Multicooker Market Size

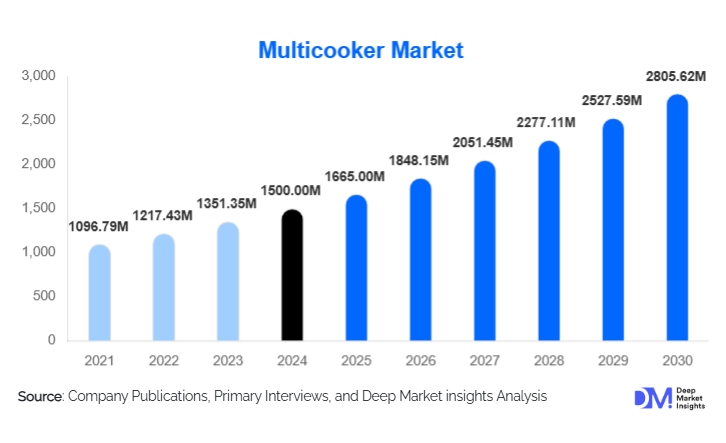

According to Deep Market Insights, the global multicooker market size was valued at USD 1,500.00 million in 2024 and is projected to grow from USD 1,665.00 million in 2025 to reach USD 2,805.62 million by 2030, expanding at a CAGR of 11.0% during the forecast period (2025–2030). The multicooker market growth is primarily driven by increasing consumer demand for time-efficient and multi-functional kitchen appliances, rising adoption of smart and IoT-enabled devices, and growing health consciousness, encouraging home-cooked meals.

Key Market Insights

- Smart and IoT-enabled multicookers are transforming kitchens, enabling remote control, automated cooking, and app-based recipe guidance.

- Household adoption dominates, with nuclear families and urban consumers preferring convenient, multi-functional cooking appliances.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, urbanization, and e-commerce penetration in China, India, and Southeast Asia.

- North America and Europe hold significant market share, with tech-savvy consumers adopting premium smart multicookers and multi-function models.

- Online retail channels are increasingly preferred, offering easy access, promotions, and doorstep delivery.

- Energy efficiency and health-focused cooking, such as low-oil frying and steaming, are major trends shaping consumer preferences.

What are the latest trends in the multicooker market?

Smart and Multi-Functional Appliances Driving Growth

Manufacturers are increasingly introducing smart multicookers with IoT connectivity, smartphone integration, and AI-driven cooking programs. Consumers benefit from features such as remote operation, recipe suggestions, and cooking alerts. Multi-functionality, allowing steaming, slow-cooking, frying, and baking in one appliance, is becoming standard. These trends appeal to urban households seeking time-saving, space-efficient, and technologically advanced kitchen solutions.

Energy-Efficient and Health-Oriented Cooking

With growing health awareness, consumers are gravitating toward appliances that facilitate low-fat cooking and energy efficiency. Steam and pressure cooking options allow nutrient retention while reducing cooking time. Energy-efficient models are being emphasized in marketing and government energy labeling initiatives, boosting adoption. Smart energy-saving features also align with consumer demand for sustainability in daily kitchen practices.

What are the key drivers in the multicooker market?

Urbanization and Changing Lifestyles

Urban populations and nuclear families are increasingly seeking appliances that reduce cooking time while offering versatility. Busy schedules, dual-income households, and smaller kitchen spaces drive demand for compact, multi-functional multicookers that replace multiple appliances.

Technological Advancements

Smart features such as Wi-Fi connectivity, app control, and AI-assisted cooking have become major growth drivers. Tech-savvy consumers prefer appliances that offer convenience, pre-programmed cooking modes, and customizable settings, enhancing the overall cooking experience.

Health and Wellness Awareness

Consumers are increasingly adopting home-cooked meals for healthier diets, favoring appliances that allow steaming, low-oil frying, and pressure cooking. Multicookers supporting healthy cooking are driving demand across urban households and institutional kitchens alike.

What are the restraints for the global market?

High Initial Cost of Premium Models

Smart and multi-function multicookers have higher upfront costs, limiting penetration in price-sensitive markets. Consumers often weigh cost against perceived convenience and advanced features, which can slow adoption among budget-conscious households.

Complexity of Use

Advanced multicookers with multiple functions may intimidate older or less tech-savvy consumers, potentially restricting broader adoption. Simplified interfaces and better consumer education are necessary to overcome this barrier.

What are the key opportunities in the multicooker market?

Integration with Smart Home Technologies

The rise of smart kitchens provides manufacturers with opportunities to integrate multicookers with smartphones, voice assistants, and IoT ecosystems. Features like recipe automation, remote monitoring, and connectivity with other kitchen devices can capture premium consumer segments.

Expansion in Emerging Economies

Emerging markets such as India, China, and Southeast Asia show strong growth potential. Rising urbanization, nuclear family structures, and increasing disposable incomes are driving demand. Government initiatives supporting domestic manufacturing and e-commerce expansion further enhance market opportunities for new entrants and existing players.

Energy-Efficient and Health-Focused Cooking Solutions

Consumers increasingly seek appliances that promote healthy eating and reduce energy consumption. Multicookers offering steam, low-fat frying, and pressure cooking meet these demands. Manufacturers focusing on eco-friendly designs, energy-saving features, and nutrient-retaining cooking methods can differentiate their offerings.

Product Type Insights

Electric multicookers dominate the market, representing 55% of the 2024 global market. Their affordability, energy efficiency, and multi-functionality drive adoption. Smart electric multicookers are particularly popular, integrating IoT connectivity and automated cooking features. Gas and induction multicookers hold smaller market shares but are preferred in regions with specific culinary preferences or energy constraints.

Cooking Capacity Insights

Mid-sized multicookers (3–5 liters) account for 40% of the global market, balancing household cooking needs and energy efficiency. Smaller (<3L) and larger (>7L) models serve niche markets, while 5–7L appliances target larger families or small commercial setups. The trend toward compact yet versatile appliances continues to favor mid-sized offerings.

Distribution Channel Insights

Online retail accounts for 35% of market sales, driven by e-commerce penetration, product reviews, and doorstep delivery. Offline channels, including supermarkets and specialty stores, remain relevant in developed markets. Direct brand websites and digital marketplaces are increasingly important for premium model sales, providing consumers with detailed product information and easy comparison options.

End-Use Insights

Households represent the largest end-use segment, contributing 65% of the 2024 market. Busy urban families, working professionals, and tech-savvy consumers are driving adoption. Commercial kitchens, including restaurants and hotels, increasingly adopt multicookers for time efficiency and energy savings. Institutional applications, such as schools and hospitals, are emerging, creating new demand opportunities. Export demand is high from North America and Europe, where premium appliances are imported from Asia-Pacific manufacturers.

| By Product Type | By Cooking Capacity | By Technology/Features | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 28% of the global market, driven by U.S. and Canadian consumers adopting smart, multi-functional appliances. Busy lifestyles, high disposable incomes, and urbanization encourage household and small commercial adoption. Smart home integration and online retail channels accelerate growth.

Europe

Europe contributes 25% of the market, with Germany, the U.K., and France leading demand. Health consciousness, premium appliance adoption, and urban household penetration drive growth. Younger consumers are increasingly interested in IoT-enabled multicookers and multi-function appliances.

Asia-Pacific

Asia-Pacific is the fastest-growing region due to China, India, and Southeast Asia. Rising middle-class wealth, increasing urbanization, and expanding e-commerce platforms drive strong adoption. Demand is particularly strong for smart, mid-sized, and energy-efficient multicookers.

Latin America

Brazil and Mexico are leading markets, with gradual adoption among urban households. Growth is supported by increasing awareness of multi-functional appliances and access to imported premium models.

Middle East & Africa

Adoption is growing in the UAE, Saudi Arabia, and South Africa. Premium multicookers are preferred, and smart kitchen integration is gaining traction among high-income households. Africa serves both as a market and a manufacturing base for some regional brands.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Multicooker Market

- Instant Brands (Instant Pot)

- Philips

- Panasonic

- Moulinex

- Breville

- Cuisinart

- Tiger Corporation

- Zojirushi

- Tefal

- Kenwood

- Hamilton Beach

- Supor

- Midea

- Arzum

- De’Longhi

Recent Developments

- In May 2025, Instant Brands launched a new smart multicooker with AI-assisted recipe suggestions and smartphone connectivity.

- In April 2025, Philips introduced a compact 3–5L multi-function electric multicooker targeting urban households in India and Southeast Asia.

- In February 2025, Breville unveiled a premium, energy-efficient multicooker with integrated pressure, slow, and steam cooking features for the North American and European markets.