Motorcycle Boots Market Size

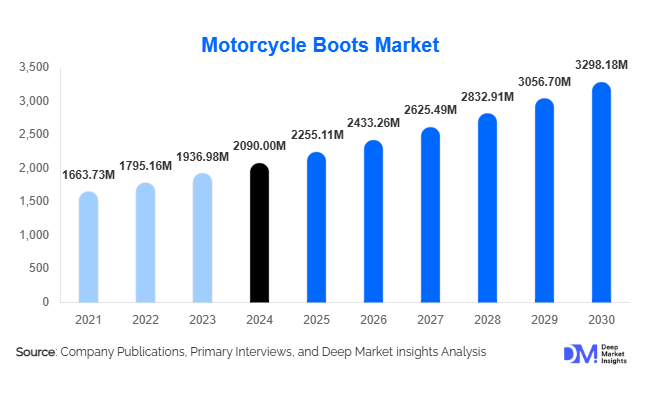

According to Deep Market Insights, the global motorcycle boots market size was valued at USD 2,090 million in 2024 and is projected to grow from USD 2,255.11 million in 2025 to reach USD 3,298.18 million by 2030, expanding at a CAGR of 7.9% during the forecast period (2025–2030). The market growth is primarily driven by increasing motorcycle sales, a growing culture of adventure and touring activities, and rising demand for protective and stylish riding gear that blends safety with fashion appeal.

Key Market Insights

- Rising global motorcycle ownership is propelling demand for high-performance and protective riding boots across commuter, sports, and adventure segments.

- Adventure and touring boots dominate the premium segment, supported by the increasing popularity of long-distance motorcycling and organized rides.

- Asia-Pacific leads the global market in volume, driven by strong two-wheeler sales in India, China, and Southeast Asia.

- Europe remains a major revenue contributor, with growing demand for CE-certified, high-quality riding gear from professional and leisure riders.

- Online retail channels are witnessing strong traction, fueled by brand-led e-commerce platforms and rising adoption of digital shopping among riders.

- Technological innovation in materials, including lightweight composites, breathable membranes, and smart impact protection, is reshaping product design.

Latest Market Trends

Integration of Smart and Adaptive Materials

Manufacturers are increasingly adopting smart materials that offer enhanced protection and comfort. Innovations include temperature-regulating linings, self-healing leather, and shape-memory polymers that conform to the rider’s foot during long rides. Brands are also experimenting with embedded sensors for impact monitoring and pressure distribution analysis. These advancements are aligning motorcycle boots with the broader trend of wearable safety technology.

Rise of Sustainable and Vegan Motorcycle Boots

The growing sustainability movement is influencing the motorcycle gear industry, leading to the adoption of eco-friendly materials such as recycled microfibers, vegan leather, and water-based adhesives. Consumers are increasingly conscious of ethical production, pushing brands to launch “green” product lines. European and North American manufacturers are particularly active in introducing sustainable motorcycle boots certified for environmental standards, catering to eco-aware riders.

Motorcycle Boots Market Drivers

Increasing Motorcycle Ownership and Adventure Riding Culture

The rapid expansion of the motorcycle market globally, particularly in emerging economies, is driving demand for protective riding gear. Adventure and touring events, such as cross-country rallies and group rides, are fostering higher consumer spending on premium boots that offer enhanced grip, waterproofing, and impact resistance. The rising trend of motorcycling as a lifestyle activity, especially among millennials, is also boosting sales of branded boots that combine safety with style.

Stricter Safety Regulations and Certification Standards

Governments across Europe, North America, and parts of Asia are enforcing stricter safety norms for motorcycle gear. The adoption of CE and ISO-certified boots is becoming mandatory in many regions, particularly for sports and racing applications. This regulatory push is creating sustained demand for certified boots and encouraging innovation in protective materials and ergonomic design.

Market Restraints

High Product Costs and Counterfeit Challenges

Premium motorcycle boots equipped with advanced protective technologies are relatively expensive, limiting their adoption among cost-sensitive consumers, particularly in developing markets. Additionally, the proliferation of counterfeit products in online marketplaces undermines brand reputation and reduces overall market profitability. Ensuring product authenticity and balancing price-performance remains a key challenge for manufacturers.

Seasonal and Regional Demand Variability

Demand for motorcycle boots often fluctuates with seasonality and climatic conditions. Sales typically peak during riding seasons and decline in colder or monsoon-prone regions. Moreover, differences in terrain and local riding culture influence product preferences, complicating inventory management for global brands. These regional disparities act as a restraint on consistent growth momentum.

Motorcycle Boots Market Opportunities

Customization and Personalization Trends

Consumers are increasingly seeking personalized designs and fit options in riding gear. Brands offering customizable motorcycle boots, with options for color, fit, and protective inserts, are gaining a competitive edge. The integration of 3D scanning and digital foot measurement technologies enables bespoke fitting, improving comfort and brand loyalty among enthusiasts.

Expansion in Women’s Motorcycle Gear Segment

The rising participation of women in motorcycling is unlocking new opportunities for product diversification. Manufacturers are introducing women-specific motorcycle boots featuring ergonomic fits, lighter designs, and aesthetic appeal without compromising protection. This growing demographic is expected to contribute significantly to market expansion over the next decade.

Product Type Insights

Racing boots lead in technology adoption, incorporating advanced protection systems for professional and track riders. Adventure and touring boots dominate revenue share due to their versatility, featuring waterproof membranes, reinforced soles, and high ankle protection. Cruiser and casual boots appeal to urban commuters seeking everyday usability, while off-road boots are popular among motocross and enduro riders, emphasizing ruggedness and superior grip.

Distribution Channel Insights

Online retail platforms hold a growing share, supported by easy product comparisons, user reviews, and attractive discounts. Specialty motorcycle stores remain critical for premium and professional-grade boots, offering expert fitting and in-store customization. OEM partnerships with motorcycle manufacturers are also expanding, where boots are sold alongside branded riding gear collections.

| By Product Type | By Application | By Distribution Channel | By Material Type | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global motorcycle boots market, accounting for the largest volume share due to high two-wheeler penetration in India, China, Indonesia, and Vietnam. Rising disposable incomes and increasing awareness of riding safety are driving the shift from informal footwear to certified riding gear. Local manufacturing hubs and expanding e-commerce infrastructure further support market growth.

Europe

Europe represents a major revenue hub, driven by strong adoption of CE-certified products, a well-developed motorcycle sports culture, and premium brand presence. Countries such as Germany, Italy, and the U.K. lead in demand for high-performance racing and touring boots. Sustainability-driven innovation and the presence of heritage brands like Alpinestars and Dainese reinforce Europe’s leadership in product quality and design.

North America

North America’s market growth is supported by a strong adventure and cruiser motorcycle segment. Riders in the U.S. and Canada favor heavy-duty touring boots and branded merchandise associated with Harley-Davidson and adventure models from BMW and Triumph. E-commerce penetration and motorcycle club culture are enhancing consumer engagement and brand visibility.

Latin America

Latin America is witnessing rising adoption of protective riding gear, with Brazil, Mexico, and Argentina emerging as key markets. Increasing motorcycle ownership for commuting and leisure, along with improved retail networks, is creating opportunities for both global and domestic brands. Mid-priced adventure and street boots are particularly in demand.

Middle East & Africa

Steady growth in the Middle East and Africa is driven by expanding adventure tourism, desert rallies, and premium motorcycle imports. Countries such as the UAE, South Africa, and Saudi Arabia are witnessing growing consumer interest in high-quality riding gear, supported by the presence of international dealerships and motorcycle clubs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Motorcycle Boots Market

- Alpinestars S.p.A.

- Dainese S.p.A.

- Fox Racing, Inc.

- REV’IT! Sport International

- TCX Boots

- Forma Boots

- Held GmbH

- SIDI Sport S.R.L.

- SPYKE

- FLY Racing

Recent Developments

- In July 2025, Alpinestars launched a new line of AI-integrated racing boots featuring real-time impact detection and dynamic protection systems.

- In May 2025, Dainese introduced a sustainable boot collection made from recycled microfibers and eco-certified leathers, targeting environmentally conscious riders.

- In March 2025, TCX Boots announced its expansion into Southeast Asia through exclusive partnerships with regional distributors in Indonesia and Thailand.

- In January 2025, REV’IT! unveiled its Adventure-X series, designed for hybrid touring with waterproof Gore-Tex lining and enhanced ankle protection.