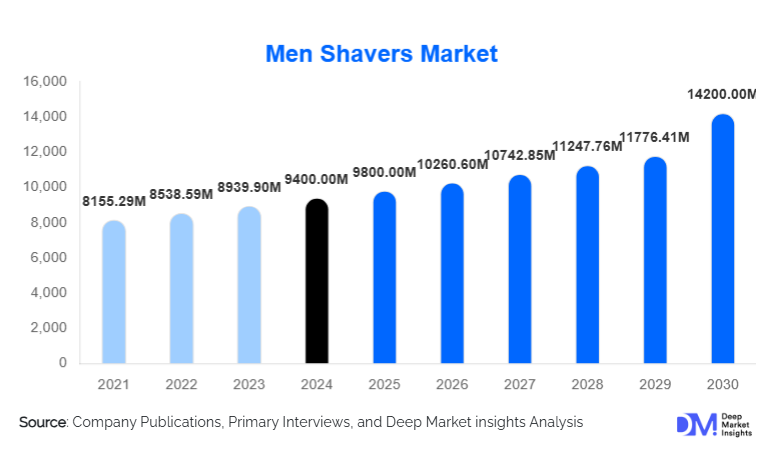

According to Deep Market Insights, the global men shavers market was valued at USD 9,400 million in 2024 and is projected to grow from USD 9,800 million in 2025 to reach USD 14,200 million by 2030, expanding at a CAGR of 4.7% during 2025–2030. The market growth is primarily driven by increasing male grooming awareness, expanding penetration of electric and hybrid shaving technologies, and rising consumer willingness to invest in premium, smart, and subscription-based grooming products.

Men Shavers Market Size

Key Market Insights

- Premiumization of grooming devices is reshaping the men shavers market, with consumers increasingly preferring advanced, ergonomic, and skin-friendly models.

- Electric and cordless shavers dominate demand globally, supported by technological upgrades, fast charging, and waterproof features.

- Asia-Pacific leads in volume growth, driven by urbanization, income growth, and expanding e-commerce accessibility.

- Online distribution channels are emerging as the fastest-growing sales avenue, especially for direct-to-consumer and subscription models.

- Smart and connected shavers integrating IoT and AI features are creating new high-value opportunities for manufacturers.

What are the latest trends in the men shavers market?

Smart and IoT-Enabled Shavers

Manufacturers are increasingly integrating sensors, adaptive motors, and app-based connectivity into premium models. Smart shavers can monitor skin pressure, analyze shaving patterns, and provide maintenance alerts through mobile apps. This connectivity trend reflects consumers’ broader adoption of smart personal-care devices and enables companies to build data-driven subscription and servicing models.

Subscription-Based Consumable Models

Recurring blade-head replacement and maintenance kits are driving repeat revenues. Brands are launching subscription programs delivering cartridges, cleaning fluids, or lubricants to customers on schedule. This model improves user convenience, enhances retention, and stabilizes long-term income for companies transitioning from single-purchase to service-based revenue streams.

Eco-Friendly and Sustainable Materials

Growing environmental awareness has prompted companies to redesign razors and shavers using recyclable metals, reducing plastic, and using biodegradable packaging. Initiatives to manufacture energy-efficient motors and durable components are gaining traction among premium brands, aligning with global sustainability trends and corporate ESG commitments.

What are the key drivers in the men shavers market?

Rising Male Grooming Consciousness

The global shift in male grooming attitudes, fueled by social media, influencer marketing, and the premium personal-care movement, has normalized spending on advanced shaving devices. Urban male consumers increasingly seek convenience, comfort, and skin-care compatibility, propelling the adoption of electric and smart shavers.

Technological Innovation and Product Differentiation

Continuous R&D investment in faster motors, flexible shaving heads, long-life batteries, and wet/dry capabilities enhances user experience and brand differentiation. Manufacturers integrating AI-driven skin sensors and adaptive speed controls have expanded their premium product portfolios, lifting overall average selling prices (ASP).

Expansion of E-commerce and D2C Sales

Online sales channels, especially Amazon, brand websites, and regional e-commerce leaders, are enabling broader geographic penetration. The ability to compare models, access reviews, and receive direct servicing boosts trust and conversion rates. E-commerce’s share of global shaver sales is projected to exceed 25% by 2024 and continue rising through 2030.

What are the restraints for the global market?

High Initial Cost and Price Sensitivity

Premium and smart electric shavers often carry steep upfront prices, deterring adoption in emerging markets. Consumers accustomed to low-cost disposable razors may resist upgrading without visible value or durability assurance, slowing penetration of mid- and high-end categories.

After-Sales and Replacement Supply Gaps

Electric shavers require periodic blade or head replacements. Inconsistent spare-part availability, high replacement costs, and limited repair networks, particularly in developing countries, pose major adoption barriers and constrain long-term device usage.

What are the key opportunities in the men shavers industry?

Smart Connectivity and Personalization

The integration of AI-driven sensors and mobile connectivity enables brands to deliver tailored shaving recommendations and predictive maintenance alerts. Personalization increases user satisfaction, enhances brand loyalty, and provides valuable usage data for targeted marketing.

Emerging Market Penetration

Rapid income growth, urbanization, and expanding e-commerce infrastructure in India, Southeast Asia, and Latin America create vast untapped markets for affordable, durable shavers. Localization of production and strategic partnerships with regional retailers can drive long-term growth.

Sustainable and Circular Manufacturing

Brands embracing eco-design, modular blades, and recyclable packaging can capture environmentally conscious consumers. Circular programs encouraging device refurbishment or component recycling strengthen brand reputation while reducing environmental impact.

Product Type Insights

Electric foil shavers dominate the market, accounting for approximately 25–30% of global revenue in 2024. Their close-shave precision and comfort appeal to daily users in developed markets. Rotary and hybrid models follow, serving consumers prioritizing flexibility and facial-contour adaptation. Manual razors remain significant in volume but are steadily declining in market share due to limited innovation and shorter product lifecycles.

Power Mode Insights

Cordless rechargeable shavers lead global adoption, representing about 70% of electric shaver sales. Lithium-ion technology enables faster charging, longer runtime, and improved safety. Portability and convenience have made cordless units the preferred choice for both personal and travel grooming.

Price Tier Insights

The premium/high-end segment contributes roughly 35% of total revenue owing to higher ASP and repeat purchase of consumables. Consumers are increasingly upgrading to feature-rich models offering superior performance, durability, and brand prestige. Mid-range and economy tiers continue to compete aggressively on pricing, primarily across emerging markets.

Distribution Channel Insights

Online and direct-to-consumer (D2C) channels are growing rapidly, accounting for nearly 25% of sales by 2024. Digital marketing, influencer promotions, and subscription platforms have redefined purchase behavior. Offline channels such as supermarkets and specialty stores remain essential in mature regions for product trials and immediate availability.

End-Use Insights

Personal/home use dominates with more than 90% share of total market revenue. Rising awareness of self-grooming and convenience drives consistent growth. The professional/commercial segment, including barbershops and salons, remains smaller but steady, demanding durable, high-performance equipment. Emerging institutional applications in hospitality and gifting further diversify end-use demand.

| By Product Type | By Power Mode | By Price Tier | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

Accounting for about 25–30% of global market value in 2024, North America remains a mature, premium-driven region. The U.S. leads adoption of high-tech and smart shavers, supported by strong brand presence and advanced retail infrastructure. Growth remains steady at 3–4% CAGR.

Europe

Europe holds a 20–25% share, with Germany, the U.K., and France as key markets emphasizing sustainability and quality engineering. Premium electric and eco-friendly shavers are in high demand, supported by robust e-commerce penetration and preference for durable design.

Asia-Pacific

APAC is the fastest-growing region, commanding about 30–35% share in 2024. China and India lead volume growth, supported by rising disposable income and digital retail expansion. The region’s CAGR may exceed 6–8% through 2030, making it the focal point for new entrants and localization strategies.

Latin America

Latin America contributes an 8–10% share, led by Brazil and Mexico. Increasing male grooming awareness and influencer culture drive the adoption of electric shavers, though economic volatility and import duties can affect pricing dynamics.

Middle East & Africa

MEA represents a 5–8% share in 2024 but shows strong future potential. Gulf Cooperation Council (GCC) countries favor luxury and smart grooming products, while Africa’s emerging urban centers present growing mid-tier opportunities. Regional CAGR is estimated at 5–8%.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Note: The above countries are part of our standard off-the-shelf report, we can add countries of your interest

Regional Growth Insights Download Free Sample

Key Players in the Men Shavers Market

- Koninklijke Philips N.V.

- Panasonic Corporation

- The Procter & Gamble Company (Gillette)

- Wahl Clipper Corporation

- Remington Products Company

- Conair Corporation

- Edgewell Personal Care

- Xiaomi Corporation

- Andis Company

- Beurer GmbH

- Syska India

- Havells India Ltd.

- Sharp Corporation

- Super-Max Group

- Pan International Limited

Recent Developments

- June 2025 - Philips Norelco launched a new smart shaver series with AI-driven pressure sensors and app-based performance tracking, strengthening its leadership in premium grooming electronics.

- May 2025 - Panasonic announced an investment in a sustainable manufacturing facility in Japan focused on recyclable shaver components to align with global ESG mandates.

- April 2025 - Gillette expanded its subscription program across Asia-Pacific, offering automatic blade deliveries and loyalty-linked replacements to build recurring revenue streams.

Frequently Asked Questions

How big is the global men shavers market?

According to Deep Market Insights, the global men shavers market was valued at USD 9,400 million in 2024 and is projected to grow from USD 9,800 million in 2025 to reach USD 14,200 million by 2030, expanding at a CAGR of 4.7% during 2025–2030.

What are the key opportunities in the market?

Key opportunities include smart IoT-enabled shavers, subscription-based consumable models, and sustainable & eco-friendly grooming devices.

Who are the leading players in the market?

Koninklijke Philips N.V., Panasonic Corporation, Gillette, Wahl Clipper Corporation, Remington, Conair, Edgewell Personal Care, Xiaomi, Andis, and Beurer GmbH are the leading global players.

What are the factors driving the growth of the market?

Rising male grooming consciousness, technological innovation in electric and smart shavers, and expansion of e-commerce/D2C channels are driving market growth.

Which are the various segmentations that the market report covers?

The market report is segmented as follows: By Product Type, By Power Mode, By Price Tier, By Distribution Channel, By End-Use.