Merchandising Units Market Size

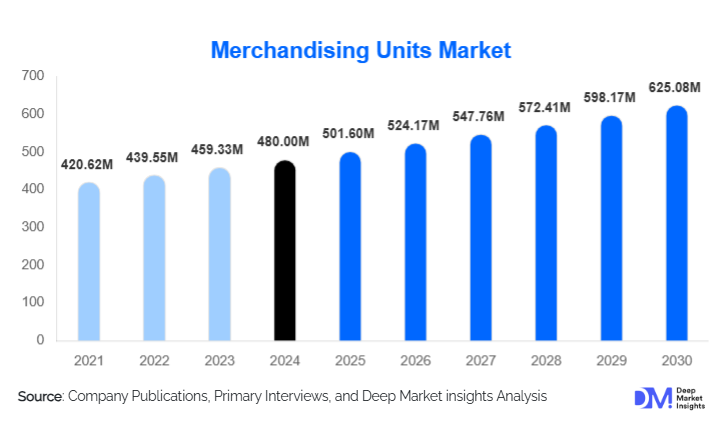

According to Deep Market Insights, the global merchandising units market size was valued at USD 480 million in 2024 and is projected to grow to around USD 501.60 million in 2025 and USD 625.08 million by 2030, expanding at a CAGR of 4.5% over the forecast period (2025–2030). This steady growth is fueled by increasing retail modernization, demand for experiential and sustainable in-store fixtures, and rising adoption of modular and interactive merchandising solutions.

Key Market Insights

- Floor-standing displays (FSDUs) dominate the product mix, offering the best visibility, brand exposure, and flexibility for retail promotions.

- Corrugated board remains the preferred material, due to its cost-effectiveness, recyclability, and ease of customization.

- Temporary/promotional merchandising units are a high-growth segment, leveraged heavily for campaigns, seasonal offers, and product launches.

- Offline (brick-and-mortar) retail continues to account for the majority of demand, underscoring the continued importance of physical stores in merchandising investment.

- North America captures the largest regional share, supported by mature retail infrastructure and rapid adoption of advanced fixture designs.

- Asia-Pacific is the fastest-growing region, driven by rapid retail modernization, rising middle-class consumption, and increased organized retail penetration in markets like China and India.

- Sustainability is a critical theme, with an accelerating shift toward recyclable corrugated materials, modular designs, and eco-friendly merchandising units.

- Digital & interactive displays are gaining ground, as brands seek to integrate touchscreens, IoT, and smart modules into merchandising units to engage consumers more effectively.

What are the latest trends in the merchandising units market?

Sustainable & Circular Design Focus

Manufacturers are increasingly designing merchandising units with circularity in mind. Displays made from recycled corrugated cardboard, bio-based plastics, or other eco-friendly materials are becoming more common. The trend toward modular and reusable units supports reuse and reconfiguration across multiple retail campaigns, minimizing waste. In addition, the adoption of energy-efficient lighting (such as low-power LEDs) and designs that facilitate disassembly and recycling is broadening the appeal of “green” merchandising solutions to environmentally conscious retailers.

Rise of Interactive & Digital Displays

Merchandising units are no longer just passive structures. Brands are embedding interactive elements like touchscreens, QR-code modules, and sensor-based systems to create meaningful customer engagements. Such digital merchandising units can provide product information, capture shopper insights, and even accept orders or payments. The integration of IoT devices and data-collection capabilities is transforming these units into strategic activations rather than simple display fixtures.

Modular & Reconfigurable Fixtures

Modular merchandising units, designed to be reconfigured, expanded, or repurposed, are gaining strong traction. Retailers favor them because they can be reused across different campaigns, reducing long-term investment and improving store flexibility. This modularity also supports sustainability priorities, since reusable units help reduce waste and inventory costs.

What are the key drivers in the merchandising units market?

Retail Modernization and Organized Retail Expansion

The ongoing transformation of retail infrastructure, particularly in emerging markets, is a major driver. As supermarkets, specialty stores, and modern trade channels proliferate, demand for advanced merchandising units increases. Retailers are investing in better in-store layouts and visual merchandising, triggering growth in demand for high-quality units that improve product presentation and shopper experience.

Growing Demand for Experiential and Shopper-Engaging Displays

In-store customer experience has become a key differentiation factor in retail. Merchandising units play a strategic role in creating compelling, brand-driven shopper journeys. Interactive, digital, and modular displays deepen consumer engagement, drive impulse purchases, and provide retailers with valuable consumer data and merchandising flexibility.

Sustainability & ESG Pressures

Regulatory pressure and brand commitments to environmental, social, and governance (ESG) goals are pushing merchandising-unit makers toward sustainable designs. Eco-friendly materials (recycled board, bio-plastics), energy-efficient lighting, and circular product lifecycle concepts are all contributing to increased adoption and innovation. This sustainability focus helps companies reduce waste, comply with regulations, and market themselves as responsible partners.

What are the restraints for the global merchandising units market?

High Capital Requirements for Premium and Digital Units

Advanced merchandising units, especially those that are modular, custom-designed, or digitally enabled, entail significant upfront costs in engineering, materials, and installation. Smaller retailers may struggle with these investments, limiting adoption of premium designs in lower-margin settings or regional stores with tighter budgets.

Raw Material Volatility & Supply Chain Risks

The cost of key materials such as corrugated board, plastics, and metals is sensitive to global commodity fluctuations. Supply chain disruptions, due to geopolitical tensions, transport constraints, or resource shortages, can raise production costs and delay delivery. Sourcing sustainable materials adds complexity and risk, potentially increasing manufacturing lead times and price variability.

What are the key opportunities in the merchandising units industry?

Eco-Friendly Merchandising Solutions

There is a growing opportunity to develop merchandising units using recycled, biodegradable, or bio-based materials. Manufacturers can differentiate themselves by offering sustainable product lines that resonate with brands committed to ESG goals. Retailers are increasingly seeking eco-conscious displays to align with their sustainability mandates and customer expectations, creating a strong business case for green merchandising solutions.

Smart & Interactive Displays

By integrating digital technologies, such as touchscreens, IoT sensors, or interactive modules, manufacturers can provide value-added merchandising units that serve not simply as displays but as engagement platforms. These units can gather shopper data, provide tailored content, and even enable transactions. For new entrants or innovators, modular digital display units represent a high-margin growth opportunity.

Expansion in Emerging Retail Markets

Emerging economies in the Asia-Pacific, Latin America, and parts of Africa are modernizing their retail infrastructure rapidly. There is increasing demand for cost-effective, scalable merchandising units tailored for local markets. Players can capture this by establishing regional manufacturing, local partnerships, and designs customized for emerging retail formats. This regional expansion, combined with local production, helps reduce logistics costs and offers a significant growth runway.

Product Type Insights

Floor-standing displays (FSDUs) dominate the merchandising units market, accounting for roughly 30–35% of global demand. They are favored for their visibility, versatility, and ability to carry large branding messages. Temporary or promotional units (campaign-based) are also increasingly important, making up about 25–30% of the market; these are heavily used by brands for product launches, seasonal promotions, and limited-time offers. Modular units are growing in appeal, representing around 20–25% of demand, because they can be reconfigured and reused across multiple retail campaigns.

Application Insights

Supermarkets and hypermarkets remain the largest end-use segment, accounting for 35–40% of global merchandising-unit demand. Their large floor spaces and high promotional activity require a wide range of displays, from pallet units to endcaps and FSDUs. Within product categories, FMCG (fast-moving consumer goods) brands are among the heaviest users, running frequent promotions and seasonal campaigns. Consumer electronics and personal care segments are also significant users: electronics brands use countertop and interactive units for new-product launches, while beauty brands deploy customized stands in specialty stores to elevate in-store brand experience.

Distribution Channel Insights

Offline retail (brick-and-mortar) remains the dominant channel for merchandising units, accounting for nearly 70–75% of demand. Traditional retail chains, department stores, and specialty shops continue to rely heavily on physical fixtures. However, omnichannel and hybrid retail models are boosting demand for pop-up units, interactive kiosks, and modular displays that support both online and in-store strategies. As e-commerce retailers occasionally run pop-up or experiential stores, they too are contributing to merchandising unit adoption.

| By Product Type | By Material | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, representing about 35–40% of global demand (estimated USD 170–190 million in 2024). The region’s well-established retail infrastructure, combined with high adoption of advanced merchandising technologies and sustainability initiatives, drives unit demand. Retailers in the U.S. and Canada are investing in experiential fixtures, digital displays, and modular units to enhance shopper engagement and store flexibility.

Europe

Europe holds roughly 20–25% of the global merchandising units market (USD 100–120 million in 2024), driven by mature, design-conscious retail markets and stringent environmental regulations. Demand is skewed toward recyclable corrugated units, modular designs, and low-impact displays as sustainability becomes core to both brand and store strategies.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a 2024 share of about 25–30% (USD 120–145 million). Rapid urbanization, the rise of modern trade in China and India, and growing disposable incomes are fueling investments in in-store merchandising solutions. Retailers are increasingly deploying modular and promotional displays as they modernize store formats.

Latin America

Latin America accounts for around 5–8% of the market (USD 25–40 million) and is witnessing growth as organized retail expands in countries like Brazil and Mexico. Cost-effective corrugated units are especially popular due to their affordability and ease of deployment in promotional campaigns.

Middle East & Africa

The Middle East & Africa region holds approximately 5–7% of the global demand (USD 25–35 million in 2024). Growth is supported by increasing investment in modern retail infrastructure in GCC countries and rising interest in premium merchandising units for pop-up stores and experiential retail. In Africa, regional retail expansion and demand for modular units are contributing to market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Merchandising Units Market

- Smurfit Kappa Group

- DS Smith Plc

- WestRock Company

- International Paper Company

- Sonoco Products Company

- STI Group

- Pratt Industries

- Creative Displays Now

- Boxes & Packaging

- Cart King International

- Print & Display Inc.

- Panda Inspire

- Tilsner Carton Company

- Cheshire Packaging

- DCI Marketing

Recent Developments

- Mergers & Consolidation: Large packaging companies are consolidating to expand their capacity for merchandising unit production, such as corrugated board specialists partnering to increase scale in high-demand regions.

- Investment in Digital Displays: Several display manufacturers have launched new lines of IoT-enabled merchandising units, integrating touchscreens and sensor modules to offer interactive in-store experiences.

- Sustainability Initiatives: Manufacturers are increasingly rolling out sustainable display collections, leveraging recycled materials, modular design, and circular-disposal concepts to meet retailer ESG goals.