Music NFT Market Size

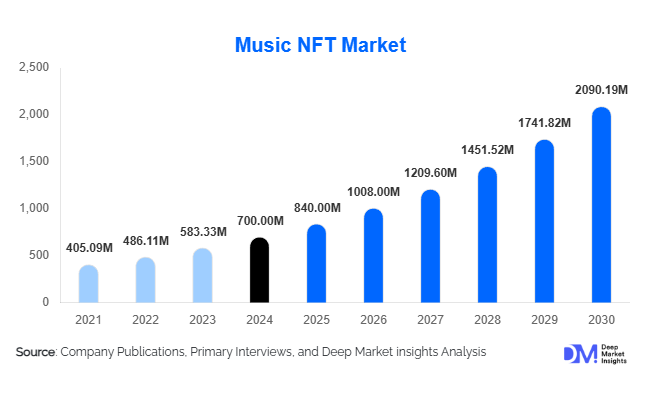

According to Deep Market Insights, the global music NFT market size was valued at USD 700.00 million in 2024 and is projected to grow from USD 840.00 million in 2025 to reach USD 2090.19 million by 2030, expanding at a CAGR of 20.0% during the forecast period (2025–2030). Market growth is driven by the rapid penetration of smart home ecosystems, increasing adoption of energy-monitoring devices, and falling connectivity module costs that make smart plugs more affordable for consumers worldwide.

Key Market Insights

- Wi-Fi-enabled smart plugs dominate the market, accounting for over 65% of 2024 global revenue due to ease of installation and compatibility with voice assistants.

- Residential users represent the largest end-use segment, comprising about 56% of total demand in 2024, driven by convenience and energy-efficiency applications.

- North America leads the global market with around 32% share in 2024, supported by early smart home adoption and robust retail distribution networks.

- Asia-Pacific is the fastest-growing region, forecast to grow at a 28–30% CAGR through 2030 as countries like China, India, and Japan expand smart-home deployments.

- Integration with Matter and Thread standards is accelerating cross-platform interoperability, reducing ecosystem fragmentation and boosting adoption.

- Falling hardware costs and government initiatives such as “Made in China 2025” and “Make in India” are fostering local manufacturing and export growth.

What are the latest trends in the music NFT market?

Tokenisation of Music Rights & Royalty Streams

A major trend in the music NFT market is the tokenisation of rights and royalty streams. Instead of simply issuing a collectible, artists and rights-holders are increasingly offering fractionalised ownership of songs, future streaming income, or licensing rights via NFTs. This enables fans and investors to participate in an artist’s revenue upside while giving artists new funding avenues. Such models strengthen engagement by aligning fan incentives with artist success and broaden the use case of music NFTs beyond mere digital collectibles.

Integration with Virtual Events & Fan-Experience Models

Another significant trend is the bundling of NFTs with live/virtual experiences. Music NFTs are being issued as access passes to metaverse concerts, VR/AR events, backstage-digital meet-ups, or limited-edition fan experiences. This hybrid model (music asset + event access) deepens the value proposition for fans and builds new revenue avenues for artists and platforms. As virtual concert infrastructure matures and blockchain ticketing/ownership models evolve, this trend is expected to accelerate.

Mobile-First Platforms and Emerging Region Expansion

Emerging markets and mobile-first platforms are increasingly important in the music NFT space. Regions such as India, Southeast Asia, Latin America, and Africa are witnessing growth in digital music consumption, mobile wallet adoption, and fan-community engagement. Platforms optimised for low-cost blockchain transactions, local payment rails, and regional language UI are enabling adoption. This geographic shift is helping the overall market scale faster and reach new fan segments previously inaccessible via traditional music monetization means.

What are the key drivers in the music NFT market?

Growing Artist Demand for Alternative Revenue Models

The traditional music industry model (streaming, downloads, label revenue splits) has faced pressure on margins and artist earnings. NFTs offer an alternative channel: artists can mint unique assets, retain a high share of first-sale revenue, set smart-contract royalties on secondary trades, and engage directly with their fan base. This has become a powerful driver of growth as more independent artists and smaller labels explore NFT issuance as a viable monetisation strategy.

Rising Fan Demand for Unique Ownership and Collectibles

Consumers and music fans are increasingly motivated by exclusivity, ownership, digital collectibles, and experience access rather than simply streaming. Music NFTs capitalise on this shift: fans can purchase limited-edition tracks, albums, or access rights, which carry scarcity, provenance, and potential resale value. This behavioural shift, treating music assets as collectibles or investments, positively impacts market growth.

Advancements in Blockchain Infrastructure and Web3 Usability

A third driver is the maturation of blockchain, marketplace platforms, and Web3 infrastructure. Improvements such as lower transaction (gas) fees, multi-chain compatibility, wallet-less onboarding, fiat-on-ramp support, and integrations with streaming/social platforms make music NFTs more accessible to both artists and fans. As technical friction reduces, the market can scale more rapidly.

Restraints

Copyright, Rights-Management and Legal Uncertainty

One major restraint is the complexity of music rights and copyright tokenisation. Songs often involve multiple stakeholders (writers, performers, labels, publishers). Ambiguities about what exactly is conveyed in the NFT (ownership vs licence), how royalties are enforced across jurisdictions, and how secondary trades are monitored create legal/regulatory friction. This uncertainty can slow down broader adoption.

Adoption Barriers and Market Speculation Risks

Another key restraint is adoption friction: many fans and artists face blockchain-wallet setup challenges, crypto volatility, speculative asset risk, and scepticism about long-term value. The broader NFT market’s past downturns and regulatory scrutiny add caution. These factors may limit rapid growth until user experience improves and mainstream trust increases.

What are the key opportunities in the music NFT industry?

Empowering Artists via Fan-Owned Rights & Communities

One of the most compelling opportunities is enabling artists to issue NFTs that grant fans fractional rights, a stake in streaming revenue, or governance in creative decisions. By fostering fan communities around ownership and shared upside, platforms can build stronger engagement, recurring revenue, and loyalty. New entrants can develop infrastructure that simplifies tokenising rights, royalty-splitti, and community management for artists of all sizes. This creates a dual opportunity: for artists to monetise differently and for platforms to monetize economies.

Metaverse and Virtual Experience Extensions of Music NFTs

Another major opportunity lies in weaving NFTs into virtual concerts, AR/VR fan experiences, metaverse venues, and digital merchandise. Music NFTs that grant access to virtual concerts, backstage passes in digital worlds, or avatars linked to artists create new hybrid products with higher value. Platforms that integrate music NFT issuance with event-ticketing, virtual venue technology, and immersive experiences stand to capture large incremental revenue beyond static collectibles.

Regional Expansion & Emerging Market Entry via Mobile-First Platforms

Thirdly, there is a significant opportunity in expanding into emerging markets (Asia-Pacific, Latin America, Africa) through mobile-first, regionally localised NFT platforms. These regions offer large youthful digital audiences and high mobile wallet growth. By tailoring UX, local payment rails, language support, and artist partnerships in these regions, entrants can capture growth ahead of saturation in mature markets. This geographic expansion offers both new markets for music NFTs and a deeper reach for artists globally.

Product Type Insights

Single Track NFTs dominate the global Music NFT market, accounting for approximately 54% of the total market value in 2024 ( USD 0.49 billion of USD 0.90 billion). This dominance stems from their accessibility for artists and affordability for fans. Single tracks are easier and faster to mint compared to albums or bundles, allowing musicians, particularly independent artists, to reach audiences directly without intermediaries. For fans, the lower price point encourages more frequent purchases and greater participation in artist-led NFT ecosystems. As the industry matures, album-based NFTs and bundled experiences are expected to gain share, but single tracks will continue to lead due to their liquidity, simplicity, and fan engagement potential.

Platform Insights

General NFT marketplaces with music verticals hold an estimated 35% share of the 2024 market ( USD 0.315 billion). Their leadership is driven by extensive user bases, high liquidity, and existing Web3 infrastructure that enables seamless minting, sales, and resales. These platforms, such as OpenSea, Blur, and Magic Ede, offer built-in audiences and interoperability, allowing music NFTs to benefit from exposure alongside art, gaming, and sports NFTs. This ecosystem integration reduces entry barriers for artists and collectors while fostering cross-category discovery. In contrast, dedicated music-only NFT platforms are still scaling their communities and technology stacks, positioning them for future growth as the market fragments and matures.

Monetization Model Insights

Primary sales account for approximately 60% ( USD 0.54 billion) of the total market value in 2024, representing the leading monetization model. This dominance reflects the early-stage nature of the market, where most NFT revenue originates from the first issuance rather than secondary resales. Artists prefer primary drops because they offer immediate revenue, creative control, and verifiable authenticity. These drops often feature limited editions or time-bound releases that generate scarcity-driven demand. While secondary trading and royalty-based models are expected to expand through 2025–2030, primary issuance remains the main commercial driver as new artists, labels, and brands enter the space.

Application Insights

Fan engagement and digital collectibles represent the largest application category, capturing around 45% ( USD 0.405 billion) of the 2024 market. These NFTs enable fans to own a verifiable piece of their favorite artist’s journey, ranging from exclusive audio clips and album art to backstage passes and virtual experiences. The segment’s dominance reflects the emotional and community-driven nature of music fandom, where ownership and identity intertwine. Artists are leveraging NFTs to deliver enhanced engagement through tiered fan clubs, token-gated experiences, and collectible merchandise. As more fans seek direct digital connections, collectibles will continue to anchor market growth before yield-bearing and rights-tokenized NFTs become mainstream.

End-Use Insights

The end-use ecosystem for Music NFTs spans artists and labels, fans and collectors, investors, and brands collaborating with musicians. Among these, independent artists are the fastest-growing end-user group, leveraging NFTs to monetise music directly while bypassing traditional label contracts and streaming royalty models. This direct-to-fan approach enhances transparency, ensures greater revenue retention, and fosters community loyalty.

Fans and collectors form the second-largest end-use segment, driven by demand for exclusive and experiential content. Limited-edition drops, concert-linked NFTs, and virtual access tokens encourage repeat engagement and strengthen the artist-fan relationship. Meanwhile, brands and media companies are entering the NFT space to enhance digital marketing, loyalty programs, and metaverse activations. They are increasingly sponsoring artist drops or integrating NFTs into cross-channel campaigns. The underlying growth of global streaming and live events alongside expanding cross-border digital payments is driving export-led NFT demand, where artists from one region sell directly to fans worldwide.

| By NFT Type | By Blockchain Platform | By Sales Channel | By Buyer Type | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global Music NFT market, accounting for approximately 42% of the total value in 2024 ( USD 378 million). The region’s leadership is supported by strong music industry infrastructure, deep cryptocurrency adoption, and high disposable income. The United States dominates both artist issuance and collector participation, with Los Angeles, New York, and San Francisco emerging as creative and technological hubs. Growth drivers include partnerships between record labels and blockchain startups, NFT integrations with mainstream streaming services, and early adoption of fan-token economies. Continued venture investment in NFT infrastructure and Web3 analytics tools is expected to sustain North America’s leadership through the forecast period, though growth will moderate as the market matures.

Europe

Europe represents the second-largest market with a roughly 28% share ( USD 252 million) in 2024. Major contributors include the U.K., Germany, and France, where strong digital music ecosystems and established fan cultures fuel adoption. European growth is primarily driven by interest in collectibles tied to sustainability, local artist communities, and cross-border music collaborations. The implementation of the EU’s Markets in Crypto-Assets (MiCA) regulation is improving investor confidence and standardising NFT operations across member states. Key regional drivers include a high concentration of independent labels, creative grant funding for Web3 innovation, and emerging partnerships between artists and gaming studios integrating music NFTs into metaverse environments.

Asia-Pacific

The Asia-Pacific (APAC) region holds approximately 20% market share ( USD 180 million) in 2024 but is projected to be the fastest-growing regional market through 2030. Rapid digitalisation, mobile-first consumer behaviour, and the popularity of K-pop, J-pop, and Bollywood music underpin adoption across India, South Korea, Japan, and China. Rising familiarity with blockchain wallets, crypto exchanges, and fan-token ecosystems supports broader NFT integration. Key regional growth drivers include government-backed Web3 innovation programs in Japan and South Korea, expanding creator economies in India, and NFT-linked fan club models launched by entertainment agencies. The region’s youthful demographic and expanding streaming base ensure sustained double-digit CAGR through the forecast period.

Latin America

Latin America currently contributes between 5–7% of global revenue ( USD 45–63 million) and represents a high-potential emerging market. Brazil and Mexico lead regional adoption, driven by robust social media engagement, expanding digital payment systems, and growing indie-music scenes. NFT collaborations between Latin artists and global platforms are increasing visibility, while crypto-friendly regulations in countries like Brazil are easing participation. Regional growth is powered by cross-border collaborations, rising middle-class purchasing power, and community-driven fandom models. Over the medium term, Latin America’s vibrant youth culture and digital innovation hubs are expected to accelerate the uptake of music NFTs as affordable collectibles.

Middle East & Africa

The Middle East and Africa (MEA) region accounts for roughly 3–5% of the 2024 global market value ( USD 27–45 million). Growth remains nascent but is gaining momentum as Gulf nations like the UAE and Saudi Arabia invest heavily in blockchain infrastructure and creative-economy diversification. Dubai has positioned itself as a regional NFT innovation hub, hosting major Web3 and metaverse events that attract music-tech collaborations. In Africa, South Africa and Nigeria are emerging as creative front-runners with strong independent artist movements and NFT-linked music distribution. Key growth drivers include government-backed digital-economy initiatives, expanding smartphone penetration, and rising demand for regional virtual concert experiences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Global Music NFT Market

- Sound.xyz

- Royal.io

- Catalog

- OneOf

- Opulous

- Async Music

- Reveel

- Serenade

- RCRDSHP

- YellowHeart

- MusicArt

- Audius

- Mint Songs

- Royalty Exchange

- Nina Protocol

Recent Developments

- In June 2025, Sound.xyz launched its AI-powered discovery engine for NFT music, allowing fans to mint personalized compilations based on listening history and on-chain preferences.

- In May 2025, Royal.io announced expanded partnerships with independent record labels, enabling fractional ownership of streaming royalties for over 500 new artists globally.

- In April 2025, Catalog introduced multi-chain interoperability, allowing artists to mint NFTs across Ethereum, Polygon, and Solana simultaneously for reduced transaction costs and increased visibility.

- In March 2025, OneOf partnered with major music festivals in North America and Europe to offer NFT-based ticketing and backstage access utilities.

- In February 2025, Opulous raised USD 30 million in Series B funding to expand its DeFi-based music financing platform across Asia-Pacific and Latin America.