Nasal Aspirators Market Size

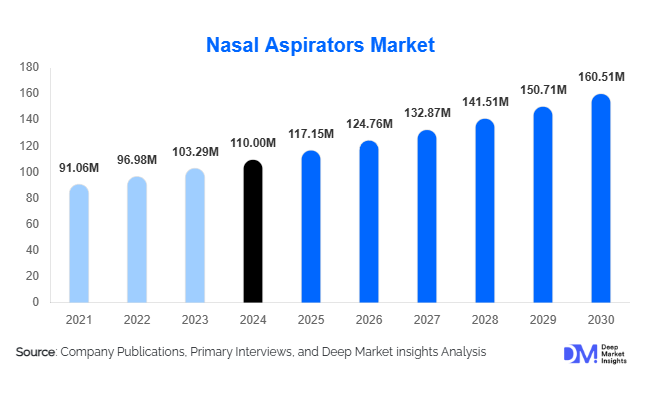

According to Deep Market Insights, the global nasal aspirators market size was valued at USD 110 million in 2024 and is projected to grow from USD 117.15 million in 2025 to reach USD 160.51 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing awareness of infant nasal hygiene, rising incidence of respiratory conditions, and the adoption of technologically advanced home-care devices that simplify nasal congestion management for infants, toddlers, and adults alike.

Key Market Insights

- Electric and battery-operated nasal aspirators are gaining traction, offering ease of use, ergonomic designs, and hygienic features that attract modern parents and home-care users.

- Home-care usage dominates, with parents and caregivers increasingly preferring convenient at-home solutions over frequent clinical visits for minor nasal congestion management.

- North America leads the market in 2024, driven by higher disposable incomes, strong e-commerce penetration, and greater awareness of infant and adult nasal health.

- Asia-Pacific is the fastest-growing region, fueled by rising birth rates, growing middle-class households, and expanding online and offline retail infrastructure.

- Technological innovation, including smart suction controls, IoT-enabled monitoring, and hygienic filters, is transforming product offerings and driving premium segment adoption.

- Emerging markets present opportunities for low-cost manual and electric aspirators, allowing manufacturers to expand geographically and capture untapped demand.

Latest Market Trends

Shift Toward Electric and Smart Devices

Manufacturers are increasingly focusing on electric and battery-operated nasal aspirators, equipped with adjustable suction, soft silicone tips, and hygienic filters. IoT-enabled devices allow caregivers to monitor usage and cleaning schedules via mobile applications. These advancements appeal to tech-savvy parents, enhancing user convenience and reducing infection risks. Smart devices with portable charging options are also gaining popularity among frequent travelers and daycare facilities, creating new niche demand.

Growing Home-Care Adoption

There is a clear trend toward home-based care for infants and toddlers, driven by parental preference for convenience, cost savings, and reduced hospital visits. Subscription models for replacement tips and filters are emerging, enabling continuous usage and engagement with brands. Telehealth and pediatric online platforms are further promoting home-care device adoption, allowing parents to receive guidance while using nasal aspirators effectively at home.

Nasal Aspirators Market Drivers

Increasing Awareness of Infant Nasal Hygiene

Parents are becoming more informed about infant respiratory health, recognizing the importance of timely mucus removal to prevent breathing difficulties and infections. Educational campaigns by pediatricians and e-commerce platforms are boosting awareness, which in turn drives sales of safe and easy-to-use nasal aspirators.

Rising Incidence of Respiratory Conditions

Factors such as seasonal allergies, urban pollution, and frequent viral infections contribute to nasal congestion in infants, children, and adults. This recurring need for relief increases device adoption and repeat purchases, particularly for electric and hygienic aspirators designed for home use.

Technological Innovation and Product Differentiation

Modern aspirators now feature advanced suction controls, ergonomic designs, hygienic filters, and smart connectivity, enabling caregivers to monitor usage and cleaning. These innovations allow premium pricing and differentiate brands in a competitive market, boosting overall adoption.

Market Restraints

Price Sensitivity in Emerging Markets

In price-sensitive regions, consumers often prefer low-cost manual bulb aspirators or traditional remedies, limiting the adoption of premium electric or smart devices. This restricts penetration and slows growth in these areas.

Hygiene and Usability Concerns

Cleaning and maintaining aspirators can be cumbersome, especially in devices with multiple components. Perceived hygiene risks or difficulty in proper maintenance can restrain adoption, particularly in manual and mid-range segments. Regulatory compliance requirements for safety and hygiene also present additional barriers for new entrants.

Nasal Aspirators Market Opportunities

Expansion in Emerging Markets

Asia-Pacific and Latin America present untapped growth potential due to rising birth rates, increasing awareness of child health, and expanding retail infrastructure. Companies can introduce cost-effective aspirators tailored for price-sensitive consumers, leveraging e-commerce and local distribution to increase penetration.

Smart Device Innovation

Developing electric and IoT-enabled aspirators with hygienic features, mobile connectivity, and monitoring capabilities provides opportunities for premium market growth. Replacement tips, filters, and subscription services can generate recurring revenue streams.

Integration with Home-Care and Telehealth Trends

Partnerships with telehealth platforms, pediatricians, and home-care kits can drive adoption by providing caregivers with guidance and product bundles. Travel-friendly and daycare-focused models also create new demand channels.

Product Type Insights

Electric nasal aspirators dominate the market, accounting for nearly 45% of the 2024 market. Their ease of use, consistent suction, and hygienic features make them attractive to modern parents, while manual bulb aspirators remain relevant in low-cost segments. Battery-operated portable devices are gaining adoption in travel and daycare settings, highlighting a trend toward convenience and mobility.

Application Insights

The primary application is infant and toddler nasal care, driven by high parental awareness and frequent congestion episodes. Adult usage for allergies and respiratory discomfort is emerging as a secondary application. Daycare and preschool facilities are adopting aspirators for on-site management, while travel and home-care kits expand market reach beyond conventional use.

Distribution Channel Insights

Online retail dominates the market (50% share), offering convenience, product reviews, and direct-to-consumer access. Offline retail, including pharmacies and specialty baby-care stores, remains significant for manual and mid-range products. Medical device procurement and daycare supply channels provide incremental growth opportunities. E-commerce platforms are increasingly used for product education, subscriptions, and replacement part sales.

End-User Insights

Parents and caregivers of infants and toddlers constitute the largest end-user segment, followed by daycare centers and hospitals. Home-care adoption is expanding rapidly due to convenience and telehealth support. Travel, daycare, and elderly care segments are emerging as new applications, driving incremental demand. Export-oriented manufacturers from Asia benefit from supplying high-income markets in North America and Europe, where premium device adoption is strong.

Age Group Insights

Infants and toddlers (1–3 years) represent the primary market segment (35% of the 2024 market), while neonates (0–1 year) also account for substantial demand. Adult users and geriatrics constitute smaller yet growing segments as awareness of home-care nasal devices rises for allergy and respiratory relief. Pediatric-focused designs dominate, while universal designs for all ages are slowly gaining traction.

| By Product Type | By Target Age / User | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share (40%) due to higher disposable income, awareness of infant health, and e-commerce penetration. The U.S. and Canada lead demand, with caregivers favoring premium electric and smart devices. Hospitals and daycare centers further reinforce usage in institutional settings.

Europe

Europe accounts for 25% of the 2024 market, led by the U.K., Germany, and France. Awareness of child hygiene, regulatory compliance, and premium device adoption supports market growth. Online retail is expanding rapidly, particularly in urban centers, providing convenience for caregivers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by India, China, Japan, and South Korea. Rising birth rates, expanding middle-class households, and growing online and offline retail infrastructure contribute to double-digit growth rates in several markets.

Latin America

Brazil and Argentina are key markets, with slow but steady adoption of both manual and electric aspirators. Affordability remains a factor, while urban centers show stronger uptake.

Middle East & Africa

MEA contributes a smaller share (5%) but shows potential in GCC countries and South Africa. High-income households, luxury retail channels, and growing awareness are driving early-stage adoption. Regional expansion is largely dependent on awareness campaigns and distribution infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nasal Aspirators Market

- Fridababy

- NUK (MAPA GmbH)

- Pigeon Corporation

- NeilMed Pharmaceuticals Inc.

- B.Well Swiss AG

- Graco Children’s Products Inc.

- Beaba

- Magnifeko

- Rumble Tuff

- DigiO2

- Nu-beca & maxcellent

- Flaem Nuova

- OCCObaby

- BabyBubz

- Welbutech

Recent Developments

- In March 2025, Fridababy launched an updated electric aspirator with IoT-enabled suction control and replaceable hygiene filters, targeting home-care and daycare segments.

- In February 2025, NUK expanded distribution in India and Southeast Asia with low-cost manual and electric aspirators to capture growing emerging market demand.

- In January 2025, NeilMed Pharmaceuticals introduced a smart battery-operated nasal aspirator with mobile app connectivity, enhancing parental monitoring and device hygiene compliance.