Men’s Sneakers Market Size

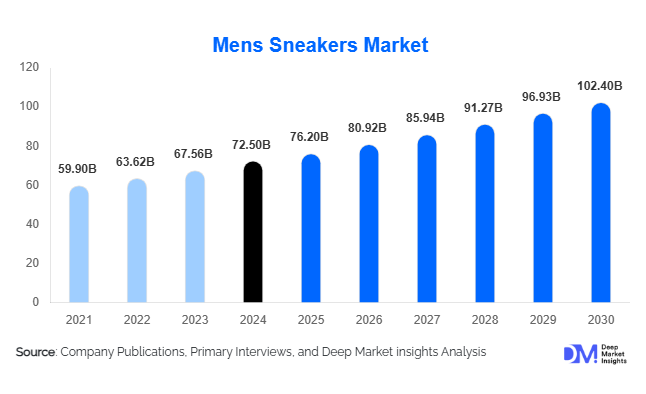

According to Deep Market Insights, the global men’s sneakers market size was valued at USD 72.5 billion in 2024 and is projected to grow from USD 76.2 billion in 2025 to reach USD 102.4 billion by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The men’s sneakers market growth is primarily driven by rising athleisure adoption, growing health and fitness awareness, and increasing consumer preference for lifestyle-oriented and fashion-forward footwear.

Key Market Insights

- Running and lifestyle sneakers dominate global sales, with consumers seeking comfort, style, and performance in a single product.

- Premium and luxury segments are expanding rapidly, fueled by brand collaborations, celebrity endorsements, and limited-edition releases.

- North America and Europe remain key markets, accounting for the majority of revenue, driven by high disposable income and strong brand awareness.

- Asia-Pacific is the fastest-growing region, with rising urbanization, growing middle-class populations, and increasing e-commerce penetration, boosting market demand.

- Technological innovations such as smart sneakers, knit fabrics, and sustainable materials are reshaping product offerings and consumer engagement.

- Online retail channels are increasingly preferred, providing convenience, extensive product choices, and personalized shopping experiences.

Latest Market Trends

Rise of Athleisure and Lifestyle Sneakers

The convergence of sportswear and fashion has fueled the growth of lifestyle sneakers. Consumers increasingly prefer sneakers that offer both performance and style, suitable for casual, work, and social settings. Brands are leveraging collaborations with designers, influencers, and celebrities to produce limited-edition collections that generate hype and maintain premium pricing. The trend toward athleisure has also encouraged innovation in materials, such as breathable knit fabrics, lightweight soles, and eco-friendly components, making sneakers versatile for multiple occasions.

Sustainable and Eco-Friendly Materials

Sustainability has emerged as a critical market trend, with consumers seeking sneakers made from recycled plastics, vegan leather, and biodegradable components. Major brands are investing in eco-certified production processes and adopting circular economy models, including take-back and recycling programs. This approach not only addresses environmental concerns but also enables brands to target premium eco-conscious consumers willing to pay a higher price for ethical products.

Men’s Sneakers Market Drivers

Increasing Health & Fitness Awareness

Growing participation in sports, running, gym workouts, and outdoor activities has driven demand for performance-oriented sneakers. Consumers prioritize comfort, durability, and injury prevention, which is fueling the demand for technologically advanced and ergonomically designed footwear.

Athleisure Fashion Trend

The popularity of sneakers as a fashion statement has increased sales across casual and lifestyle segments. Consumers seek sneakers that provide style without compromising comfort, making lifestyle sneakers one of the fastest-growing categories in the global market.

E-Commerce and Omni-Channel Growth

Online retail platforms and brand websites have expanded market reach, particularly in emerging economies. Personalized recommendations, AR-enabled try-on, and easy return policies encourage higher conversions, while hybrid retail models combining offline and online channels further support growth.

Market Restraints

High Competition and Price Sensitivity

The market faces intense competition, particularly in the mid-range segment, leading to pressure on profit margins. New entrants must invest heavily in marketing and branding to compete with established global players, creating barriers to entry.

Raw Material Price Fluctuations

Volatility in the cost of leather, synthetic materials, and rubber affects production costs and profitability. Budget and mid-range manufacturers are particularly vulnerable, as increased input costs may limit their ability to maintain competitive pricing.

Men’s Sneakers Market Opportunities

Expansion in Emerging Markets

Asia-Pacific, Latin America, and parts of Africa represent high-growth opportunities due to rising urbanization, growing middle-class populations, and increasing exposure to global fashion trends. Strategic market entry through e-commerce, partnerships, and localized marketing can drive substantial revenue growth in these regions.

Integration of Smart and Tech-Enabled Sneakers

Fitness tracking, AI-powered foot analysis, and wearable technology integration are emerging as premium product differentiators. Tech-enabled sneakers appeal to health-conscious and fitness-savvy consumers, creating opportunities for higher margins and brand loyalty through innovation.

Celebrity Collaborations and Limited Editions

Brands are leveraging influencer and celebrity partnerships to launch limited-edition sneakers, creating exclusivity and hype. These strategies not only boost short-term sales but also strengthen long-term brand positioning, particularly among younger demographics.

Product Type Insights

Running sneakers dominate the market with approximately 28% of the 2024 market share, driven by high consumer adoption for both sports and casual use. Lifestyle sneakers are quickly catching up, capturing about 25% of market share, thanks to the athleisure trend. Basketball and training sneakers are popular in regions like North America and Europe, where sports culture drives higher demand for performance-oriented footwear. Leather and synthetic materials remain preferred choices due to durability and aesthetic appeal, while knit/fabric sneakers are growing rapidly, accounting for around 12% of sales in 2024.

Distribution Channel Insights

Online retail dominates, accounting for over 35% of global sales, due to convenience, variety, and personalized experiences. Offline channels, including brand stores and multi-brand outlets, account for around 50%, with hybrid retail strategies bridging the gap. Increasing omni-channel strategies, mobile apps, and subscription-based models are further enhancing consumer engagement and sales conversion.

End-Use Insights

Sports and fitness remain the largest end-use segment, comprising 40% of the market in 2024. Casual wear and fashion-driven purchases account for 35%, growing faster due to the athleisure trend. Corporate and specialized uniform use is emerging as a niche application. The demand for export-oriented sneakers is increasing, particularly in regions like North America, Europe, and the Asia-Pacific, where consumers seek branded products from global players. Rising disposable income and lifestyle changes in emerging markets are accelerating adoption across end-use categories.

| By Product Type | By Material | By Price Range | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 30% of the global market in 2024, with the U.S. being the largest contributor. High disposable income, established sports culture, and strong brand presence drive growth. Lifestyle sneakers and premium collaborations are particularly popular in this region.

Europe

Europe holds around 28% of the market, led by Germany, the UK, and France. Sustainability trends, fashion-forward consumer behavior, and mature retail channels drive demand. Eco-friendly sneakers and limited-edition collaborations are trending strongly in urban centers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by rising middle-class populations, e-commerce expansion, and increasing brand awareness in China, India, Japan, and South Korea. Growth is projected at a CAGR above 7% through 2030, with demand driven by both lifestyle and sports-oriented segments.

Latin America

Brazil, Argentina, and Mexico are emerging markets, contributing 6–7% to the global market. Consumers increasingly prefer branded lifestyle sneakers, while urbanization and youth fashion trends support growth.

Middle East & Africa

Africa represents core production hubs, while the Middle East, led by the UAE and Saudi Arabia, drives premium sneaker sales. Combined, this region accounts for approximately 9% of the global market, with strong demand for luxury and fashion sneakers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Men’s Sneakers Market

- Nike

- Adidas

- Puma

- New Balance

- Under Armour

- ASICS

- Skechers

- Reebok

- Converse

- Vans

- Li-Ning

- Anta

- Fila

- Brooks Sports

- Mizuno

Recent Developments

- In March 2025, Nike launched a new line of sustainable sneakers made from recycled plastics and biodegradable components, targeting the European market.

- In January 2025, Adidas introduced limited-edition lifestyle sneakers in collaboration with a celebrity influencer, driving premium segment growth globally.

- In February 2025, Puma expanded its e-commerce platform in Asia-Pacific, integrating AR-based virtual try-on features and personalized recommendations.