Medicated Skincare Market Size

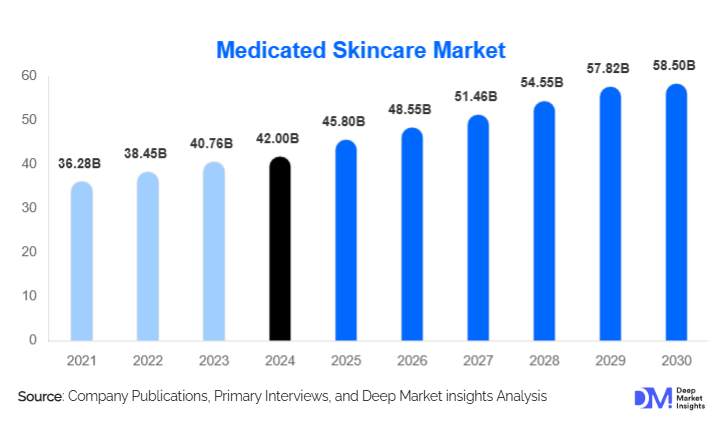

According to Deep Market Insights, the global medicated skincare market size was valued at approximately USD 42.0 billion in 2024 and is projected to rise to around USD 45.8 billion in 2025, eventually reaching nearly USD 58.5 billion by 2030, expanding at a CAGR of 6.0 % over the forecast period (2025–2030). This sustained growth is fueled by the rising prevalence of dermatological conditions (e.g., acne, eczema), increasing consumer demand for clinically backed skincare, deeper penetration through OTC and e-commerce channels, and innovation in formulation and delivery mechanisms.

Key Market Insights

- Acne remains the dominant indication segment, accounting for roughly 30–32 % of revenues in 2024, as adolescents and young adults alike continue investing in effective therapies.

- OTC / Retail pharmacy distribution is rising fast, enabling greater access for mild-to-moderate skin conditions and reducing the dependence on specialist channels.

- Asia-Pacific is the fastest-growing regional market, propelled by rising incomes, urban pollution challenges, and growing consumer awareness in markets like China, India, and Southeast Asia.

- North America retains the largest share (30–32 % of the global market in 2024) thanks to high consumer spending, mature dermatological infrastructure, and regulatory support for OTC actives.

- “Clean/natural medicated” formulations are gaining groundcompanies that combine clinical efficacy with gentler, plant-based ingredients are carving niche, premium positions.

- Digital, AI, and teledermatology integration is reshaping distribution, diagnosis, and consumer engagement, enabling personalized solutions at scale.

Latest Market Trends

Clean & Botanical Medicated Hybrids

One of the most visible trends is the blending of clinical actives with gentle, naturally derived ingredients. Medicated skin care brands are formulating “clean” versions of treatments such as anti-inflammatories, retinoids, or antibiotics by combining them with botanical extracts, barrier-repair lipids, prebiotic ingredients, and soothing peptides. This approach helps reduce irritation and appeals to consumers wary of purely synthetic formulas. The success of such hybrids is prompting more established players to launch lines marketed as “dermatologist-tested, fragrance-free, clean medicated formulations.” In many developed markets, this hybrid strategy helps brands justify premium pricing and defend margins in the face of competitive pressure.

AI & Teledermatology in Treatment Personalization

Technology is playing an ever-larger role. AI-driven skin analysis apps, teledermatology consultations, and even at-home patch testing or microbiome kits are increasingly incorporated into medicated skincare solutions. Brands are embedding diagnostics and personalized regimens into their D2C platforms: a user uploads skin images and receives a bespoke medicated protocol. This digital layer helps retain customers via subscription models, enables continuous monitoring (e.g., tracking flare-ups), and supports claims substantiation via data. In crowded markets, those with smarter digital interfaces often outpace traditional brands in retention and growth.

Medicated Skincare Market Drivers

Rising Incidence of Chronic Skin Conditions

Chronic skin disordersacne, eczema, psoriasis, rosacea, and hyperpigmentation becoming more prevalent globally, owing to urban pollution, UV exposure, stress, unhealthy diets, and aging. This has created a consistent and growing demand for medicated skincare solutions, especially for OTC and clinic-based regimens. Dermatologists increasingly prescribe combination therapies that include topical medicated products, further anchoring this market in long-term treatment patterns.

Consumer Sophistication & Demand for Proven Solutions

Consumers are becoming more discerning: they expect clinical validation, dermatologist endorsement, transparent ingredient lists, and real results. This demand is pushing brands toward higher R&D investment, better safety profiles, and stronger efficacy claims. Unlike traditional cosmetics, where branding or aesthetics might suffice, medicated skincare must deliver results or face rapid rejection. Thus, companies investing in clinical trials, dermatological partnerships, and real-world data win trust and loyalty.

Expansion of E-commerce & OTC Accessibility

The proliferation of e-commerce and direct-to-consumer channels has eroded geographical barriers. Consumers in previously underserved regions can now order OTC medicated treatments with informed guidance, reviews, and teleconsultation support. In parallel, regulatory relaxations or prescription-to-OTC switches in certain markets are expanding the pool of accessible medicated formulations. The synergy of digital reach and easier access is accelerating growth outside urban centers.

Market Restraints

Regulatory Barriers & Compliance Costs

Medicated skincare is constrained by stricter regulatory requirements compared to cosmetic skincare. Clinical studies, safety evaluations, registration, compliance across jurisdictions, labeling standards, and claims substantiation all entail high investment and time. For global brands, heterogeneous regulatory regimes create complexity in formulation adaptation, delaying scale-up and increasing overhead.

Risks of Side Effects & Consumer Perception

Powerful actives (steroids, strong retinoids, antibiotics) may cause irritation, sensitization, or long-term side effects if misused or overused. Consumer apprehension about these risks can inhibit adoption, especially for first-time users. Brands must invest heavily in education, safer formulations, and gradual titration approaches. Negative publicity around side effects can cause outsized damage to brand reputation and slow market trust.

Medicated Skincare Market Opportunities

Personalized & Subscription-Based Therapeutic Regimens

Integrating AI, teledermatology, and predictive analytics offers a compelling opportunity to differentiate. Brands that can deliver personalized medicated regimens (based on skin diagnostics, genetics, microbiome, and environmental exposure) and retain customers via subscription models stand to boost lifetime value and reduce churn. New entrants can partner with digital health platforms or dermatology clinics to gain entry and data access.

Expansion in High-Growth Emerging Markets

Many regions, including South Asia, Southeast Asia, Latin America, and parts of the Middle East and Africa, are underserved in terms of medicated skincare. Rising urbanization, rising incomes, growing awareness, and increasing incidence of skin issues represent untapped markets. Local adaptation (formulation for climate, skin types, price sensitivity), leveraging local distribution (pharmacies, regional e-commerce), and regulatory alignment can yield outsized returns.

Innovative Delivery & Low-Irritation Technologies

Delivering potent actives in gentler, consumer-friendly ways is a key frontier. Advances such as micro-encapsulation, nanocarriers, patch delivery systems, microneedle adjuncts, slow-release formulations, and microbiome-friendly actives can improve tolerability and efficacy. Brands that pioneer these technologies and secure patents can secure premium positioning and entry barriers for competitors.

Product Type Insights

In product form, creams dominate the medicated skincare market, forming roughly 40–45 % of the total in 2024. Their popularity stems from formulation flexibility (to include both hydrophilic and lipophilic actives), ease of application, barrier repair support, and consumer comfort. Meanwhile, lotions, gels, serums, and ointments serve niche roles: gels are often used in oilier skin types, serums for concentrated actives, ointments for more occlusive barrier support, and specialty spray/patch forms for localized dosing. The trend is toward hybrid formats (e.g., lightweight cream-gel, water-based medicated serums) that deliver clinical strength without a heavy feel.

Ingredient / Mechanism Insights

Within ingredient categories, anti-inflammatory actives (e.g., corticosteroids, non-steroidal anti-inflammatory agents, soothing agents) accounted for about 26–28 % of the market in 2024, making them the leading mechanism class. In many dermatological conditions (acne, eczema, rosacea), inflammation is a core pathology, so many treatments require anti-inflammatory activity. Moreover, formulations combining anti-inflammatory agents with antibacterial, antioxidant, or barrier repair moieties are increasingly popular, boosting share. Natural/ botanical actives (e.g., cica, niacinamide, plant polyphenols) are rising fast in proportion, often as adjuncts to reduce irritation in harsher medicated actives.

Distribution Channel Insights

OTC / Retail pharmacies & e-commerce is the largest distribution route, accounting for about 43–45 % of total revenues. This is due to convenience, consumer preference for self-treatment, and the expansion of online pharmacy platforms. Dermatology/specialist clinics remain vital for higher-complexity prescriptions and chronic cases. Hospital pharmacies also contribute, particularly in regions with public healthcare systems. Direct sales / D2C is gaining share thanks to tech-enabled consultation, subscription models, and diagnostic integration. Over time, omnichannel strategies (clinic + online + retail) are increasingly standard among leading players.

End-Use Insights

The primary end-use remains home/consumer use via OTC formulations, which is the fastest-growing segment thanks to convenience, digital access, and consumer-driven preventive care. Dermatology clinics for moderate-to-severe cases are steadily growing, as patients seek professional oversight. A newer growth vector is teledermatology/remote treatment, enabling medicated skincare to be prescribed and monitored virtually. In addition, pediatric / baby medicated skincare is emerging (e.g., gentle eczema, diaper-rash treatments), and male-focused medicated grooming lines are expanding. Export-driven demand is significant: many advanced-market brands export OTC medicated products to emerging markets, and regional dermatology clinics in underserved markets import specialized formulations. Thus, end-use growth is tied to the growth of dermatology services, pharmacy access, and consumer health spending in developing geographies.

| By Product Type | By Skin Condition / Indication | By Active Ingredient / Mechanism | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America commanded the largest regional share (30–32 %) of the global medicated skincare market in 2024. Strong dermatology infrastructure, high consumer health spending, favorable regulation (OTC access to stronger actives), and high awareness drive demand. The U.S. leads, with many prescription and OTC medicated skincare brands headquartered there. Although maturation tempers growth, the region still posts steady 4–6 % annual expansion, especially in niche/premium / “clean medicinal” lines.

Europe

Europe holds a significant share (20–25 %). Key countries include Germany, the U.K., France, and Italy. The region emphasizes safety, ingredient transparency, and strict regulation, so quality and compliance are essential. Anti-aging medicated lines, barrier repair innovations, and natural ingredient blends are highly favored. Growth is moderate (5–6 %) but stable; emerging markets of Eastern Europe may progress faster.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a share estimated at 20–25 % in 2024. China, India, South Korea, and Japan are major contributors. Rising incomes, urban pollution, greater healthcare access, booming e-commerce and mobile penetration, and increasing skin health awareness fuel rapid adoption. In many markets, conversion from cosmetic skincare to medicated skincare is accelerating. Regional CAGR may reach 7–8 % or higher in some countries, outpacing more mature regions.

Latin America

Latin America’s share is around 8–12 %. Major countries include Brazil and Mexico. Market growth is strong from a smaller base, driven by rising beauty & health awareness, increasing access to OTC medicated products, and imports of specialty brands. Pricing sensitivity and regulatory fragmentation are challenges, but growth rates remain attractive in double digits in local terms.

Middle East & Africa (MEA)

MEA holds roughly 7–10 % of the market. Key markets include South Africa, the UAE, Saudi Arabia, Egypt, and Nigeria. Demand is rising due to intense UV exposure, higher rates of skin diseases, growing affluence, and the expansion of telehealth and e-commerce. In many sub-markets, regulatory harmonization and consumer education remain key constraints. Yet, percentage growth is among the highest, especially in Gulf states and Africa’s urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Medicated Skincare Market

- Johnson & Johnson

- L’Oréal S.A.

- Beiersdorf AG

- Procter & Gamble

- Unilever

- Galderma Laboratories

- Obagi Medical

- SkinCeuticals

- Neocutis

- La Roche-Posay

- Murad

- PCA Skin

- Dermalogica

- Cetaphil (Galderma brand) / Eucerin (Beiersdorf brand)

- Cosmedica / regional specialty dermatology brands

Recent Developments

- In June 2025, L’Oréal acquired a majority stake in British skincare brand Medik8, a science-driven, vitamin A / retinoid specialist brand, enhancing its premium dermatological portfolio globally. :contentReference[oaicite:0]{index=0}

- Leading manufacturers are expanding R&D centers in Asia (e.g., China, Korea) and launching regional formulation hubs to adapt medicated skincare to local skin types and climates.

- Several brands are releasing AI-based skincare diagnostic apps and teledermatology tie-ups, offering bespoke medicated plans via mobile platforms to drive conversion and loyalty.