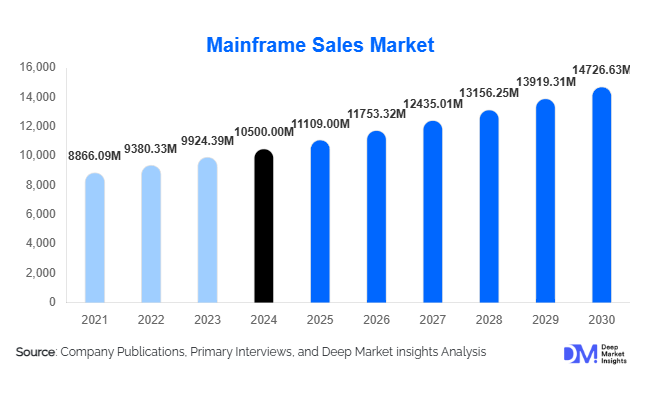

Mainframe Sales Market Size

According to Deep Market Insights, the global mainframe sales market size was valued at USD 10,500 million in 2024 and is projected to grow from USD 11,109 million in 2025 to reach USD 14,726.63 million by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of hybrid and cloud-based mainframe systems, rising demand from banking and government sectors, and integration of AI and advanced analytics into mainframe operations.

Key Market Insights

- Large-scale mainframes continue to dominate global deployments due to their ability to handle enterprise-wide mission-critical workloads with high reliability and security.

- Hybrid and cloud-integrated mainframes are gaining traction, providing scalable solutions for mid-sized enterprises while reducing upfront capital expenditure.

- North America leads the market, with the U.S. and Canada accounting for the largest share of deployments, driven by strong enterprise IT spending and regulatory compliance requirements.

- Asia-Pacific is the fastest-growing region, propelled by digital transformation initiatives in India, China, and Japan, and rising demand from financial institutions and government agencies.

- Banking & financial services remain the top end-user segment, requiring secure, high-volume transaction processing and analytics capabilities.

- Technological advancements, including AI, machine learning, and analytics integration, are reshaping mainframe applications and enhancing enterprise decision-making capabilities.

Latest Market Trends

Shift Toward Hybrid and MaaS Models

Enterprises are increasingly adopting hybrid mainframe architectures that combine on-premises systems with cloud infrastructure. Mainframe-as-a-Service (MaaS) offerings allow organizations to access powerful computing capabilities on a subscription basis, reducing upfront investment and operational costs. This trend has broadened mainframe adoption among mid-sized enterprises and is driving recurring revenue streams for providers. The hybrid model also facilitates integration with AI, analytics, and big data workloads, enabling flexible scaling and workload optimization.

AI and Analytics Integration on Mainframes

Mainframes are no longer limited to transaction processing; they are now leveraged for predictive analytics, machine learning, and real-time data processing. Financial institutions, healthcare providers, and government agencies are deploying AI workloads on mainframes due to their high-speed, secure, and reliable computing environment. This trend enhances operational efficiency, reduces processing latency, and enables faster decision-making. Vendors are introducing tools and software that streamline AI integration and workload optimization, positioning mainframes as strategic assets for enterprise innovation.

Mainframe Sales Market Drivers

Digital Transformation in Core Industries

Enterprises in banking, healthcare, and government are modernizing legacy IT systems to handle high-volume, mission-critical operations. Mainframes offer unparalleled reliability, availability, and serviceability (RAS), making them indispensable for secure transaction processing and enterprise-scale analytics. Organizations seeking uninterrupted service and regulatory compliance continue to invest in mainframe infrastructure, supporting sustained market growth.

Cloud and Hybrid Adoption

The integration of cloud solutions with mainframes allows businesses to reduce operational costs while retaining enterprise-grade performance. Hybrid mainframe deployments are expanding rapidly in mid-sized enterprises, enabling scalable infrastructure and workload flexibility. This shift supports faster innovation, optimized resource utilization, and broadens the market reach for mainframe solutions.

Rising Data Security and Compliance Needs

Regulatory mandates such as GDPR, HIPAA, and SOX require a secure, auditable IT infrastructure. Mainframes provide high levels of encryption, fault tolerance, and compliance-friendly architecture. Enterprises with stringent data security requirements are prioritizing mainframes for mission-critical workloads, sustaining steady demand across sectors like finance, healthcare, and government.

Market Restraints

High Upfront Costs

Traditional mainframe systems require significant capital investment, deterring smaller enterprises from adopting on-premises solutions. While MaaS offerings mitigate upfront expenditure, the premium pricing of large-scale mainframes remains a challenge, particularly in emerging markets.

Skill Shortages

Mainframe deployment and maintenance require specialized expertise. Organizations face difficulties in hiring and retaining skilled personnel, which can slow the adoption and expansion of mainframe systems.

Mainframe Sales Market Opportunities

Expansion into Emerging Markets

APAC and LATAM regions are witnessing growing demand for mainframes in banking, government, and healthcare. Investments in digital infrastructure and public-sector modernization create opportunities for vendors to introduce mid-range and hybrid mainframes, expand support networks, and capture emerging market share.

AI and Analytics Integration

Mainframes capable of handling AI and analytics workloads offer a competitive advantage. Companies can differentiate through solutions optimized for predictive modeling, real-time analytics, and enterprise-scale AI, creating premium revenue opportunities.

Government and Public Sector Contracts

Governments investing in digital transformation initiatives, citizen data management, and defense systems present high-value opportunities. Mainframes remain critical for secure, mission-critical operations, providing long-term contract-based revenue streams for vendors.

Product Type Insights

Large-scale mainframes dominate the market, catering to enterprises requiring high-volume transaction processing and mission-critical operations. Mid-range mainframes serve mid-sized organizations looking for scalable solutions with lower initial investment. Specialized mainframes, designed for AI, analytics, or industry-specific applications, are growing rapidly due to increasing demand for customized enterprise computing solutions.

Application Insights

Transaction processing continues to be the leading application segment, particularly in banking, insurance, and e-commerce. Data analytics and AI workloads are expanding, while ERP and enterprise applications remain critical for supply chain, finance, and HR operations. Emerging uses in predictive modeling, fraud detection, and large-scale government data management are further enhancing market adoption.

Distribution Channel Insights

Mainframe systems are primarily sold through direct enterprise contracts and vendor-managed services. Subscription-based MaaS offerings are gaining traction, while integrator partnerships help address mid-sized enterprise demand. Direct vendor sales dominate high-value contracts, while consulting and managed service providers facilitate deployment and support.

End-User Insights

Banking & financial services are the largest end-users, accounting for nearly 40% of global demand. Government and healthcare are fast-growing segments, driven by data security, citizen services, and electronic health records. Telecom, retail, and manufacturing are adopting mainframes for analytics, ERP, and transaction processing. Export-driven demand from APAC and LATAM contributes to market growth, supporting global mainframe vendors.

| By System Type | By Deployment Type | By Application | By Industry Vertical |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest market, with the U.S. and Canada accounting for 35% of the global market share in 2024. Demand is driven by regulatory compliance, enterprise IT spending, and hybrid mainframe adoption. Financial institutions and government agencies are major adopters.

Europe

Europe holds 28% of the global market share, led by the U.K. and Germany. Growth is supported by digitalization initiatives in finance, healthcare, and public sector IT infrastructure. Hybrid and AI-enabled mainframes are increasingly adopted across enterprise segments.

Asia-Pacific

APAC is the fastest-growing region, driven by India, China, and Japan. Investments in banking modernization, government infrastructure, and emerging digital industries are accelerating mainframe adoption. Projected CAGR is 6.5% from 2025–2030.

Latin America

Brazil and Mexico lead market adoption in LATAM, with demand focused on banking modernization and government projects. CAGR is projected at 5.2%, with growing interest in hybrid mainframes.

Middle East & Africa

Key markets include the UAE, Saudi Arabia, and South Africa, driven by government digitization initiatives and secure citizen data management. Intra-African adoption is growing as regional governments modernize their IT infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mainframe Sales Market

- IBM

- Fujitsu

- Hitachi

- Unisys

- Atos

- NEC

- Dell Technologies

- HPE

- Lenovo

- Oracle

- Huawei

- Siemens

- Bull

- Micro Focus

- TCS

Recent Developments

- In March 2025, IBM launched a hybrid cloud mainframe solution integrating AI workloads and predictive analytics for enterprise customers.

- In February 2025, Fujitsu expanded its mainframe offerings in APAC, targeting banking and government digital transformation projects.

- In January 2025, Hitachi introduced energy-efficient mainframes with advanced encryption and compliance tools for regulated industries.