Mobile Esports Market Size

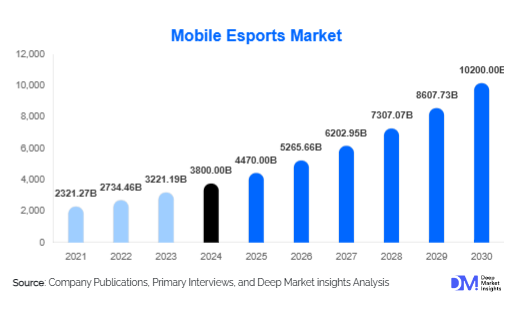

According to Deep Market Insights, the global mobile esports market size was valued at USD 3,800 million in 2024 and is projected to grow from USD 4,470 million in 2025 to reach USD 10,200 million by 2030, expanding at a CAGR of 17.8% during the forecast period (2025-2030). The growth of the mobile esports market is fueled by rising smartphone penetration, affordable high-speed internet access, and the mainstream adoption of competitive gaming across Asia-Pacific, North America, and Europe.

Key Market Insights

- Asia-Pacific dominates the global mobile esports market, led by China, India, and Southeast Asian countries, which together account for over 55% of the total market share in 2024.

- 5G adoption and cloud gaming integration are transforming the competitive experience by enabling seamless play on mid-tier devices.

- Sponsorships and advertising remain the largest revenue streams, accounting for nearly 40% of total industry revenue in 2024.

- iOS-based platforms are witnessing strong growth in North America and Europe, while Android dominates emerging economies due to affordability.

- Franchise leagues and invitational tournaments are attracting global audiences, increasing monetization opportunities for organizers and publishers.

- Hybrid monetization models, including subscription services, microtransactions, and NFT-based collectibles, are emerging as new growth drivers.

What are the latest trends in the mobile esports market?

Integration of 5G and Cloud Gaming

The rollout of 5G networks is revolutionizing mobile esports by ensuring low-latency gameplay, enabling competitive matches at scale. Cloud gaming services are further democratizing access by allowing players with low-spec devices to participate in tournaments for high-graphic games. This has been particularly impactful in Southeast Asia and Latin America, where device affordability often limits competitive participation.

Rise of Franchise-Based Leagues

Global publishers are investing heavily in structured franchise leagues, similar to traditional sports. These leagues not only attract significant sponsorship revenue but also improve fan engagement by creating consistent, seasonal competition. The Call of Duty: Mobile World Championship and PUBG Mobile Global Championship are prime examples of reshaping the competitive landscape.

What are the key drivers in the mobile esports market?

Growing Smartphone Penetration

With over 6.5 billion smartphone users globally, the availability of affordable yet powerful devices has enabled mass participation in mobile esports. In emerging economies, budget Android devices with strong processing power have unlocked large gamer bases that were previously untapped.

Monetization via Sponsorships and Media Rights

Brands are increasingly leveraging esports platforms to connect with Gen Z and Millennial audiences. Sponsorships and advertising accounted for nearly 40% of industry revenues in 2024. Media rights sales to streaming platforms further strengthen the revenue ecosystem, creating sustainable profitability for organizers and publishers.

Streaming and Community Platforms

Live streaming on platforms like Twitch, YouTube Gaming, and regional apps such as Nimo TV has amplified fan engagement. The ability to monetize through donations, subscriptions, and ad revenues has created secondary income streams for players and organizers, fueling the overall growth of mobile esports.

What are the restraints for the global market?

Monetization Challenges Beyond Sponsorships

While sponsorships dominate, reliance on this revenue stream poses risks. In regions with underdeveloped ad markets, organizers face difficulties in monetizing tournaments effectively. Balancing free participation with paid access also remains a challenge in scaling long-term revenue.

Infrastructure and Regulatory Issues

Inconsistent internet infrastructure in developing nations and regulatory uncertainty in key markets such as China limit stable growth. Policies restricting gaming hours for younger audiences and a lack of standardized governance frameworks pose risks to sustainable expansion.

What are the key opportunities in the mobile esports industry?

Expansion into Emerging Economies

Countries such as India, Brazil, Indonesia, and Vietnam are becoming global hotspots for mobile esports. With young demographics, low device costs, and rapidly improving internet infrastructure, these markets present vast untapped potential for publishers, sponsors, and tournament organizers.

Cross-Industry Collaborations

Partnerships between telecom operators, fintech companies, and game publishers are creating innovative ecosystems. Examples include bundled data plans with esports content, digital wallet integrations for in-game purchases, and co-marketing campaigns with consumer brands. These partnerships are expected to diversify revenue streams and boost adoption.

Web3 and Blockchain Integration

Blockchain technology offers opportunities to introduce NFT-based rewards, digital collectibles, and play-to-earn models. These innovations can enhance fan engagement, enable decentralized ownership of esports assets, and provide new monetization routes for players and teams.

Product Type Insights

MOBA (Multiplayer Online Battle Arena) titles dominate the mobile esports landscape, accounting for nearly 35% of the 2024 market share. Games like Mobile Legends: Bang Bang and Arena of Valor are leading due to their strong fan base in Southeast Asia and China. Battle Royale games such as PUBG Mobile and Free Fire are the second-largest category, capturing 28% of the market, driven by high global popularity and streaming appeal.

Application Insights

Sponsorships and media rights represent the largest application area, contributing around 40% of global revenues in 2024. Ticket sales and merchandise follow, supported by live tournaments and fan events. Subscription-driven models, though nascent, are expected to grow at a CAGR above 20% through 2030 as publishers experiment with premium fan engagement ecosystems.

Distribution Channel Insights

Digital platforms dominate the mobile esports ecosystem, with YouTube Gaming, Twitch, and regional platforms leading content distribution. Direct publisher apps and social media platforms such as TikTok and Instagram are becoming vital for community-driven engagement. Offline distribution through live arenas is also growing, but remains secondary compared to digital reach.

End-Use Insights

Professional players and teams remain the largest stakeholders in revenue generation, supported by sponsorships, streaming income, and tournament winnings. Streaming platforms are rapidly gaining influence as they expand fan engagement opportunities. Advertisers and sponsors are also crucial, leveraging esports for youth-targeted brand campaigns. The fastest-growing end-user segment is tournament organizers, expected to grow at 19% CAGR through 2030, driven by increasing demand for structured leagues.

| By Game Genre | By Revenue Model | By Platform | By Tournament Format | By End-User/Stakeholders |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

APAC accounts for nearly 55% of the global market in 2024, with China, India, and Southeast Asia as key growth hubs. Strong smartphone penetration, cultural affinity for mobile-first gaming, and government support in countries like South Korea and Singapore are driving adoption. India is the fastest-growing sub-market with a CAGR above 20% expected through 2030.

North America

North America holds around 20% of the global market in 2024. The U.S. dominates with large-scale tournaments and publisher-backed leagues. Strong streaming culture and integration with mainstream sports franchises fuel regional growth.

Europe

Europe contributes approximately 15% of market revenues in 2024. Countries such as Germany, France, and the U.K. are strong markets, with established esports ecosystems transitioning from PC dominance to mobile titles. Europe is projected to grow steadily at ~16% CAGR through 2030.

Latin America

LATAM is emerging as a high-growth region, particularly in Brazil and Mexico, where battle royale titles dominate. Esports events attract strong youth participation, with local publishers investing in grassroots tournament development.

Middle East & Africa

MEA is a nascent but rapidly expanding market, with Saudi Arabia and the UAE investing heavily in esports infrastructure. Africa, led by Nigeria and South Africa, shows rising engagement, though infrastructure challenges remain. Government-led initiatives such as Saudi Vision 2030 are expected to boost esports penetration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mobile Esports Market

- Tencent Holdings

- Garena (Sea Ltd.)

- Supercell

- Krafton Inc.

- Activision Blizzard

- Moonton Games

- NetEase Games

- Riot Games

- Electronic Arts (EA)

- Gameloft

- Niantic

- Ubisoft

- Scopely

- FunPlus

- AppLovin

Recent Developments

- In May 2025, Tencent announced the expansion of its global franchise league system for Honor of Kings, integrating Southeast Asia into its competitive roadmap.

- In April 2025, Krafton partnered with telecom operators in India to launch cloud-based PUBG Mobile tournaments with bundled 5G plans.

- In February 2025, Garena introduced a blockchain-based NFT marketplace for Free Fire fans, allowing digital ownership of in-game collectibles tied to esports events.