Manual Espresso Machines Market Size

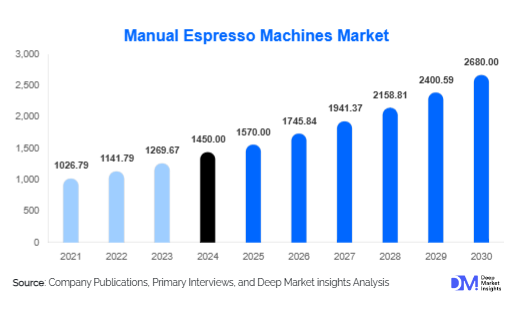

According to Deep Market Insights, the global manual espresso machines market size was valued at USD 1,450 million in 2024 and is projected to grow from USD 1,570 million in 2025 to reach USD 2,680 million by 2030, expanding at a CAGR of 11.2% during the forecast period (2025–2030). The manual espresso machines market growth is primarily driven by the rising home coffee culture, consumer preference for artisanal and authentic brewing methods, and the increasing penetration of premium specialty coffee in both developed and emerging economies.

Key Market Insights

- Home coffee brewing is expanding rapidly, with a surge in demand for manual espresso machines among coffee enthusiasts seeking café-quality beverages at home.

- Premium and luxury machine categories dominate value share, driven by affluent consumers prioritizing design, durability, and precision brewing.

- Europe remains the largest market, supported by deep-rooted coffee traditions in Italy, France, and Germany.

- Asia-Pacific is the fastest-growing region, led by urbanization, rising disposable incomes, and the booming specialty coffee scene in China, South Korea, and India.

- E-commerce and direct-to-consumer (D2C) channels are reshaping distribution, allowing niche brands to scale globally with curated digital marketing strategies.

- Technological enhancements in hybrid manual machines are making espresso preparation easier while maintaining artisanal control.

What are the latest trends in the manual espresso machines market?

Growing Popularity of At-Home Specialty Coffee

Consumers worldwide are increasingly replicating café-style beverages at home, fueled by the global rise in specialty coffee consumption. Manual espresso machines, particularly lever-operated models, are gaining traction among enthusiasts who value control, authenticity, and ritual in coffee preparation. Social media platforms and coffee influencers are amplifying this trend, showcasing home setups and encouraging the adoption of manual brewing methods. This shift is particularly visible in urban centers where consumers are investing in premium machines as lifestyle and status symbols.

Hybrid Machines Blending Manual and Assisted Brewing

While traditional lever machines remain popular, hybrid models that combine manual pressure with spring or piston assistance are growing in adoption. These machines appeal to a wider consumer base by reducing the skill barrier while retaining artisanal qualities. This segment is expanding fastest in Asia-Pacific and North America, where new coffee drinkers prefer semi-assisted experiences before transitioning to fully manual devices. The integration of precision thermometers, pressure gauges, and ergonomic designs is improving user convenience and broadening the market.

What are the key drivers in the manual espresso machines market?

Rising Specialty Coffee Consumption

The growing appreciation for specialty coffee is a major driver of the manual espresso machines market. Consumers are seeking authenticity and control over their brewing process, and manual machines allow them to fine-tune flavors to match personal preferences. Specialty coffee shops are also promoting these machines as part of their retail strategy, reinforcing consumer interest and adoption.

Growth in E-Commerce and D2C Sales Channels

Online platforms have transformed accessibility, enabling smaller and boutique brands to compete with established manufacturers. Direct-to-consumer websites offer customization, detailed tutorials, and curated brand experiences, which are appealing to younger demographics. Subscription models for coffee beans paired with machine sales are also boosting long-term market engagement.

Premiumization and Lifestyle Influence

The perception of espresso machines as lifestyle products has significantly expanded demand in the premium and luxury categories. High-income consumers increasingly view these machines as both functional appliances and aesthetic kitchen investments. Designer collaborations, sustainable materials, and limited-edition machines are further driving premiumization trends.

What are the restraints for the global market?

High Cost of Premium and Luxury Machines

While demand is rising, premium and luxury manual espresso machines often retail above USD 1,500, limiting accessibility to affluent segments. The high upfront cost, combined with the learning curve associated with manual brewing, deters price-sensitive consumers from widespread adoption.

Operational Complexity for Beginners

Unlike automatic machines, manual models require practice, consistency, and time investment. This complexity creates barriers for first-time coffee machine buyers who prioritize convenience. Market growth is therefore constrained by the steep learning curve and limited awareness of proper espresso brewing techniques.

What are the key opportunities in the manual espresso machines industry?

Emerging Demand in Asia-Pacific

The Asia-Pacific market, particularly in China, South Korea, and India, presents a major opportunity as middle-class consumers embrace specialty coffee. Café culture is blending with home brewing, and rising disposable incomes are fueling investments in premium machines. Local manufacturing initiatives are also expected to make products more accessible, expanding the regional consumer base.

Integration of Smart Features in Manual Machines

Innovations that bridge manual brewing with digital monitoring tools—such as app-enabled temperature tracking or brew pressure guidance—are emerging opportunities. These features attract new users by reducing skill barriers while maintaining manual control. Startups and established players are experimenting with sensor-driven technologies to create a new segment of hybrid “smart manual” machines.

Sustainability and Eco-Conscious Materials

With increasing global focus on sustainability, there is a rising demand for machines made with recyclable metals, wooden finishes, and low-impact manufacturing processes. Brands that emphasize eco-conscious sourcing, long product lifecycles, and repair-friendly designs are likely to capture environmentally conscious consumer segments, particularly in Europe and North America.

Product Type Insights

Lever-operated machines dominate the global market with nearly 55% share in 2024, driven by their strong heritage, durability, and popularity among enthusiasts in Europe and North America. Hybrid machines are the fastest-growing category, projected to expand at over 13% CAGR during 2025–2030, as they attract new users seeking a balance between authenticity and ease of use.

Price Range Insights

The mid-range (USD 300–700) segment accounts for 42% of the market in 2024, making it the largest category globally. This dominance is supported by affordability for middle-income households while offering premium features such as stainless steel builds and ergonomic levers. Luxury machines are witnessing the fastest growth, supported by affluent consumers and designer collaborations.

End-Use Insights

Residential consumers represent 65% of market demand in 2024, as home brewing becomes a lifestyle trend worldwide. Cafés and boutique restaurants form the key commercial segment, accounting for 35% of the market. The rise of micro-roaster cafés selling machines alongside beans is positively impacting commercial demand.

Distribution Channel Insights

Online retail and D2C platforms captured 48% of sales in 2024, owing to digital marketing strategies and influencer-driven adoption. Offline specialty stores remain critical for premium and luxury buyers, who prefer hands-on demonstrations before purchasing.

| By Product Type | By Price Range | Material & Build Quality | By Distribution Channel | By End-Use | Geography |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global manual espresso machines market with a 39% share in 2024, supported by long-standing coffee traditions and the strong presence of heritage brands in Italy, Germany, and France. The region also dominates luxury machine sales due to affluent consumer bases and design-focused preferences.

North America

North America accounts for 28% of the market in 2024, driven by the booming specialty coffee culture in the U.S. and Canada. Consumers are increasingly investing in home setups, with hybrid machines gaining popularity among younger demographics.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at a CAGR of 14.5% during 2025–2030. China and South Korea lead adoption due to urban coffee culture, while India is emerging as a promising market driven by café chains and rising middle-class spending power.

Latin America

Latin America is gradually adopting manual espresso machines, particularly in Brazil, Argentina, and Chile, where café culture is strong. The region currently accounts for under 8% of global demand but shows potential for mid-range product adoption.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is emerging as a hub for luxury manual machines. Africa remains niche, though South Africa shows steady demand through specialty cafés and home enthusiasts.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Manual Espresso Machines Market

- La Pavoni

- Elekta

- Flair Espresso

- ROK Espresso

- La Marzocco

- Slayer

- ECM Manufacture

- Rocket Espresso

- Profitec

- Olympia Express

- Quick Mill

- Bezzera

- Lelit

- Nurri Leva

- Wega Macchine

Recent Developments

- In March 2025, La Pavoni introduced a new premium lever machine with eco-conscious stainless steel and wood finishes, targeting European and North American markets.

- In January 2025, Flair Espresso announced expansion into the Asia-Pacific region with a focus on direct-to-consumer e-commerce channels in China and South Korea.

- In July 2024, ROK Espresso launched its upgraded hybrid machine series featuring ergonomic levers and integrated pressure gauges for easier use by beginners.