Microfilm and Microfiche Equipment and Supplies Market Size

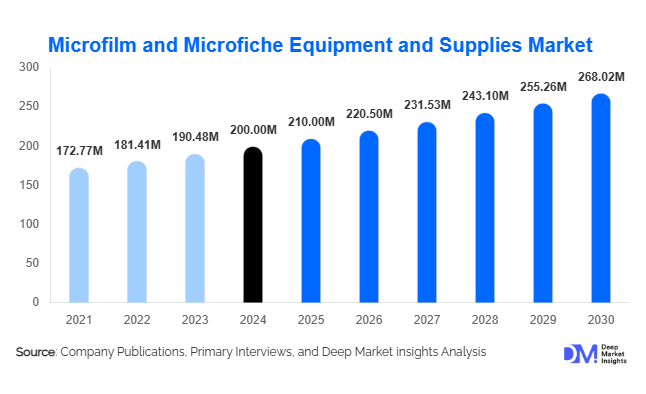

According to Deep Market Insights, the global microfilm and microfiche equipment and supplies market size was valued at USD 200 million in 2024 and is projected to grow from USD 210 million in 2025 to reach USD 268.02 million by 2030, expanding at a CAGR of around 5.0% during the forecast period (2025–2030). The market growth is driven by steady archival demand from government, legal, and institutional sectors, combined with ongoing digitization initiatives that integrate analog microform systems with digital records management.

Key Market Insights

- Microfilm scanners lead the global equipment segment, supported by the rising conversion of legacy archives into digital formats.

- Government and public archival institutions account for over 35% of demand, driven by regulatory mandates for long-term document retention.

- North America dominates the global market with around 40% share, supported by replacement cycles and modernization of aging archival infrastructure.

- Asia-Pacific is the fastest-growing region, with expanding archival and heritage preservation initiatives in China, India, and Japan.

- Hybrid analog–digital systems are reshaping the industry, integrating microform scanning, indexing, and cloud-based record management.

- Emerging opportunities lie in developing markets with increasing focus on record digitization, e-governance, and regulatory compliance.

Latest Market Trends

Hybrid Digitization Systems Driving Modernization

Institutions worldwide are transitioning from purely analog microfilm and microfiche systems to hybrid configurations that combine high-resolution scanning with digital data management. Advanced scanners and integrated software allow users to capture, index, and archive content on secure cloud or digital repositories. This trend supports modernization without discarding existing microform assets, providing cost-effective compliance with data-preservation standards. Government archives, universities, and financial institutions are leading adopters of these hybrid technologies, creating a sustained upgrade cycle for equipment manufacturers.

Archival Longevity and Regulatory Compliance Fuel Demand

As regulatory bodies enforce long-term document retention standards—particularly in government, legal, healthcare, and financial sectors—microfilm and microfiche continue to serve as reliable preservation media. Their longevity, low energy footprint, and resistance to cyber threats make them ideal for archival use. Vendors offering ISO-certified archival films, fireproof storage, and humidity-controlled cabinets are gaining traction as institutions prioritize physical backup alongside digital storage systems.

Microfilm and Microfiche Market Drivers

Long-Term Document Preservation Needs

Microfilm and microfiche formats offer unmatched stability for preserving information for centuries, unlike digital storage media that face obsolescence and data degradation. The increasing importance of secure, tamper-proof records drives continued investment in archival systems by governments, legal entities, and libraries worldwide.

Digitization of Historical and Government Archives

National and institutional digitization programs are creating strong demand for scanning equipment and hybrid systems. Converting analog archives into searchable digital repositories helps improve accessibility and preservation, ensuring microfilm and microfiche scanners remain in high demand globally.

Lifecycle Replacement of Aging Equipment

In developed markets such as the U.S., U.K., Germany, and Japan, a large installed base of legacy microform readers and processors is due for replacement. This lifecycle upgrade cycle sustains demand for newer, high-speed, energy-efficient scanners and related consumables.

Market Restraints

Competition from Fully Digital Solutions

Digital document management platforms and cloud storage systems are increasingly replacing analog archives. While microfilm remains valuable for long-term preservation, the convenience and scalability of digital records management are gradually eroding analog system adoption, especially in smaller institutions.

High Initial Equipment Costs and Limited Technical Support

Specialized microfilm and microfiche scanners, printers, and processing systems are capital-intensive. In emerging markets, high procurement and maintenance costs, coupled with limited access to technical support and spare parts, restrict wider adoption and slow modernization.

Microfilm and Microfiche Market Opportunities

Digitization and Hybrid Archival Solutions

Institutions holding decades of microfilm archives require conversion to digital formats to ensure accessibility. Vendors offering integrated scanning, indexing, and cloud storage solutions are poised to capture significant demand. Partnerships with government archives, universities, and cultural institutions will open recurring revenue streams through service contracts and software subscriptions.

Growing Demand in Emerging Regions

Asia-Pacific and Latin America are emerging as new frontiers for archival infrastructure. Government-led e-governance programs and historical record preservation projects in countries like India, Brazil, and Mexico are creating demand for both microfilm equipment and consumables. Local manufacturing initiatives such as “Make in India” and modernization grants are also encouraging regional production and distribution hubs.

Compliance-Driven Preservation in Regulated Industries

Healthcare, banking, and legal sectors face stringent data retention regulations. Microfilm’s physical stability and immunity to digital tampering make it a preferred medium for backup archival. Equipment suppliers that emphasize compliance-ready products and ISO-certified media will see increasing procurement from regulated industries.

Product Type Insights

Microfilm scanners dominate the equipment segment, accounting for nearly 30% of global market share in 2024. They are essential for digitization projects that transform analog film archives into searchable digital databases. The scanners segment benefits from continuous technological upgrades such as AI-powered image correction, auto-indexing, and OCR capabilities. In contrast, standalone microfilm readers and printers are gradually declining as hybrid digitization systems gain prominence.

End-Use Industry Insights

Government agencies represent the largest end-use segment, with approximately 35% of the 2024 market share. Long-term document retention laws, property and census record preservation, and national archival projects sustain demand. Libraries and universities follow closely, supported by heritage preservation and academic digitization initiatives. The fastest-growing end-use sectors include healthcare and insurance, where analog archiving is being reintroduced for compliance, redundancy, and data integrity.

| By Product Type | By Supplies / Consumables | By End-Use Industry |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds about 40% of global revenue, driven by the modernization of U.S. federal and state archives, university repositories, and legal institutions. Ongoing equipment replacement cycles and archival conversion projects ensure steady demand. The U.S. remains the single largest national market, supported by robust institutional funding and service infrastructure.

Europe

Europe represents roughly 25% of the global market, with strong archival activity in the U.K., Germany, and France. Publicly funded heritage digitization programs and preservation of historical documents sustain market activity. Eastern Europe shows increasing investment as EU funding expands access to digital archival infrastructure.

Asia-Pacific

Asia-Pacific is the fastest-growing region with an estimated CAGR of 6–8% through 2030. China and India are leading markets as governments push for the digitization and modernization of administrative archives. Japan and South Korea maintain steady replacement demand for high-end scanning and archival systems. Regional suppliers are emerging to serve domestic requirements, reducing dependence on imports.

Latin America

Latin America contributes around 8–10% of the global market. Brazil and Mexico are the largest markets, investing in national archives and digital transformation programs. Regional universities and government departments are gradually shifting to microform-digital hybrid systems, creating a foundation for future growth.

Middle East & Africa

MEA accounts for about 5% of the market, with growth driven by cultural heritage preservation and government archival projects in the GCC and South Africa. National digitization efforts and the establishment of historical record centers are stimulating equipment and supplies demand, particularly for scanners and archival-grade storage systems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Microfilm and Microfiche Equipment & Supplies Market

- Canon Inc.

- Konica Minolta Holdings, Inc.

- The Crowley Company

- Eastman Park Micrographics

- e-ImageData Corporation

- SunRise Imaging

- Mekel Technology

- Wicks & Wilson Ltd.

- Microbox GmbH

- BMI Imaging Systems

- ST Imaging Inc.

- Microtek International Inc.

- Kodak Alaris Imaging Services

- Indus International

- Docharbor Document Technology

Recent Developments

- In June 2025, Canon Inc. launched a new high-speed hybrid microfilm scanner integrating cloud-based indexing and automated OCR to enhance archival digitization efficiency.

- In March 2025, Konica Minolta expanded its consumables portfolio in North America, introducing archival-grade microfilm rolls and protective storage solutions for government and university archives.

- In January 2025, e-ImageData Corporation partnered with several national archives in the Asia-Pacific region to provide full-service microfilm-to-digital conversion programs, including scanners, software, and training support.