Memory Foam Mattress Toppers Market Size

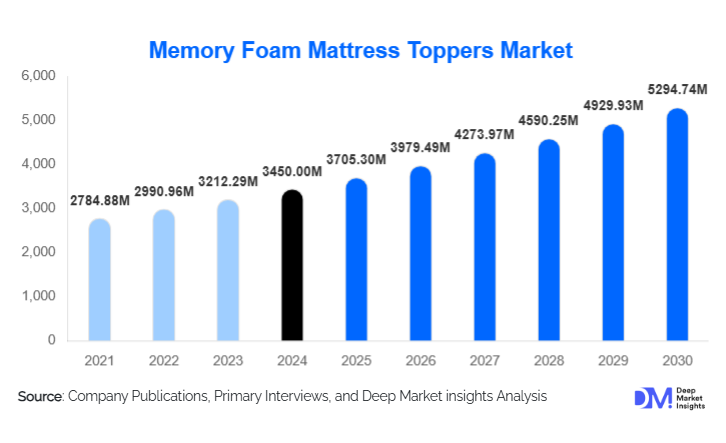

According to Deep Market Insights, the global memory foam mattress toppers market was valued at approximately USD 3,450 million in 2024 and is projected to grow from about USD 3,705.30 million in 2025 to reach around USD 5,294.74 million by 2030, expanding at a CAGR of 7.4% over the forecast period (2025–2030). This steady growth is underpinned by rising demand for upgraded sleep comfort, increasing health and wellness awareness, and enhanced distribution through online channels.

Key Market Insights

- Traditional viscoelastic memory foam remains dominant, accounting for the largest share of topper sales globally, thanks to its proven comfort, pressure relief, and cost efficiency compared to niche alternatives.

- Mid-thickness (2–3 inch) toppers lead adoption in most markets, offering a balance between affordability and perceptible comfort improvements.

- Residential demand is the main revenue engine, as homeowners and renters prefer to “upgrade” existing mattresses rather than replace them entirely.

- North America holds a strong lead in market share in 2024, due to high per capita income, deep e-commerce penetration, and consumer familiarity with memory foam bedding.

- Asia-Pacific is emerging as a fast-growing region, fueled by rising disposable incomes, urbanization, and increased awareness of sleep health in China, India, and Southeast Asia.

- Innovation in cooling, plant-based foams, and smart integrations is reshaping the competitive landscape, enabling brands to differentiate in an otherwise saturated product class.

Latest Market Trends

Eco-Friendly, Low-Emission Foam Innovations

More consumers today demand sustainable material credentials and low chemical emissions. In response, manufacturers are developing plant-based memory foams, bio-polyol blends, and reducing VOC emissions during production. Certification (e.g., CertiPUR, OEKO-TEX) is becoming a key purchasing criterion. These greener toppers also allow brands to command a price premium in mature markets, particularly in Europe and North America. Manufacturers investing early in eco-certified lines are likely to gain a competitive advantage as regulatory scrutiny over indoor air quality and chemical safety intensifies.

Smart & Functional Enhancements in Toppers

To differentiate in a crowded field, brands are embedding functionalities into toppers gel infusion for cooling, phase change layers, dual-firmness zones, anti-microbial covers, and even sleep sensors to monitor pressure or thermal patterns. Hotels, wellness resorts, and premium residential buyers especially seek these “intelligent” offerings. In some pilot cases, toppers integrate with sleep apps or mattress ecosystems to deliver adaptive comfort over time.

Channel & Business Model Disruption

The growth of D2C e-commerce, online mattress brands, and direct subscription/replacement models is transforming distribution. Brands now experiment with “100-night trials,” modular topper upgrades, and partnerships with mattress manufacturers to bundle toppers. Especially in markets with high logistics costs, local assembly or micro-warehousing strategies are enabling broader reach.

Market Restraints

Price Sensitivity & Cost Barriers

Premium memory foam toppers (higher density, thicker, feature-rich) carry a significant cost, which limits adoption in price-sensitive markets. Consumers may opt for cheaper foam types or reject the upgrade entirely. Raw material price fluctuations (polyols, isocyanates, gels) further strain margins, prompting periodic price hikes that can deter demand.

Sustainability & Durability Concerns

Off-gassing, chemical emissions, foam degradation, and disposal difficulties are persistent issues. Negative consumer perceptions or regulatory restrictions on VOCs or chemical additives may slow growth. In markets where recyclability or eco-standards matter, noncertified offerings may suffer. Ensuring long-term durability is also essential, since sagging or early breakdown negatively influences repeat purchase behavior.

Memory Foam Mattress Toppers Market Opportunities

Regional Penetration in Emerging Economies

Emerging markets in Asia, Latin America, and the Middle East present untapped demand. As the middle classes grow, awareness of sleep quality rises, and online commerce expands, consumers start to prefer comfort upgrades over full mattress replacement. Brands that localize pricing, optimize supply chains, and adapt feature sets to local climates (cooling, thinner toppers) can gain early inroads. Government programs incentivizing domestic manufacturing (e.g., “Make in India”) also help reduce entry barriers and costs.

Institutional & Healthcare Specification Contracts

Large institutional buyershospitals, elder care facilities, student housing, and correctional facilities, scalable, hygienic, durable topper solutions. There is an opportunity for players to win long-term contracts, including tenders specifying low-VOC, anti-microbial, pressure-relief toppers. As health systems emphasize patient comfort and infection control, memory foam toppers with hygienic covers have a strong appeal.

Certification & Standardization as a Market Differentiator

With rising regulations on indoor air quality and consumer demand for safety, companies that lead in certified low-emission foams, fire safety compliance, and transparent material disclosure can differentiate. Being first movers in new standards or government-endorsed eco labeling can open doors in regulated markets (e.g. EU). Over time, these compliance investments may become prerequisites rather than differentiators.

Product Type Insights

Among the various product types, traditional viscoelastic memory foam toppers dominate due to their well-known performance and cost effectiveness. However, gel-infused memory foam toppers are gaining share rapidly, especially in warmer climates and among hot sleepers, because of their better thermal management. Plant-based / bio-foam toppers are emerging as a niche premium segment, appealing to eco-conscious consumers willing to pay a premium for sustainability credentials.

Application Insights

The residential segment remains the largest application, as many consumers prefer upgrading existing mattresses with a topper instead of replacing the entire mattress. Within residential, young urban professionals and middle–upper income households spend more on comfort accessories. The hospitality sector (hotels, resorts) is a significant tool that is used to enhance guest experience without re-mattressing. Healthcare and eldercare applications are growing steadily, with demand for pressure relief and hygiene features. Institutional applications (student housing, dorms) also represent a growing niche for cost-effective comfort upgrades.

Distribution Channel Insights

Online retail (brand webstores, marketplaces) is rapidly growing, enabling broad reach, dynamic pricing, and direct consumer relationships. Offline retail (specialty bedding, furniture stores, department stores) continues to maintain a strong presence, especially where consumers prefer to test comfort. Direct sales (factory outlets, B2B contracts with institutions) serve bulk/contract markets. Many brands now adopt omnichannel approaches, combining showroom presence with online convenience and hybrid fulfillment strategies. Return policies, sleep trials, and bundled offers are key to reducing purchase friction in direct channels.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America commands a leading share ( 30–35 %) in 2024, driven by high disposable incomes, mature awareness of memory foam bedding, and robust e-commerce. The U.S. leads demand, with strong adoption of premium toppers, cooling, and smart variants. Canada follows, with similar consumer preferences. Growth is bolstered by home renovation trends and demand from hospitality. Brands offering generous sleep trials and strong digital presence tend to succeed here.

Europe

Europe accounts for 25–30 % of the market. Countries like Germany, the UK, France, and Italy are key. Sustainability norms and regulations push demand for certified, low-emission, eco-friendly toppers. Buyers are quality and brand-sensitive. The fastest growth is seen in Eastern Europe and Scandinavia, where rising incomes and home improvement trends fuel demand. The EU’s environmental and materials standards also shape product design.

Asia-Pacific

Asia-Pacific holds a 20–25 % share in 2024, with China, India, Japan, South Korea, and Australia leading. Growth in China and India is especially strong: rising middle classes, crowded urbanization, and growing awareness of sleep health are pushing consumer upgrades. Southeast Asia and Australia also show promising growth. Among these, India and Southeast Asia are among the fastest growing, backed by increasing online penetration and lower baseline penetration of premium toppers.

Latin America

Latin America contributes a 5–10 % share; Brazil and Mexico are key markets. Demand is sensitive to macroeconomic cycles and currency fluctuations. But hospitality growth and urbanization drive incremental uptake in higher-end segments. Import of premium toppers is common, though regional manufacturing is emerging.

Middle East & Africa

MEA represents a 5–8 % share. Gulf countries (UAE, Saudi Arabia) lead with high per capita incomes and luxury hotel investments, while South Africa and parts of East Africa show rising adoption. Intra-African trade and tourism growth support expansion. Logistics, cost sensitivity, and regulatory challenges are constraints, but growth is promising in niche luxury and hospitality channels.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Memory Foam Mattress Toppers Market

- Tempur-Pedic International

- Serta Simmons Bedding

- Purple Innovation

- Lucid (Kingsdown / related brands)

- Zinus

- Layla Sleep

- Brooklyn Bedding

- Bear Mattress

- Avocado Green Mattress

- Nectar Sleep

- Tuft & Needle

- Helix Sleep

- Sleep Number

- Dreamfoam Bedding

- American National Manufacturing

Recent Developments

- 2025: Leading mattress brand Tempur-Pedic expanded its memory foam topper line with a gel-infused, cooling variant, marketed in partnership with major online retailers.

- 2024–2025: Layla Sleep acquired Dreamfoam Bedding to vertically integrate foam supply and scale its topper R&D.

- 2024: Several North American and European brands launched Eco / low-VOC memory foam lines to comply with stricter indoor air quality regulations.

- 2025: New startup entrants in Asia introduced smart sensor-enabled memory foam toppers tied to sleep apps, capturing early interest among tech-savvy consumers.