Massage Insoles Market Size

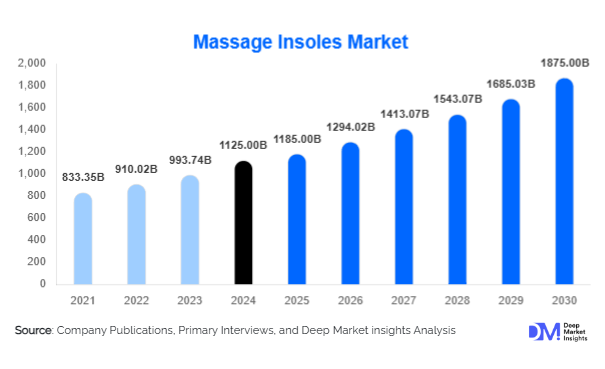

According to Deep Market Insights, the global massage insoles market size was valued at USD 1,125 million in 2024 and is projected to grow from USD 1,185 million in 2025 to reach USD 1,875 million by 2030, expanding at a CAGR of 9.2% during the forecast period (2025-2030). The market growth is primarily driven by increasing consumer awareness of foot health, rising prevalence of plantar and foot-related disorders, growing adoption among athletes and the elderly, and the expansion of e-commerce channels providing easy accessibility to innovative insoles.

Key Market Insights

- Health-conscious consumers are increasingly adopting massage insoles for foot pain relief, plantar fasciitis management, and fatigue reduction, driving consistent market growth.

- Electronic and acupressure-based insoles are gaining popularity among athletes and office workers for enhanced comfort and wellness during prolonged standing or physical activity.

- North America dominates the massage insoles market, led by high disposable income, increased awareness of foot health, and the prevalence of sedentary office jobs contributing to demand for ergonomic footwear solutions.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class populations, increasing urbanization, and growing adoption of health-focused products in countries like China, India, and Japan.

- Technological innovations, such as smart vibrating insoles and temperature-regulated massage insoles, are reshaping consumer preferences and enhancing product differentiation.

What are the latest trends in the massage insoles market?

Integration of Smart Technology in Insoles

Technological adoption in massage insoles is a growing trend, with smart insoles incorporating sensors, vibration motors, and app connectivity. These innovations allow users to track foot pressure, walking patterns, and overall foot health. Health-focused apps paired with smart insoles provide real-time data and personalized recommendations, driving the premium segment of the market. Smart insoles are particularly popular among athletes, office workers, and elderly consumers who seek preventive health solutions and enhanced comfort.

Focus on Wellness and Preventive Foot Care

Consumer interest is shifting toward preventive foot health solutions, boosting demand for massage insoles designed to relieve fatigue, improve circulation, and provide comfort during prolonged standing or walking. Lifestyle changes, such as increased desk jobs and urban commuting, have further fueled adoption. Products with acupressure points or gel-based cushioning are particularly appealing to wellness-conscious consumers. Partnerships between orthopedic specialists and insole manufacturers are also increasing product credibility, influencing purchase decisions.

What are the key drivers in the massage insoles market?

Rising Foot Health Awareness

Globally, consumers are more aware of foot-related health issues such as plantar fasciitis, flat feet, and heel pain. This awareness drives consistent demand for massage insoles as a non-invasive, preventive solution. Market players are leveraging this trend through education campaigns and collaborations with healthcare professionals, thereby increasing adoption rates across age groups and occupational segments.

Growing Elderly and Athletic Population

The aging global population, combined with a surge in active sports participation, is expanding the target consumer base for massage insoles. Elderly users require insoles for comfort and pain relief, while athletes use them for performance recovery and foot support. This dual-segment growth ensures broad market applicability and continuous expansion, particularly in North America and Europe.

Expansion of Online Retail Channels

E-commerce platforms are increasingly providing access to a wide range of massage insoles, allowing consumers to compare prices, reviews, and features conveniently. Online availability also enables smaller brands to reach global markets, fostering competition and innovation. Social media marketing and influencer endorsements further accelerate awareness and adoption, particularly among younger demographics.

What are the restraints for the global market?

High Product Costs in Premium Segments

Advanced electronic and smart insoles are often priced higher, limiting accessibility for price-sensitive consumers. While economy and mid-range options exist, high-end products remain restricted to affluent buyers, potentially slowing growth in emerging markets.

Consumer Skepticism and Limited Awareness in Developing Regions

Despite global trends, adoption rates in certain developing regions remain low due to limited consumer awareness, a lack of education on foot health, and low penetration of online sales channels. Overcoming skepticism and providing demonstrable health benefits remain critical challenges for manufacturers entering these markets.

What are the key opportunities in the massage insoles industry?

Technological Innovation and Smart Insoles

Developing advanced electronic insoles with sensors, vibration mechanisms, and app connectivity offers significant growth potential. Companies can leverage data-driven health insights and personalized comfort features to differentiate products, targeting tech-savvy consumers, athletes, and corporate wellness programs. Integration with wearable health devices and smart footwear ecosystems presents long-term opportunities.

Rising Demand from Asia-Pacific Markets

Emerging economies in the Asia-Pacific, including China, India, Japan, and South Korea, are witnessing rapid urbanization, rising disposable incomes, and increasing health awareness. These factors create a large untapped consumer base for massage insoles. Localizing product offerings for these markets, including pricing strategies and culturally relevant marketing, can significantly boost growth.

Corporate and Healthcare Partnerships

Collaborating with hospitals, physiotherapy centers, and corporate wellness programs offers lucrative opportunities. Integrating massage insoles into employee health initiatives or rehabilitation programs enhances visibility and creates recurring demand. Governments and organizations promoting preventive health further reinforce this trend.

Product Type Insights

Gel-based massage insoles dominate the market, accounting for approximately 28% of the 2024 market. Their popularity is driven by superior shock absorption, comfort, and affordability across individual, athletic, and elderly segments. Foam-based insoles follow closely, offering lightweight cushioning and broad usability. Acupressure and electronic insoles are rapidly gaining traction in premium segments, reflecting increasing consumer preference for advanced foot care solutions.

Application Insights

Plantar fasciitis and heel pain relief are the leading applications, representing around 32% of the global market in 2024. High prevalence among the elderly and office-working populations, coupled with increasing awareness of preventive foot care, sustains demand. General wellness and fatigue relief applications are growing steadily, particularly in the corporate wellness and athletic recovery segments, creating avenues for innovative product launches.

Distribution Channel Insights

Online retail dominates sales, representing 40% of the 2024 market. E-commerce provides convenience, product variety, and comparison tools that appeal to tech-savvy consumers. Offline retail, including pharmacies, specialty stores, and supermarkets, accounts for the remaining 60%, particularly in regions with lower internet penetration or a preference for physical product trials.

End-Use Insights

Individual consumers account for the largest end-use segment, driven by general wellness and daily comfort needs. The athlete and sports segment is expanding rapidly, projected to grow at a CAGR of 10% through 2030, fueled by demand for performance recovery and injury prevention. Elderly and medical users maintain a steady demand for therapeutic insoles. Export-driven demand is increasing, with North America and Europe importing premium insoles from APAC manufacturers.

| By Product Type | By Application / Foot Condition | By Distribution Channel | By End User | By Price Range | By Material |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America held the largest market share at 35% in 2024. The U.S. leads demand due to high disposable income, office-based employment, and awareness of foot health issues. Canada shows steady growth, driven by aging populations and wellness trends. The region favors premium and smart insoles, which also benefit from widespread e-commerce penetration.

Europe

Europe accounted for 28% of the 2024 market, with Germany, the U.K., and France leading demand. High adoption of health-focused products, strong regulatory standards for comfort and safety, and urban workforce trends drive growth. Germany shows rapid adoption of acupressure and electronic insoles, while the U.K. market favors gel and foam-based insoles for office and home use.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with countries like China, India, Japan, and South Korea showing strong year-on-year growth. Rising urban middle-class populations, awareness of preventive healthcare, and e-commerce expansion support market penetration. China leads in volume, while Japan and South Korea contribute significantly to the premium and smart insoles segment.

Latin America

Brazil, Mexico, and Argentina are emerging markets, primarily for economy and mid-range insoles. Outbound e-commerce and growing awareness of foot health among urban consumers are key growth drivers.

Middle East & Africa

UAE, Saudi Arabia, and South Africa show moderate adoption, mainly driven by high-income urban populations. The market is niche, focusing on premium and innovative products. Rising awareness of lifestyle-related foot conditions is expected to gradually increase demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Massage Insoles Market

- Scholl

- Dr. Scholl’s

- Superfeet

- Spenco

- SOLE

- Pedag

- Vionic

- ProFoot

- Powerstep

- Currex

- Walkfit

- Feetures

- Hoka One One

- Birkenstock

- Orthaheel

Recent Developments

- In June 2025, Superfeet launched a smart vibrating insole line in North America, integrating app connectivity to track foot pressure and walking patterns.

- In March 2025, Scholl introduced gel-based insoles targeting office workers in Europe, enhancing comfort for prolonged standing and walking.

- In January 2025, Dr. Scholl’s expanded its e-commerce operations in Asia-Pacific, boosting direct-to-consumer sales and localized marketing campaigns.