Micellar Water Market Size

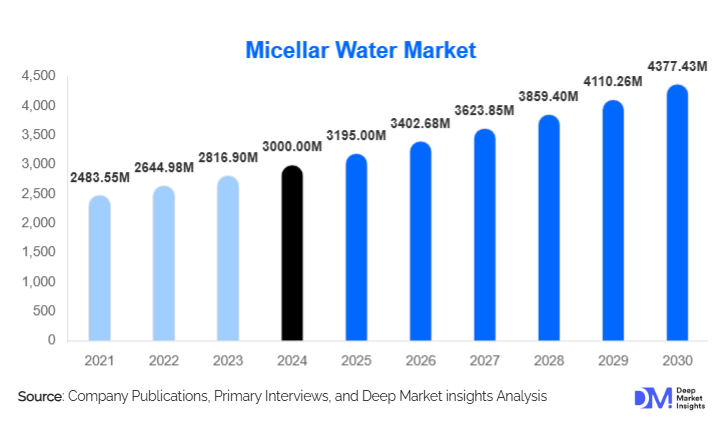

According to Deep Market Insights, the global micellar water market size was valued at USD 3,000 million in 2024 and is projected to grow from USD 3,195.00 million in 2025 to reach USD 4,377.43 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). Market growth is primarily driven by rising consumer demand for gentle, multifunctional skincare, the expansion of clean beauty trends, and increasing adoption of no-rinse cleansing solutions across global demographics.

Key Market Insights

- Water-based micellar water remains the dominant product type, capturing the largest share due to its gentle, universally compatible formulation.

- Makeup removal applications lead global consumption, supported by strong adoption among women and increasing skincare awareness among Gen Z and millennials.

- Asia-Pacific is the fastest-growing regional market, driven by rising disposable incomes, rapid e-commerce adoption, and strong K-beauty and J-beauty influence.

- Hypermarkets and supermarkets continue to dominate distribution, although e-commerce is gaining rapid momentum due to digital beauty retailing.

- Clean beauty and sustainability trends are reshaping product development, with brands emphasizing eco-friendly packaging and transparent formulations.

- Technological innovation is accelerating, including the use of active ingredients like niacinamide and hyaluronic acid and the integration of recyclable or refillable packaging systems.

What are the latest trends in the micellar water market?

Sustainable & Clean-Beauty Formulations Surge

Clean beauty continues to drive major reformulation efforts as consumers increasingly seek gentle, transparent, and environmentally responsible skincare solutions. Brands are reducing harsh preservatives, adopting plant-derived surfactants, and integrating dermatologically tested, hypoallergenic formulations. Sustainability initiatives, such as refill stations, biodegradable wipes, and recycled PET packaging, are growing rapidly. Many companies now emphasize low-waste production and responsible ingredient sourcing to align with consumer expectations and strengthen eco-conscious positioning.

Advanced Micellar Waters with Active Ingredients

Micellar water is evolving beyond its role as a basic cleanser, with brands introducing variants enhanced with functional skincare actives such as hyaluronic acid, niacinamide, salicylic acid, and antioxidants. These hybrid micellar solutions target specific skin concerns, including hydration, brightening, or acne control, transforming micellar water into a multifunctional skincare step. This trend is especially popular among younger consumers seeking simplified skincare routines that deliver visible benefits without multiple products.

What are the key drivers in the micellar water market?

Growing Demand for Gentle, Multifunctional Skincare

Consumers worldwide are prioritizing gentle skincare routines that minimize irritation and simplify daily regimens. Micellar water, known for its mild surfactants and no-rinse application, is increasingly used as a replacement for harsher cleansers or multi-step routines. The growing popularity of “skinimalism”, favoring minimalist, effective skincare, further fuels demand. Dermatologist recommendations and the rising prevalence of sensitive skin concerns reinforce micellar water’s position as a preferred everyday cleanser.

Rapid Expansion of E-commerce Beauty Retail

The global shift toward digital beauty retail is significantly boosting micellar water sales. Online platforms offer consumers easy access to diverse brands, ingredient breakdowns, user reviews, and personalized recommendations. Influencer-driven content, skincare tutorials, and social media marketing reinforce awareness and accelerate conversions. The convenience of subscription-based delivery and direct-to-consumer beauty brands further supports sustained market expansion through online channels.

What are the restraints for the global market?

Market Saturation and Pricing Pressure

The proliferation of micellar water brands, from multinational corporations to indie beauty startups, has intensified competition and led to product commoditization. Price wars in mass-market segments, particularly across supermarkets and online retail, have made it increasingly difficult for brands to differentiate based on basic cleansing performance alone. This saturation challenges new entrants and reduces profit margins for established players seeking premium positioning.

Limited Awareness in Emerging Markets

Despite global growth, consumer awareness of micellar water remains relatively low in several developing countries. Traditional cleansing products such as soaps, gels, and face washes continue to dominate. Price sensitivity and misconceptions about micellar water being a premium or non-essential product slow adoption. Brands must invest heavily in education, sampling, and localized marketing to overcome cultural barriers and accelerate penetration in these regions.

What are the key opportunities in the micellar water industry?

Expansion into Men’s Grooming

The rapid rise of the male grooming industry presents a major untapped opportunity. Men are increasingly adopting skincare routines, creating demand for simple, effective products. Micellar water can be positioned as a convenient, travel-friendly, and gentle cleanser suitable for pre- and post-shave care. Tailored formulations addressing oil control, acne, or sensitivity can unlock a high-growth demographic and diversify revenue streams for brands.

Growth Potential in Dermatology & Professional Care

Dermatology clinics, spas, and professional skincare environments are integrating micellar water into pre- and post-procedure cleansing due to its non-irritating and residue-free properties. This presents a niche but expanding segment for clinical-grade micellar water formulations. Opportunities include partnerships with dermatologists, co-branded clinic lines, and products formulated for sensitive or medically treated skin.

Product Type Insights

Water-based micellar water dominates the market, accounting for the majority of global demand thanks to its broad skin compatibility and cost-effectiveness. Oil-infused micellar waters are gaining popularity for effectively removing waterproof makeup and long-wear cosmetics, appealing particularly to beauty enthusiasts. Micellar wipes maintain a stable niche in travel and convenience-driven segments but face scrutiny due to environmental concerns. Specialty variants, including micellar waters formulated with hyaluronic acid, niacinamide, or exfoliating acids, are driving premiumization and attracting consumers seeking targeted skincare benefits.

Application Insights

Makeup removal is the leading application, contributing the largest share of revenue, driven by its effectiveness in dissolving cosmetics without harsh rubbing. Daily cleansing represents a fast-growing application as consumers adopt micellar water into their morning and night routines. Toning and hydration-focused variants are rising as multifunctional products become mainstream. The professional dermatology segment is emerging, supported by increasing use of gentle cleansers in clinical treatments and aesthetic procedures.

Distribution Channel Insights

Hypermarkets and supermarkets lead global distribution, offering mass visibility and competitive pricing. Pharmacies and drugstores maintain strong traction due to the clinical positioning of many trusted micellar water brands. E-commerce is the fastest-growing channel, benefiting from influencer marketing, subscription models, and digital skincare education. Specialty beauty retailers continue to expand premium product offerings, while salons and spas increasingly stock professional-grade micellar products for in-treatment and retail use.

End-User Insights

Women represent the largest consumer segment, driven by makeup removal and skincare routines. Men are an emerging, high-potential demographic as grooming habits evolve and simplified skincare gains popularity. Teenagers and young adults show strong adoption due to sensitive skin and influence from social media skincare trends. Unisex formulations dominate overall market positioning, helping brands target multiple demographics.

| By Product Type | By Skin Type | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents a significant share of global demand, supported by high awareness of gentle skincare products, strong clean beauty trends, and widespread adoption of multifunctional cleansers. The U.S. drives regional consumption through both mass-market and premium skincare channels, with e-commerce becoming increasingly influential in purchase decisions.

Europe

Europe remains a highly mature market and the historical birthplace of micellar water, with strong demand in countries such as France, Germany, and the U.K. European consumers prioritize dermatologist-tested, fragrance-free, and sensitive-skin formulations. Premium pharmacy brands maintain strong regional loyalty, supported by advanced R&D and strict cosmetic regulations.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rising disposable income, growing skincare culture, and aggressive expansion of global and local beauty brands. China and India dominate volume growth, while South Korea and Japan lead innovation trends. E-commerce penetration and K-beauty influence significantly accelerate product adoption across APAC.

Latin America

Latin America is experiencing steady growth with increasing beauty awareness and expanding retail access. Brazil and Mexico lead regional demand, supported by rising urbanization, social media influence, and a shift toward Western skincare habits. Affordable product formats and localized marketing strategies are critical for wider adoption.

Middle East & Africa

The Middle East and Africa are emerging markets with rising demand for premium skincare products. The growth is supported by expanding retail infrastructure, increasing disposable incomes, and a strong preference for dermatologist-recommended products. South Africa shows especially high growth potential, while GCC countries drive premium segment adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Micellar Water Market

- L'Oréal S.A. (Garnier, L’Oréal Paris)

- Bioderma (NAOS)

- Unilever PLC

- Johnson & Johnson

- Beiersdorf AG

- Shiseido Company

- Procter & Gamble

Recent Developments

- In 2024, several global brands expanded their sustainable packaging lines, introducing refill pouches and bottles made from 100% recycled PET to support circular beauty initiatives.

- In 2025, leading manufacturers launched micellar waters infused with niacinamide and hyaluronic acid, targeting consumers seeking functional, treatment-based cleansing products.

- In 2025, multiple K-beauty brands entered the European and North American markets with probiotic and botanical micellar formulations, accelerating competitive intensity in premium skincare segments.