these categories are leading revenue generation due to high consumer trust and willingness to pay for scientifically validated benefits.

Application Insights

Anti-aging products account for 35% of the global market in 2024, led by demand from aging populations and preventive skincare routines. Hydration and repair-focused products follow closely, while skin brightening and acne treatments are experiencing rising adoption among younger demographics. Increasing awareness of preventive skincare and multi-benefit formulations is driving growth across all applications.

Distribution Channel Insights

Online retail dominates with 30% of 2024 revenue, supported by e-commerce penetration, virtual consultations, and AI-driven personalized recommendations. Specialty stores and pharmacies remain key for premium and dermatologist-endorsed products. Supermarkets and hypermarkets capture a significant share of mass-market products, while spas and beauty salons are increasingly offering exclusive night skincare treatments as add-on services. Direct-to-consumer subscription models are emerging as a new channel to increase retention and repeat purchases.

End-Use Insights

The primary end-use segment is personal skincare, accounting for over 60% of demand. Professional spa and salon applications are growing rapidly due to specialized night treatments. Export-driven demand is increasing in APAC and Europe, supported by global e-commerce and rising disposable income. Emerging applications include skin sensitivity, pigmentation correction, and overnight repair treatments, broadening the end-use landscape and driving market expansion.

| By Product Type | By Application | By Distribution Channel | By Skin Type | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 28% of the global market in 2024, led by the U.S. High disposable income, early adoption of innovative skincare, and widespread online retail penetration support strong demand. Anti-aging and premium night creams dominate consumption, with growing interest in organic and sustainable products.

Europe

Europe accounts for 25% of the 2024 market share. Germany, France, and the U.K. are leading consumers, driven by a strong culture of premium skincare and environmentally conscious purchasing behavior. Growth is fueled by rising urban populations, e-commerce adoption, and the popularity of multi-benefit products targeting anti-aging, hydration, and repair.

Asia-Pacific

APAC is the fastest-growing region (~9% CAGR), led by China, India, Japan, and Australia. Increasing urbanization, rising disposable incomes, and growing beauty awareness are driving adoption. Chinese consumers favor luxury and group-oriented products, while India is a high-growth market for mid-range night skin care targeting hydration and anti-aging.

Latin America

Brazil and Mexico are the leading markets, supported by urban middle-class expansion and increasing beauty consciousness. Demand is growing for both mid-range and premium products, though overall market share remains smaller (~10%).

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is a high-income market for premium and luxury night skin care products. Africa shows steady growth in urban hubs, with demand concentrated in specialty products and e-commerce-driven channels. Rising awareness of anti-aging and premium formulations supports long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Night Skin Care Products Market

- L’Oréal

- Estée Lauder

- Shiseido

- Procter & Gamble

- Unilever

- Beiersdorf

- Johnson & Johnson

- Amorepacific

- Kao Corporation

- Coty Inc.

- Avon Products

- Natura & Co

- GlaxoSmithKline

- LG Household & Health Care

- Revlon

Recent Developments

- In June 2025, Estée Lauder launched a new line of anti-aging night serums incorporating plant-based peptides and sustainable packaging to target premium consumers in North America and Europe.

- In March 2025, L’Oréal introduced AI-driven personalized night skin care kits through its online platform, expanding digital engagement in APAC markets.

- In January 2025, Shiseido unveiled an overnight hydrating mask line in India and China, catering to rising demand in emerging urban centers and leveraging influencer marketing campaigns.