Mirror Sheets Market Size

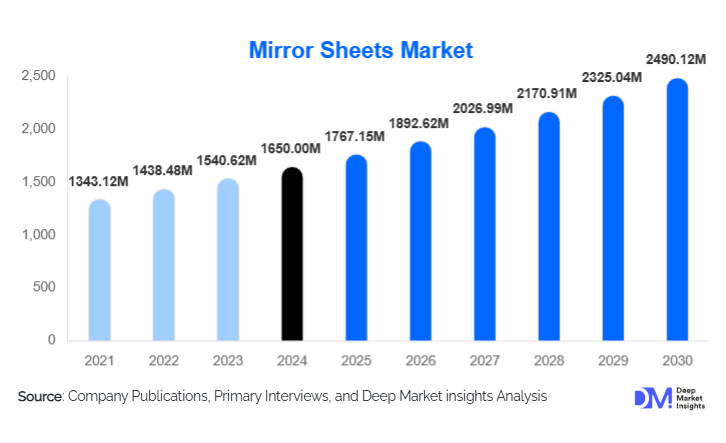

According to Deep Market Insights, the global mirror sheets market size was valued at USD 1,650 million in 2024 and is projected to grow from USD 1,767.15 million in 2025 to reach USD 2,490.12 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). This growth trajectory is driven by rising adoption in construction, commercial interiors, automotive applications, and design-oriented markets, as well as growing demand for lightweight, durable, and safer alternatives to traditional glass mirrors.

Key Market Insights

- Acrylic (PMMA) mirror sheets dominate, offering high impact resistance, lightweight design, and customization flexibility, which makes them the preferred material in modern construction and decorative applications.

- Commercial interiors are the largest end-use segment, driven by demand from offices, hotels, retail stores, and hospitality spaces seeking aesthetic, safe, and modular design solutions.

- Asia-Pacific leads the market, with China and India especially contributing strongly due to expanding infrastructure and manufacturing capacity.

- Offline distribution remains predominant, given the need for custom cutting, inspection, and large-volume orders in building-material supply chains.

- Technological innovation is accelerating adoption, with advances in coatings (anti-fog, scratch-resistant), self-adhesive backings, and custom shape fabrication (laser-cut, colored mirrors).

- Sustainability and green building integration are emerging as key themes as mirror sheet manufacturers align with eco-friendly construction practices and recyclable materials.

What are the Key Trends in the Mirror Sheets Market?

Design-Driven Customization and Decorative Innovation

One of the prominent trends is the rising demand for mirror sheets in creative, decorative, and design-focused applications. Rather than simply being used as flat mirrors, mirror sheets are now fabricated into non-standard shapes, hexagons, ovals, and laser-cut patterns and coated with colors or mirrored finishes to serve as art walls, feature panels, retail displays, and designer furniture. This shift is being propelled by interior designers and architects who view mirror sheets not just functionally, but as design elements that can reflect light, enhance spatial perception, and add sophistication. Such versatility encourages manufacturers to invest in advanced production capabilities (CNC, laser cutting) and customized coatings, thereby unlocking higher-margin business lines.

Lightweight & Safe Material Adoption

Compared to traditional glass mirrors, acrylic and polycarbonate mirror sheets are much lighter and more impact-resistant, making them safer for installation in high-traffic, public, or mobile environments. This safety advantage is fueling adoption in sectors such as commercial interiors, automotive interiors, and public infrastructure like malls, office lobbies, and transport hubs. Because acrylic mirror sheets are significantly less prone to shattering, they reduce risk and installation costs, and are easier to transport, thereby promoting broader use. Manufacturers are increasingly highlighting these benefits as competitive differentiators.

Sustainable Building & Green Construction Integration

Sustainability is a growing theme in construction globally, and mirror sheets are finding meaningful adoption in green building projects. Their lower weight reduces transportation emissions, and certain materials can be recycled more easily than conventional glass. Mirror sheet manufacturers are responding by developing eco-friendly variants, e.g., recyclable acrylics, low-VOC coatings, and aligning their production with green building certification standards. As governments and developers push sustainable development, mirror sheets are being positioned as both aesthetic and environmentally responsible building materials, creating significant demand in LEED, BREEAM, and other certified projects.

What are the Key Drivers in the Mirror Sheets Market?

Urbanization and Rapid Construction Activity

The accelerating pace of urbanization and commercial real estate growth across regions, particularly in the Asia-Pacific, is a fundamental driver. As developers construct offices, hotels, retail centers, and luxury residential complexes, there is increasing demand for materials that are visually striking yet practical. Mirror sheets provide a unique blend of aesthetics, safety, and lightweight construction, making them a favored choice for decorative panels, walls, ceilings, and furniture. The boom in interior renovations, especially in hospitality and branded commercial spaces, is also pushing volume.

Demand for Safer, Lightweight Alternatives to Glass

Traditional glass mirrors carry risks of breakage and injury, especially in high-traffic, commercial, or transport-oriented settings. Mirror sheets made from acrylic or polycarbonate offer far greater impact resistance, lower weight, and easier handling. This makes them particularly suited for environments where safety is essential, such as public buildings, car interiors, gyms, and children’s areas. The inherent advantage of being shatter-resistant drives procurement by architects and specifiers who want the mirror look without the hazard.

Technological Advancements & Product Innovation

Continued R&D in the mirror sheets industry is unlocking value through coatings, adhesives, and bespoke fabrication. Anti-fog and anti-scratch surface treatments extend applications into humid or heavy-use environments like bathrooms and fitness centers. Self-adhesive backings simplify installations, reducing labor and cost. Meanwhile, the rise of laser cutting and CNC machines enables companies to deliver highly customized shapes and decorative designs. These innovations are expanding the addressable market and allowing manufacturers to cater to specialized, design-oriented segments willing to pay premium prices.

What Are the Restraints for the Global Mirror Sheets Market?

Volatile Raw Material Prices

Mirror sheet production relies on feedstock such as PMMA, polycarbonate, and specialty resins. Fluctuations in these raw materials' costs, driven by petrochemical volatility, energy prices, and supply chain constraints, can significantly affect manufacturing margins. Smaller manufacturers without strong procurement strategies may struggle to absorb cost shocks, leading to pricing pressure or reduced profitability. For premium or value-added mirror sheets (coated, custom-cut), these cost swings are even more impactful.

Competition from Alternative Materials

Mirror sheets are not the only option for reflective or decorative surfaces. They compete with traditional glass mirrors, polished metals, coated metals, and even digital mirror-like surfaces (e.g., smart glass). In high-end architectural or decorative projects, specifiers may choose alternative materials that offer unique aesthetics, greater durability, or lower maintenance. Regulatory and building code considerations (fire resistance, building safety) may also favor other materials in certain projects, limiting the proliferation of some mirror sheet types.

What Are The Key Opportunities in the Mirror Sheets Market?

Expansion into Green & Smart Buildings

There is a strong opportunity for mirror sheet manufacturers to align with green building and smart infrastructure trends. By offering eco-friendly products (recyclable, low-emission mirror sheets), companies can partner with developers of LEED- or BREEAM-certified projects. Further, integrating mirror sheets with smart-glass technologies (e.g., switchable mirror panels) can unlock new applications in responsive façades, energy-efficient interiors, and futuristic building designs, tapping into the growing investment in smart, sustainable cities.

Customization & Luxury Design Segment

The demand for personalized, design-led interiors, especially in hospitality, boutique retail, and high-end residential spaces, is rising. Mirror sheet producers who invest in advanced fabrication (laser cutting, CNC), specialized coatings, and bespoke finishes can serve high-margin design customers. Offering custom shapes (geometric, abstract), decorative gradients, colored mirrors, or mirrored furniture panels can set these firms apart in a competitive market. There is also scope for collaboration with interior design studios and architects for exclusive, limited-edition panels.

Regional Expansion & Export Opportunities

Manufacturers can expand into emerging and high-growth geographies, especially in Asia-Pacific (China, India), Latin America, and the Middle East. These regions are investing heavily in infrastructure, hospitality, and commercial real estate, creating strong local demand. At the same time, established production bases (particularly in China and India) can serve export markets in Europe and North America. By leveraging cost-efficient production, local partnerships, and supply networks, companies can scale and capture both domestic and cross-border demand.

Material Type Insights

Acrylic mirror sheets clearly dominate the market, accounting for about 62% of total global demand in 2024 (~USD 1.0 billion of the USD 1.6 billion market). Their leadership is due to superior impact resistance, lightweight properties, and flexibility in fabrication (cutting, shaping, coating). Acrylic is also safer than glass, making it especially appealing in commercial interiors, public buildings, transportation interiors, and decorative applications. Because acrylic can be easily molded, colored, and coated, it supports a wide range of decorative and functional use cases, driving high adoption over more brittle or heavier alternatives.

Application Insights

Among the various end-use applications, commercial interiors (offices, hotels, retail) are the largest consumers of mirror sheets. This is driven by growing investments in modern, design-driven architecture, where mirror panels are used to enhance spatial perception, reflect lighting, and deliver visually appealing, safe surfaces. Retail stores and hospitality spaces especially favor mirror sheet walls and partitions for their light-reflective and decorative qualities. Meanwhile, residential demand is growing rapidly for mirror-finished furniture, decorative accent pieces, and vanity installations. In the automotive sector, the lightweight and shatter-resistant nature of acrylic and polycarbonate mirror sheets is gaining traction for vehicle interiors, particularly in EVs and ride-sharing vehicles. Also noteworthy is signage & display, where custom-shaped and coated mirror sheets are increasingly used in advertising, showrooms, and experiential retail displays.

Distribution Channel Insights

The offline distribution channel remains dominant, capturing around 65–70% of global mirror sheet sales. This is largely because construction firms, interior designers, and contractors often rely on local building-material suppliers who offer cut-to-size services, quality inspection, and immediate availability for large orders. However, online channels (e-commerce platforms, B2B websites, direct manufacturer sales) are gaining traction, particularly for custom or small-batch orders. The growth of online sales is being fueled by designers, DIY consumers, and smaller contractors who value the convenience of web-based ordering, customization, and door-to-door shipping.

| By Material Type | By Coating & Finish | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region in the mirror sheets market, representing about 35–40% of global demand in 2024. China and India are the key contributors: China not only consumes heavily but is also a major manufacturing and export hub, while India’s booming real estate and construction sectors drive strong domestic adoption. Urbanization, rising incomes, and investments in commercial real estate and hospitality are fueling demand. In addition, regional manufacturers benefit from cost advantages and export capacity, helping them serve markets in Europe and North America.

North America

North America (primarily the U.S. and Canada) accounts for roughly 25–30% of the global market. This region’s demand is driven by commercial renovations, luxury residential construction, and strong safety standards that favor lightweight mirror sheet materials. Designers and builders in this region favor high-performance, coated, and custom mirror sheet products for premium interiors. While growth is more modest compared to APAC, stable construction spending and design-conscious customers make it a mature but important market.

Europe

Europe accounts for around 20% of the mirror sheets global market. Major markets include Germany, the UK, France, and Italy. Demand is underpinned by high architectural standards, stringent safety and building codes, and a strong push toward sustainable building materials. Mirror sheet usage in luxury commercial and residential interiors is growing, especially in green-certified buildings. European buyers also place a premium on quality, design, and eco-friendly materials, driving uptake of advanced acrylic and treated mirror sheet products.

Latin America

In Latin America, mirror sheet demand is smaller (around 5–8% of global share) but rising. Countries like Brazil and Mexico are modernizing their commercial and hospitality infrastructure, fueling demand for decorative mirror panels. Economic fluctuations and import costs are constraints, but as design and construction sophistication grows, mirror sheet adoption is expected to accelerate, particularly for retail, office, and hospitality segments.

Middle East & Africa (MEA)

MEA contributes roughly 5–7% of the global mirror sheets market. Rapid development in tourism, luxury hotels, malls, and high-end real estate (especially in GCC countries such as the UAE and Saudi Arabia) is driving demand for mirror sheet materials. These markets favor decorative, premium, and safety-grade mirror sheets in both façades and interiors. Meanwhile, intra-region demand is also rising as African cities invest more in commercial and public infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mirror Sheets Market

- SABIC

- Arkema

- Emco Plastics

- Evonik

- Mitsubishi

- Plaskolite

- Fabback

- Reynolds Polymer Technology

- Rohm GmbH

- Tap Plastics

- Perspex International

- Lucite International

- Altuglas International

- Palram

- GSC Plastics

Recent Developments

- In mid-2025, a major acrylic sheet producer announced capacity expansion of its mirror sheet production line to support rising export demand from Asia-Pacific to Europe and North America.

- In early 2025, a leading chemical company unveiled a new anti-fog mirror sheet grade tailored for fitness centers, bathrooms, and humid environments.

- In late 2024, a mirror sheet manufacturer introduced colored and laser-cut mirror panels, collaborating with design studios to launch a decorative line for luxury interior projects.