Nanosilver-Based Toiletries Market Size

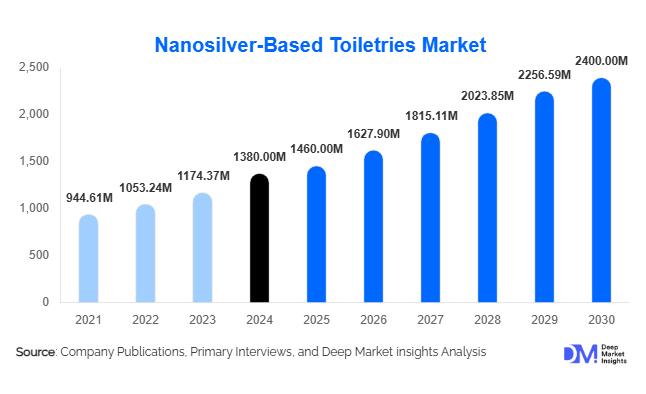

According to Deep Market Insights, the global nanosilver-based toiletries market size was valued at USD 1,380 million in 2024 and is projected to grow from USD 1,460 million in 2025 to reach USD 2,400 million by 2030, expanding at a CAGR of 11.5% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer awareness of hygiene, increasing adoption of antimicrobial solutions, and technological advancements in nanosilver formulations across personal care products.

Key Market Insights

- Nanosilver-based toiletries are gaining popularity due to superior antibacterial and antiviral properties, appealing to health-conscious consumers across all age groups and demographics.

- Shampoos, soaps, deodorants, and oral care products dominate the product mix, leveraging nanosilver for long-lasting antimicrobial protection and skin-friendly formulations.

- Asia-Pacific leads global demand, fueled by high population, urbanization, and rising disposable income, while North America maintains steady growth driven by premium personal care adoption.

- E-commerce and online retail are rapidly expanding, enabling penetration into tier-2 and tier-3 cities, particularly in emerging economies.

- Institutional adoption in hospitals, hotels, and corporate hygiene programs is emerging as a key growth driver, driven by enhanced infection control and regulatory initiatives.

- Technological integration in formulations, including slow-release nanosilver and hybrid natural-antimicrobial products, is reshaping product development and consumer preferences.

Latest Market Trends

Consumer Preference for Antimicrobial Personal Care

Consumers are increasingly prioritizing personal hygiene and infection prevention, driving demand for nanosilver-infused toiletries. Nanosilver soaps, shampoos, and toothpaste are viewed as high-efficacy products offering long-lasting antibacterial protection. Urban populations in Asia-Pacific, Europe, and North America are especially conscious of product safety and effectiveness, which is prompting companies to develop premium formulations that address skin sensitivity while providing superior antimicrobial benefits. Multi-functional products, such as anti-dandruff shampoos with nanosilver, are also gaining traction, reflecting a growing trend toward value-added toiletries.

Technological Advancements in Nanosilver Formulation

Recent innovations include slow-release nanosilver technology, hybrid formulations combining herbal and nano-antimicrobial agents, and skin-safe nanoparticles that minimize irritation. These advancements allow manufacturers to market products with higher efficacy, longer-lasting protection, and improved user safety. Additionally, companies are adopting eco-friendly formulations and biodegradable packaging to appeal to environmentally conscious consumers. This trend not only enhances product differentiation but also strengthens brand positioning in a highly competitive market.

Nanosilver-Based Toiletries Market Drivers

Rising Hygiene Awareness

Growing global awareness of bacterial and viral infections has made consumers more inclined toward antibacterial toiletries. Nanosilver’s proven antimicrobial properties make it an ideal ingredient for soaps, body washes, and oral care products, boosting overall adoption. Surveys indicate that over 60% of urban consumers actively seek antimicrobial features in their personal care products, reflecting the direct impact of hygiene consciousness on market growth.

Technological Innovations

Continuous advancements in nanosilver technology, including controlled release and hybrid formulations, have improved product safety and efficacy. Companies investing in R&D can offer premium or clinical-grade toiletries, enabling higher adoption and profitability. These innovations support product differentiation and allow expansion into sensitive consumer segments such as pediatric, elderly, and hospital-use markets.

Expansion of Online Retail Channels

E-commerce platforms have broadened market reach, making nanosilver-based toiletries accessible to tier-2 and tier-3 cities. Online sales accounted for approximately 20% of global revenue in 2024, showing strong double-digit growth. Platforms offering subscription models, direct-to-consumer sales, and promotional bundles are particularly effective in increasing consumer engagement and repeat purchases.

Market Restraints

Regulatory Challenges

Strict safety regulations in the U.S., Europe, and other regions restrict nanosilver usage in personal care products. Lengthy approval processes and compliance requirements can delay product launches and restrict expansion.

Price Sensitivity

Nanosilver-based products are often priced higher than conventional alternatives, limiting adoption in price-sensitive markets. Raw material costs and complex formulation processes contribute to higher retail prices, which can slow penetration in emerging economies.

Nanosilver-Based Toiletries Market Opportunities

Emerging Economies as Growth Hubs

Asia-Pacific, Latin America, and the Middle East offer significant opportunities due to rising urbanization, middle-class growth, and increasing disposable income. Affordable, region-specific variants can drive mass-market adoption, particularly in India, China, and Brazil, while premium offerings capture urban segments.

Integration of Advanced Nanotechnology

Innovations such as slow-release nanosilver, hybrid herbal-nano formulations, and smart packaging can enhance product differentiation. Companies investing in R&D to develop higher-efficacy and skin-friendly products are likely to gain premium market share and higher profit margins.

Institutional Adoption in Healthcare & Hospitality

Hospitals, clinics, hotels, and corporate hygiene programs increasingly prefer nanosilver-based toiletries for their superior antimicrobial protection. Bulk supply agreements and long-term contracts with these institutions provide steady revenue streams, while government hygiene initiatives and regulatory mandates amplify demand.

Product Type Insights

Among product types, soaps and body washes dominate the market, accounting for roughly 28% of the global market in 2024. Consumers prefer these products due to their daily utility and direct antimicrobial benefits. Shampoos, oral care, and deodorants follow, with growing adoption driven by multi-functional formulations integrating antibacterial, anti-dandruff, and skin-care properties.

Application Insights

Personal care consumers represent the largest application segment, but institutional usage in hospitals, hotels, and corporate facilities is growing rapidly. Hospital-grade antibacterial soaps and sanitizers using nanosilver are being increasingly deployed to prevent infections, while premium hotels incorporate nanosilver toiletries to enhance guest safety. Emerging applications include pediatric care, elderly care, and wellness-focused products incorporating nanosilver for antimicrobial efficacy.

Distribution Channel Insights

Supermarkets and pharmacies remain major channels, but online retail is the fastest-growing channel, providing broader access to niche products and premium formulations. Direct-to-consumer e-commerce websites, subscription models, and digital marketing campaigns allow brands to reach younger, tech-savvy demographics effectively. Specialty stores catering to premium and clinical-grade toiletries also support brand differentiation and customer loyalty.

End-Use Insights

The personal care segment drives the majority of demand, but hospitals and hospitality sectors are the fastest-growing end-use segments due to infection control requirements. Exports of nanosilver-based toiletries from Asia to Europe and North America are increasing, reflecting rising global adoption. Hospitals and hotels account for approximately 15% of global demand, with projected double-digit growth by 2030.

| By Product Type | By Formulation | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 25% of the global market in 2024. The U.S. and Canada are key contributors, driven by premium product adoption, high hygiene awareness, and regulatory support. Hospital-grade and high-end personal care products are widely used, supporting steady growth.

Europe

Europe accounts for around 22% of the global market, with Germany, France, and the U.K. as major markets. Eco-friendly and clinical-grade toiletries, combined with regulatory approvals, boost adoption. Younger demographics and urban populations increasingly prefer advanced antibacterial solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and South Korea. Urbanization, rising middle-class income, and e-commerce penetration drive market expansion. China and India together represent nearly 40% of regional growth in 2024, with a CAGR exceeding 13%.

Latin America

Brazil and Mexico are major markets, focusing on urban centers with growing premium product adoption. Demand is increasing for both personal care and institutional usage, though price sensitivity remains a challenge.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is adopting premium and hotel-grade nanosilver toiletries. South Africa represents the largest market in Africa, supported by urban centers and the hospitality industry.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nanosilver-Based Toiletries Market

- Johnson & Johnson

- Procter & Gamble

- Unilever

- Colgate-Palmolive

- Beiersdorf AG

- Kimberly-Clark Corporation

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Reckitt Benckiser Group

- L'Oréal S.A.

- SC Johnson & Son, Inc.

- Edgewell Personal Care

- Godrej Consumer Products Limited

- Hindustan Unilever Limited

- Amway Corporation

Recent Developments

- In March 2025, Unilever launched a new line of nanosilver soaps in India with slow-release antimicrobial technology targeting urban households.

- In January 2025, Johnson & Johnson expanded its hospital-grade nanosilver handwash portfolio across North America, enhancing infection control protocols.

- In February 2025, Colgate-Palmolive introduced nanosilver toothpaste variants for sensitive teeth in Europe and APAC, combining antimicrobial efficacy with dental care.