Mica Heater Market Size

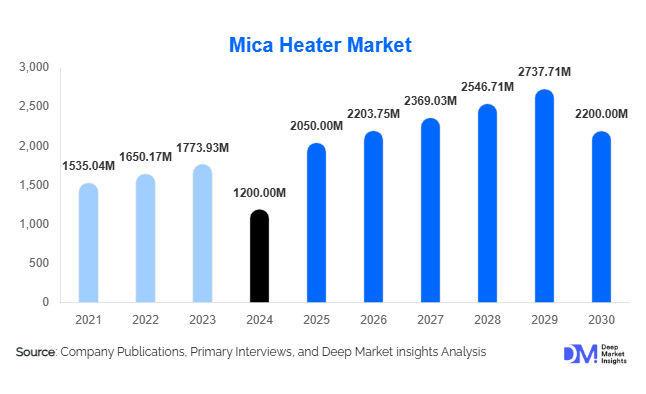

The global mica heater market is estimated to have been valued at approximately USD 1,200 million in 2024. Over the period from 2025 to 2030, the market is projected to grow from approximately USD 1,290 million to USD 1,851.96 million, expanding at a CAGR of 7.5 % during 2025–2030. This growth reflects rising demand across industrial heating, electronics, automotive, medical, and consumer applications, as well as increasing emphasis on energy efficiency and customization.

Key Market Insights

- Industrial heating & processing remains a core demand driver, as many sectors (plastics, chemicals, packaging, and metal processing) require robust, high-temperature heating that mica heaters are well-suited for.

- Flexible mica heater types are gaining traction because of their ability to conform to curved or complex surfaces, making them widely adopted in automotive, electronics, and OEM equipment designs.

- Asia-Pacific dominates market share, due to its large manufacturing base, growing industrialization, lower manufacturing costs, and strong export orientation.

- North America and Europe retain premium and high-spec segments, driven by advanced applications (semiconductors, medical, aerospace) and stricter regulatory/efficiency requirements.

- Technological integration (sensors, control systems, IoT) is reshaping product offerings, enabling more intelligent, responsive mica heater solutions in new or premium applications.

Latest Market Trends

Transition to Etched-Foil and Thin / High Witt Density Designs

One of the emerging trends is the increased adoption of etched-foil mica heater designs and ultra-thin mica heater layers. These designs allow more uniform heat distribution, better surface contact, faster thermal ramp-up, and lower thermal gradients. In many premium industrial and electronics applications, buyers now expect mica heaters to deliver uniformity and thermal management with minimal bulk. Manufacturers are investing in precision etching, higher-purity mica substrates, and improved bonding methods to reduce hotspots, improve reliability, and meet tighter tolerances. This trend is driving premium pricing and differentiation among providers.

Integration with Sensors, Control Systems & Smart Features

Another growing trend is embedding temperature sensors, feedback loops, and IoT / intelligent control capabilities into mica heater units. Rather than standalone resistive elements, next-generation heaters are expected to adjust their output in real time based on ambient conditions or process needs. This trend benefits customers by reducing energy consumption, extending life, and enabling predictive maintenance. In applications like semiconductor processing, medical devices, or battery preheating, this kind of smart thermal control is increasingly demanded. As downstream systems become more automated and digitized, mica heater vendors are compelled to add “intelligence” to their products.

Mica Heater Market Drivers

Expansion of Industrial and Manufacturing Capacity

As many economies (especially in Asia, Latin America, and parts of the Middle East & Africa) continue to industrialize and expand manufacturing output, demand for heating elements in machinery, processing lines, ovens, extruders, and thermal treatment systems rises. Mica heaters are well-positioned in many of these thermal stages, thanks to their durability, temperature tolerance, and insulation properties. Capital investments in factories and thermal equipment directly boost the market for heating elements, including mica-based ones.

Demand for Energy Efficiency and Precision Heating

Because heating often accounts for a significant portion of operating energy costs across industries, customers are increasingly looking for solutions that minimize losses, heat more precisely, and respond more quickly. Mica heaters, especially advanced designs, offer better insulation, reduced standby losses, and tighter temperature control capability. As regulatory and sustainability pressures grow, the shift toward energy-efficient thermal management is a key growth driver.

Growth in Downstream Sectors (EV, Electronics, Medical, Food Processing)

Many downstream industries that rely on heating functions are themselves in high-growth mode. For instance, electric vehicles require battery preheating or thermal management; electronics and semiconductors require precise temperature zones; medical diagnostic devices often need controlled heating; and food processing depends on sterilization, baking, drying, and packaging heat stages. Because these sectors are growing rapidly, their heating component demand (including mica heaters) grows in tandem.

Market Restraints

Raw Material Price Volatility & Supply Constraints

Mica, particularly high-grade mica sheets or insulating mica layers, is a natural mineral with limited sources and variable quality. Fluctuations in mica supply, mining regulation, transport logistics, and energy costs can cause sharp input cost swings. These impact margins may force price increases or supply constraints. Moreover, quality consistency is critical because defects in mica insulation can lead to failure, so quality control adds cost.

Competition from Alternative Heating Technologies

Mica heaters face competition from ceramic heaters, silicon rubber heaters, polyimide (Kapton) heaters, infrared lamps, carbon / graphene-based heaters, etc. In lower-temperature or less demanding applications, cheaper alternatives may suffice. If alternative technologies improve (in cost, durability, efficiency), they may further encroach on mica heater opportunities. Thus, market participants must innovate and differentiate to maintain share.

Mica Heater Market Opportunities

Penetration into Emerging Industrial Regions

Many emerging and developing economies, particularly in Southeast Asia, Africa, Latin America, and parts of Central Asia, are investing in industrial growth, food processing capacity, electronics manufacturing, and automotive assembly. These regions often have lower existing thermal equipment penetration, and local content requirements/regulations may favor suppliers who localize. Establishing manufacturing, sales, and service presence in these regions presents a significant opportunity for both established and new entrants.

Smart and Connected Heating Solutions

Integrating IoT, sensors, self-regulating control, and predictive maintenance features into mica heaters opens new value propositions: lower energy use, longer life, remote diagnostics, and adaptive heating profiles. Customers in high-cost, high-precision applications increasingly expect “smart” heating components. Suppliers that can provide integrated, plug-and-play, intelligent mica heaters will differentiate themselves and command premium pricing.

Regulatory / Incentive Driven Upgrades & Retrofitting

Governments are increasingly applying energy-efficiency standards, emissions control mandates, and incentives for upgrading industrial equipment. Many existing facilities may be mandated or motivated to replace or retrofit aging heating elements with more efficient, safer, and better-performing ones (mica-based). This “replacement and retrofit opportunity” is especially sizable in mature markets (North America, Europe) and in energy-intensive industries. Also, public infrastructure / industrial park projects often specify high-efficiency heating standards, creating demand for qualified mica heater suppliers.

Product Type Insights

Among product types, flexible mica heaters currently dominate in terms of growth potential and adoption, particularly in electronics, automotive, and OEM applications. Their ability to conform to curved or irregular surfaces, combined with thin profiles and customization flexibility, makes them attractive for thermal wrap, battery heating, component heating, and compact systems. Meanwhile, rigid mica band and strip heaters remain strong in heavy industrial heating roles. The trend toward thinner, higher watt density designs, as well as combined sensor/control integration, is shifting some value toward flexible types in premium applications.

Application Insights

Industrial heating & processing is the largest application, relying on mica heaters for ovens, extrusion lines, sealing machines, packaging, and thermal treatment. Automotive/battery thermal management is a growing application, especially in electric vehicles. Electronics and semiconductor manufacturing demand fine, uniform heating (e.g., wafer processing, reflow zones). Medical and laboratory applications requiring precise, small-scale heating also contribute. Food & beverage packaging and sterilization use mica heaters in ovens, dryers, and sealing systems. As applications diversify, customized shapes and integration with control features are in greater demand.

Distribution Channel Insights

OEM direct sales remain a dominant channel, especially for industrial, automotive, and electronics applications, where the heater is integrated into equipment. Distributors and specialty thermal component suppliers serve replacement, repair, or lower-volume markets. Online / e-commerce is growing, especially for small, standard heaters, spare parts, and aftermarket buyers. In emerging markets, local agents or representatives help address distance, service, and support barriers. Value-added distributors offering technical support and customization are preferred where application complexity is higher.

End-User Industry Insights

Within end users, the electronics/semiconductor segment is rising fastest, driven by global demand for chips, sensors, and miniaturized devices with tight thermal tolerances. The automotive & EV segment follows closely, driven by battery preheating, thermal management, cabin heating, and temperature-sensitive components. Industrial manufacturing & processing remains the largest base segment, sustaining demand and stability. Medical / healthcare is emerging as a niche but high-value segment requiring reliability and compliance. Food & beverage/packaging demand is stable and growing, especially in regions with rising food processing and export sectors.

| By Product Type | By Application | By Distribution Channel | By End-User Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia Pacific

Asia Pacific commands the largest share of the global mica heater market ( 40–45 % in 2024). China is the largest single country demand center, fueled by extensive manufacturing of electronics, automotive, consumer appliances, and industrial systems. India is nearly the fastest-growing regional markets, due to government support for manufacturing (“Make in India”), expanding industrial base, and growing domestic demand. Southeast Asian countries (Vietnam, Thailand, Malaysia) are benefiting from global supply chain shifts and increasing exports, further boosting demand for mica heater components. The relatively lower cost base and capacity expansion in these countries support competitive pricing and export volume.

North America

North America holds about 25-30 % of the market in 2024. The United States leads, powered by high-spec industrial, semiconductor, aerospace, medical, and automotive markets. Strict efficiency standards, high safety/compliance requirements, and innovation demand favor premium, high-margin mica heater products. Canada and Mexico add to the base demand in manufacturing and industrial sectors. Growth here is moderate but steady, with replacement/retrofit opportunities and stricter regulatory pressures favoring updated heater designs.

Europe

Europe’s share is about 15–20 %. Germany, the UK, France, Italy, and Eastern European nations are key contributors, primarily in advanced manufacturing, automotive, food processing, and machinery. Strong regulation around energy efficiency, safety, and emissions pushes demand for higher-performance heaters. Eastern Europe is showing faster growth within the region due to industrial catch-up, lower costs, and relocation of manufacturing from Western Europe. Growth is stable, though incremental.

Latin America

Latin America holds a smaller share (5–8 %). Brazil and Mexico are leading markets for industrial, food processing, and light manufacturing demand. These markets often import mica heater elements or depend on regional vendors. Growth is slower due to capital constraints, foreign exchange volatility, and weaker infrastructure. Nonetheless, with rising industrial investment and demand for upgrading machinery, there is an incremental opportunity.

Middle East & Africa (MEA)

MEA accounts for 5–7 %. Gulf countries (UAE, Saudi Arabia) are driving demand via petrochemicals, heavy industry, and infrastructure projects, while North Africa and South Africa contribute via food processing and industrial expansion. Harsh environmental conditions, high temperature demands, and infrastructure investments drive demand for robust, reliable heaters. The fastest regional growth is expected in the Gulf / GCC region as part of industrial diversification plans.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mica Heater Market

- Chromalox Inc.

- Watlow Electric Manufacturing Company

- Tempco Electric Heater Corporation

- Tutco Heating Solutions Group

- Backer Hotwatt, Inc.

- Omega Engineering, Inc.

- Heatron Inc.

- National Plastic Heater, Sensor & Control Inc.

- Minco Products, Inc.

- Elmatic Ltd.

- Zoppas Industries S.P.A.

- Delta MFG

- Holroyd Components Ltd.

- Heat and Sensor Technology

- BriskHeat Corporation

Recent Developments

- 2025 – Chromalox and partners launched a new line of high-watt-density mica band heaters optimized for harsh industrial environments, with improved thermal cycling resilience and longer life.

- In early 2025, BriskHeat announced a collaboration with Keenovo to co-develop open mica heater modules for high-temperature industrial use, enabling modular, scalable heating systems.

- Mid-2025 – A leading semiconductor OEM awarded Sable Thermal a major supply contract for mica heaters with integrated temperature sensors for wafer processing tools, reflecting the shift toward “smart” heater components.