Multiwall Paper Bags Market Size

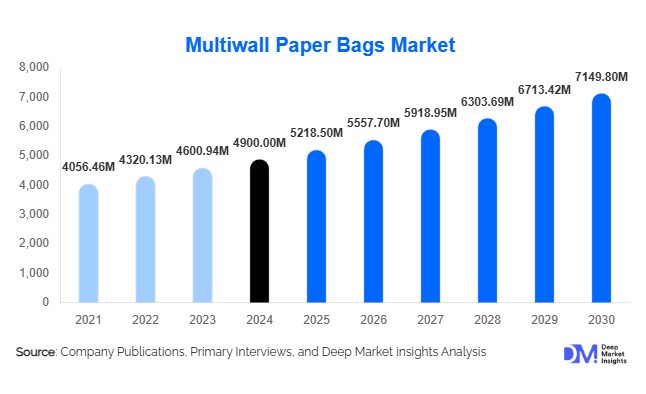

According to Deep Market Insights, the global multiwall paper bags market size was valued at USD 4,900 million in 2024 and is projected to grow from USD 5,218.50 million in 2025 to reach USD 7,149.80 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). Growth in this market is primarily driven by the rising demand for sustainable bulk packaging solutions, rapid industrialization in emerging economies, and increasing regulatory restrictions on plastic-based packaging. The sector is also benefiting from advancements in high-performance kraft paper, barrier coatings, and automated filling technology.

Key Market Insights

- Asia-Pacific dominates the global market, accounting for nearly 37% of total demand in 2024, led by China and India’s rapid industrial expansion and rising food & construction packaging needs.

- Valve-bottom multiwall paper bags lead product demand due to their compatibility with automated filling systems and efficient handling in industrial packaging.

- Growing sustainability regulations are accelerating the shift from woven polypropylene and plastic film sacks to recyclable, paper-based alternatives across Europe and North America.

- Hybrid laminate paper bags combining kraft paper with plastic or foil films are witnessing strong adoption for moisture-sensitive contents such as chemicals and powdered food products.

- 3-ply configurations remain the industry standard, offering the ideal balance of strength, cost-effectiveness, and barrier performance for heavy-duty applications.

- Technological innovations such as resealable tops, digital printing, and RFID tracking are redefining the competitive landscape, supporting higher-margin product differentiation.

What are the latest trends in the Multiwall Paper Bags Market?

Shift Toward Sustainable and Recyclable Packaging

With mounting pressure to reduce plastic waste, industries are accelerating the adoption of sustainable multiwall paper bags. Manufacturers are producing eco-certified (FSC-approved) kraft paper bags that meet recyclability and compostability standards. Additionally, bio-based barrier coatings and water-based inks are replacing conventional plastic laminates, aligning with circular-economy objectives. These initiatives not only comply with environmental mandates but also strengthen brand positioning among eco-conscious consumers. Governments in Europe and Asia have introduced plastic reduction acts, significantly stimulating the demand for multiwall paper alternatives.

Emergence of Advanced Functional Designs

Product innovation is reshaping the competitive landscape. The development of pinch-bottom and valve-bottom bags that enable dust-free filling, resealable closures for retail food applications, and high-definition digital printing for branding are key differentiators. Companies are investing in automation-compatible bag designs to optimize high-speed filling operations, particularly in construction and chemical sectors. Integration of QR codes and RFID tags is also gaining ground, enabling real-time logistics tracking and inventory transparency across supply chains.

What are the key drivers in the Multiwall Paper Bags Market?

Increasing Demand from Food, Agriculture, and Construction Sectors

Rapid industrialization and growth in end-use sectors, especially food, animal feed, fertilizer, and cement, have significantly raised the consumption of multiwall paper bags. Their high tensile strength and moisture resistance make them ideal for packaging powdered and granular materials. Infrastructure investments in Asia and Africa are further boosting construction material packaging, accounting for nearly 25% of the total market value in 2024.

Rising Environmental Awareness and Packaging Regulations

Global plastic bans and carbon-reduction commitments have driven industries toward biodegradable packaging. Paper-based multiwall sacks align perfectly with these goals, offering recyclability and a reduced carbon footprint. As large corporations and governments push for greener packaging alternatives, demand for multiwall paper bags continues to accelerate, especially in Europe and North America.

Technological Advancements and Product Customization

Advances in bag-making machinery, coating materials, and automated sealing technologies are enhancing product performance. Companies are introducing hybrid kraft-paper laminates, moisture barriers, and resealable valves to meet industry-specific needs. Custom printing capabilities using digital and flexographic methods are adding marketing value for brands in food, pet food, and consumer goods packaging.

What are the restraints for the global market?

Raw Material Cost Volatility

Paper pulp and kraft liner prices fluctuate based on global fiber availability, energy costs, and logistics disruptions. These fluctuations strain manufacturers’ margins, particularly for small converters operating on thin spreads. Passing on cost increases to customers remains difficult due to intense market competition.

Competition from Alternative Packaging Materials

Woven polypropylene and FIBC bulk bags continue to compete on cost and moisture resistance, especially in agricultural and chemical packaging. Plastic-based sacks offer superior water resistance and durability in humid climates, posing a substitution threat to paper-based multiwall formats in some applications.

What are the key opportunities in the Multiwall Paper Bags Industry?

Eco-Certified Premium Packaging Solutions

As brands seek sustainability credentials, there is growing demand for multiwall paper bags with biodegradable coatings and certifications such as FSC or PEFC. Offering recyclable and compostable premium packaging presents lucrative opportunities, particularly for pet food, organic products, and specialty chemicals manufacturers seeking eco-labeled packaging partners.

Regional Expansion in Emerging Markets

Asia-Pacific, Africa, and Latin America offer untapped potential due to rising construction activity, agricultural exports, and local manufacturing. Establishing regional production hubs in India, Indonesia, or Brazil can reduce logistics costs, provide customization flexibility, and capture growing domestic demand. Infrastructure spending and government manufacturing initiatives (e.g., “Make in India”) further enhance these opportunities.

Smart and Functional Bag Innovations

Integration of intelligent tracking systems, resealable valves, and high-barrier coatings is transforming paper bags into performance packaging solutions. These innovations cater to growing needs in industrial and retail packaging segments, driving differentiation and premium pricing opportunities for manufacturers adopting advanced technology.

Product Type Insights

Valve-bottom multiwall paper bags lead the global product segment, representing about 22% of market share in 2024. Their compatibility with high-speed automated filling lines, superior sealing efficiency, and ability to minimize dust loss make them the preferred choice in cement, chemical, and construction sectors. Pasted open-mouth and pinch-bottom bags follow, used primarily in food and agriculture packaging applications requiring easy filling and moisture protection.

Material Insights

Kraft paper + plastic laminate constructions account for roughly 28% of the total market value in 2024. This hybrid material structure combines the sustainability appeal of kraft paper with the barrier protection of plastic film, extending shelf life for moisture-sensitive goods. Recycled-fiber paper bags and virgin kraft bags are also gaining ground as regulations emphasize recyclability and renewable materials.

End-Use Insights

Building and construction applications dominate the end-use segment with about 25% of total demand in 2024, driven by cement, mortar, and plaster packaging. The food & beverage sector, including flour, sugar, and pet food, is the fastest-growing application area with an expected CAGR above 7%. Emerging opportunities are also observed in specialty chemicals and powdered minerals, where moisture protection and barrier integrity are critical.

| By Product Type | By Material Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents approximately 24% of global demand in 2024, with the U.S. leading due to its well-established food and chemical packaging sectors. Growth remains moderate (3–4% CAGR) amid stable industrial demand and regulatory support for paper packaging in place of plastics.

Europe

Europe accounts for nearly 28% of the market, driven by strong environmental policies and circular-economy initiatives. Germany, France, and the U.K. are major contributors. The region’s transition from plastics to recyclable paper formats continues to stimulate steady growth of around 4–5% annually.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market, commanding roughly a 37% share in 2024. China and India lead demand, supported by expanding food processing, agriculture, and infrastructure development. Regional CAGR is expected to exceed 6.5% through 2030 as governments encourage domestic manufacturing of paper-based packaging.

Latin America

Latin America contributes about 8% of the total market share, with Brazil and Mexico as the leading countries. Growth is propelled by agricultural exports, fertilizer packaging, and mining operations. Regional manufacturers are adopting laminated and high-strength paper bags for export packaging needs.

Middle East & Africa

MEA holds around an 11% share in 2024, supported by construction booms in Saudi Arabia, the UAE, and South Africa. Expanding cement and mineral packaging drives steady demand, while governments’ sustainability commitments create opportunities for paper-based alternatives to plastic sacks.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Multiwall Paper Bags Market

- Mondi Group

- Smurfit Kappa Group

- WestRock Company

- Sonoco Products Company

- International Paper Company

- Huhtamaki Oyj

- Amcor Plc

- Berry Global Inc.

- Klabin S.A.

- BillerudKorsnäs AB

- Oji Fibre Solutions

- Segezha Group

- Novolex Holdings, Inc.

- LC Packaging International N.V.

- Tetra Pak International S.A.

Recent Developments

- June 2025 – Mondi Group expanded its European multiwall paper bag production capacity by 15% to meet increasing demand for sustainable industrial packaging.

- April 2025 – Smurfit Kappa launched a new range of recyclable barrier-coated paper bags designed for moisture-sensitive food products.

- February 2025 – WestRock Company announced a strategic partnership with Indian packaging firms to enhance domestic paper sack manufacturing under “Make in India.”

- January 2025 – Huhtamaki introduced digitally printed multiwall paper bags for pet food brands in Europe, improving brand visibility and customization flexibility.