Motorized Pergolas Market Size

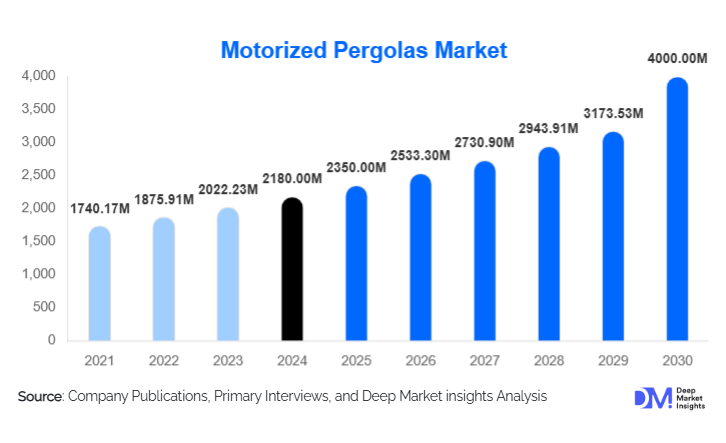

According to Deep Market Insights, the global motorized pergolas market was valued at approximately USD 2,180 million in 2024 and is projected to grow from about USD 2,350 million in 2025 to reach roughly USD 3,421 million by 2030, expanding at a CAGR of 7.8 % during the forecast period (2025–2030). This growth is largely driven by rising consumer interest in outdoor living spaces, smart home automation, and increasing investments in commercial and hospitality sectors for flexible shading solutions.

Key Market Insights

- Aluminum‐based motorized systems dominate due to their lightweight, corrosion resistance, and ease of automation.

- Smart / IoT integrated controls are rapidly gaining traction, enabling users to open/close via app or sensors (wind, rain, sun).

- Residential applications lead demand, driven by homeowners upgrading patios, decks, and rooftops into functional outdoor living zones.

- Hospitality and commercial segments are among the fastest-growing, as cafés, restaurants, and resorts leverage flexible outdoor seating to enhance ambiance and margins.

- North America commands the largest share, supported by high disposable incomes, a strong home-improvement culture, and the adoption of premium automation solutions.

- Asia-Pacific shows the highest growth rates, with expanding middle classes, increased construction activity, and rising outdoor living trends in China, India, and Australia.

Latest Market Trends

Rise of Weather-Adaptive & Sensor-Driven Pergolas

Pergola manufacturers are increasingly embedding ambient sensors for wind, rain, temperature, or solar radiation that automatically raise or tilt louvers or retract covers when weather changes. This removes user effort and improves safety in storms. Systems that “self-close” when wind thresholds are exceeded are especially valued in regions with variable weather. Integration with home automation platforms (Alexa, Google Home, Apple HomeKit) is also becoming standard, giving users voice or app control over their outdoor shading.

Modular, Lightweight & Easier Installation Designs

To reduce shipping, installation time, and costs, many new pergola models adopt modular kits. Components are pre-engineered to snap or bolt together, reducing the need for heavy site labor or structural modification. Use of extruded aluminum with form-fitting fittings, prewired motors, and plug-and-play controls simplifies deployment. These designs also allow scalable expansions (e.g., adding side screens, lighting, heating later) without full replacement.

Motorized Pergolas Market Drivers

Consumer Shift to Outdoor Living & Home Enhancement

In many developed and developing markets alike, consumers are investing more in outdoor amenities, decks, and gardens, as extensions of indoor living. Motorized pergolas provide flexibility so users can enjoy outdoors in the sun or partial shade or close the cover during rain. The trend toward experiential homes (spaces for entertaining, relaxing) strongly drives demand.

Demand for Smart / Automated Control & Convenience

As smart home adoption grows, consumers expect automation in more systems, pergolas. The convenience of controlling shade patterns by app or voice, or having the system respond to weather changes, is a differentiator. This adds perceived value and helps justify premium pricing. Products that seamlessly integrate with home ecosystems gain preference.

Energy Efficiency & Passive Cooling Benefits

Motorized pergolas help reduce interior heat gain by shading windows, terraces, or glazed facades; this lowers cooling loads and electricity consumption. In regions with high cooling demand, that benefit becomes a selling point. Governments promoting energy efficiency and sustainable building incentives further bolster adoption.

Market Restraints

High Upfront Cost & Complexity

The additional cost of motors, sensors, control systems, structural support, and skilled installation makes a motorized pergola significantly more expensive than a static pergola. These higher capital costs deter price-sensitive buyers, especially in less mature markets.

Regulatory, Building Codes & Permitting Barriers

In many jurisdictions, outdoor structures require permitting, compliance with wind or snow load standards, waterproofing, and electrical safety norms. These regulations can delay project timelines and raise costs. Local zoning, height restrictions, and architectural constraints also limit design freedom in some dense urban areas.

Motorized Pergolas Market Opportunities

Integration with Smart Homes & IoT Ecosystems

There’s a significant opportunity for players to offer plug-and-play modules or APIs that allow pergolas to integrate with broader home automation systems. Partnerships with smart home platforms, offering SDKs for third-party integrations, or bundling with home automation firms, offer a path for differentiation. Further, predictive algorithms (forecast-based closure) and remote diagnostics/maintenance features add value.

Penetration in Emerging Markets & Tier-2/3 Cities

In many APAC, Latin America, and MEA markets, awareness and adoption are still low. Targeting mid-income segments or tier-2/3 cities with simplified versions (fewer features, lower cost) can unlock large untapped demand. Local manufacturing or assembly, lower cost supply chains, and financing models (instalments, leasing) can overcome affordability barriers.

Commercial & Hospitality Contracts / Urban Infrastructure Projects

Large-scale contracts from hotels, resorts, restaurants, malls, public plazas, or governments designing shaded open spaces (parks, promenades, open corridors) represent big volume opportunities. Securing framework agreements or infrastructure project bids allows scale. In climates where outdoor seating is lucrative, pergolas can be part of value enhancement and revenue generation for premises.

Value-Add Features: Lighting, Heating, Audio & Solar Integration

Beyond shade, consumers increasingly expect pergolas with integrated LED lighting, heating (infrared), speakers, side screens, or even photovoltaic panels. These add-ons provide upsell potential and widen appeal. Suppliers who modularize and standardize add-on interfaces can reduce complexity in customizing these features for various clients.

Product Type Insights

Among product types, motorized louvered/pergola roofs are dominating since they provide a balance of shade control, ventilation, and rain protection. Aluminum-based louver systems remain the top choice due to durability and compatibility with motors. Simpler motorized retractable fabric covers also appeal in milder climates or lower-cost tiers, though they lack the robustness and premium positioning of rigid systems. As automation and sensor control become more mainstream, features like self-adaptive louvers may define future premium segments.

Application Insights

Residential applications (patios, backyards, rooftops) continue to dominate market share, as homeowners adopt motorized pergolas to enhance outdoor usability. Commercial and hospitality uses (restaurants, cafés, resorts) are the fastest growth sector: pergolas convert unused outdoor space into revenue-earning seating even in variable weather. Institutional and public projects (parks, promenades) also contribute, particularly in urban renewal or climate adaptation initiatives where shaded outdoor corridors or walkways are desired.

Distribution Channel Insights

Manufacturers increasingly sell direct to customers/installers, enabling end-to-end control and higher margin capture. Specialist outdoor living/shade solution dealers and installers remain critical, especially for local projects. Architectural / design firms often specify motorized pergolas in new construction or retrofit projects. Some firms increasingly utilize e-commerce / digital quoting systems for custom pergola kits, especially for residential customers. Alliances with solar/smart home firms or channel partnerships help broaden reach. Also, subscription or maintenance service models (warranty, scheduled checkups) are emerging.

| By Product Type | By Material | By Control System | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

The U.S. and Canada account for the largest share of motorized pergola demand globally, likely 30-40 % in 2024. High disposable incomes, home improvement culture, and progressive adoption of smart home systems drive demand. Many U.S. homeowners add pergolas to patios or poolside areas; luxury homes increasingly incorporate motorized, sensor-controlled shading solutions. The market is mature but still growing through feature upgrades and retrofit demand.

Europe

Europe likely holds about a 20-30 % share. Countries like Germany, France, the UK, Italy, and Spain are strong markets, with high demand for outdoor dining, garden amenities, and shading to reduce cooling loads. European building regulations encouraging energy efficiency, green building codes, and incentives for shading / passive cooling support adoption. Germany and France are among the leading national markets within Europe.

Asia-Pacific

APAC is the fastest-growing region. China, Australia, Japan, India, and Southeast Asia are driving adoption. In many cities, as construction and real estate growth continue and middle-class incomes rise, consumers invest more in outdoor amenities. Smart home adoption is also rising in places like China and Australia, making motorized pergolas an attractive upgrade. Growth rates in APAC are expected to exceed those of mature Western markets.

Middle East & Africa

Though smaller in absolute volume (maybe 5-10 % share), MEA is important, especially in premium projects. Harsh sun, luxury real estate, resorts, and hospitality demand strong shading solutions. Wealthy GCC countries (UAE, Saudi Arabia) increasingly import high-end motorized systems, especially for resorts, villas, and outdoor living zones. Local installation challenges and import costs remain obstacles.

Latin America

Latin America has a comparatively low share, possibly 5 % or less, but growth potential exists in Brazil, Mexico, and Argentina. Luxury residential and hospitality segments are early adopters. Import duties, currency volatility, and lower per capita incomes constrain broad uptake, but upside remains in niche premium projects and urban resorts.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Motorized Pergolas Market

- The AZEK Company (StruXure Outdoor)

- Renson

- Brustor

- ShadeFX

- Gibus S.p.A

- Ohio Awning

- Eclipse Shading Systems

- TEMO Sunrooms

- Azenco Outdoor

- Solisysteme

- Weinor

- Pratic

- Stobag AG

- Retractable Awnings (brand)

- Patio Roof / Pergola Roof (brand)

Recent Developments

- In 2025, some leading manufacturers began offering predictive weather-adaptive control, enabling pergolas to auto-close before storms based on forecast data.

- In 2024–2025, modular product offerings were expanded: lighter, easier-to-ship kits targeting mid-tier residential markets became more widespread.

- In 2025, several firms announced partnerships with smart home / IoT platform providers (e.g., voice assistant integrations, sensor platforms) to enhance interoperability and user convenience.