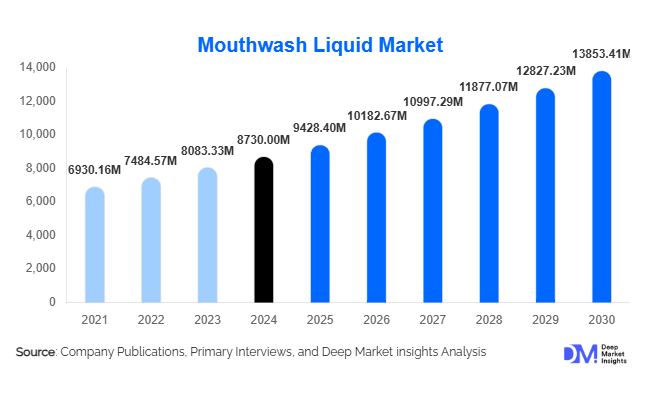

Mouthwash Liquid Market Size

According to Deep Market Insights, the global mouthwash liquid market size was valued at USD 8,730 million in 2024 and is projected to grow from USD 9,428.40 million in 2025 to reach USD 13,853.41 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The market growth is primarily driven by rising oral hygiene awareness, increasing demand for alcohol-free and herbal mouthwashes, and the proliferation of dental care products in emerging economies.

Key Market Insights

- Rising focus on oral hygiene due to the growing prevalence of dental caries, halitosis, and gum diseases is fueling mouthwash consumption globally.

- Alcohol-free and herbal formulations are gaining traction as consumers seek gentler, natural, and sustainable oral care solutions.

- Asia-Pacific is the fastest-growing market, driven by urbanization, increased disposable incomes, and rapid retail expansion in India and China.

- North America dominates the market share owing to well-established oral care habits and product innovation by leading brands.

- Online retail channels are expanding rapidly, supported by subscription-based oral care models and influencer-driven marketing.

- Technological advancements in oral microbiome science are leading to next-generation mouthwash products with probiotic and targeted antimicrobial formulations.

Latest Market Trends

Growing Popularity of Alcohol-Free and Herbal Mouthwash

Consumers are increasingly avoiding alcohol-based mouthwashes due to concerns about oral dryness and irritation. This shift has fueled demand for herbal, fluoride-free, and natural-ingredient-based alternatives. Brands are incorporating ingredients such as tea tree oil, neem, aloe vera, and green tea extracts to appeal to health-conscious consumers. The rise in vegan and cruelty-free certifications further supports this transition toward natural formulations. Premium mouthwash lines positioned as part of holistic wellness routines are also gaining shelf space across supermarkets and pharmacies.

Smart and Functional Mouthwash Innovations

Manufacturers are introducing mouthwash products with functional claims such as whitening, enamel strengthening, and gum protection. Smart packaging featuring metered dispensing, refillable bottles, and QR-linked oral care tips is enhancing user engagement. Additionally, biotechnology-based mouthwashes designed to balance oral microbiota are emerging in premium markets. These innovations are aligned with broader consumer trends toward personalized oral care solutions, convenience, and eco-friendly packaging.

Mouthwash Liquid Market Drivers

Increasing Oral Health Awareness and Preventive Care

Growing awareness of oral health as an integral part of overall wellness is a major driver for the mouthwash market. Preventive dental care campaigns by governments, NGOs, and dental associations have increased mouthwash adoption across demographics. Rising disposable incomes and willingness to invest in premium oral care products further enhance market growth. The growing frequency of dental visits and recommendations by dental professionals to include mouthwash in daily routines has strengthened category penetration globally.

Rising Demand for Alcohol-Free and Sensitive Formulations

The market is witnessing rapid adoption of alcohol-free mouthwash variants, particularly among children, elderly populations, and individuals with oral sensitivity. These products offer antibacterial benefits without burning sensations or mucosal irritation. Additionally, growing interest in fluoride and essential oil–based mouthwashes reflects consumer demand for products that are effective yet gentle. Major players are leveraging this trend by introducing low-sugar, paraben-free, and pH-balanced formulations.

Market Restraints

Presence of Counterfeit and Low-Quality Products

The growing influx of unregulated and counterfeit mouthwash products in developing economies undermines consumer confidence and brand reputation. These low-quality variants often fail to meet safety or efficacy standards, posing a challenge to premium and established brands. Regulatory inconsistencies across regions further exacerbate product authentication issues, limiting market transparency.

Potential Side Effects and Alcohol Concerns

While mouthwash is widely promoted as a daily hygiene product, concerns over potential side effects such as altered taste perception and oral dryness persist. Alcohol-based mouthwashes, in particular, face criticism for possible mucosal irritation and associations with oral health risks when overused. This perception challenge, though mitigated by the rise of alcohol-free products, continues to restrict adoption in certain consumer segments.

Mouthwash Liquid Market Opportunities

Expansion in Emerging Markets

Rising disposable income levels, increasing urbanization, and expanding retail infrastructure in developing economies present lucrative opportunities. Countries such as India, Indonesia, Brazil, and Nigeria are witnessing increased oral care awareness, creating demand for affordable yet effective mouthwash products. Localized marketing campaigns emphasizing freshness, social confidence, and dental health are key success strategies for brands entering these markets.

Integration with Personalized and Subscription Oral Care

Personalized oral hygiene kits that include tailored mouthwash formulations are emerging as a growth avenue. Subscription-based models offering monthly deliveries and eco-refill packs are becoming popular in North America and Europe. Digital oral health startups are partnering with dental professionals to offer custom mouthwash blends targeting sensitivity, whitening, or gum health. This evolution aligns with consumer preference for convenience and long-term dental wellness.

Product Type Insights

Therapeutic mouthwash dominates the market due to its efficacy in addressing gum inflammation, plaque control, and bacterial management. Cosmetic mouthwash remains popular for providing temporary freshness and aesthetic benefits, while antiseptic mouthwash is increasingly recommended for post-dental procedures and infection control. Herbal mouthwash is the fastest-growing subsegment, driven by rising preference for natural and alcohol-free solutions.

Ingredient Insights

Alcohol-based formulations account for a significant share due to their traditional antibacterial properties, but alcohol-free variants are rapidly gaining traction. Fluoride-containing mouthwash is widely used for cavity prevention, while herbal and essential oil–infused formulations are popular among eco-conscious consumers. Innovation in probiotic and pH-balanced ingredients is further diversifying product portfolios, supporting brand differentiation.

Distribution Channel Insights

Offline retail, including supermarkets, pharmacies, and dental clinics, continues to dominate sales. However, the online segment is expanding rapidly due to convenience, price transparency, and subscription-based purchasing models. E-commerce platforms and direct-to-consumer websites are leveraging digital marketing and influencer endorsements to engage younger demographics and promote product education.

End-User Insights

Individual consumers represent the largest end-user segment, followed by institutional buyers such as dental clinics and hospitals. The growing adoption of mouthwash in professional oral care settings for pre- and post-procedural hygiene further supports demand. Additionally, rising adoption among corporate wellness programs and hospitality industries is expanding usage beyond traditional consumer channels.

| By Product Type | By Ingredient | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global market, supported by high oral care awareness, premium brand penetration, and frequent product innovations. The U.S. accounts for the majority of consumption, with a strong presence of key brands such as Colgate, Listerine, and Crest. The region’s focus on alcohol-free and whitening mouthwash formulations continues to shape product development trends.

Europe

Europe represents a mature yet innovation-driven market, characterized by strict regulatory standards and rising demand for sustainable packaging. Western European countries such as Germany, France, and the U.K. are emphasizing eco-friendly and vegan-certified mouthwash products. The growing adoption of natural and fluoride-free variants aligns with regional consumer preferences for ethical and health-oriented choices.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by expanding middle-class populations, dental health education initiatives, and the availability of affordable oral care brands. China and India are key growth drivers, with local players introducing region-specific flavors and formulations. The proliferation of online retail and partnerships with dental associations is boosting market penetration in Southeast Asia and Oceania.

Latin America

Latin America is witnessing steady growth, particularly in Brazil, Mexico, and Argentina, driven by improving dental hygiene awareness and increasing product availability. Market players are focusing on affordable, family-size packaging and refreshing flavors tailored to local preferences.

Middle East & Africa

The Middle East & Africa region is emerging as a potential growth frontier, supported by rising healthcare spending, urbanization, and a growing youth population. South Africa, Saudi Arabia, and the UAE represent key markets, with premium and alcohol-free mouthwashes gaining strong traction. The regional focus on wellness and aesthetic oral care further supports adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mouthwash Liquid Market

- Colgate-Palmolive Company

- Procter & Gamble (Crest, Oral-B)

- Johnson & Johnson (Listerine)

- GlaxoSmithKline plc (Sensodyne)

- Unilever plc

- Henkel AG & Co. KGaA

- Church & Dwight Co., Inc.

- Lion Corporation

- Amway Corporation

- Himalaya Wellness Company

Recent Developments

- In September 2025, Colgate-Palmolive launched a biodegradable packaging line for its Total mouthwash series, targeting sustainability-conscious consumers in North America.

- In July 2025, Johnson & Johnson’s Listerine introduced a probiotic-infused mouthwash aimed at restoring oral microbiome balance and reducing sensitivity.

- In May 2025, Himalaya Wellness expanded its herbal mouthwash range across Southeast Asia, featuring neem and clove variants catering to regional preferences for traditional ingredients.

- In March 2025, P&G launched an alcohol-free variant under the Oral-B brand, emphasizing clinically proven gum protection for sensitive users.