Mobile Phone Protective Cover Market Size

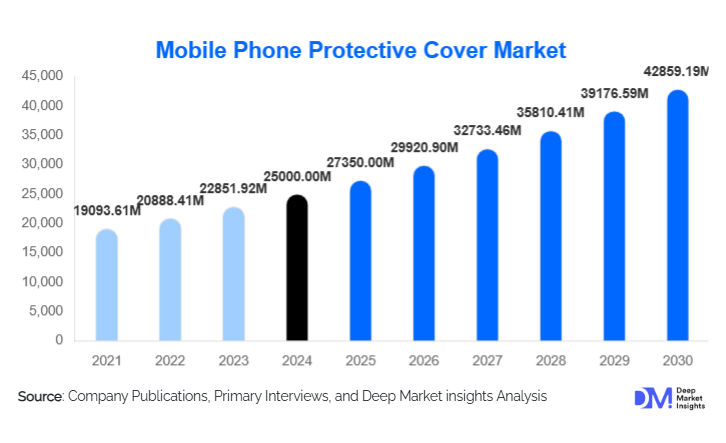

According to Deep Market Insights, the global mobile phone protective cover market size was valued at USD 25,000.00 million in 2024 and is projected to grow from USD 27,350.00 million in 2025 to reach USD 42,859.19 million by 2030, expanding at a CAGR of 9.40% during the forecast period (2025–2030). Market growth is primarily driven by the surging global smartphone adoption, increasing consumer emphasis on device protection and personalization, and the rapid expansion of e-commerce channels that facilitate easier access to diverse, customizable, and eco-friendly protective cases.

Key Market Insights

- Asia-Pacific dominates the global protective cover market, contributing nearly half of the total revenue in 2024 due to high smartphone production and consumption in China and India.

- Silicone materials account for over 56% of the global market, owing to their durability, flexibility, and low manufacturing cost.

- Offline retail channels remain the largest distribution mode, capturing around 65% of total 2024 revenue, although online channels are expanding fastest.

- Mid-range covers (USD 20–40) represent the largest price segment, striking a balance between quality and affordability.

- Eco-friendly and biodegradable cases are emerging as the most promising innovation area, aligning with consumer sustainability preferences.

- Technological integration, such as antimicrobial coatings, wireless-charging compatibility, and ruggedized multi-layer designs, is reshaping product differentiation.

What are the latest trends in the mobile phone protective cover market?

Rise of Sustainable and Eco-Friendly Covers

Growing environmental awareness among consumers is propelling demand for biodegradable, compostable, and recyclable protective covers made from plant-based plastics, bamboo fibers, or recycled thermoplastics. Major brands are integrating sustainability into their product lines, emphasizing reduced carbon footprints and circular-economy compliance. This trend is particularly strong in Europe and North America, where regulations on single-use plastics are tightening. Companies adopting eco-design and take-back programs are expected to capture premium-price segments and long-term brand loyalty.

Customization and Style-Centric Designs

Phone covers are increasingly viewed as fashion accessories rather than purely protective utilities. Consumers seek personalization, custom prints, limited-edition collaborations, and influencer-designed themes. The aesthetic shift toward lifestyle-based protection drives higher margins for brands offering tailored designs. Platforms enabling on-demand 3D printing or personalized engraving are gaining traction, particularly among younger demographics who value self-expression in accessories.

Smart and Function-Integrated Cases

Emerging technologies are transforming conventional cases into multifunctional accessories. Wireless-charging compatibility, built-in battery modules, antimicrobial coatings, and integrated kickstands are among the most popular functional upgrades. Some manufacturers are exploring cases with embedded sensors for temperature monitoring and wireless connectivity. This trend bridges convenience with protection, appealing strongly to premium smartphone owners.

What are the key drivers in the mobile phone protective cover market?

Rapid Smartphone Penetration and Replacement Cycle

Global smartphone ownership continues to surge, particularly in emerging economies where digital connectivity is expanding. With device prices escalating and designs becoming more fragile (glass backs, bezel-less displays), consumers increasingly invest in protective covers. Frequent smartphone replacement cycles further boost recurring purchases, creating a steady demand pipeline for accessory manufacturers.

Growth of E-Commerce and Omni-Channel Retail

The proliferation of online marketplaces and brand D2C platforms has democratized access to protective covers worldwide. Consumers benefit from vast design catalogs, competitive pricing, and custom ordering. Enhanced logistics networks and same-day delivery have strengthened the online retail share, which, although smaller than offline currently, is growing at the fastest rate. Hybrid sales models integrating physical showrooms with online experiences are further accelerating adoption.

Fashion-Driven Consumer Behavior

Protective covers have evolved into expressions of personal identity, blending aesthetics with protection. This behavioral shift fuels demand for branded and designer cases. Luxury brands entering the market (e.g., Gucci, Coach) validate this transformation from commodity accessory to lifestyle product. The interplay between protection, appearance, and personalization underpins sustained long-term market expansion.

What are the restraints for the global market?

Price Pressure and Low-Cost Competition

Low entry barriers and widespread OEM manufacturing in Asia have created an oversupply of low-priced generic cases. Price competition erodes margins, especially in budget and mid-range categories. Counterfeit and unbranded products also dilute brand equity, forcing leading players to invest heavily in marketing and differentiation to maintain profitability.

Market Saturation in Developed Economies

In mature markets such as North America and Western Europe, smartphone penetration and case usage are already near universal levels, limiting volume growth. Replacement purchases occur primarily during phone upgrades, making these regions reliant on premiumization rather than volume expansion for revenue growth.

What are the key opportunities in the mobile phone protective cover industry?

Adoption of Green Manufacturing and Recycling Programs

Manufacturers adopting closed-loop recycling systems and biodegradable materials can appeal to eco-conscious consumers and comply with tightening sustainability regulations. Strategic collaboration with material science firms to develop bioplastics and compostable TPU alternatives will create premium sub-markets with robust growth potential.

Expansion Across Emerging Markets

Asia-Pacific, Latin America, and Africa present immense opportunities as smartphone adoption rises rapidly in Tier-II and Tier-III cities. Affordable mid-range and budget cases tailored to regional tastes and climate conditions can deliver large-scale volume gains. Government initiatives supporting domestic electronics manufacturing, such as India’s “Make in India,” further stimulate local production of protective covers.

Integration with Smart Accessories Ecosystem

Next-generation protective cases will increasingly align with the broader smart-accessory ecosystem. Opportunities exist in integrating NFC tags, wireless charging compatibility, and AR-enabled branding. These innovations can enhance user experience, increase product lifetime value, and position companies as technology-driven leaders rather than commodity producers.

Product Type Insights

Body gloves dominate the market, accounting for approximately 34% of global revenue in 2024 ( USD 8.2 billion). These slim back-plate cases offer balanced protection and portability, making them universally appealing. Hybrid and rugged cases are gaining traction in the premium segment due to enhanced shock resistance and design aesthetics. Pouches and skins represent niche segments serving specific design or professional markets. Continuous innovation in materials and ergonomics ensures body-glove dominance in both developed and emerging economies.

Material Type Insights

Silicone covers lead the material category, capturing around 56.6% share in 2024 (USD 13.6 billion). Their popularity stems from superior grip, shock absorption, and low production cost. TPU and polycarbonate cases are common in mid-to-premium ranges, offering rigidity and clarity for transparent designs. Leather and fabric variants appeal to high-income consumers seeking premium aesthetics. Future growth will emphasize biodegradable composites and recycled thermoplastics to meet sustainability goals.

Distribution Channel Insights

Offline retail remains the dominant channel, representing about 65% of the market in 2024 (USD 15.6 billion), largely driven by consumer preference for tactile inspection before purchase. Multi-brand outlets, smartphone retail chains, and accessory kiosks remain primary sales touchpoints. However, online channels are expanding rapidly, propelled by marketplace platforms and social-commerce marketing. E-commerce is expected to surpass 40% share by 2030.

Price Range Insights

Mid-range covers (USD 20–40) hold the leading share, estimated at 45% of 2024 revenue (USD 10.8 billion). These provide balanced protection and style, appealing to the largest consumer segment. Premium covers above USD 40 are witnessing faster CAGR due to rising disposable incomes and preference for luxury smartphone accessories.

End-User Insights

Individual consumers represent the dominant end-user category, contributing approximately 85% of global demand (USD 20.4 billion in 2024). Corporate and OEM segments form niche but steadily growing markets, especially rugged covers used by enterprises in logistics, construction, and field operations. OEM-bundled cases with flagship smartphones also contribute to incremental growth in premium segments.

| By Product Type | By Material Type | By Distribution Channel | By Price Range | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific (48% share, USD 11.5 billion in 2024) is the largest and fastest-growing regional market. China leads with around 26% of global revenue, supported by strong manufacturing and domestic consumption. India is the fastest-growing country with a CAGR above 10% (2025–2030). Rising smartphone penetration, affordable e-commerce, and expanding youth demographics underpin regional dominance.

North America

North America contributes roughly 14% of global revenue (USD 3.3 billion in 2024). High smartphone replacement rates and preference for branded, rugged, and design-forward cases drive steady but moderate growth. Consumers increasingly favor eco-friendly and wireless-charging compatible cases, while luxury collaborations sustain premium demand.

Europe

Europe accounts for approximately 15% (USD 3.6 billion in 2024). Demand centers in the U.K., Germany, and France, emphasizing sustainable and fashion-driven covers. Regulatory frameworks encouraging recyclable materials and carbon-neutral production give European players a strategic edge in green product development.

Latin America

Latin America, valued near USD 1 billion in 2024, is an emerging market with Brazil and Mexico as primary growth hubs. Expanding middle-class smartphone ownership and urban retail networks fuel demand. Local production incentives could enhance regional self-sufficiency by 2030.

Middle East & Africa

This region represents about 5% of the 2024 market (USD 1.2 billion) and shows strong growth potential (forecast CAGR ≈ 8.6%). GCC countries and South Africa lead consumption, driven by affluent consumers and expanding retail ecosystems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mobile Phone Protective Cover Market

- Otter Products LLC

- Belkin International Inc.

- ZAGG Inc.

- Spigen Inc.

- Tech21 Limited

- Urban Armor Gear (UAG)

- Griffin Technology Inc.

- Casetify Limited

- RhinoShield Technologies

- Mous Products Ltd.

- Ringke (Anker Innovations Co. Ltd.)

- PureGear LLC

- Amzer Inc.

- i-Blason LLC

- Guangdong Pitaka Technology Co., Ltd.

Recent Developments

- In May 2025, Otter Products launched a new series of biodegradable cases made from post-consumer recycled plastics, targeting eco-conscious buyers in North America and Europe.

- In April 2025, Spigen Inc. introduced a magnetic charging-compatible rugged case line optimized for foldable smartphones.

- In February 2025, Casetify Limited announced global expansion of its customization studios, enabling real-time personalization across Asia-Pacific and U.S. flagship stores.