Mechanical Watch Market Size

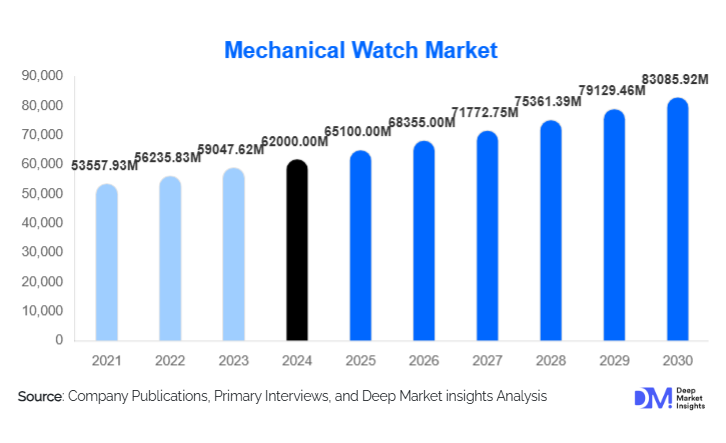

According to Deep Market Insights, the global mechanical watch market size was valued at USD 62,000 million in 2024 and is projected to grow from USD 65,100 million in 2025 to reach USD 83,085.92 million by 2030, expanding at a CAGR of 5% during the forecast period (2025–2030). Market growth is driven by rising luxury consumption, increasing collector interest, expansion of mechanical watch demand in Asia-Pacific, and the enduring appeal of traditional craftsmanship despite the rise of smartwatches.

Key Market Insights

- Automatic mechanical watches dominate global demand, driven by convenience, durability, and mass appeal among luxury and mid-tier consumers.

- Luxury mechanical watches (USD 3,000–20,000) hold the largest revenue share, supported by strong brand heritage and collector-driven purchasing behavior.

- Asia-Pacific is emerging as the fastest-growing region due to rising disposable incomes and increasing appetite for premium and aspirational luxury goods.

- North America remains the largest single regional market, fueled by a strong collector culture and high per-capita luxury spending.

- Hybrid mechanical–smart innovations are gaining traction as watchmakers experiment with merging traditional movements and connected features.

- Pre-owned and certified-pre-owned channels are rapidly expanding, reshaping buyer behavior, and boosting accessibility to high-value mechanical watches.

What are the latest trends in the mechanical watch market?

Hybrid Mechanical–Smartwatch Innovations Rising

Mechanical watch brands are increasingly experimenting with hybrid technologies that integrate traditional craftsmanship with digital functionality. Features such as smartphone connectivity, discreet notification modules, and health-monitoring sensors are being paired with mechanical movements. These innovations appeal to younger buyers who admire horology but expect modern convenience. Brands are also using digital interfaces to enhance after-sales services, including real-time performance diagnostics and maintenance alerts. This emerging category is poised to reshape entry-level and mid-tier mechanical watch offerings.

Growing Enthusiasm for Limited Editions and Complications

Collectors worldwide are showing increased appetite for limited-edition models, high complications (tourbillons, perpetual calendars, moon phases), and heritage revivals. Watchmakers are releasing more short-run series, boutique-only models, and anniversary reissues to strengthen brand loyalty and exclusivity. Advanced materials such as ceramic, titanium, and forged carbon are being used to elevate craftsmanship while maintaining durability. Social media communities, influencer collectors, and digital auction platforms are amplifying demand for rare mechanical pieces, fueling investment-driven purchases.

What are the key drivers in the mechanical watch market?

Rising Global Luxury Demand and Collector Culture

An expanding population of high-net-worth individuals is driving demand for premium and ultra-luxury mechanical watches. Consumers increasingly view mechanical watches as both status symbols and investment assets. Limited editions and high-complication models continue to appreciate, attracting investors seeking alternative assets. Luxury groups are expanding flagship boutiques and customer-experience programs, including personalization, concierge servicing, and VIP-only launches, to strengthen their premium positioning.

Growing Preference for Heritage, Craftsmanship & Authenticity

Mechanical watches are benefiting from a cultural shift toward craftsmanship, artisanal authenticity, and products with long-term value. As consumers seek alternatives to disposable electronics, mechanical watches serve as durable, sentimental, and heirloom-grade accessories. Governments and brands are investing in horology education, skill development, and traditional manufacturing, reinforcing a long-term supply of craftsmanship talent. Sustainability trends also support mechanical watches because they are repairable, long-lasting, and battery-free.

What are the restraints for the global market?

High Price Points Limiting Mass Adoption

Mechanical watches involve intensive labor, hand-finishing, and high-grade materials, resulting in elevated retail prices that limit accessibility. This restricts volume growth, particularly in emerging markets where price sensitivity remains high. Fluctuations in precious metal prices and rising labor costs further increase manufacturing expenses, pressuring margins and potentially raising consumer prices. Additionally, import duties and luxury taxes in several countries make mechanical watches significantly more expensive for end buyers.

Competition from Smartwatches and Lower-Cost Quartz Watches

The rapid adoption of smartwatches poses a strong functional alternative to mechanical watches, particularly among younger and tech-focused consumers. Quartz watches also compete on affordability and low maintenance. While mechanical watches appeal emotionally and aesthetically, they offer fewer practical features, creating a competitive barrier in mainstream markets. The industry must navigate this functional gap, especially among first-time watch buyers.

What are the key opportunities in the mechanical watch industry?

Expansion in Emerging Luxury Markets

Asia-Pacific, Latin America, and the Middle East present high-growth opportunities due to rising affluence and strong interest in luxury goods. Localized retail expansions, region-specific limited editions, and culturally relevant designs can significantly boost sales. E-commerce adoption among younger consumers is also increasing brand reach. As wealth grows in China and India, the mid-tier and luxury mechanical watch segments are expected to expand rapidly.

Sustainable & Ethical Watchmaking

Mechanical watch brands can differentiate by emphasizing sustainable materials, ethical sourcing, and zero-battery movements. Initiatives such as recycled steel cases, solar-powered manufacturing, and carbon-neutral production appeal strongly to environmentally conscious consumers. Programs that support craftsmanship preservation also receive government backing in Switzerland, Japan, and other watchmaking hubs. This sustainability narrative provides a compelling value proposition and premium pricing opportunity.

Product Type Insights

Automatic mechanical watches dominate the market due to their convenience and broad appeal, accounting for nearly 70% of global mechanical watch sales. Manual-winding watches attract purists and collectors who appreciate tactile engagement and aesthetic movement design. High-complication watches, including chronographs, tourbillons, and perpetual calendars, hold a small volume share but deliver significant revenue due to premium pricing. Hybrid mechanical-digital models represent a growing sub-segment as brands experiment with blending craftsmanship and modern technology.

Application Insights

Collector and complication watches form a critical revenue-generating category, driven by high-value limited editions and heritage models. Fashion-oriented mechanical watches attract mid-range buyers seeking style, craftsmanship, and brand prestige. Sports and dive watches remain popular due to durability and iconic design legacies. Bespoke and limited-edition watches cater to ultra-luxury clientele, supporting brand exclusivity and high-margin sales.

Distribution Channel Insights

Offline retail, brand boutiques, authorized dealers, and luxury department stores continue to dominate mechanical watch sales with an 85–90% share. Buyers value hands-on evaluation, authenticity assurance, and personalized service. Online channels are rapidly emerging, especially through brand e-commerce, marketplace luxury sections, and certified pre-owned platforms. Younger demographics increasingly research and purchase watches online, driving strong multi-channel integration across the industry.

Buyer Type Insights

Collectors and horology enthusiasts represent a significant portion of revenue, frequently purchasing high-complication and limited-edition models. Luxury and premium buyers, often purchasing for lifestyle, status, or gifting, drive demand across mid- and high-tier segments. First-time buyers increasingly enter the market through microbrands and entry-level luxury mechanical watches. Investors represent a niche but rising group focusing on high-resale and low-production-volume models that appreciate over time.

Age Group Insights

Buyers aged 31–50 represent the largest mechanical watch consumer group, driven by higher disposable incomes and appreciation for heritage craftsmanship. Younger buyers aged 18–30 contribute to growth through mid-tier mechanical purchases, microbrand engagement, and online shopping. Buyers aged 51–65 form a core luxury segment that favors high-end and complication models. The 65+ demographic contributes to stable premium sales, often valuing traditional designs and established heritage brands.

| By Product Type | By Price Range | By End User | By Distribution Channel | By Material Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, holding approximately one-third of global mechanical watch revenues. Strong collector communities, luxury spending power, and a robust retail ecosystem support demand. The U.S. leads online sales and certified pre-owned growth, with increasing interest in limited editions and high complications. Personalized concierge services, brand clubs, and boutique-exclusive launches are particularly popular among North American buyers.

Europe

Europe accounts for about one-quarter of global demand and remains central to global watchmaking heritage. Switzerland, Germany, the U.K., France, and Italy sustain strong regional consumption. The region also benefits from a mature luxury retail infrastructure and a longstanding horological culture. European buyers show high interest in sustainability, heritage revivals, and artisanal craftsmanship, making it a stable yet sophisticated market.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for roughly 30% of the global mechanical watch market. China leads high-value purchases due to its expanding wealthy population and luxury appetite. India is rapidly emerging with strong mid- to premium-tier growth. Japan and Southeast Asia offer steady demand, particularly for sports and heritage mechanical watches. Increasing air connectivity and luxury mall expansions further strengthen the regional market.

Latin America

Latin America contributes a smaller but expanding share, led by Brazil, Mexico, and Argentina. Consumers in this region prefer fashionable mechanical watches and mid-range luxury models. Currency fluctuations and import taxes limit mass adoption, but demand among affluent buyers continues to rise. Niche boutiques and curated luxury retailers are gaining traction, especially in metropolitan centers.

Middle East & Africa

The Middle East is one of the fastest-growing luxury watch markets, with the UAE, Saudi Arabia, and Qatar driving premium and ultra-luxury demand. High-income populations and strong luxury mall ecosystems support market growth. Africa’s demand is rising gradually, with South Africa leading the region in mechanical watch retail and collector activity. Growing regional tourism also boosts boutique sales in key hubs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mechanical Watch Market

- Rolex

- Patek Philippe

- Audemars Piguet

- Omega (Swatch Group)

- TAG Heuer (LVMH)

- Cartier (Richemont)

- IWC

- Jaeger-LeCoultre

- Vacheron Constantin

- Blancpain

- Hublot

- Seiko

- Citizen

- Oris

- Tudor

Recent Developments

- In March 2025, Rolex expanded its certified pre-owned program across additional global markets, strengthening its presence in the secondary luxury watch ecosystem.

- In January 2025, Omega introduced a new line of hybrid mechanical–digital watches incorporating advanced movement monitoring and connected features.

- In February 2025, Seiko announced an investment in a new movement manufacturing facility in Japan to increase capacity for mid-tier mechanical production.